Hasta la Vista, Baby!

- February 24, 2021

Fourth-Quarter Commentary

Taxable Fixed Income

Leo Dierckman, Senior Portfolio Manager

Michael Richman, Senior Portfolio Manager

Leo Dierckman and Michael Richman discuss fourth-quarter performance in fixed income markets, share their outlook for the economy in 2021 and analyze a long-term trend in interest rates.

2020 began with drama as the novel coronavirus spread around the world. As the year unfolded, we endured the economic fallout from the pandemic along with social isolation and unrest. Not surprisingly, the year didn’t go away quietly. In addition to the disruption of our holiday traditions, we witnessed a toxic election season culminating in a mob storming Capitol Hill shortly after year end. Is anyone sad to see 2020 come to an end? We’re with you: “Hasta la vista, baby!” As we look ahead to another new year, the stormy skies may be dissipating. Vaccines are being administered, fiscal and monetary stimulus continues to buoy the economy and there’s a wave of pent up consumer demand ready to be unleashed as life normalizes.

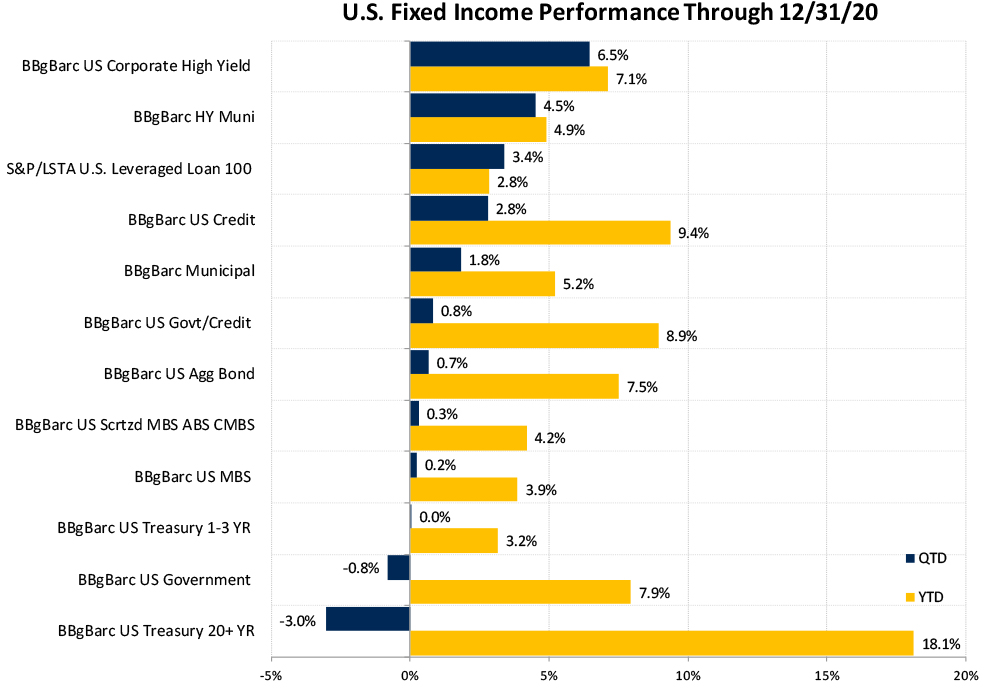

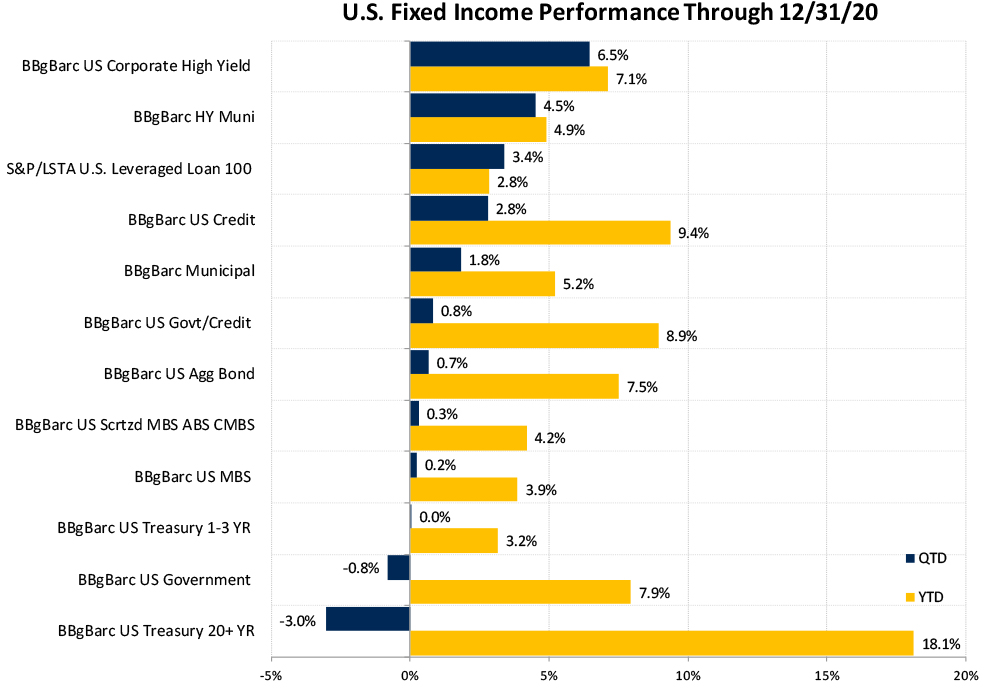

Yields remain near historic lows as the two-year and 10-year Treasuries entered the quarter yielding 0.13% and 0.69%, respectively. While near-term rates remained low and stable, longer-term rates increased during the risk-on rally leading to a steeper yield curve. Corporate credit returns were positive due to credit spread compression during the quarter. Below are highlights on fixed income performance during the quarter.

- The 10-Year Treasury yield started the quarter at 0.69% and ended the quarter at 0.93%. Treasuryprices on longer dated maturities declined as the yield curve steepened. Treasuries across the curvewere flat to down during the quarter.

- High yield and investment-grade credit rallied in the risk-on environment as investors drove creditspreads tighter. The Bloomberg Barclays U.S. Credit index returned 2.8% while the U.S. CorporateHigh Yield Credit index returned 6.5%. High yield was the best-performing fixed income segment asspreads tightened from 541 basis points at the beginning of the quarter to 386 basis points at theend of the quarter.

- Leveraged loans/floating rate appreciated due to credit spread tightening as the S&P/LSTA U.S.Leveraged Loan 100 Index returned 3.4%.

- Municipal bonds continued to appreciate as tax exempt income increasingly looks attractive asinvestors anticipate changing tax rates from the new administration. The Bloomberg BarclaysMunicipal Bond index generated a 1.8% return for the quarter. High yield municipal bondsgenerated a return of 4.5%.

- Non-U.S. local currency global bonds benefited from a declining U.S. dollar during the quarter. Emerging-market debt, both dollar and non-dollar, experienced spread tightening. Just about all major developed and emerging-market currencies appreciated relative to the U.S. dollar.

What to Expect in 2021

We believe the Fed deserves a round of applause for its heroic actions in 2020. The immediate rate cuts and emergency programs put in place at the outset of the pandemic quickly restored liquidity to markets and spurred a market recovery. The market ended the year as if the spring turbulence never existed. Investment grade bonds returned 7.5% per the Bloomberg Barclays US Aggregate Index and high yield bonds posted a 6.2% return per the ICE BofA US High Yield Index. If one simply looked at the string of annualized fixed income returns over the past five years, 2020 would not stand out much, but the intra-year volatility will go down in the history books.

For now, the Fed is on hold. We do not expect rate increases until 2023 at the earliest. The yield curve is certainly low but is favorably sloped, suggesting we have entered a multi-year expansionary period. Given changes to the Fed’s monetary policy framework discussed in our last quarterly letter, the Fed is likely to remain on hold even longer than it has in the past.

We anticipate positive but somewhat unpredictable gross domestic product in all four quarters of 2021. Much will depend on the speed at which vaccines are manufactured, distributed and administered along with adherence to safety precautions. Look for 2021 GDP in the 3%-4% range as we continue to pull out of the Covid-19 fog.

While a few publicized measures of inflation may intermittently suggest concern, the measure that matters to us (and the Fed) is core personal consumption expenditures. We believe this metric will move back toward 2% over time from the most recent reading at 1.4% in November. We expect unemployment to decline to the 5.5% to 6% range in 2021 from 6.7% currently. Given that the economy was not generating significant levels of inflation at pre-pandemic unemployment levels around 3.5%, we do not expect a sustained surge in inflation.

We expect modest total return to be in low single-digits for investment-grade bonds as corporate spreads are near historic tights to US Treasury bonds. We still want to take advantage of the extra yield corporate bonds offer over treasury and agency bonds. On the high-yield front, we anticipate a coupon clipping year with a mid-single digit total return. Our favorite ratings categories remain crossover credits: BBs and select Bs. For the most part, we are on the sidelines with CCC credits.

We do anticipate favorable performance from banks and finance companies on the investment- grade front as they benefit from a steeper yield curve during 2021. They should also provide a safe haven for investors given prospects for leveraging across other corporate sectors. We favor select retail and hospitality credits in high yield and REITs as we anticipate they will benefit from pent-up consumer demand.

As long-term investors, we continue to position portfolios to be dependable components of an overall asset allocation. We remain focused on producing income, not over-reaching for yield, and taking advantage of opportunities presented by the market.

Lower for Longer Rates

Today, the federal funds rate is at zero and is expected to remain there for at least a couple of years. The benchmark 10-year Treasury bond, as of year-end 2020, yielded 0.92% after hitting an all-time low of 0.51% in August 2020. Similarly, yields on most fixed-income products are near all-time lows. Many developed economies issue debt at negative interest rates. How did we get here?

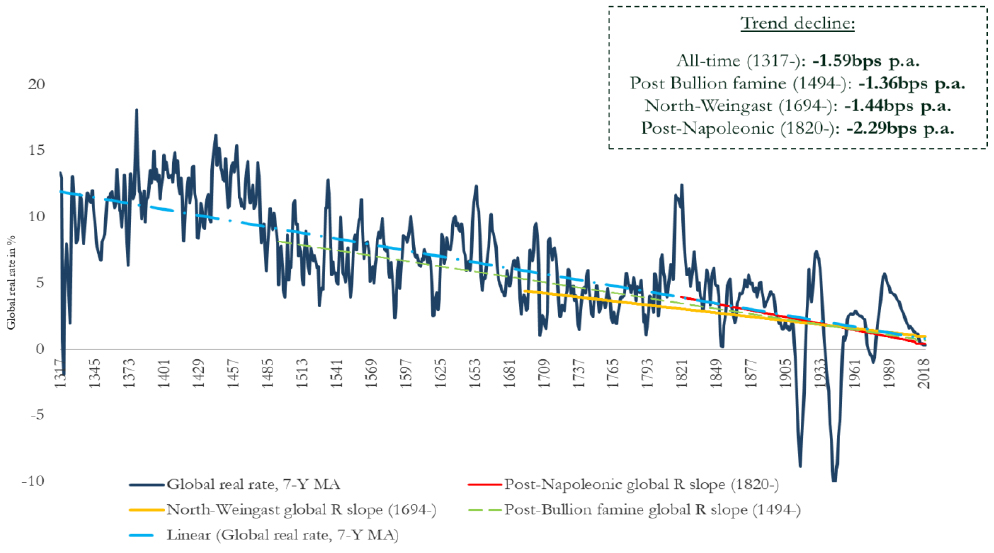

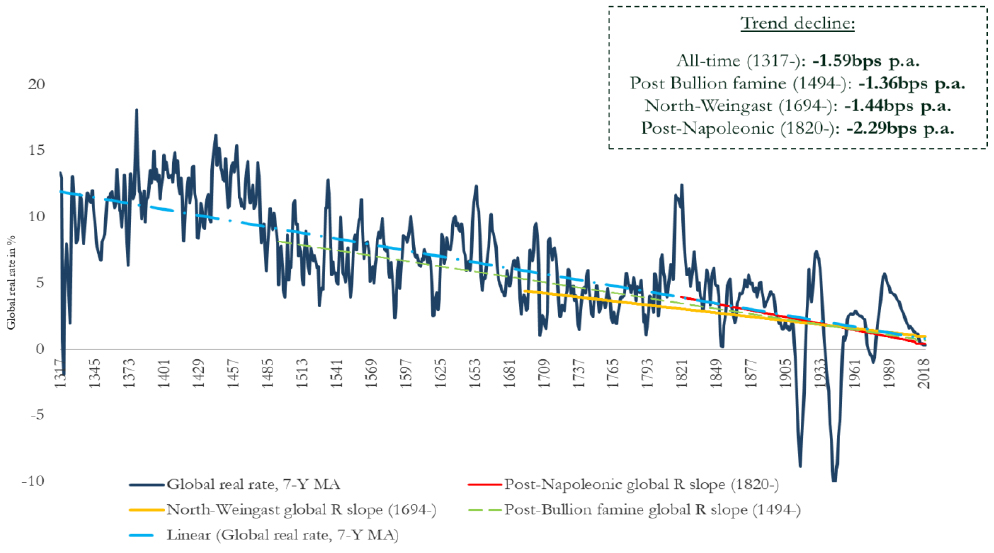

Most investors are aware that interest rates have been falling steadily in the United States since 1981 after then Fed Chairman Paul Volcker raised rates to tame unacceptably high inflation. However, many people might not be aware that, in January 2020, Harvard economic historian Paul Schmelzing published a paper that examined “safe asset” global real rates over the past 700 years and discovered a persistent decline. Some explanations for this phenomenon include general capital accumulation and rising life expectancies (increasing savings supply) and shorter, less destructive conflicts (reducing investment demand.)

Schmelzing expects real short-term rates will become permanently negative in the 2020s and long-term rates sometime after 2050. Investors can agree or disagree with this assertion. The point here is not that there is little risk of cyclically higher interest rate fluctuations, but that, counterintuitively, near-zero or negative real risk free rates are not obviously at abnormal levels.

The economic debate over the explanation of historically low interest rates for the past decade has focused on two camps. Economist Larry Summers promotes a secular stagnation theory, which focuses on a lack of investment demand. Former Fed Chairman Ben Bernanke sees a global savings glut. Their theories are more complementary than competitive. Summers’ secular stagnation theory sees declining population growth and aging populations in the developed world economies requiring less investment in factories and housing. As well, technological progress has reduced the amount of savings required to purchase a given amount of capital goods.

Meanwhile, Bernanke’s global savings glut argument focused on international trade flows, particularly developing countries transforming from debtor to creditor nations after the 1997 Asian financial crisis and China’s rapid economic growth. These countries issued debt to their citizens and used the proceeds to build up foreign exchange reserves to insure against capital flow volatility and prevent local currency appreciation, bolstering export-led growth. Export profits helped to build up foreign currency savings, weighing on sovereign rates globally. As we emerge from the Covid-19 pandemic and look into the future, we should expect at least a modest cyclical rise in interest rates as growth and inflation recover from the recession. However, all of the longer-term trends driving lower interest rates remain intact.

How We’re Positioning Portfolios

We believe markets are being supported by the prospect of declining Covid-19 cases at a time when the federal government and central bank are still supporting the economy. As long-term, value investors in fixed income, we remain focused on portfolio duration and credit. We maintain our bias toward rising interest rates in the near-term and favor corporate credit. With the 10-year Treasury trading below 1.15% yields and the U.S. economy in recovery mode, clipping the more attractive coupon provided by U.S. corporate investments should result in stronger portfolio performance over the long term. Remember, our bottom-up investment process and extensive research focus helps us identify relative value opportunities, giving us confidence in the risk-reward trade-offs in our portfolios. While market fluctuations can cause short-term underperformance, our long-only style of investing has delivered positive results with reduced volatility over the long term.

DISCLOSURE

© 2021 Oppenheimer Asset Management Inc. This commentary is intended for informational purposes only. The information and statistical data contained herein have been obtained from sources we believe to be reliable. Oppenheimer Investment Advisers (OIA) is a division of Oppenheimer Asset Management Inc. The opinions expressed are those of Oppenheimer Asset Management Inc. (“OAM”) and its affiliates and are subject to change without notice. No part of this commentary may be reproduced in any manner without the written permission of OAM or any of its affiliates. Any securities discussed should not be construed as a recommendation to buy or sell and there is no guarantee that these securities will be held for a client’s account nor should it be assumed that they were or will be profitable. Past performance does not guarantee future comparable results.

Indices are unmanaged, hypothetical portfolios of securities that are often used as a benchmark in evaluating the relative performance of a particular investment. An index should only be compared with a mandate that has a similar investment objective. An index is not available for direct investment, and does not reflect any of the costs associated with buying and selling individual securities or management fees.

High-yield bonds, those rated below investment grade, are not suitable for all investors. The risk of default may increase due to changes in the issuer's credit quality. Price changes will occur as a result of changes in interest rates and available market liquidity of a bond. When appropriate, these bonds should only comprise a modest portion of a portfolio.

Special Risks of Fixed Income Securities: there is a risk that the price of these securities will go down as interest rates rise. Another risk of fixed income securities is credit risk, which is the risk that an issuer of a bond will not be able to make principal and interest payments on time. Liquidity risk refers to the risk that investors won’t find an active market for a bond, potentially preventing them from buying or selling when they want and obtaining a certain price for the bond. Many investors buy bonds to hold them rather than to trade them, so the market for a particular bond or a small position in a bond may not be especially liquid and quoted prices for the same bond may differ.

OAM is a wholly owned subsidiary of Oppenheimer Holdings Inc. which also wholly owns Oppenheimer & Co. Inc. (“Oppenheimer”), a registered broker/dealer and investment adviser: Securities are offered through Oppenheimer and will not be insured by the FDIC or other similar deposit insurance, will not be deposits or other obligations of Oppenheimer or guaranteed by any bank or other financial institution, will not be endorsed or guaranteed by Oppenheimer and will be subject to investment risks, including the possible loss of principal invested.

This report contains forward-looking statements which reflect the current expectations of OAM regarding the economy and financial markets. These statements reflect OAM's current beliefs with respect to future events and are based on information currently available to OAM. Forward-looking statements involve significant known and unknown risks, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements. This material is not a recommendation as defined in Regulation Best Interest adopted by the Securities and Exchange Commission. It is provided to you after you have received Form CRS, Regulation Best Interest disclosure and other materials. 3465386.1