Inflection Points in Rolling Excess Return

- March 9, 2021

An analysis of style return winning streaks and their impact on forward return variance.

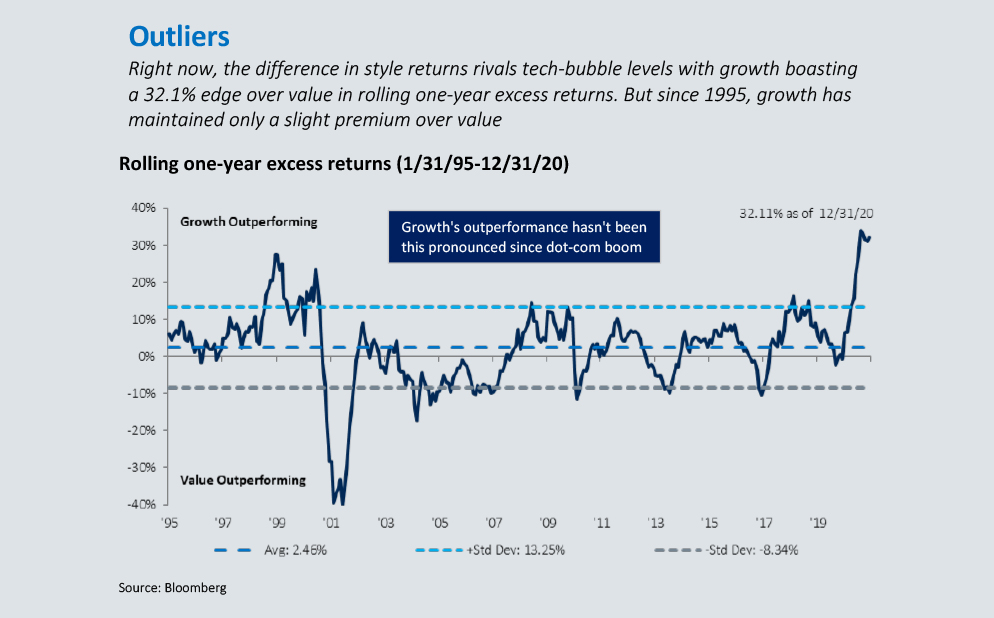

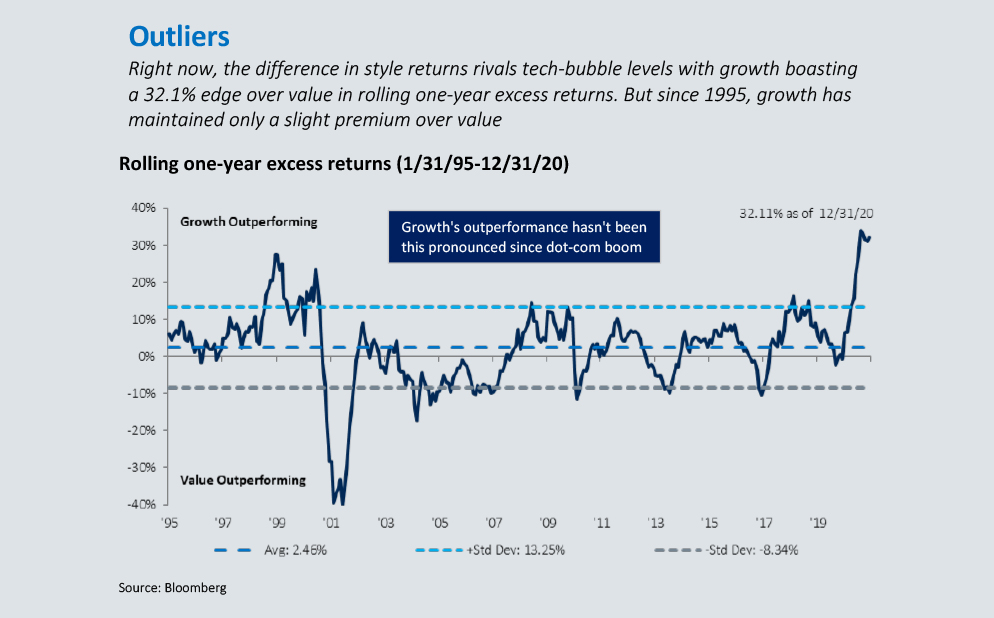

Index performance can be fleeting as investing styles tend to fall in and out of favor quickly. This is evident when you look at rolling one-year excess returns of the S&P 500 Growth and Value indexes. Examining excess rolling returns over prolonged periods provides clues to the sustainability of winning streaks and helps spot inflection points.

The return disparity between growth and value hasn’t been this pronounced since the dotcom boom. The one-year rolling excess return of growth over value is currently 32.1%, well above the one standard deviation band. The figure was slightly higher at the end of the third quarter at 33.3% but, prior to that, there hasn’t been a greater rolling one-year excess return of growth over value since the tech boom of 2000. Although growth companies have received the majority of investor and media attention over the past few years, growth has averaged just a slight return premium over value since 1995.

Divergence among Russell indexes rivals tech bubble levels. The rolling one-year excess returns are even greater within the Russell 1000. The Russell 1000 Growth Index currently has a 35.7% annual excess rolling return over Russell 1000 Value, above the standard deviation upper band of 12.9% and 40-year average of 0.9%. Outside of the third quarter of 2020, the divergence hasn’t been this wide since 2000. Russell Mid Cap Growth currently has a 30.6% annual excess rolling return over Russell Mid Cap Value, in excess of the upper standard deviation band of 16.5% and far greater than the 35-year average of 0.7%. The divergence hasn’t been this wide since 2000.

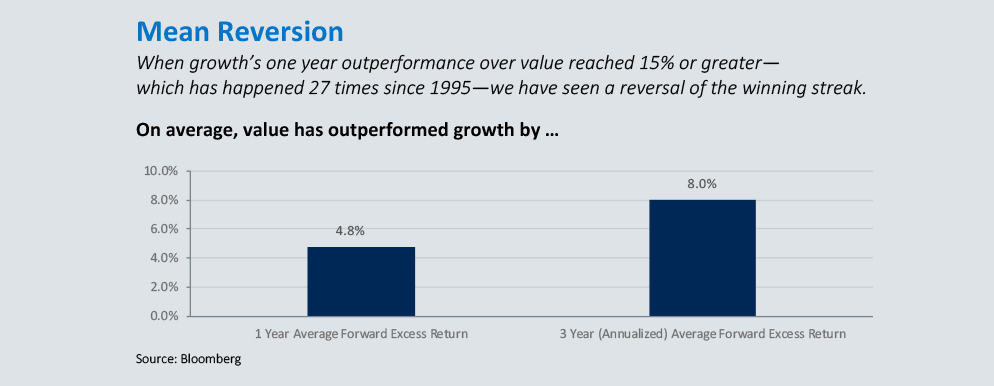

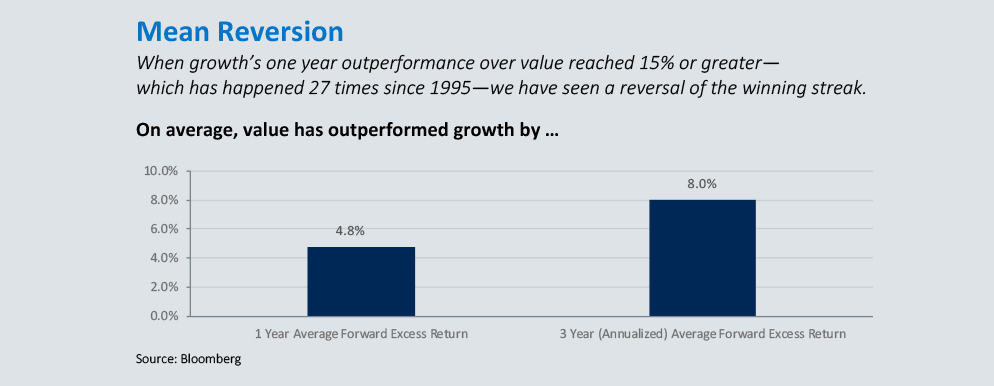

Rolling excess returns have revealed inflection points. It’s important to examine what happens to forward returns when past rolling excess returns reach a significant level. By looking at forward returns, an investor can better contextualize and predict how durable excess returns are over time. We calculated one- and three-year returns when trailing one-year excess rolling returns were greater than 15% since 1995—for both growth and value. We’ve identified average forward returns for this period.

When performance divergence was 15% or greater, the mean reversion has been pronounced. Since 1995, on a trailing one-year performance basis, S&P 500 Growth beat S&P 500 Value by 15% or more 27 times (monthly) for an average of 21.9%. As of Dec. 31, 2020, the trailing one-year divergence between S&P 500 Growth and S&P 500 Value was 32.1%. When trailing performance diverged by more than 15%, value outperformed growth by 4.8% over the next year and 8% in the next three years.

Spotting inflection points in style returns can be a useful tool. It’s important to keep significant return variances in perspective. When examining historical returns, most of the time the style that was deeply out of favor then outperformed on forward one- and three-year periods.

DISCLOSURE

This information is provided for informational purposes only and should not be construed as an endorsement of or a solicitation to invest in any specific program. The opinions expressed herein are subject to change without notice. There is a substantial risk of loss when investing in alternative investments and, for each specific fund, the risk of underperforming the general markets or other funds. The investor should carefully review the PPM of any fund before investing. Alternative investments are not appropriate for all investors and only may be offered to certain qualified investors. Past performance does not guarantee future results.

Investors must be able to bear the economic risk of such an investment for an indefinite period and can afford to suffer the complete loss of investment. An Investor’s ability to redeem from such investments is limited to specific time periods (eg. monthly, quarterly, semi-annually, annually) with certain notice requirements.

Some of the alternative fund managers that OAM is recommending are recently formed and have limited operating history. Some newly formed managers and funds may have limited assets under management. With newly formed managers, there may be greater operational and financial risk factors. Oppenheimer & Co. Inc. has selling agreements with the hedge funds on the alternative fund platform. Oppenheimer & Co. Inc. receives part of the management fee and incentive fee and does not receive the same compensation from each hedge fund. This may be a potential conflict of interest for Oppenheimer & Co. Inc. and its financial advisors to recommend funds that pay higher compensation.

The value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements. Both past performance and yields are not reliable indicators of current and future results. There is no guarantee that any forecast will come to pass or that any investment strategy will be successful. Investors should consider the fund as a supplement to an overall investment program and should invest only if they are willing to undertake the risks involved.

The risks associated with investing in fixed income include risks related to interest rate movements as the price of these securities will decrease as interest rates rise (interest rate risk and reinvestment risk), the risk of credit quality deterioration which is an issuer will not be able to make principal and interest payments on time (credit or default risk), and liquidity risk (the risk of not being able to buy or sell investments quickly for a price that is close to the true underlying value of the asset).

This commentary may contain forward looking statements or projections. These statements and projections relate to future events or future performance. Forward-looking statements and projections are based on the opinions and estimates of Oppenheimer as of the date of this presentation, and are subject to a variety of risks and uncertainties and other factors, such as economic, political, and public health, that could cause actual events or results to differ materially from those anticipated in the forward-looking statements and projections.

Indices are unmanaged, hypothetical portfolios of securities that are often used as a benchmark in evaluating the relative performance of a particular investment. An index should only be compared with a mandate that has a similar investment objective. An index is not available for direct investment, and does not reflect any of the costs associated with buying and selling individual securities or management fees.

Oppenheimer Asset Management is the name under which Oppenheimer Asset Management Inc. (OAM) does business. OAM Alternatives is a division of OAM. OAM is a registered investment adviser and is an indirect wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc., a registered investment adviser and broker dealer. 3404344.1