Climbing the Ladder

Looking to step up your income game? Want access to a diversified bond portfolio? OIA Municipal Bond Ladder Portfolios can balance these objectives while keeping costs down.

When it comes to building a bond ladder, buying the right bonds for the right price is what counts. Changing market dynamics—increased credit risk and lower inventory—have made it more challenging for individual investors to do it themselves in a cost-effective way.

Bond Ladder Basics

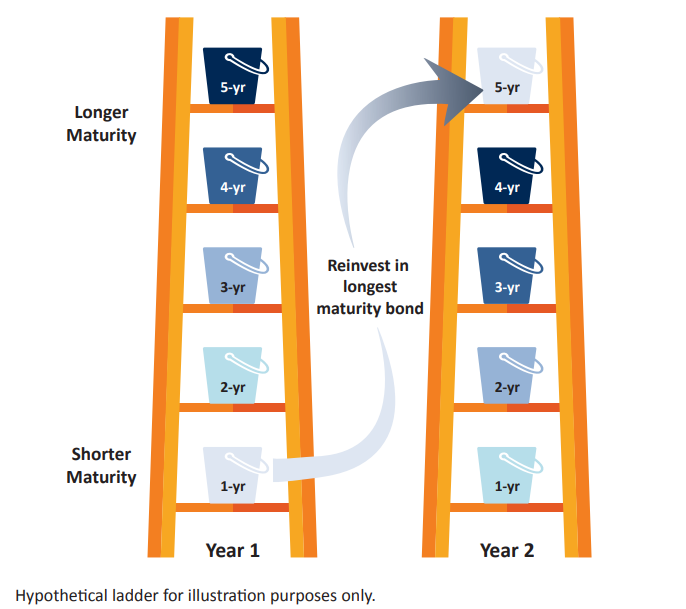

A bond ladder is a portfolio of individual bonds that mature on different dates. Their maturity dates are evenly spaced across several years so that the proceeds are reinvested as the bonds mature.

The individual bonds are akin to rungs on a ladder while the time between maturities represents the space between each rung.

Staggering maturities may help investors achieve diversification, earn steady income from the coupon payments and minimize exposure to interest-rate fluctuations.

Since 2006, the number of municipal bonds rated AAA has declined to 14% of the municipal bond universe from approximately 70%.1 Defaults, once a rare phenomenon in municipal bonds, have become more common. With San Bernardino, Calif., Detroit and Puerto Rico filing for bankruptcy, fixed-income investors are now facing the risk of significant losses. As a result, the muni market has become increasingly inefficient, which makes it challenging to find attractively priced investment-grade bonds.

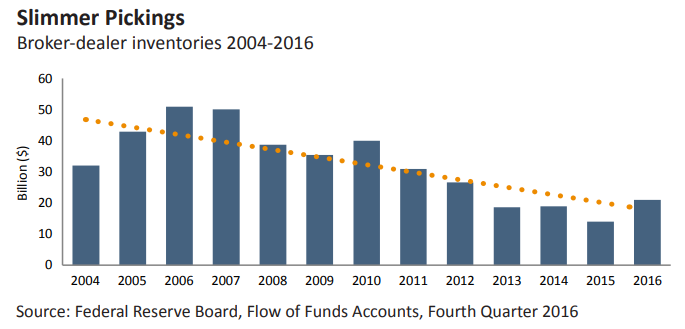

While still dominated by individual investors, the muni market has seen a rise in the popularity of mutual funds and separately managed accounts, which means that do-ityourselfers have to compete with professional investors. Further, overall bond inventory has shrunk during the last decade as new regulations have made it less attractive for financial institutions to sell bonds. Quality bonds are scarce, they require in-depth credit research and access to the best bonds is limited to a few large institutional players.

Bond Ladder Mechanics

An investor spreads an initial allocation across multiple bonds with different maturity years with the ability to reinvest as the bonds come due.

These characteristics pose formidable obstacles for income seekers, especially those who are in or near retirement. However, a professionally managed municipal bond ladder can offer better pricing and execution, deep credit expertise and ongoing credit monitoring when compared to the do-it-yourself variety. At the same time, you’re getting steady income, tax efficiency and the peace of mind that comes with a professional bond manager monitoring the credit quality of your investments.

|

Number

|

Why invest in a bond ladder?

|

|---|---|

1 |

Earn reliable tax-free income |

2 |

Preserve capital |

3 |

Reduce risk |

How Bond Ladders Work

When the first bond reaches maturity, the principal is then used to buy a new five-year bond. The following year, you repeat the same steps while collecting coupon payments.

We offer three equally weighted portfolios:

Our Laddered Strategies

-

Short Ladder:

One to five years

For clients who have higher liquidity needs and are concerned about the erosion of principal from rising interest rates. -

Intermediate Ladder:

One to 10 years

For clients who would like to strike a balance between income and modest market value fluctuations from interest-rate movements. -

Long Ladder:

Five to 15 years

For clients who are primarily focused on maximizing income and can tolerate fluctuations in value. (Bonds will generally be sold when maturity is less than five years.)

Why OIA Bond Ladders?

Structure

Professionally managed portfolios with a clearly defined, rules-based process

Discipline

Combines the team’s 54 years of fixed-income experience with rigorous credit research and monitoring

Reliability

Generates steady income over the life of the ladder

Access

Taps a network of more than 25 municipal bond dealers

The value of investments, as well as any investment income, is not guaranteed. Diversification does not assure a profit or protect against loss. The ladder strategy described does not insure against the risks associated with municipal bond securities, such as credit risk, market risk, interest-rate risk and liquidity risk. Please see below for further disclosures. 1 Source: Bloomberg Barclays.

To learn more about our laddered bond portfolios,

contact your Oppenheimer Financial Professional.

Oppenheimer does not provide tax, legal or accounting advice. Please consult your own tax, legal and accounting advisors before engaging in any transaction.

© 2017 All rights reserved. This report is intended for informational purposes only. All information provided and opinions expressed are subject to change without notice. The information and statistical data contained herein have been obtained from sources we believe to be reliable. No part of this report may be reproduced in any manner without the written permission of Oppenheimer Asset Management or any of its affiliates. Any securities discussed should not be construed as a recommendation to buy or sell and there is no guarantee that these securities will be held for a client’s account nor should it be assumed that they were or will be profitable. There can be no assurance that any investment strategy will be successful. The characteristics and other information shown is of a representative portfolio and is included for illustrative purposes only. Holdings are subject to change. Securities discussed herein should not be viewed as a recommendation to buy or sell, and there is no guarantee that they will be held in a client account or they will be profitable.

Liquidity risk: Investments with low liquidity can have significant changes in market value, and there is no guarantee that these securities could be sold at fair value.

Fixed-income market risks: The risks associated with investing in bonds include risks related to interest rate movements (interest rate risk and reinvestment risk), and the risk of credit quality deterioration (credit or default risk). OIA may invest in securities it believes are undervalued in the market; however there is a risk this assessment will not be realized. Fixed income securities markets are subject to many factors, including economic conditions, government regulations, market sentiment, and local and international political events. Further, the market value of fixed-income securities will fluctuate depending on changes in interest rates, currency values and the creditworthiness of the issuer.

Credit risk: The value of a fixed-income security may decline, or the issuer or guarantor of that security may fail to pay interest or principal when due, as a result of adverse changes to the issuer’s or guarantor’s financial status and/ or business. In general, lower-rated securities carry a greater degree of credit risk than higher-rated securities.

Interest-rate risk: Generally, the value of fixed-income securities will change inversely with changes in interest rates. The risk that changes in interest rates will adversely affect investments will be greater for longer-term fixed income securities than for shorter-term fixed income securities. There is no guarantee that the risks described above will be mitigated or lessened by the strategy described herein. Past performance does not guarantee future results. There is no assurance regarding the performance of this strategy. This material is not a recommendation as defined in Regulation Best Interest adopted by the Securities and Exchange Commission. It is provided to you after you have received Form CRS, Regulation Best Interest disclosure and other materials.

Oppenheimer Investment Advisers is a division of Oppenheimer Asset Management. Oppenheimer Asset Management is the name by which Oppenheimer Asset Management Inc. (OAM) does business. OAM is an indirect, wholly owned subsidiary of Oppenheimer Holdings Inc., which is also the indirect parent of Oppenheimer & Co. Inc. (Oppenheimer). Oppenheimer is a registered investment adviser and broker dealer. Securities are offered through Oppenheimer. OAM10132017JC1