Understanding Alternative Investments

What are alternative investments?

Alternative investments are any investments outside of publicly traded stocks, bonds and cash. They include hedge funds, private equity, venture capital, private debt, real assets and real estate. As institutional and individual investors seek to construct sound portfolios that can weather various economic and market environments, the search for diversifying and complementary investments drives investors to alternative strategies.

What role do alternative investments play in a portfolio?

Alternative investment strategies seek to generate returns independent of market movements, or alpha, and preserve capital in up and down markets. They exhibit lower correlation, which makes them a good diversifier and a complementary investment within portfolios dominated by investments in traditional asset classes. Asset growth among alternative strategies has been powerful as assets have tripled to $9.5 trillion over the past decade and they’re expected to grow to $14 trillion by 2023. Alternative investments are designed to make portfolios more efficient by enhancing return, minimizing risk or both. They’re perhaps best utilized as a complement to rather than as a substitute for traditional investments.

How can alternative investments provide disciplined risk management?

The key to reducing risk in a portfolio is to own investments that have low correlations with one another, meaning that they will perform differently in different market environments. Institutional investors favor alternative investments due to their potential for better risk-adjusted returns relative to more liquid strategies. Hedge funds have historically provided downside protection and generated alpha in negative environments. When the market gets too frothy, irrational exuberance among investors can lead to an overbought condition. Oftentimes, that’s followed by a meaningful correction in the stock market that can erode accumulated wealth. In that scenario, hedge funds are expected to cushion the blow on the way down.

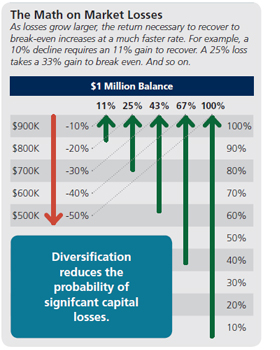

The Math on Market Losses

As losses grow larger, the return necessary to recover to break-even increases at a much faster rate. For example, a 10% decline requires an 11% gain to recover. A 25% loss takes a 33% gain to break even. And so on.

Less Downside Over Time

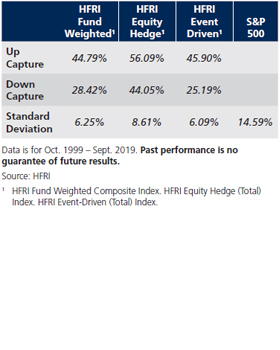

Through a full market cycle, hedge funds, on average, have participated less in the upside but protected more on the downside.

How can alternatives achieve higher rates of return?

Alternative investments have some advantages over traditional investments in that they have more tools at their disposal. They can use leverage, derivatives and short selling. They also have fewer redemption periods, which protects investors from sudden market moves but also limits liquidity. Private equity firms are known to take a more active approach to investing than their traditional counterparts and can create unique features, such as board seats at a private company. While these private equity active management strategies are expected to enhance returns, they add to the risk of investment loss.

The dearth of IPOs since the listing peak in 1996 has reduced the rate of new businesses entering the public market such that the average public company is 50% older and roughly four times larger than it was 20 years ago. Over the same period, the number of companies in the S&P 500 growing at 20% or greater has halved.

The most attractive feature of private equity is its return enhancement potential. From 1999-2018 private equity achieved a return of approximately 5% greater than large cap public equities. Private equity investors should expect to be compensated for the additional risks and illiquidity with excess returns, given the characteristics of PE investments: a long time horizon, illiquidity and a return profile that is commonly called the J-curve effect—negative in the early years and growing increasingly positive in the middle to late years.

When should I invest in alternatives?

Alternative investments play a key role in portfolios during all stages of market cycles and especially during periods of volatility. An alternative strategy has a number of tools available to hedge and protect a portfolio. Alternative investments can provide unique benefits that enhance portfolio construction to improve risk-adjusted returns. By developing a thorough understanding of the role alternative investment strategies play in a portfolio, including the rewards and risks, investors can better utilize these strategies to construct robust portfolios. The OAM Alternatives team strives to educate investors on how to allocate to alternatives while maintaining appropriate investment expectations.

Privates Matter

The number of public companies in the S&P 500 that generate more than 20% revenue growth has been cut in half over the last 20 years, as more companies are finding sufficient financing in the private sector.

How can I invest in alternatives at Oppenheimer?

Hedge Funds

Private investment pools that offer investors greater flexibility than traditional investments with the goal of hedging potential market volatility. Defining characteristics include the ability to benefit from declining stock prices through short positions, the ability to use leverage, as well as access to global markets and derivatives. These features provide investors the potential to generate positive returns in both up and down markets.

|

Hedge Fund |

Objective |

Defining Characteristic |

|---|---|---|

|

Long/Short Equity |

Outperform the equity market with lower levels of volatility over a full market cycle |

Generate alpha from long and short stock selections |

|

Event-Driven |

Exploit perceived mispricing of securities in anticipation or as a result of an event or catalyst |

Profits when anticipated event occurs to close the price-value gap |

|

Global Macro |

Profit from geopolitical or economic events |

Uses options, futures, forwards, swaps and other complex derivatives to express trade themes and manage risk |

|

Fixed Income and Relative Value |

Identify investments through market inefficiencies, which present opportunities to profit from converging prices of long and shortpositions |

Invest across a range of public and private debt of varying grades, private loans, structured products and derivatives |

Private Equity

Equity strategies that make majority and minority investments in companies that aren’t listed on a public exchange. Invested capital is provided by limited partners and put to work by general partners to acquire businesses for control, fund new projects, solidify a company’s balance sheet, restructure the business model and management or fund acquisitions. They are typically less liquid with investments lasting years.

|

Private Equity |

Objective |

Defining Characteristic |

|---|---|---|

|

Leveraged Buy-Out |

Identify public companies to take private in order to turn around or grow the business |

Uses debt to facilitate transactions, improving the return on capital for investors |

|

Venture Capital |

Identify fast-growing startups poised to disrupt industries and established competitors |

Seeks to exit investments through IPOs or strategic sales |

|

Co-Investment |

Provide access to sourced, well researched and structured investments into privates |

Direct investment in a private company |

Private Debt

Private debt covers the lending of money to companies and individuals by entities other than banks.

|

Private Debt |

Objective |

Defining Characteristic |

|---|---|---|

|

Sponsored |

Provide attractive risk-adjusted returns, floating rate income with potential for capital gains while maintaining low beta to equity markets |

Senior secured loans to private businesses backed by private equity sponsors that provide capital, expertise and governance |

|

Non-Sponsored |

Provide attractive risk-adjusted returns, floating rate income with potential for capital gains while maintaining low beta to equity markets |

Senior secured loans to private businesses, typically family or entrepreneur-owned |

Real Assets

Physical assets with an intrinsic worth due to their substance and properties—like precious metals and commodities.

|

Real Assets |

Objective |

Defining Characteristic |

|---|---|---|

| Energy |

Profit from supply-and-demand trends associated with energy prices and serve as an inflation hedge |

Uses debt to facilitate transactions, improving the return on capital for investors |

|

Commodities |

Profit from supply-and-demand trends shaped by global growth and serve as an inflation hedge |

Seeks to exit investments through IPOs or strategic sales |

|

Infrastructure |

Invest in large physical assets with stable revenue to generate attractive returns for long-term investors seeking income and growth |

Direct investment in a private company |

Public and Private Real Estate

Tangible property made up of land and anything on it, including buildings, plants, animals and natural resources. As an investment, real estate seeks income and capital appreciation.

|

Real Estate |

Objective |

Defining Characteristic |

|---|---|---|

|

Mortgage/Lending |

Generate yield from a portfolio of assetbacked real estate loans |

More conservative real estate investment with senior claim on physical real estate for principle protection on yield investment |

|

Core |

Invest in fully operational and stabilized properties within major markets that are financed with low levels of debt |

Investors are primarily compensated through stable cash distributions rather than property appreciation |

| Value Add |

Invest in operational properties within broader developed markets that might be experiencing occupancy or management problems |

Potential to increase cash flow yield by increasing rental yield from growing occupancy or rental rates. Leverage is used to finance acquisitions and boost yield |

|

Development |

Provide capital to finance ground-up real estate projects to generate capital appreciation |

Direct investment in early-stage, developmental real estate projects |

Glossary

-

Alpha

A measure of nonsystematic return—one that cannot be attributed to market gains or losses—that shows how the portfolio would have performed had the market had no gain or loss.

-

Closed-end Funds

Funds that have a predetermined term life that can be extended at the discretion of the general partner, where committed capital is locked up for the term of the fund until liquidation occurs. Leveraged buyout and venture capital funds are typically closed-end.

-

Correlation

A statistic that measures the extent to which two securities move in relation to each other. Positive correlation suggests that the performance of securities move up or down together, while negative correlation implies they move in opposite directions.

-

Diversification

A risk management strategy used during portfolio construction that combines different types of assets to yield higher long-term returns with a lower risk profile.

-

Downside Capture

The percentage of market losses endured by a manager when markets are down.

-

J-curve Effect

A characteristic of private equity funds whereby returns are negative at the onset due to management fees and other costs but as the investment matures, it begins to realize gains and generate positive cash flows.

-

Leverage

Leverage is an investment strategy that uses borrowed money or debt—specifically through various financial instruments—to increase the potential return of an investment. It can multiply potential returns but it also multiplies the downside risk of the investment.

-

Open-end Funds

Funds that offer more liquidity to investors, featuring the opportunity for regular subscriptions and redemptions with a specified notice period. Hedge funds are typically open-end.

-

Upside Capture

The percentage of market gains captured by a manager when markets are up.

If you're a client and want to learn more about Alternative Investments, contact your Financial Professional.

Not a client and want to learn more? Reach out to an Oppenheimer Financial Professional.

Alternative investments are riskier than traditional investments and not appropriate for all investors. Investors must bear the risk of complete investment loss and indefinite investment time horizons, as their ability to redeem may be limited by market conditions or the terms of the investment.

Alternative investments are not appropriate for all investors and many may only be offered to certain qualified investors. Investors must be able to bear the economic risk of such an investment for an indefinite period and can afford to suffer the complete loss of investment. An Investor’s ability to redeem from such investments is limited to specific time periods (eg. monthly, quarterly, semi-annually, annually) with certain notice requirements.

Oppenheimer Asset Management is the name under which Oppenheimer Asset Management Inc. (OAM) does business. The Alternative Investments Group (AIG) is a division of OAM. OAM is a registered investment adviser and is an indirect wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc., a registered investment adviser and broker dealer.

The opinions expressed herein are those of the managers and not necessarily those of Oppenheimer Asset Management Inc. and are subject to change without notice. Some of the alternative fund managers that OAM is recommending are recently formed and have limited operating history.

Some newly formed managers and funds may have limited assets under management. With newly formed managers, there may be greater operational and financial risk factors. Oppenheimer & Co. Inc. has selling agreements with the hedge funds on the alternative fund platform. Oppenheimer & Co. Inc. receives part of the management fee and incentive fee and does not receive the same compensation from each hedge fund. This may be a potential conflict of interest for Oppenheimer & Co. Inc. and its financial professionals to recommend funds that pay higher compensation.

There is a substantial risk of loss when investing in alternative investments and, for each specific fund, the risk of underperforming the general markets or other funds. Past performance does not guarantee future results.

Indices are unmanaged, hypothetical portfolios of securities that are often used as a benchmark in evaluating the relative performance of a particular investment. An index should only be compared with a mandate that has a similar investment objective. An Index is not available for direct investment, and does not reflect any of the costs associated with buying and selling individual securities or management fees.

This material is not a recommendation as defined in Regulation Best Interest adopted by the Securities and Exchange Commission. It is provided to you after you have received Form CRS, Regulation Best Interest disclosure and other materials.

HFRI 500 Equity Hedge Index

The HFRI 500 Equity Hedge Index is a global, equalweighted index of the largest hedge funds that report to the HFR Database, which are open to new investments and offer quarterly liquidity or better. The index is rebalanced on a quarterly basis.

HFRI 500 Event-Driven Index

The HFRI 500 Event Driven Index is a global, equalweighted index of the largest hedge funds that report to the HFR Database which are open to new investments and offer quarterly liquidity or better. The event-driven funds that comprise the index are a subset of the HFRI 500 Fund Weighted Composite Index.

HFRI 500 Fund Weighted Composite Index

The HFRI 500 Fund Weighted Composite Index is a global, equal-weighted index of the largest hedge funds that report to the HFR Database, which are open to new investments and offer quarterly liquidity or better. The index constituents are classified into equity hedge, event-driven, macro or relative value strategies.

S&P 500 Index

The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index (stock price times number of shares outstanding) with each stock’s weight in the index proportionate to its market value. The index is one of the most widely used performance benchmarks for U.S. large-cap equities.