Fed Pivot, Inflation to Color 2022 Markets

- January 31, 2022

A shift in central bank policy and rising consumer prices pose palpable risks to the recovery but strong economic growth and higher corporate earnings could offset volatility in the coming year.

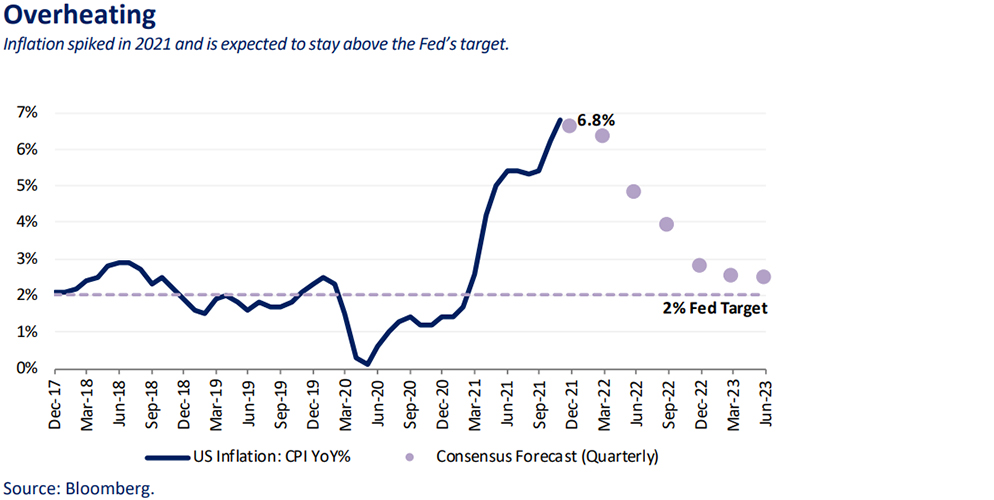

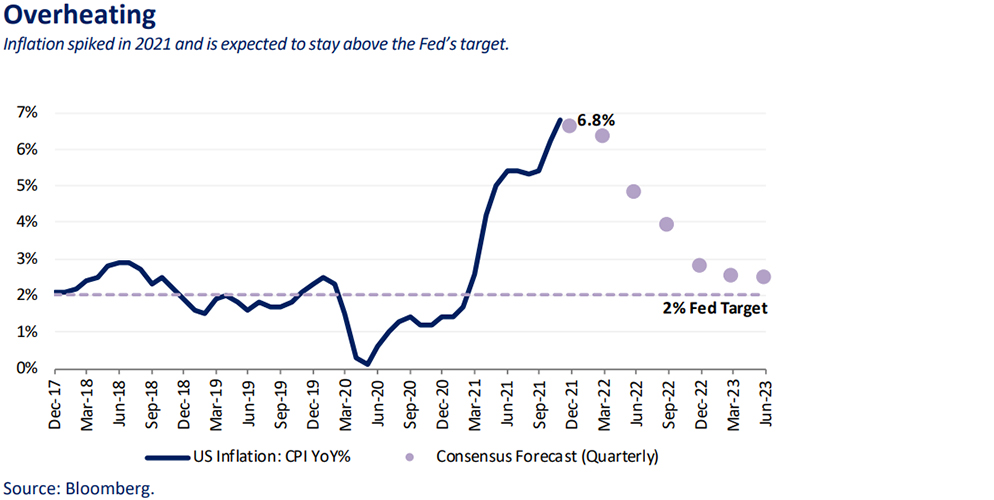

“Transitory” was a popular finance buzzword in 2021. As inflation crept higher in early spring, the Federal Reserve and many market pundits described spiking prices as transitory, forecasting the pace of price increases would normalize quickly. Their rationale was based on a diagnosis of the root causes of the issue as logistical and technical. The logistical issue was the sudden closure and subsequent restarting of complex global supply chains. Assumptions about the pace and ease of commercial reopening were overly optimistic as Covid-19 and hiring challenges have persisted. The technical issue stemmed from the economic shutdown in 2020, which generated substantially lower metrics for year-over-year economic comparisons, formally known as the “base effect.”

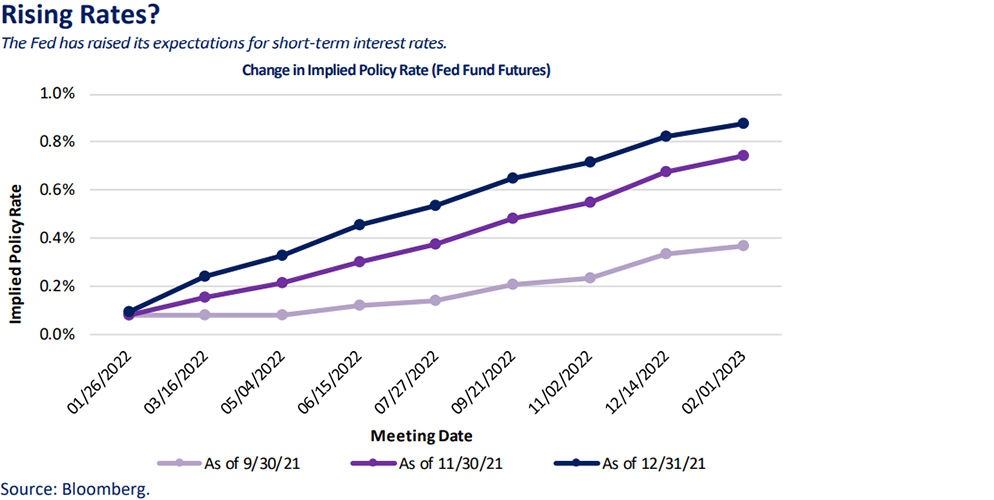

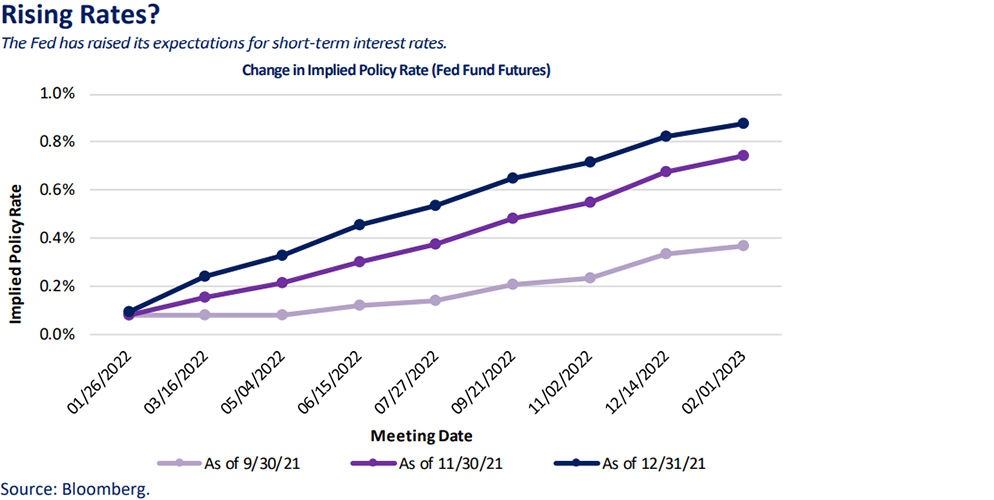

However, as inflation remained elevated and even trended higher in some cases, market participants have been questioning whether these inflationary pressures are truly transitory. After a few more persistently higher data points, the Fed voted to accelerate the pace of tapering and is projecting three rate hikes in 2022. That brings the year-end target range for the federal funds rate to 0.75%-1%. In addition, Fed officials are currently projecting another three hikes for 2023 followed by two more in 2024. The Fed’s pivot makes it clear that its biggest economic concern is persistently high inflation. As a result, central bankers are prepared to curb inflation even as the U.S. economy remains short of the Fed’s maximum employment goal and economic growth forecasts are scaled back.

Muted Response

Despite the hot inflation numbers and a significant pivot in Fed projections, the market reaction has been fairly muted. Contrary to expectations, the yield curve flattened in the fourth quarter, with shorter-term rates reacting to anticipated rate hikes while longer-term rates remained largely unchanged. The flattening yield curve—historically a bearish signal for risk assets—seems to indicate diverging short-term and long-term views. Bond investors may be looking past near-term data anticipating that inflation and economic growth will return to recent trend levels over the intermediate to longer-term. Breakeven inflation rates for both the five-year and 10-year horizons spiked in November but have since come down. Notably, both rates remain higher than the Fed’s 2% long-term target. Economic growth expectations also have been tempered recently, as the outlooks for 2021 and 2022 growth have come down over the last six months. Still, most economists have U.S. GDP growth remaining slightly above trend for the next several years.

It’s also possible that the bond market expects the Fed to pull back from its hawkish tilt sometime soon. Currently, the fed futures market is pricing in three hikes for 2022, in line with what the Fed has telegraphed. However, the market appears less convinced of additional moves in 2023 and 2024 given uncertainties. In the equity markets, given that valuations in many areas are already extended, U.S. stocks may react more aggressively to Fed tightening. We’ve already witnessed a substantial drawdown among high-growth stocks that aren’t profitable due to the risk of higher interest rates. And it’s possible the selloff becomes more widespread as the Fed tightens further.

If the U.S. experiences a sizable market correction, it is conceivable that the Fed could back off on its hawkish approach, at least temporarily, which would represent a replay of its response to the late 2018 market decline. The U.S. midterm elections could also play an unstated role in Fed policy, as the central bank will have to weigh its actions against the impact on growth in the run up to key Senate and House races. Lastly, the Covid-19 pandemic remains a wild card as it pertains to its impact on the global economy. Although the latest Omicron variant appears to produce milder symptoms compared to past variants, it has spread rapidly across the world and still has the potential for economic disruption.

Given the uncertainties surrounding growth, inflation and the pandemic, we anticipate that market volatility will remain elevated heading into 2022. The strongest equity returns for this cycle are likely in the rear view and stretched valuations for certain segments mean that a correction in 2022 is much more likely. However, economic growth remains above trend, earnings growth is still strong and stocks have historically performed well in the early portion of a tightening cycle. Conversely, we expect most core fixed-income markets to continue to face headwinds given the expectation of higher interest rates over the intermediate-term. And we’ve already seen interest rates move higher in early 2022. Against this backdrop, we remain slightly overweight equities, underweight fixed income and favor diversifying, uncorrelated strategies as complements to our equity overweight.

Opportunities Overseas

Although we continue to preach diversification within equity allocations, international developed market equities have looked increasingly appealing in recent periods. Evidence has shown a significant home bias among equity investors, which means that the average U.S. investor is meaningfully underweight international stocks. For the past decade, this has generally been favorable positioning, as U.S. stocks have dominated most other asset classes since the Global Financial Crisis.

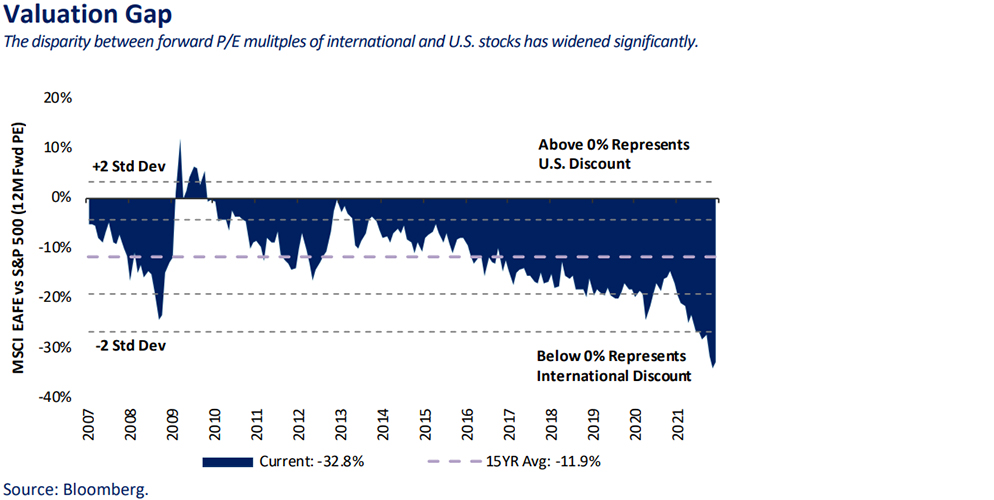

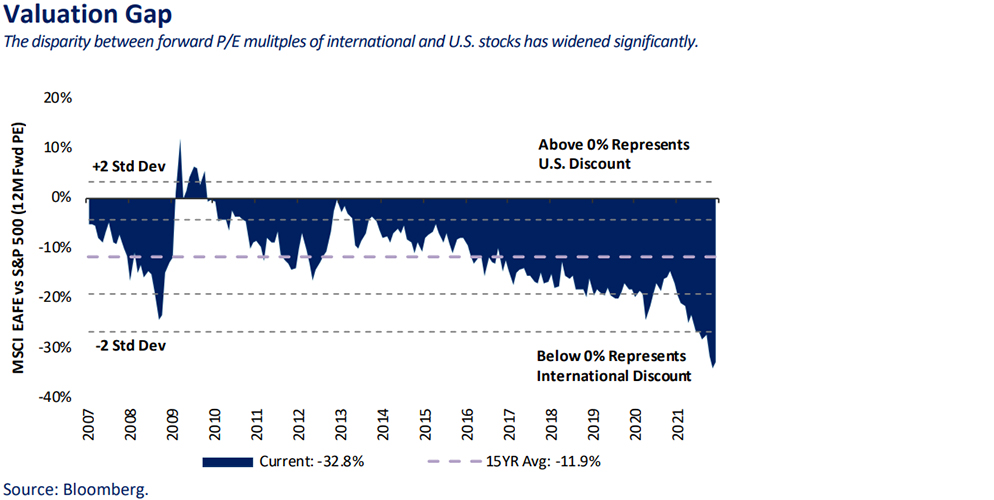

However, we see a number of factors that suggest some mean reversion over the intermediate-term. The most notable reason is the valuation differential between U.S. and non-U.S. stocks. International stocks have historically traded at a discount compared to their U.S. counterparts. But that discount widened significantly over the last decade and has reached extreme levels more recently in the wake of the Covid-19 pandemic. By December 2021, non-U.S. equities were trading at discounts to U.S. stocks of greater than two standard deviations below the historical average. Even compared to their own history, most developed markets are trading at reasonable valuations.

Over the last decade, part of the valuation dispersion could be justified by superior GDP growth, earnings growth and monetary stimulus in the United States relative to abroad. However, we see the winds shifting for international developed markets. Unlike the previous recession, most foreign governments and central banks were quick to react to the Covid-19 recession by providing ample fiscal and monetary stimulus, avoiding the worst-case scenarios in most economies. Foreign central banks appear willing to remain highly accommodative while the Fed tightens, which should further buoy international equities. After lagging earlier in the recovery. GDP growth forecasts for many international developed markets are now in line with or exceed the U.S. growth forecast for 2022. Meanwhile, corporate profitability has followed a similar trajectory. Earnings growth in the international developed markets is expected to rival U.S. earnings growth and rise above longer-term historical averages for the region.

Looking ahead, attractive valuations, strong economic growth and healthy fundamentals should make for a favorable environment for international equities. Yet foreign stocks are still fighting the same strong headwinds that their U.S. counterparts are facing, namely inflation and the pandemic. High commodity prices and supply chain issues are global problems that could disrupt developed-market recoveries. On the pandemic front, while the latest spike in cases in Europe is similar to the U.S. contagion, the region has shown more willingness to impose restrictions that could have negative economic consequences. Due to these uncertainties, we expect the international equity market to face bouts of volatility as well. However, we expect the substantial valuation differential across international equities to act as a defense against significant relative drawdowns.

The following Asset Class Detail section summarizes our asset class views.

Asset Class Detail

OAM Research’s sector-specific opinions are derived from ongoing analysis of valuations, momentum, economics, business cycle and fund flows.

Global Equity

Sizeable outperformance, driven by a few mega-cap growth stocks, has stretched valuations. Solid earnings and economic growth remain tailwinds but absolute performance should be more muted. As financing becomes more costly, the market will shift focus to company fundamentals. Higher rates should have a deeper impact on growth stock valuations, especially unprofitable companies with high valuations. Long/Short Equity strategies can exploit performance dispersion stemming from potential central bank actions but macro uncertainty may persist.

Current View: Slightly Positive

Valuations remain slightly higher than historical averages but not as extended as large caps. Small caps could benefit from the return of the cyclical trade but are likely to remain volatile given inflation and pandemic concerns. Fundamentals should remain paramount and unprofitable small-cap stocks may remain under pressure if interest rates continue to rise.

Current View: Slightly Positive

International equities posted positive returns but lagged U.S. stocks. Non-U.S. stocks are trading at historical discounts compared to U.S. equities and look reasonable compared to their own history. Attractive valuations and a strong earnings outlook suggests mean reversion and relative outperformance in 2022. Be wary of downside risks such as Covid-19 variants, inflationary pressures and central bank policy moves.

Current View: Slightly Positive

Valuations remain reasonable relative to most developed markets and their own history. The discount relative to U.S. stocks is notable. Still, the pandemic and economic recovery vary greatly from country to country and could spur continued performance dispersion. Active management should help navigate slowing growth, increased regulation in China and recoveries in other emerging markets.

Current View: Slightly Positive

Global Debt

Treasury yields were volatile due to persistent inflation concerns and the Fed’s hawkish pivot. We expect rates move higher over the intermediate-term as the Fed likely remains hawkish and growth remains above trend. Conservative investors should maintain exposure to core bonds to lower volatility, but investors requiring current income above inflation could supplement with investment-grade bonds, high-yield bonds or dividend-paying stocks.

Current View: Slightly Negative

Investment-grade spreads widened modestly but remain tight and yields are low relative to history. Although corporate fundamentals have improved significantly, tight credit spreads leave little room for appreciation and rising rates will create a challenging environment.

Current View: Slightly Negative

Spreads widened but remain tight relative to historical averages. However, fundamentals have significantly improved and default rates are very low. High yield provides more attractive yields and carries less duration risk than investment-grade bonds but effective active management is key.

Current View: Neutral

Interest rates overseas are modestly higher year-to-date but non-U.S. sovereign debt yields remain unattractive relative to U.S. Treasuries. Many foreign central banks are expected to remain accommodative in 2022 and non-U.S. corporate bonds provide lower yields than U.S. corporates, but fundamentals continue to improve.

Current View: Slightly Negative

Emerging market debt—government and corporate—offers much higher absolute yields relative to the rest of the world. However, economic growth and pandemic recovery remain idiosyncratic across developing countries and are likely to lead to divergence in performance. Local currency denominated debt may be a prudent hedge for dollar exposure.

Current View: Slightly Positive

Diversifying Strategies

Real assets—specifically REITs and MLPs—posted strong outperformance in 2021. But the valuation gap from a year ago has largely disappeared. REITs are no longer undervalued relative to other equities. And while MLPs are still trading at slight discounts relative to history, they don’t offer the same upside as a year ago. Both asset classes may outperform if inflation persists but it’s unlikely that we’ll see the same level of outperformance witnessed in 2021.

Current View: Slightly Positive

Macro strategies struggled in 2021 due to volatility and uncertainty. In 2022, a more hawkish Fed may provide attractive opportunities but volatility remains.

Current View: Neutral

Event-driven strategies performed well in 2021 on strong deal flow and we expect M&A activity to moderate if interest rates rise. But with strong balance sheets and stock prices, deal activity could remain robust and spur opportunities.

Current View: Positive

Reach out to your Oppenheimer Financial Professional if you have any questions.

Disclosure

The opinions expressed herein are subject to change without notice. The information and statistical data contained herein has been obtained from sources we believe to be reliable. Past performance is not a guarantee of future results. The above discussion is for illustrative purposes only and mention of any security should not be construed as a recommendation to buy or sell and may not represent all investment managers or mutual funds bought, sold, or recommended for client’s accounts. There is no guarantee that the above-mentioned investments will be held for a client’s account, nor should it be assumed that they were or will be profitable. OAM Consulting is a division of Oppenheimer Asset Management Inc. (OAM). OAM is an indirect, wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc. (Oppenheimer), a registered broker dealer and investment adviser. Securities are offered through Oppenheimer.

For information about the advisory programs available through OAM and Oppenheimer, please contact your Oppenheimer financial advisor for a copy of each firm’s ADV Part 2A.

Adopting a fee-based account program may not be suitable for all investors; anticipated annual commission costs should be compared to anticipated annual fees.

S&P 500 Index (“SPX”) is a well-known, broad-based stock market unmanaged index which contains only seasoned equity securities. The Fund does not restrict its selection of securities to those comprising the SPX. Performance of the SPX is provided for comparison purposes only. While the Fund’s portfolio may contain some or all of the stocks which comprise the SPX, the Fund does not invest solely in these stocks.

Russell 1000 Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. The Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics.

Russell 1000 Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

NASDAQ Composite Index tracks the performance of about 3,000 stocks traded on the Nasdaq exchange. The index is calculated based on market cap weighting.

VIX Index Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market's expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors' sentiments.

MSCI AC World ex-USA Index captures large- and mid- cap representation across 22 of 23 developed-market countries (excluding the U.S.) and 24 emerging-market countries.

LTM PE Ratio is the last 12-month price-to-earnings ratio.

Indices are unmanaged, do not reflect the costs associated with buying and selling securities and are not available for direct investment.

Risk Factors

The success of an investment program may be affected by general economic and market conditions, such as interest rates, the availability of credit, inflation rates, economic uncertainty, changes in laws and national and international political circumstances. These factors may affect the level and volatility of securities prices and the liquidity of a portfolio’s investments. Unexpected volatility or illiquidity could result in losses. Investing in securities is speculative and entails risk. There can be no assurance that the investment objectives will be achieved or that an investment strategy will be successful.

Special Risks of Foreign Securities

Investments in foreign securities are affected by risk factors generally not thought to be present in the United States. The factors include, but are not limited to, the following: less public information about issuers of foreign securities and less governmental regulation and supervision over the issuance and trading of securities. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Special Risks of Small- and Mid-Capitalization Companies

Investments in companies with smaller market capitalization are generally riskier than investments in larger, well established companies. Smaller companies often are more recently formed than larger companies and may have limited product lines, distribution channels and financial and managerial resources. These companies may not be well known to the investing public, may not have significant institutional ownership and may have cyclical, static or moderate growth prospects. There is often less publicly available information about these companies than there is for larger, more established issuers, making it more difficult for the Investment Manager to analyze that value of the company. The equity securities of small- and mid-capitalization companies are often traded over-the-counter or on regional exchanges and may not be traded in the volume typical for securities that are traded on a national securities exchange. Consequently, the investment manager may be required to sell these securities over a longer period of time (and potentially at less favorable prices) than would be the case for securities of larger companies. In addition, the prices of the securities of small- and mid- capitalization companies may be more volatile than those of larger companies.

Special Risks of Fixed Income Securities

For fixed income securities, there is a risk that the price of these securities will go down as interest rates rise. Another risk of fixed income securities is credit risk, which is the risk that an issuer of a bond will not be able to make principal and interest payments on time. Liquidity risk is the risk that you might not be able to buy or sell investments quickly for a price that is close to the true underlying value of the asset. When a bond is said to be liquid, there's generally an active market of investors buying and selling that type of bond.

Fixed income securities markets are subject to many factors, including economic conditions, government regulations, market sentiment, and local and international political events. Further, the market value of fixed-income securities will fluctuate depending on changes in interest rates, currency values and the creditworthiness of the issuer.

High Yield Fixed Income Risk

High yield fixed income securities are considered to be speculative and involve a substantial risk of default. Adverse changes in economic conditions or developments regarding the issuer are more likely to cause price volatility for issuers of high yield debt than would be the case for issuers of higher grade debt securities. In addition, the market for high yield debt may be less attractive than that of higher-grade debt securities.

Special Risks of Master Limited Partnerships

Master limited partnerships are publicly listed securities that trade much like a stock, but they are taxed as partnerships. MLPs are typically concentrated investments in assets such as oil, timber, gold and real estate. The risks of MLPs include concentration risk, illiquidity, and exposure to potential volatility, tax reporting complexity, fiscal policy and market risk. MLPs are not suitable for all investors.

Forward Looking Statements

This presentation may contain forward looking statements or projections. These statements and projections relate to future events or future performance. Forward-looking statements and projections are based on the opinions and estimates of Oppenheimer as of the date of this presentation, and are subject to a variety of risks and uncertainties and other factors, such as economic, political, and public health, that could cause actual events or results to differ materially from those anticipated in the forward-looking statements and projections. 4206767.1