OPPENHEIMER HOLDINGS INC.Annual Report 2022

If it’s not one thing, it’s another…

In just a few years we’ve gone from a pandemic, with closed businesses, work from home, shortages of everything, unprecedented government actions, and then a strong economic recovery, fueled by the Federal Reserve (Fed) providing expansive liquidity to capital markets and individuals. This was quickly followed by an environment burdened with the highest inflation (exceeding 9% at its peak) in a generation, which led in 2022 to a Fed course reversal with much higher interest rates, some softness in the U.S. economy and the addition of a land war in Ukraine.

This war has created significant loss of life, extreme suffering of the Ukrainian people, disruptions in supply lines, and uncertainty regarding the possibilities of hostilities – not only in Europe, but perhaps in Asia with an attack on Taiwan. This was a clear recipe for weak equity and debt markets, and significantly lower valuations in all asset classes by year end.

The global pandemic has been an agonizing chapter in our experience, both for clients, our families, and ourselves. In large measure, we endured more than two years that reset many of our traditional thoughts about the role of in-person work, how and where we live, and the impact of living our lives so differently, with the flexibility of remote access to everything.

Robert S. Lowenthal (left) President and Head of Investment Banking

Albert G. Lowenthal (right) Chairman and Chief Executive Officer

During 2022, we entered a downbeat year in which S&P 500 returns (S&P 500 declined 19.4%, the DJIA was down 8.9%, the NASDAQ declined 33.1%) ranked with the ugliest years of the Great Depression, the financial crisis of 2008, and the dot-com bust. What made 2022 even more painful for investors is that bonds, which traditionally do well whenever stocks suffer, experienced their worst showing in market history, with Fed Funds increasing 450 basis points in just a few months. Thus, the past year delivered a confluence of economic, monetary, and geopolitical factors that directly impacted our company and our clients.

The results of economic and monetary policy drove U.S. inflation to a 40-year record high and led to a shutdown in the Capital Markets deeply impacting our business. Without question, we had a disappointing 2022, specifically driven by global and domestic macro-trends, market headwinds, and an unanticipated material legal settlement in our Wealth Management business.

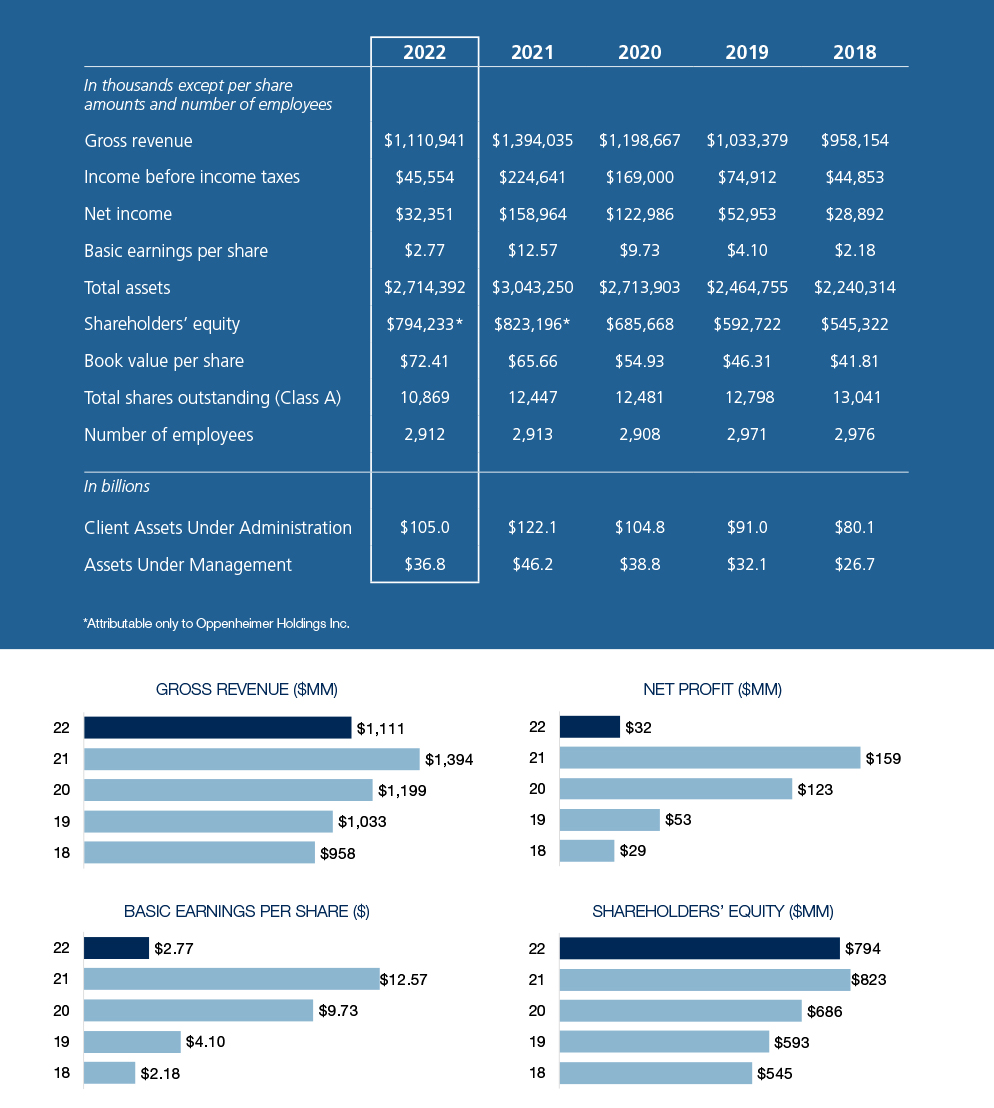

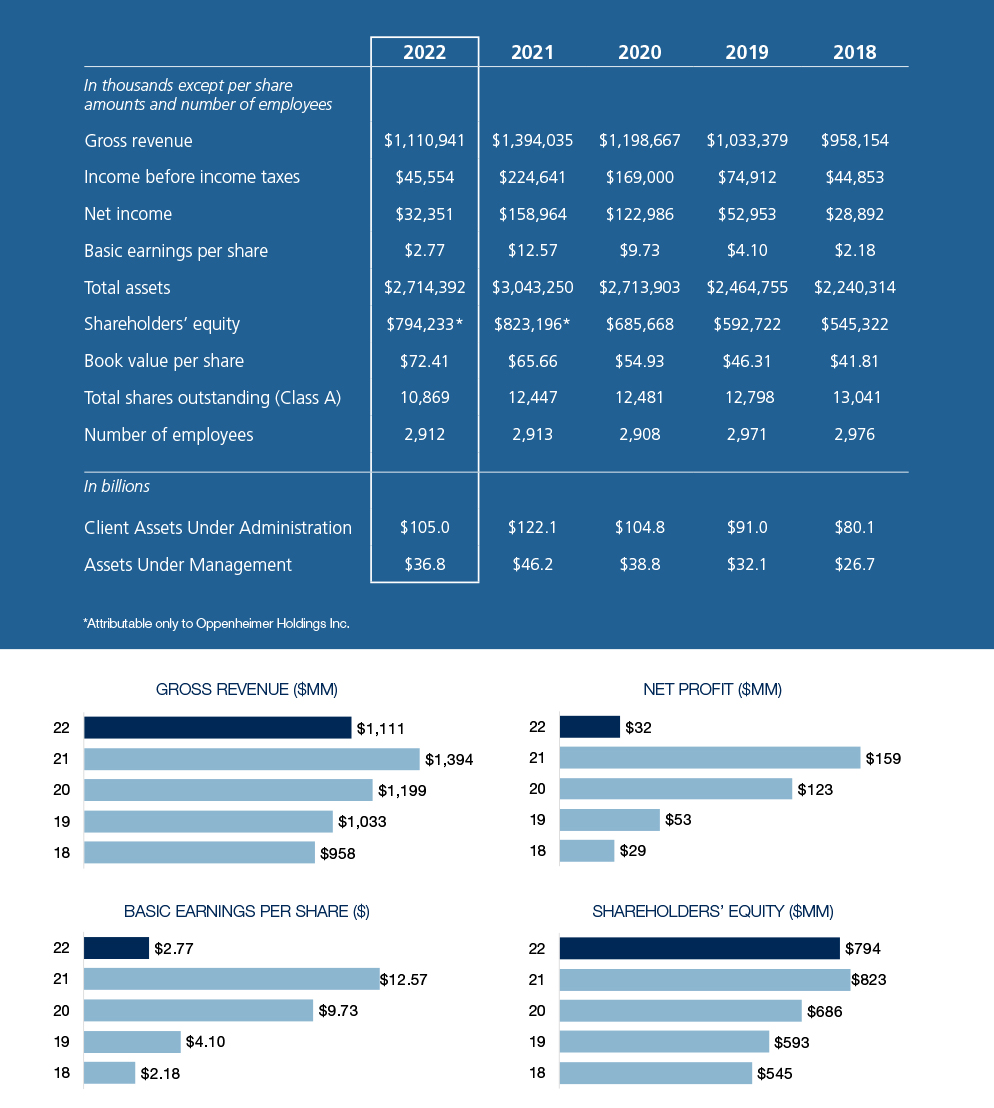

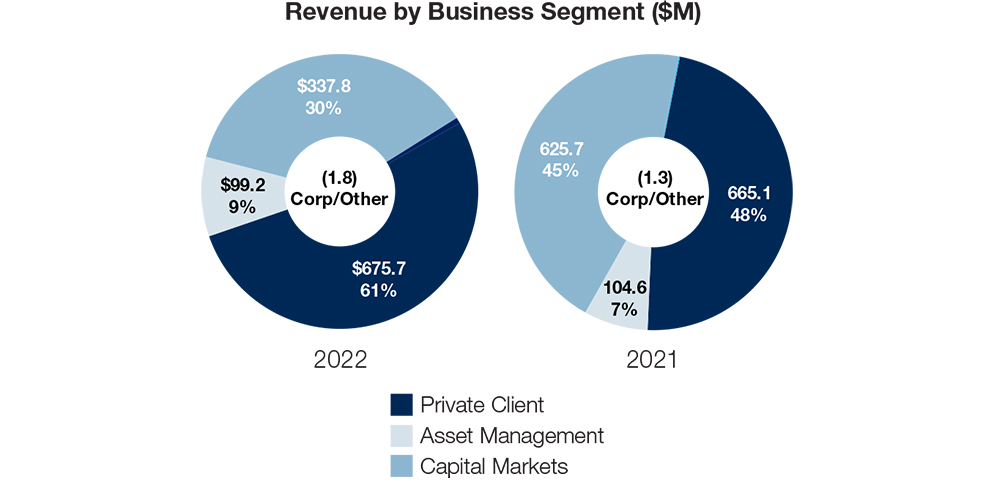

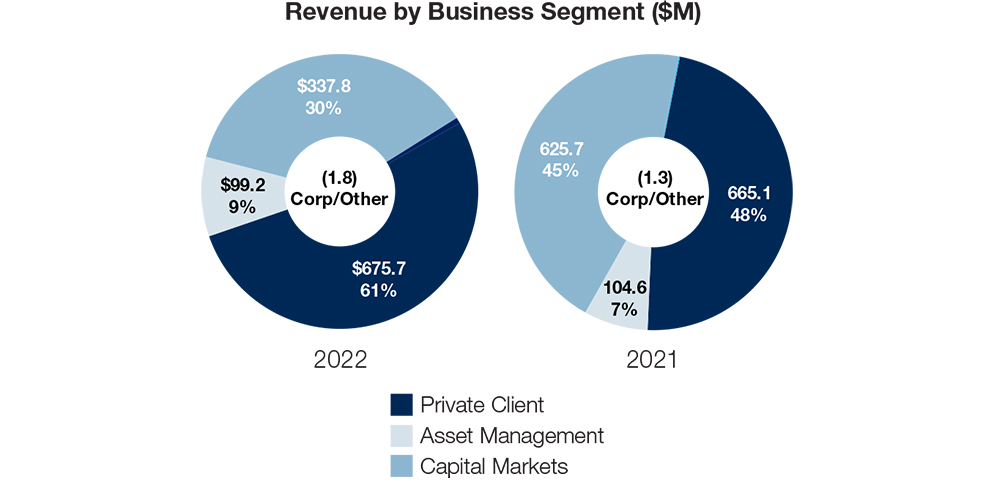

For 2022, we showed disappointing results with net revenues totaling $1.111 billion, and net income of $32.4 million (or $2.77 basic earnings per share), compared with $1.394 billion in revenue and $159.0 million (or $12.57 basic earnings per share) in 2021. This represents a decrease of 20.3 percent in revenue and a 79.6 percent decline in earnings. Our results, however, were significantly and positively impacted by interest-related income of $165.3 million in 2022 versus $52.0 million in 2021. In 2022, more than ever, our success depended on the countercyclical nature of our business model and the resilience of our highly dedicated associates.

We were, and are being impacted by a situation that came as a complete surprise. In 2021, the Securities and Exchange Commission (SEC) brought charges against a former financial advisor who had left our firm in 2016. The charges alleged that the individual was running a Ponzi scheme both during and after his employment by us. This matter has spawned a multitude of arbitrations against our firm alleging a failure to supervise which has found a sympathetic response from arbiters. In one such case, a panel awarded damages in excess of $36 million to plaintiffs although their losses were only $1.6 million, net of their cash returns. We recognized this loss in the 3rd quarter of 2022. There are no allegations that our firm knew or benefited from this activity, but we remain quite concerned about this unresolved issue. It appears that it will play out during 2023 at a significant but unknown cost to our company.

On December 31, 2022, the firm’s equity capital was $794.2 million after accounting for significant share repurchases during the year and shows a decline from $823.2 million in 2021. At year end, we had a total of 10,968,221 shares outstanding with our ending book value rising to $72.41 per share, a new record, as compared to $65.66 at the end of 2021. Under our repurchase authorization, we took advantage of the lower level of our share price and bought back 15% or 1,684,287 shares for $60.6 million, at an average price of $36.00 per share. In total, the firm returned total capital exceeding $67 million to shareholders through the combination of dividends and share repurchases.

We were pleased to be able to invest in our businesses, while at the same time, return excess capital to our shareholders through share repurchases and dividends. We also maintained our regular quarterly dividend of $0.15 per share. We did not declare a special dividend for the year, as our results did not support such action. We continued to invest in our people, our solutions, and our infrastructure – and to expand our capabilities in order to accelerate future growth.

Financial Highlights

Our three principal business units: Private Client Services, Asset Management, and Capital Markets continue to operate synergistically for the benefit of our clients, our firm, and ultimately, our shareholders.

Our Wealth Management clients focused on preserving wealth and maintaining their standard of living against a backdrop of equity and fixed income markets moving down in tandem. As we reacted to these changing times, we maintained our commitment to delivering trusted advice to individuals, families, business owners, governments, and fiduciaries as they continue to navigate an unpredictable market environment. When few safe havens are available to investors, we are called upon to provide advice that first and foremost calms investors and keeps them committed to long term goals. Our mission is to help them plan, invest, and transition wealth, so as to achieve their goals and aspirations. Our Wealth Management results were solid, offsetting lower assets under management and lower commissions with significant increases in our interest sensitive revenues.

Our commission revenues from Wealth Management were reduced, reflecting the decline in speculation and the steady decline in asset values. This was due to market conditions as individual investors re-evaluated the prices commanded by “high growth” companies in a higher interest rate environment.

The need for value-added advice and service has once again become more important than ever. In just a year, cryptocurrency both as an investment and as a basis for a business has proven highly speculative at best, and criminal at worst. It was not mere luck that we have steered our company and our clients away from this model. We are focused on what we do best, which is to help our clients make sound investment decisions through every market cycle.

Our Capital Markets business was significantly and negatively impacted by the near shutdown in the issuance of public offerings, particularly those of high growth companies. These issuers raised record amounts of capital in 2021 and found little receptivity from investors in 2022 as the market adjusted to rapidly increasing interest rates and lower valuations on the prospects of future growth. We have seen these cycles before and we are confident that innovative companies in the technology and healthcare industries will continue to change the way we work and live, and will help to conquer the challenges faced by disease and other threats to our health. These enterprises may be forced to raise money at lower valuations, but many will reemerge in a more favorable environment to be the next market leaders.

As we reacted to these changing times, we maintained our commitment to delivering trusted advice to individuals, families, business owners, governments, and fiduciaries as they continue to navigate an unpredictable market environment.

While we have strong pipelines, we will have to wait for markets to re-open. Investment Banking fees achieved record years in 2020-2021 as companies raised capital at record high equity values and record low interest rates. In contrast, 2022 had IPOs closing the year at a 32-year low for new issuance; follow-on equity volumes fell to the lowest level since 1996; and overall debt offerings were down 75%. However, as companies need to raise capital to support their ongoing growth and operations, we can anticipate significant increases in our underwriting businesses for both debt and equity securities once the Fed pauses in its rate increases, companies believe that their valuation has stabilized, and investors are open to providing that needed capital.

The post-pandemic world of work has changed. We continue to study and invest in our people in terms of where and how they produce and achieve. The “new normal” created expectations for a hybrid work environment that better exploits digital technology and remote work capabilities. The mindset of a new generation, set against a strong demand for talent, created a powerful recipe for change. We strongly believe in the benefits of apprenticeship, the power of collaboration, and the serendipity of idea generation. We continue to evolve our thinking and practices based on the changing nature and evolving demands of our business.

As part of our listening to employees, we utilized consultants to conduct research to better understand how our associates felt about their relationship to the firm, their understanding of our company and their commitment. An astounding 92% are proud to work for the firm, 59% believe we are poised for growth, and one-half report that they have a good work/life balance. Other positive attributes strongly associated with the firm include the quality of our intellectual capital, our desire to achieve good customer outcomes, and the deeply held belief that we are ethical and trustworthy. Our employees are our most important asset and we will continue to prioritize their health, engagement, their professional opportunity for growth, as well as their commitment and ability to deliver the best possible service to our clients.

We are well positioned to take advantage of the opportunities ahead and we are excited to lead an organization with a culture steeped in achieving success and excited to compete for our clients’ trust and future business.

The pace of change regarding how data is managed, how we communicate, and the digitization of everything continues to force investment in our infrastructure and capabilities. We strive to create operational efficiencies that deliver tools to empower our employees’ productivity, and meet the emerging demands of our clients. We believe that protecting our clients’ information is of the utmost importance, so we continue to implement the best cyber protections available to guard their information.

Succession at every level of the organization is important to us and we continue to invest in our human capital. We have recruited highly qualified people with experience in their areas of expertise and have promoted talented leaders throughout the firm. We continue to evaluate our goals within each business and allocate resources accordingly. We expect our people to prioritize what’s right for our customers and to implement solutions for them, while making sure to protect the firm.

We are well positioned to take advantage of the opportunities ahead and we are excited to lead an organization with a culture steeped in achieving success and excited to compete for our clients’ trust and future business.

With 2022 behind us, we have been and continue to be in the trenches with our clients, we are focused on the next cycle of opportunity, and we are reimagining how our people work together to achieve their individual goals and the firm’s mission and vision. We have the right people, a solid infrastructure, and comprehensive and innovative investment solutions. We build during times such as these. This year, the markets and other factors beyond our control or influence were set against us. We are grateful for the opportunity to lead this special company through the worst as well as the best of times. We are thankful for our dedicated Board of Directors, to our leadership team, and to so many wonderful associates that have and will help this company realize its full potential. We look forward with optimism to the future.

Sincerely,

Bud Lowenthal

Rob Lowenthal

- $128 million in investment banking revenues, with a balanced mix of advisory and capital markets activity

- Advisory business recorded the third best year on record

- Expanded our banking headcount by nearly 40 percent over the last three years and expect 2023 to be another year of controlled, targeted growth

- Retail-facing desks outperformed institutional fixed income business as higher rates drew attention of the individual investor

- Government bond business saw best result in ten years

- Lack of primary issuance further muted results already reflecting lower volumes due to economic uncertainty and extreme hawkishness from FED

- Aggressive risk management and judicious deployment of capital helped us avoid principal losses.

- Overall Equities’ Sales and Trading revenue of $141mm is up 1.9% vs 2021

- While core US Equity Agency commission revenues in 2022 decreased from 2021 primarily due to lower volumes associated with new issuances, overall revenues were buoyed by increased volatility and a subsequent increase in Options revenues

- Elevated volatility associated with macro uncertainty and significant moves in key interest rates drove a 115% increase in Derivatives client revenue (Single Stock Options) to $27.9mm

- Municipal Restructuring Practice successfully launched, providing highly differentiated process to ensure maximum value to obligors and bond investors

- #1 Placement Agent in California

- #1 Municipal Note Underwriter (No. of issues)

- #21 Total Negotiated Volume and #13 Total Unrated Bonds

- $21.9 Billion in total capital raised over 144 municipal transactions

- $675.7 million in revenues, a 1.6 percent increase

- $142.3 in pre-tax income, a 40.6 percent increase

- $104.6 million in bank sweep deposit income, a 572.1 percent increase

- Advisor census declined to 968, but focus on recruitment efforts in 2023

- Opened office in Nashville, Tennessee, a key wealth growth market

- $36.8 billion in assets under management

- $426 million in advisory revenue (includes total firm advisory fee revenue)

- New accounts grew almost 4 percent to 88,000

- Continued collaboration with Investment Banking launching the fourth successful Private Market Opportunity Investment