View of Past Epidemics on the Market

- March 9, 2020

Investor panic and fears surrounding COVID-19 have caused significant fluctuations in the global markets during the past few weeks. There are several different factors that contribute to why the stock market may move one way or another, but it’s important to always remember that the markets are resilient.

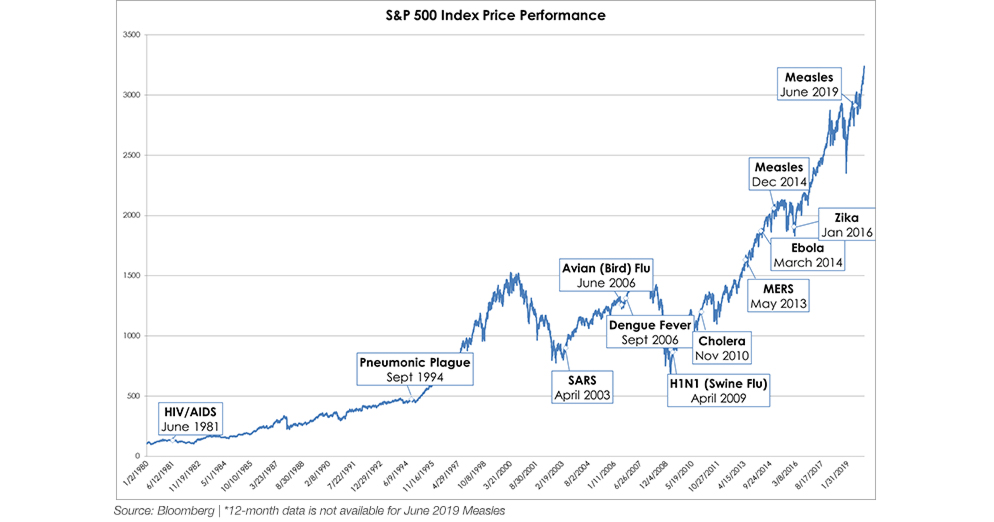

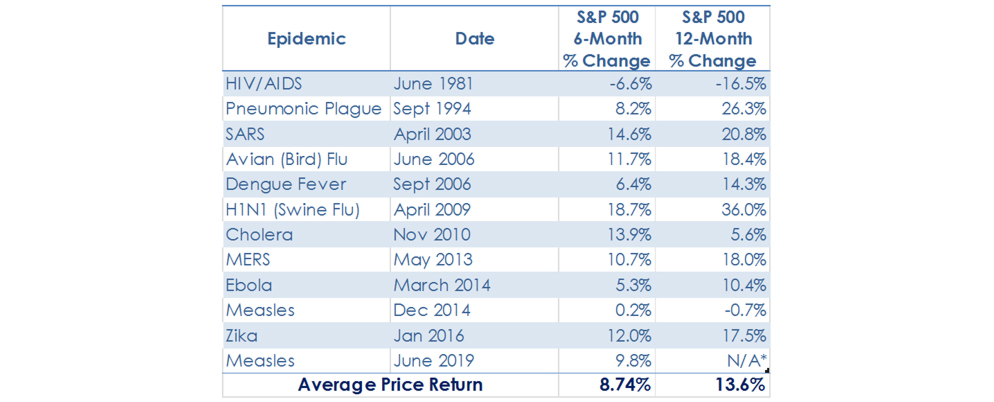

The Bloomberg data below indicates that market movements following the start of modern epidemics, including SARS, the Avian Flu and H1N1, demonstrate resilience.

Looking at this evaluation, we can see that for all but one epidemic situation, the 6-month change of the S&P 500 index was positive, with an average price return of 8.8%

Similarly, looking at the 12-month change of the S&P 500 index following the start of an epidemic, 9 out of 11 situations were positive, with an average price return of 13.6%.

We at Oppenheimer understand that the current news is concerning, if any questions arise about your investments you should contact your Oppenheimer Financial Advisor.

If you don't have a Financial Advisor with Oppenheimer, click here to find one near you.