The Importance of Remaining Diversified

- October 26, 2023

With the Magnificent Seven carrying high valuations and macro risks persisting, we believe that thoughtfully diversified portfolios are best positioned to withstand a wide range of potential outcomes.

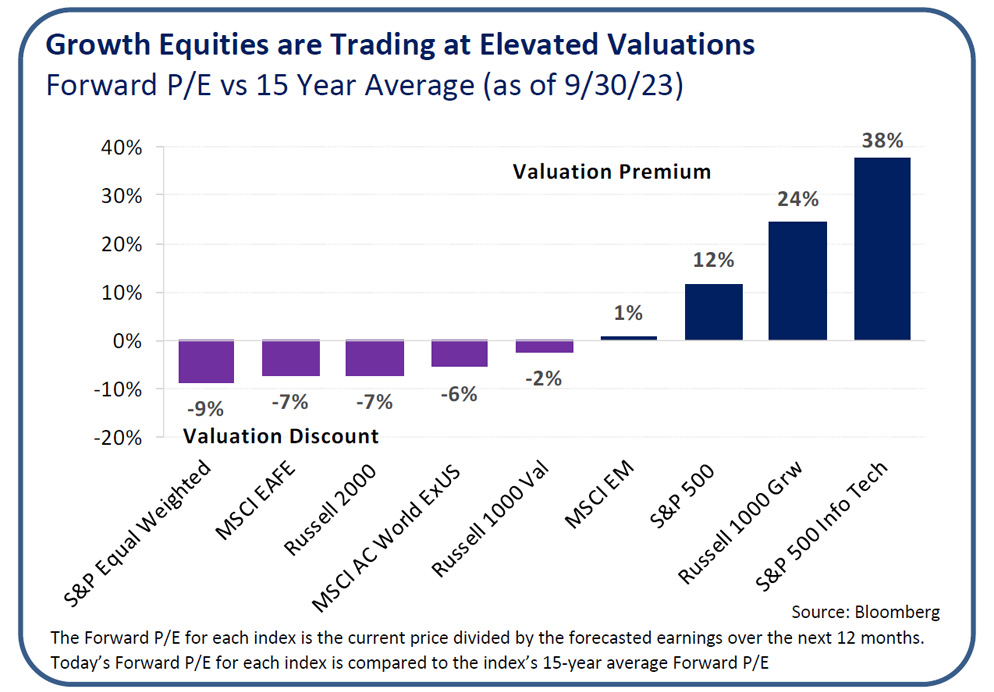

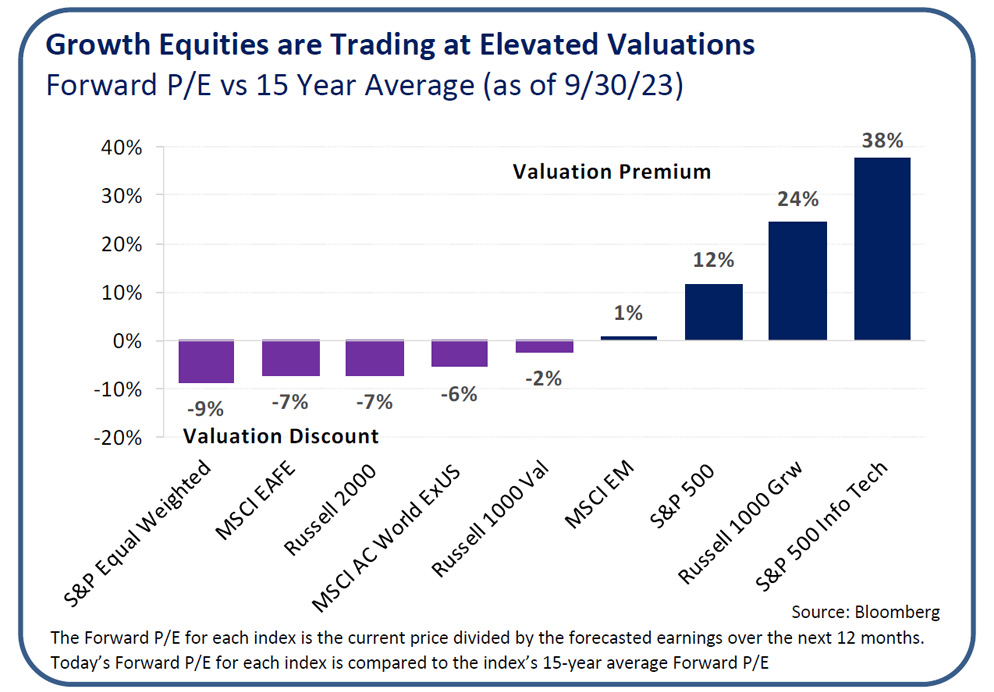

Market breadth continues to be narrow, and in last quarter’s Viewpoints, OAM Research highlighted the magnitude of the impact that the “Magnificent Seven” had on S&P 500 performance. With the sharp recovery of these stocks over the last year, large cap growth equities are back to trading at elevated valuations. As the market digests the potential for “higher for longer” interest rates and assesses the lagged impact of monetary policy making its way through the economy, OAM Research believes that investors should ensure diversification across more reasonably priced asset classes that could prove more resilient during a slowdown.

Challenging Macro Backdrop

Domestic growth has been much more resilient than expected, and the Atlanta Fed GDPNow model is forecasting a well above-trend annualized growth rate for the third quarter. The continued strength of the U.S. consumer has propelled much of the growth, as low unemployment, wage gains and excess savings helped to sustain spending habits even as prices continued to rise. With inflation prints continuing to trend lower over the summer, many investors began to buy into the soft landing or even no landing narratives.

However, we reiterate a number of outstanding headwinds that warrant skepticism of the Fed’s ability to successfully tame inflation without inducing economic pain:

- Banks have significantly tightened their lending standards for both retail and commercial customers. Borrowers that still have access to capital will likely see interest expenses move materially higher and place pressure on margins.

- Depleting consumer savings and the resumption of student loan repayments could hamper future spending, and rising delinquencies on credit card debt and auto loans have already impacted some consumers.

- The labor market has proven much more resilient than expected but is often viewed as a lagging indicator for economic weakness. Persisting challenges from union strikes are likely to increase wages and thus spending but pressure margins further. Declining corporate profits will eventually lead to slowing growth and increased slack in the labor market.

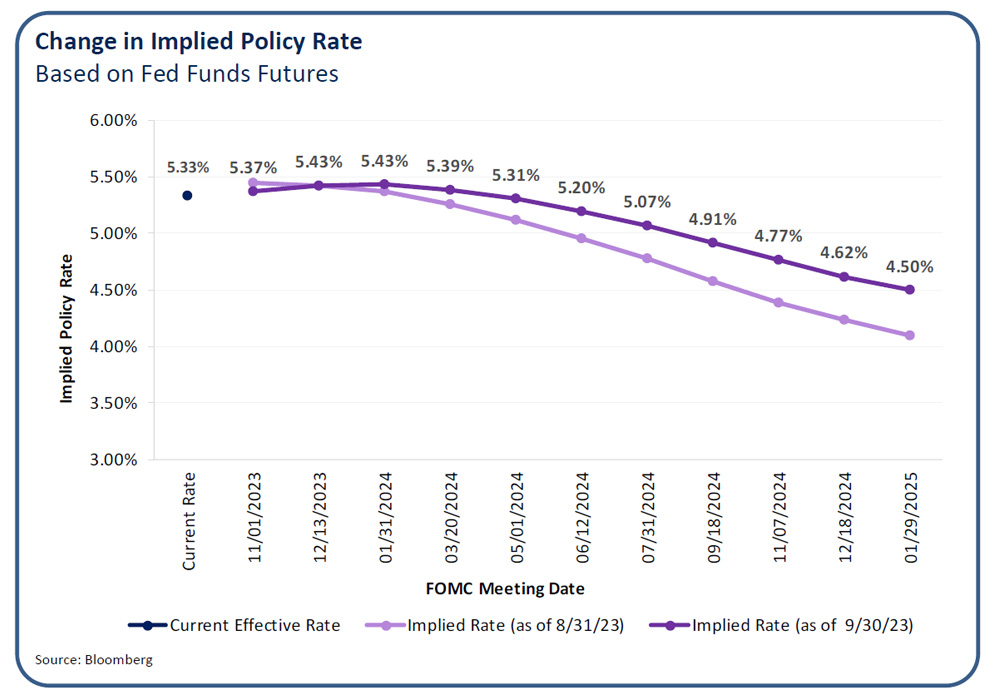

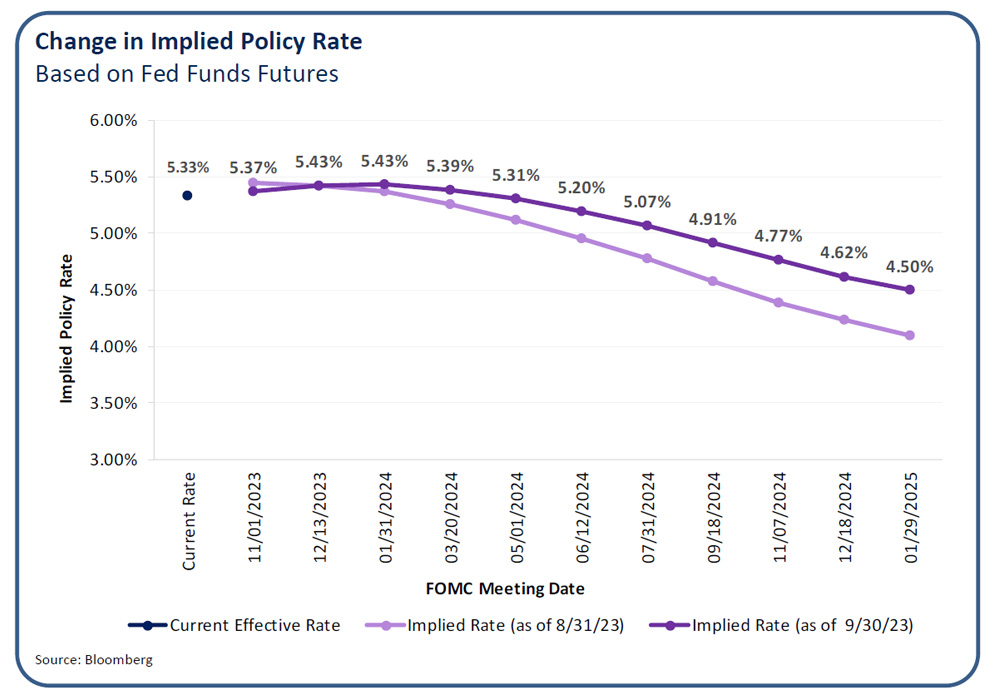

Recent weakness in both the equity and fixed income markets likely represents a resetting of expectations regarding future interest rates. While inflation has cooled from peak levels seen in June 2022, inflation expectations have once again begun to shift upward as oil prices have moved notably higher and wage growth has remained sticky. The Fed’s latest summary of economic projections reported higher than expected growth and inflation targets and a reduction in the number of interest rate cuts expected in 2024, which has exerted upward pressure on longer-term rates as investors digest a potential new normal.

Portfolio Implications

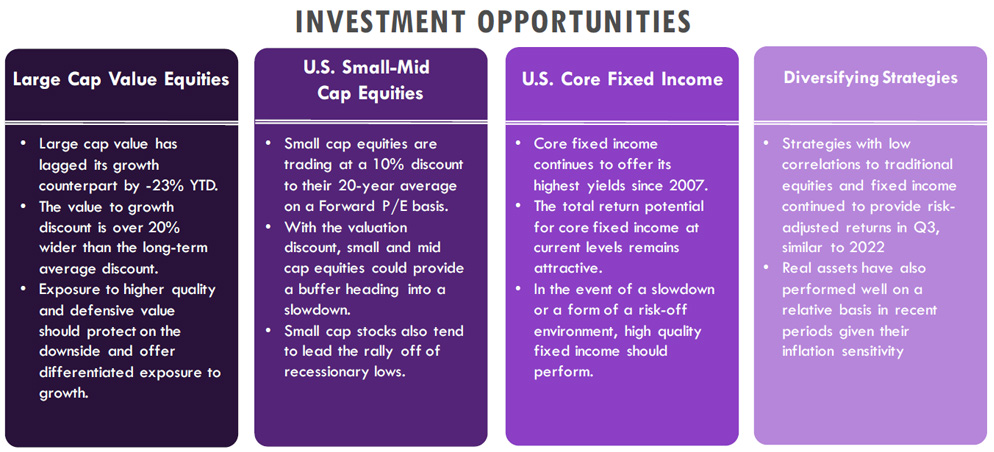

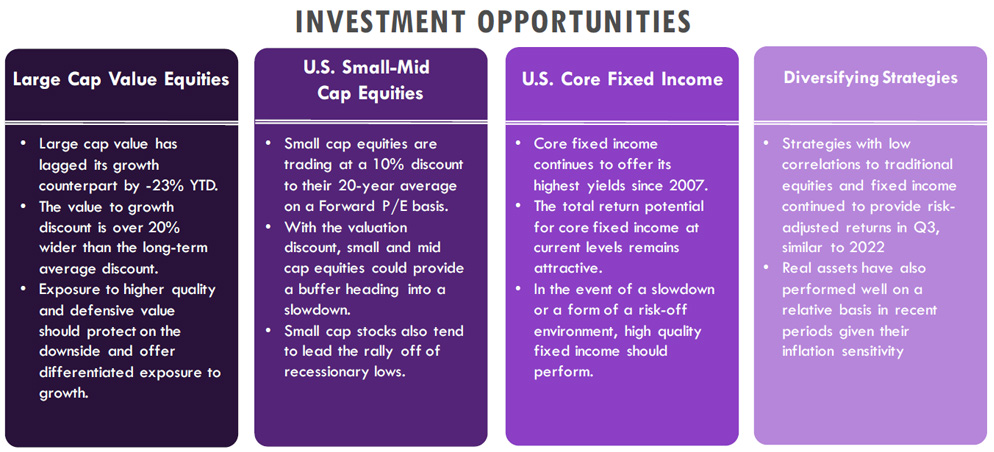

This macro landscape could prove difficult for large cap growth equities seeking to retain their dominance, as higher for longer rates could serve as a valuation headwind for longer duration assets, especially if the Fed is forced to keep interest rates high to avoid a stagflationary scenario. While new innovations such as generative artificial intelligence serve as significant potential future efficiency and growth drivers, uncertainty remains regarding the ultimate impact on earnings and future industry leaders. The rally in the first half of the year has likely caused an overweight to large cap growth equity in portfolios. We believe investors should reassess their current growth style allocations and contemplate rebalancing overweight positions back to their intended target weights.

In our view, instead of chasing the return drivers of early 2023, investors should remain diversified and ensure appropriate allocations to a variety of other asset classes with lower correlations to growth equity. Within equity markets, large cap value and smaller market cap stocks have the potential to provide attractive risk/return profiles at more reasonable valuations. Equity risk should be appropriately balanced with meaningful allocations to core fixed income and diversifying strategies that look increasingly attractive in today’s economic and interest rate environment. Many investors have been sitting on excess cash reserves given the high short-term rates, but there is an opportunity cost to sitting on the sidelines and capital appreciation may be missed if markets move quickly.

In our view, investors should consider rebalancing capital away from areas of the market that have outperformed, and OAM Research has identified four opportunities below for capital deployment that could be primed for positive mean reversion.

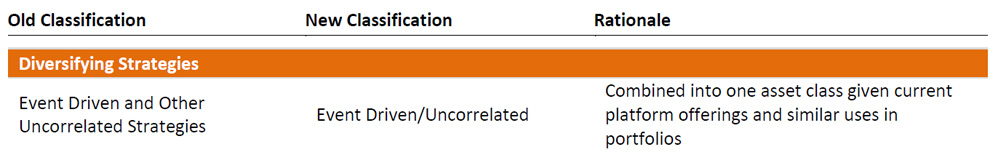

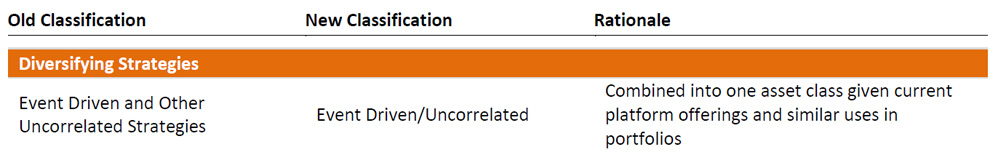

Summary of Asset Class Changes – Fourth Quarter 2023

In this section, OAM Research offers sector-specific opinions derived from ongoing analysis of valuations, momentum, economics, business cycle and fund flows. It is important to note that some asset classifications changed since the last quarter. The changes are defined in the chart below.

Global Equity

U.S. Large Cap Large caps offer investors an attractive blend of quality, yield and growth. Growth equity valuations remain very stretched, but value stocks appear more reasonably priced. Economic growth has thus far remained stronger than expected, but cautionary signs continue to emerge as the full impact of the Fed’s aggressive tightening is likely still making its way through the economy. Higher-quality companies with pricing power should be more resilient, and investors may benefit from allocating to strategies focused on quality and downside protection.

Current View: Neutral

Small and mid-cap stocks are trading at discounts relative to large caps and to their own history. Smaller companies are facing the same headwinds as their larger counterparts, primarily due to the impact of higher interest rates, higher cost of labor and lending pressures but are navigating the environment with less diversified product lines. Smaller cap stocks tend to underperform as economic growth slows, so neutral positioning is warranted despite more attractive valuations.

Current View: Slightly Negative

Most major economies outside of the U.S. are contending with weakening growth, elevated inflation, and hawkish central banks. International equities continue to trade at meaningful discounts, but given the economic uncertainties there appears to be more potential downside risk.

Current View: Slightly Negative

Valuations remain reasonable and look attractive relative to developed equities. However, China’s growth has been much weaker than expected and other emerging economies may suffer if global demand slows. Active managers can take advantage of bifurcated performance by allocating to countries with more promising growth prospects.

Current View: Neutral

Long/short strategies should benefit from increased dispersion and market dislocation, leveraging active management of both long and short positions. However, if a broad downward revision of earnings across sectors were to occur, it would likely adversely impact strategies.

Current View: Slightly Positive

Global Fixed Income

Interest rates have continued to rise and yields are much higher today than they were a year ago, providing a buffer from a total return standpoint. With the Fed nearing the end of their hiking cycle it can be an opportunity to add duration. Investment-grade credit spreads remain reasonable and corporate balance sheets are generally healthy. Spreads for high-quality securitized products represent attractive entry points.

Current View: Slightly Positive

Spreads have widened a bit recently but are tighter year-to-date and look tight if the U.S. is heading for recession. Defaults have picked up over the last year and could accelerate if the economy worsens. However, yields more than doubled over the last two years and high-yield bonds provide considerably more income today.

Current View: Neutral

Yields overseas have similarly improved over the last year and a half. However, most developed market rates remain less attractive than U.S. yields. Emerging market debt looks more attractive within the non-U.S. market, both from a yield perspective and as a portfolio diversifier, though the asset class may suffer if the risk-off trade intensifies.

Current View: Slightly Negative

Diversifying Strategies

Real Assets

Midstream energy infrastructure continues to benefit from elevated commodity prices, improved fundamentals and attractive yields. Other infrastructure segments with lower equity betas should provide stability in the face of more volatility. REITs continue to feel pressure from interest rates and loan concerns, but valuations have improved and fundamentals in many segments remain sound.

Current View: Slightly Positive

Event Driven/Uncorrelated

Event-driven strategies have rebounded from volatility in the first half of 2023 and continue to perform well as deal flow is projected to remain resilient despite increased regulatory scrutiny and recession risk. In some cases, event-driven managers with opportunistic credit exposure may benefit from stressed and distressed situations that arise. Other uncorrelated strategies such as multi-manager, macro and CTA have performed well amid elevated volatility, higher commodity prices and an increase in rates. If this environment continues, we believe these strategies should perform.

Current View: Positive

Reach out to your Oppenheimer Financial Professional if you have any questions.

Download the PDF here.

Disclosure

The opinions expressed herein are subject to change without notice. The information and statistical data contained herein has been obtained from sources we believe to be reliable. Past performance is not a guarantee of future results.

The above discussion is for illustrative purposes only and mention of any security should not be construed as a recommendation to buy or sell and may not represent all investment managers or mutual funds bought, sold, or recommended for client’s accounts. There is no guarantee that the above-mentioned investments will be held for a client’s account, nor should it be assumed that they were or will be profitable. OAM Consulting is a division of Oppenheimer Asset Management Inc. (OAM). OAM is an indirect, wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc. (Oppenheimer), a registered broker dealer and investment adviser. Securities are offered through Oppenheimer.

For information about the advisory programs available through OAM and Oppenheimer, please contact your Oppenheimer financial advisor for a copy of each firm’s ADV Part 2A.

Adopting a fee-based account program may not be suitable for all investors; anticipated annual commission costs should be compared to anticipated annual fees.

S&P 500 Index (“SPX”) is a well-known, broad-based stock market unmanaged index which contains only seasoned equity securities. The Fund does not restrict its selection of securities to those comprising the SPX. Performance of the SPX is provided for comparison purposes only. While the Fund’s portfolio may contain some or all of the stocks which comprise the SPX, the Fund does not invest solely in these stocks.

Russell 1000 Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. The Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics.

Russell 1000 Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

NASDAQ Composite Index tracks the performance of about 3,000 stocks traded on the Nasdaq exchange. The index is calculated based on market cap weighting.

VIX Index Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market's expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors' sentiments.

MSCI AC World ex-USA Index captures large- and mid- cap representation across 22 of 23 developed-market countries (excluding the U.S.) and 24 emerging-market countries.

LTM PE Ratio is the last 12-month price-to-earnings ratio.

Indices are unmanaged, do not reflect the costs associated with buying and selling securities and are not available for direct investment.

Risk Factors

The success of an investment program may be affected by general economic and market conditions, such as interest rates, the availability of credit, inflation rates, economic uncertainty, changes in laws and national and international political circumstances. These factors may affect the level and volatility of securities prices and the liquidity of a portfolio’s investments. Unexpected volatility or illiquidity could result in losses. Investing in securities is speculative and entails risk. There can be no assurance that the investment objectives will be achieved or that an investment strategy will be successful.

Special Risks of Foreign Securities

Investments in foreign securities are affected by risk factors generally not thought to be present in the United States. The factors include, but are not limited to, the following: less public information about issuers of foreign securities and less governmental regulation and supervision over the issuance and trading of securities. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Special Risks of Small- and Mid-Capitalization Companies

Investments in companies with smaller market capitalization are generally riskier than investments in larger, well established companies. Smaller companies often are more recently formed than larger companies and may have limited product lines, distribution channels and financial and managerial resources. These companies may not be well known to the investing public, may not have significant institutional ownership and may have cyclical, static or moderate growth prospects. There is often less publicly available information about these companies than there is for larger, more established issuers, making it more difficult for the Investment Manager to analyze that value of the company. The equity securities of small- and mid-capitalization companies are often traded over-the-counter or on regional exchanges and may not be traded in the volume typical for securities that are traded on a national securities exchange. Consequently, the investment manager may be required to sell these securities over a longer period of time (and potentially at less favorable prices) than would be the case for securities of larger companies. In addition, the prices of the securities of small- and mid- capitalization companies may be more volatile than those of larger companies.

Special Risks of Fixed Income Securities

For fixed income securities, there is a risk that the price of these securities will go down as interest rates rise. Another risk of fixed income securities is credit risk, which is the risk that an issuer of a bond will not be able to make principal and interest payments on time. Liquidity risk is the risk that you might not be able to buy or sell investments quickly for a price that is close to the true underlying value of the asset. When a bond is said to be liquid, there's generally an active market of investors buying and selling that type of bond.

Fixed income securities markets are subject to many factors, including economic conditions, government regulations, market sentiment, and local and international political events. Further, the market value of fixed-income securities will fluctuate depending on changes in interest rates, currency values and the creditworthiness of the issuer.

High Yield Fixed Income Risk

High yield fixed income securities are considered to be speculative and involve a substantial risk of default. Adverse changes in economic conditions or developments regarding the issuer are more likely to cause price volatility for issuers of high yield debt than would be the case for issuers of higher grade debt securities. In addition, the market for high yield debt may be less attractive than that of higher-grade debt securities.

Special Risks of Master Limited Partnerships

Master limited partnerships are publicly listed securities that trade much like a stock, but they are taxed as partnerships. MLPs are typically concentrated investments in assets such as oil, timber, gold and real estate. The risks of MLPs include concentration risk, illiquidity, and exposure to potential volatility, tax reporting complexity, fiscal policy and market risk. MLPs are not suitable for all investors.

Forward Looking Statements

This presentation may contain forward looking statements or projections. These statements and projections relate to future events or future performance. Forward-looking statements and projections are based on the opinions and estimates of Oppenheimer as of the date of this presentation, and are subject to a variety of risks and uncertainties and other factors, such as economic, political, and public health, that could cause actual events or results to differ materially from those anticipated in the forward-looking statements and projections. 6019646.1