Unleashing Your Financial Potential: The Strength of Direct Indexing

- April 30, 2024

Discover how a direct indexing strategy can be apart of your financial journey.

Direct Indexing: Its Evolution and Definition

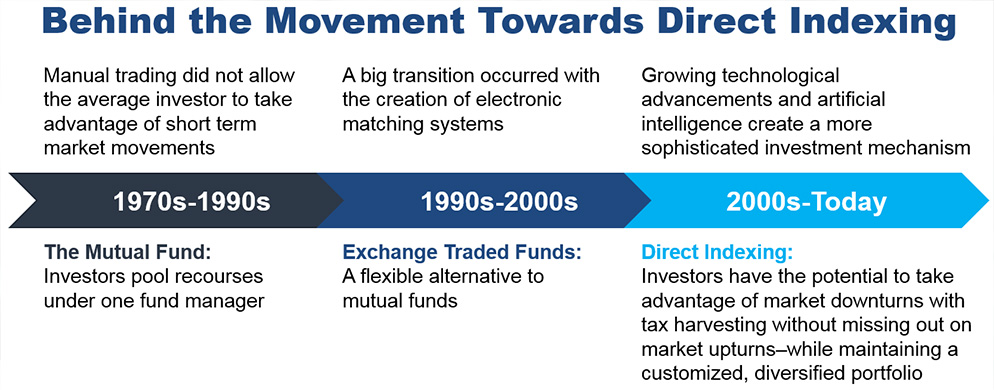

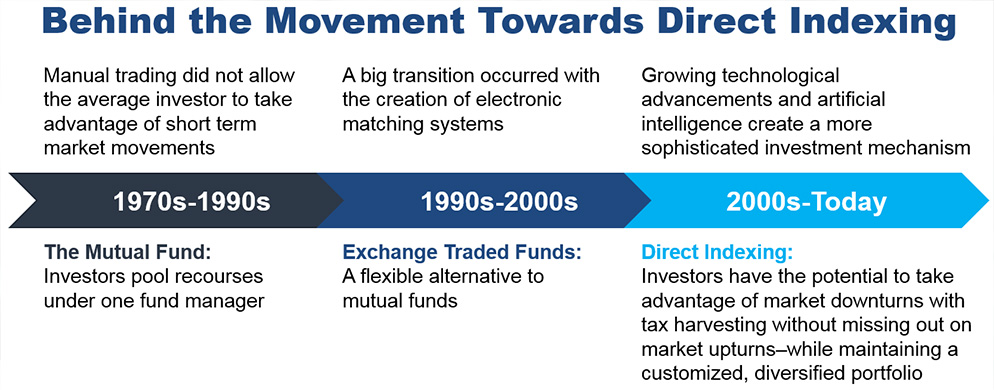

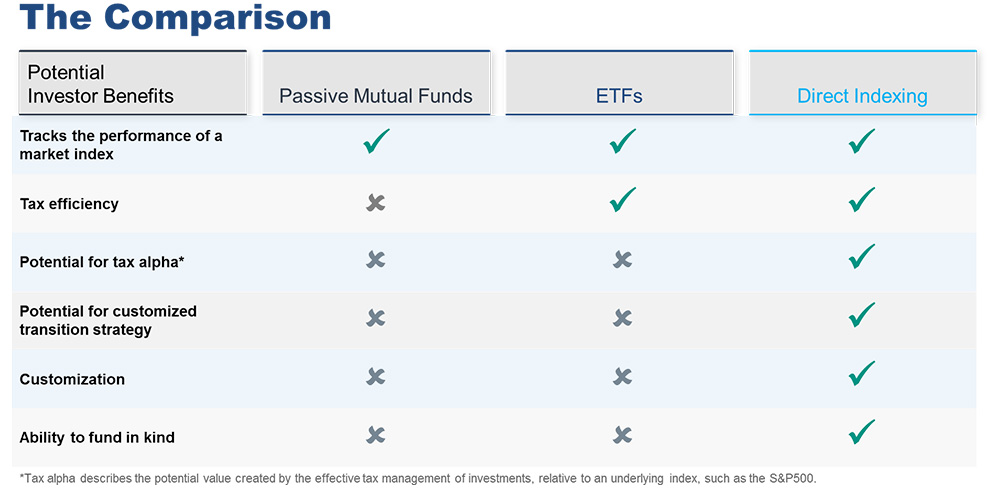

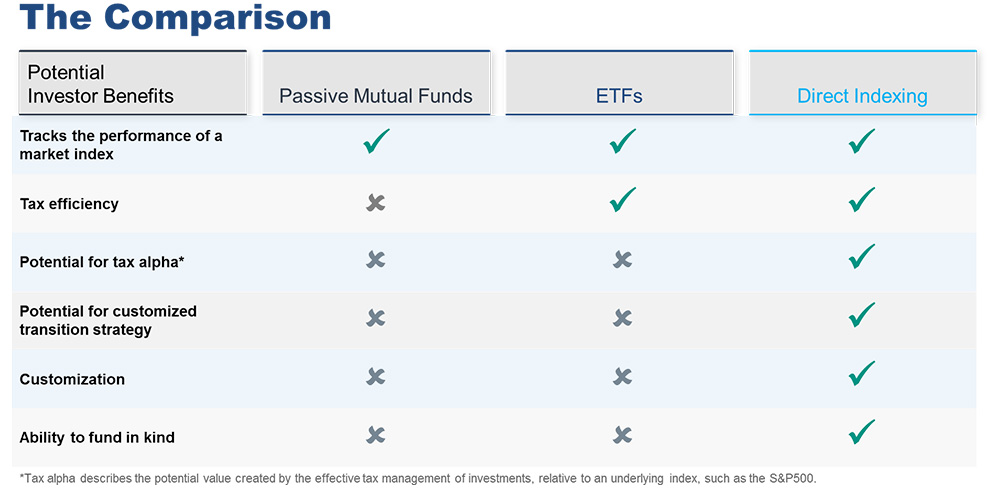

In recent years, direct indexing has surged as a game-changer in the investment arena. Building upon the foundations of mutual funds and ETFs, direct indexing offers a more personalized approach. While mutual funds and ETFs provide diversified portfolios, direct indexing stands out by allowing investors to own and manage the individual securities within their chosen target index.

Initially, mutual funds gained traction as a way for investors to pool resources and let professional fund managers handle investments. However, they came with limitations like lack of customization and potential tax inefficiencies.

ETFs emerged as a flexible alternative to mutual funds, trading on exchanges like stocks and offering intraday liquidity. While they provide diversification, investors have limited control over holdings and don’t own the underlying securities, limiting tax customization possibilities.

Direct indexing is an approach to index investing that involves buying the individual stocks that make up an index.

Direct indexing takes the ETF concept to the next level. It enables investors to build a tailored portfolio mirroring a specific benchmark, such as the S&P 500. With direct indexing, investors buy individual index securities (including fractional shares for lower minimums and broader applications), offering greater control over portfolio composition. This approach brings advantages like tax-loss harvesting, customization based on personal preferences or ESG criteria, and enhanced transparency, and control.

Key Benefits of Direct Indexing

1. Tax Efficiency: Direct Indexing empowers investors with heightened tax management control. Owning individual securities allows for potential tax optimization strategies such as tax loss harvesting, capital gains offsetting, and precise control over taxable event timing.

2. Diversification: Direct indexing can be invaluable for diversifying portfolios which contain low cost basis positions and those with significant embedded capital gains.

3. Transparency and Control: Investors opting for direct indexing gain complete visibility into their individual holdings. They can monitor holdings, understand exposures, and adjust portfolios based on market shifts, personal preferences, and financial or tax circumstances.

4. ESG and Factor Integration: Environmental, Social, and Governance (ESG) considerations matter to many investors. Direct indexing facilitates targeted ESG integration, enabling investors to include or exclude specific index companies based on ESG criteria.

Mitigating Tax Impact Through Harvesting

A standout feature of direct indexing is the strategic use of tax-loss harvesting. This involves selling underperforming positions to harvest losses, which can offset capital gains from other investments, even across different asset classes. This proactive tax-saving approach has the potential to reduce your tax liability year-round.

Tax-loss harvesting isn’t optimal with index-tracking funds, where you hold fund shares rather than the underlying securities.

The ability to harvest losses and carry them forward, independent of annual capital gains, has the potential to be a powerful tool in anticipating future taxable events, such as selling a closely held business, highly appreciated securities, or other significant taxable transactions.

Investing Aligned with Your Objectives and Values

Another compelling feature of direct indexing is unparalleled portfolio customization. While index ETFs bundle all index stocks, direct indexing lets you tailor your holdings based on financial aspirations and personal principles.

If environmental considerations influence your investment choices, direct indexing enables you to exclude companies based on your own criteria or preferences. Or if you want to diversify away from perceived risky stocks or sectors, direct indexing allows you to make these adjustments. With guidance from a dedicated Oppenheimer Financial Professional, your investments stay on course with periodic updates and rebalancing to meet performance targets.

Is Direct Indexing Right for You?

Direct indexing can be a potent tool. But, it requires a disciplined approach. Consult with your dedicated Oppenheimer Financial Professional to determine if this strategy aligns with your financial goals.

1 Direct Indexing can be considered tax efficient because it allows investors to individually manage the components of their investment portfolios. This level of control allows the investor to implement tax-saving strategies such as tax loss harvesting potentially reducing their tax liability and optimizing after-tax returns.

2 Tax alpha describes the potential value created by the effective tax management of investments, relative to an underlying index, such as the S&P500.

3 A customized transition strategy is a tailored approach to transitioning an existing investment into a direct indexing structure in a way that minimizes disruptions, maximizes tax efficiency and aligns with the investor’s financial objectives. The strategy takes into account an investor’s current holdings, tax implications and desired asset allocation with the goal of efficiently migrating from traditional investments into a direct indexing strategy. Views and opinions expressed reflect the current opinions of the author and views are subject to change at any time without notice. Other industry analysts and investment personnel may have different views or opinions. There are no guarantees to the effectiveness of tax alpha in minimizing an investor’s overall tax liabilities or to the tax results of any given transaction and the performance of an account may be negatively affected by tax gain/ loss harvesting. This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. This summary is not intended to be tax or legal advice. This summary is being used to illustrate the characteristics of direct indexing. The taxpayer should consult an independent tax advisor. There are no guarantees to the effectiveness of direct indexing in minimizing an investor’s overall tax liabilities or to the tax results of any given transaction and the performance of an account may be negatively affected by tax gain/loss harvesting. All investments involve risks, including possible loss of principal. There can be no assurance that investment objectives will be achieved or that an investment strategy will be successful. Diversification does not ensure a profit or protect against loss. This material is not a recommendation as defined in Regulation Best Interest adopted by the Securities and Exchange Commission. It is provided to you after you have received Form CRS, Regulation Best Interest disclosure and other materials.

Oppenheimer Asset Management is the name under which Oppenheimer Asset Management Inc. (OAM) does business. OAM is a registered investment adviser and is an indirect wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc. (“Oppenheimer”), a registered investment adviser and broker dealer.

©2024 Oppenheimer & Co. Inc. Transacts Business on All Principal Exchanges and Member SIPC. All rights reserved. No part of this brochure may be reproduced in any manner without the written permission of Oppenheimer. 6561012.1