After-Tax IRA Contributions and the Pro-Rata Rule

- March 31, 2022

For After-Tax Money in an IRA

It is important to understand the “pro-rata rule” before you take a distribution when you have before-tax and after-tax amounts in any traditional, SEP, and/or SIMPLE IRA (collectively “traditional IRA”).

Amounts in a Roth IRA are not subject to this rule, but some qualified employer retirement plans such as a 401(k) may be, if they allow non-Roth after-tax contributions. Also, after-tax amounts you may have in inherited IRAs, where you are the beneficiary, will also use the pro-rata rule but are not included in the pro-rata calculation for your own traditional IRAs.

The pro-rata rule prevents you from being able to simply distribute or convert only the after-tax amount (basis) or before-tax amount from your IRA. Instead, the pro-rata calculation is used to determine how much of a distribution or conversion is taxable when you have both after-tax and before- tax dollars in any of your traditional IRAs.

Before-tax and after-tax funds in traditional IRAs cannot easily be separated. This is true even if you keep the before-tax amounts in a different traditional IRA from the after-tax amounts, as the values of all traditional IRA(s) are combined for purposes of determining the percentage of any distribution (including Required Minimum Distributions) or conversion that is taxable.

Non-deductible IRA contributions

The pro-rata rule applies to any IRAs where over the years you have made both deductible and non-deductible traditional IRA contributions or have repaid reservist distributions. The ongoing filing of IRS form 8606, to keep track of the basis, is used to report all non-deductible contributions.

Qualified Retirement Plans (QRP)

You may have made both before-tax and after-tax contributions to your qualified employer sponsored retirement plan such as a 401(k), 403(b) or governmental 457(b). These after-tax amounts aren’t the same as amounts contributed to a designated Roth account in your plan. When separating from service, the entire plan balance, including any after-tax funds, can be rolled over to a traditional IRA. Under the pro-rata rule, once you roll over after-tax plan assets to a traditional IRA, you must keep a separate accounting for these amounts on IRS form 8606, which will represent basis in your traditional IRA. Instead, it is generally advisable to roll over after-tax contributions (basis) to a Roth IRA, while all before-tax amounts (including earnings on after-tax contributions) are rolled to a traditional IRA. See Convert QRP After-Tax Amounts below for additional information regarding partial distributions.

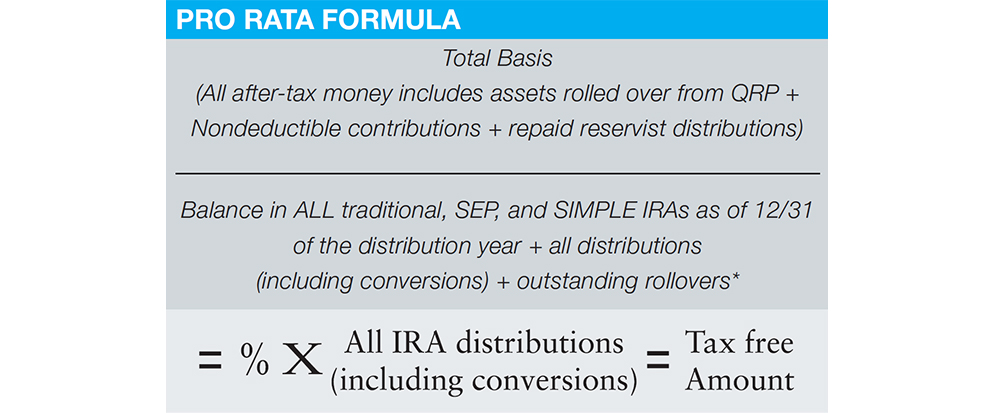

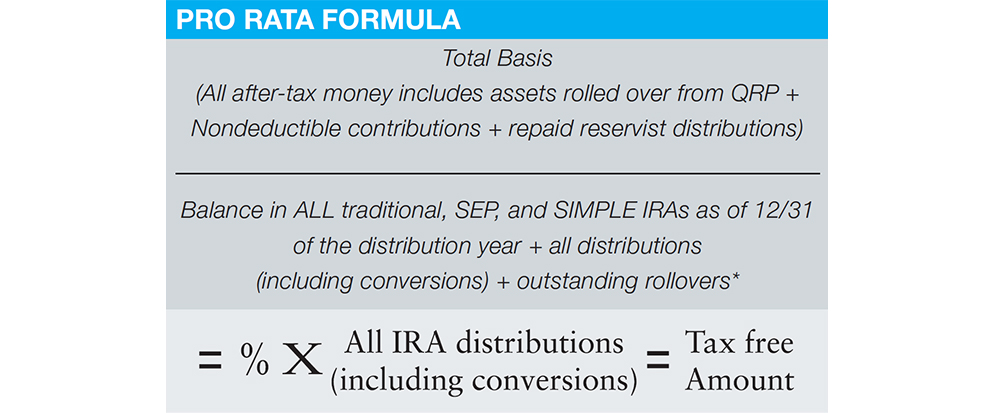

Pro-rata calculation

In order to determine the percentage of each IRA distribution that is not taxable, first, total the after-tax dollars in all of your traditional IRAs. After-tax dollars include non-deductible IRA contributions, repaid reservist distributions, or rollovers of after-tax dollars from a QRP (the amounts can be found on your IRS form 8606). Then, divide this amount by the 12/31 balance of all your traditional IRAs combined. Next, multiply that percentage by the amount of all traditional IRA distributions. The calculated amount represents the tax-free portion, and the balance of the traditional IRA distribution is taxable. Form 8606 should be filed if you take a distribution of after-tax amounts, and can be used to complete this calculation. You must also include all distributions including conversions and any outstanding rollovers* in that balance.

Note: Calculations done prior to the end of the distribution year may not reflect the actual tax-free portion. This is because the calculation is based on the 12/31 value of your IRAs.

Pro-rata and Roth conversion

The same pro-rata formula applies when calculating the taxes due on a Roth conversion. However, the pro-rata rule does not apply to Roth IRA distributions. Non-qualified Roth IRA distributions are subject to a different set of rules called ordering rules.

Convert QRP after-tax amounts

You do not have to roll your after-tax non-Roth QRP amounts to a traditional IRA. Instead you could (and probably should) choose to roll them to a Roth IRA as a conversion.

A partial distribution from a QRP must include a proportional share of the before and after-tax amounts in the account. It is important to know that you can allocate the before and after-tax eligible distributions to more than one destination, such as a new employer’s QRP, a traditional IRA, a Roth IRA and/or yourself. This allows you the option to elect a direct rollover of the before-tax basis to a traditional IRA without any tax liability and then roll the after-tax amounts to a Roth IRA as a tax-free conversion. Additionally, you could have the distribution made payable to you and within 60 days decide to convert some or the entire amount to your Roth IRA.

A conversion of after-tax basis to a Roth is not a taxable event. In addition, should you decide to convert those after tax amounts, remember those amounts are not subject to the IRS 10% additional tax for early, pre-59½, distributions when following the Roth distribution ordering rules. This strategy alleviates the blending of the before and after-tax amounts in your traditional IRAs and negates the need for the pro-rata calculation.

Remember

Keep your IRS form 8606 with other essential papers as it is important for your beneficiaries to be aware that your traditional IRAs have after-tax amounts. The pro-rata rule will apply to distributions taken by your beneficiary because your traditional IRAs will still have after-tax amounts in them.

Contact your Oppenheimer Financial Professional if you have questions about after-tax amounts in IRAs or employer retirement plans.

DISCLOSURE

© 2022 Oppenheimer & Co. Inc. Transacts Business on All Principal Exchanges and Member SIPC. All Rights Reserved.

The information contained herein is general in nature, has been obtained from various sources believed to be reliable and is subject to changes in the Internal Revenue Code, as well as other areas of law. Neither Oppenheimer & Co. Inc. (“Oppenheimer”) nor any of its employees or affiliates provides legal or tax advice. Please contact your legal or tax advisor for specific advice regarding your circumstances.

This material is not a recommendation as defined in Regulation Best Interest adopted by the Securities and Exchange Commission. It is provided to you after you have received Form CRS, Regulation Best Interest disclosure and other materials.

No part of this brochure may be reproduced in any manner without the written permission of Oppenheimer & Co. Inc. 4603056.1 RBI