2020 Is Over - Now What?

Diversification across asset classes is paramount for investors in 2021

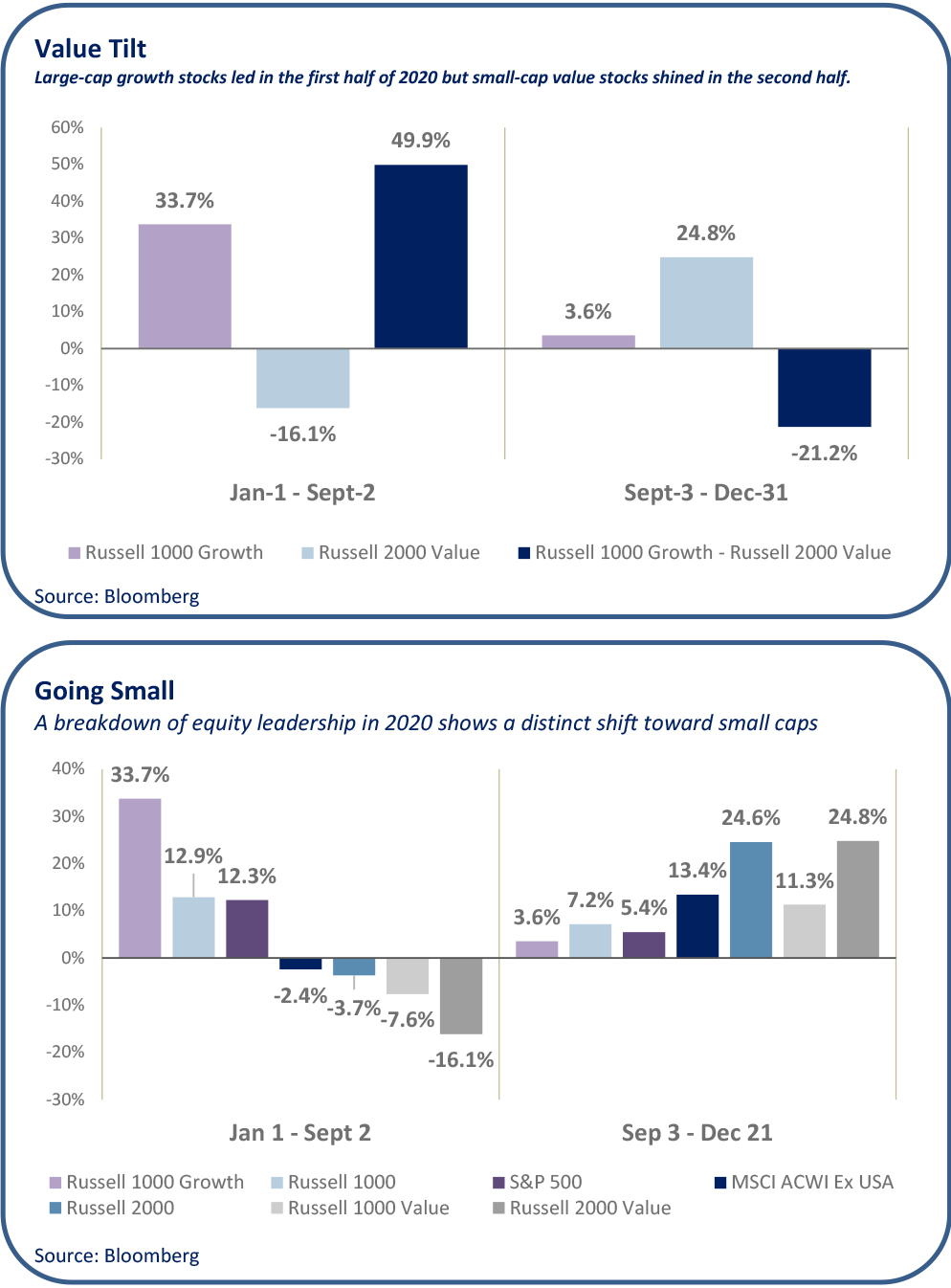

Tech stocks led the market rally that followed the end of Covid-19 shutdowns but a rotation to value is underway. For most of 2020, large-cap growth stocks, fueled by technology companies, particularly the FAANMG—Facebook, Apple, Amazon, Netflix, Microsoft and Google (Alphabet)—stocks, led the U.S. equity market. These growth stocks entered 2020 with elevated valuations yet acted as relative safe havens during the pandemic-induced selloff in the first quarter as the companies experienced accelerating earnings and benefited from the Federal Reserve’s stimulus programs. Many of these technology companies were insulated from the challenges posed by Covid-19 and the related shutdowns. In fact, some businesses directly benefited from the increase in remote work environments.

Even as the market began to recover and the U.S. and global economies began to slowly reopen, investors continued to pour capital into these stocks during the spring and summer. Their high level of conviction was based on longer-term secular trends that were accelerating in this environment. Many of these trends will have staying power even after the world moves past Covid-19.

U.S. growth stocks continued to outperform for several months after the initial correction, as investors favored tech stocks that were less impacted by the pandemic. These growth stocks, which provided meaningful downside protection in the first quarter, were also the quickest to recover. Indeed, the Russell 1000 Growth index had recouped Covid-19 losses by June 8.

Conversely, cyclical areas of the market such as small caps, value stocks and emerging markets, which typically outperform in the early stages of a new bull market, continued to lag behind growth-oriented sectors. Many companies in these cyclical sectors continued to struggle with the lasting impacts of the pandemic. By the end of the summer, these areas of the market were still meaningfully negative year-to-date while the growth indices were firmly in positive territory.

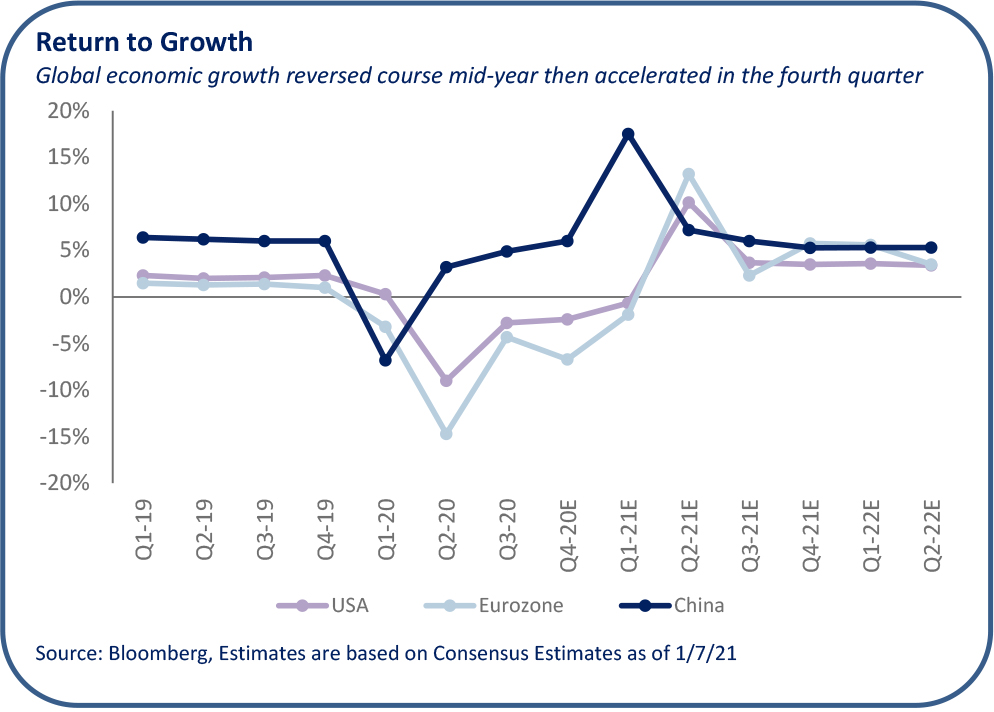

Still, we have seen a sizeable rotation in market leadership over the last few months. Since Sept. 3, U.S. small-cap stocks have rallied significantly, outpacing their larger-cap counterparts by 19.1%. The bulk of that outperformance came in November, as the market first celebrated initial expectations for a divided government. The market rallied further on news of successful drug trials for Covid-19 vaccines from Pfizer and Moderna. This news benefited small caps in particular as it raised hopes for an earlier and stronger-than-expected economic recovery in 2021. Small caps continued to rally in December, as the market looked past near-term spikes in coronavirus cases and new lockdown measures.

Value and emerging-market stocks have also outperformed over the past four months, albeit to a lesser extent. Value stocks, particularly cyclical companies that have been among the hardest hit from the pandemic, gained meaningfully on the vaccine news. Investors took this as a sign that the economy will return to normal faster than expected, leading to a renewed surge in economic activity. Specifically, areas with pent-up demand such as travel, retail and restaurants benefited. Emerging markets have also outperformed their developed-world counterparts for similar reasons and vaccine distribution will be a significant boost to their recovery. In addition, China’s economy has returned to growth faster than expected helped by its efforts to contain the virus.

Despite recent strength in equity markets, there is a lot of near-term uncertainty that may not be appropriately priced into current valuations. The market has rallied meaningfully since the first news about successful drug trials. However, these vaccines will take months to be distributed and vaccinate a significant portion of the population. This process could take longer than the market is expecting if there are any supply issues, distribution problems or if the number of people willing to get the vaccine is insufficient. In our bull-case scenario, we believe, successful vaccinations combined with significant monetary and fiscal support will lead to a strong rebound in economic growth in 2021. In this environment, small caps, value stocks and emerging-market stocks are likely to outperform.

However, in our bear-case scenario, we believe, any disruptions in the vaccination timeline could push out the recovery and lead to more market volatility in the first half of the year. Under those conditions, we could see a rotation back to technology-oriented companies as well as defensive sectors such as utilities, consumer, staples and real estate.

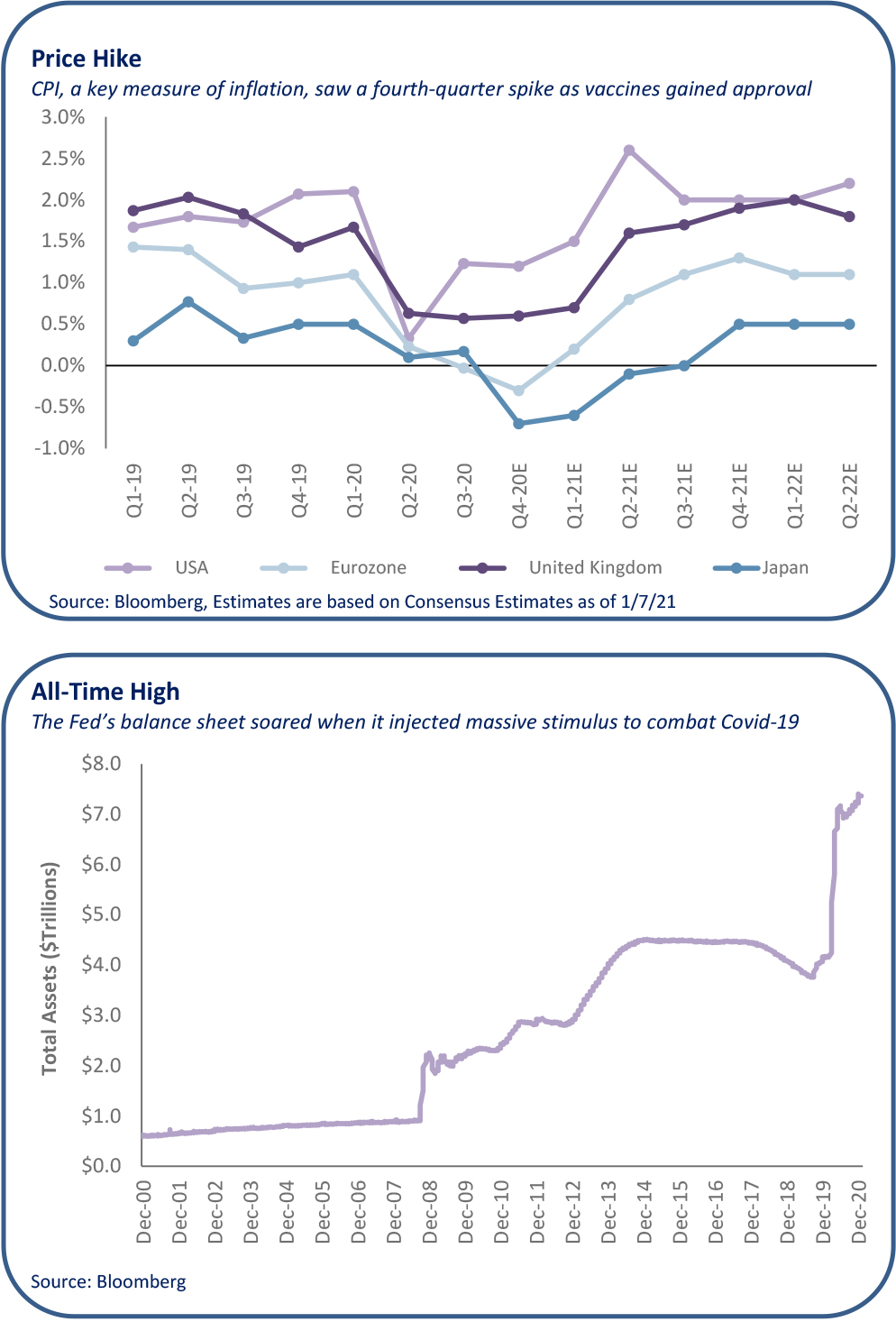

Despite historically low interest rates for the last decade, the market hasn’t witnessed any major spikes in inflation. And most inflation metrics have been running well below historical averages since the 2008 global financial crisis. However, given the expectations of a strong economic recovery in the wake of the pandemic, inflation concerns in the market over the intermediate-term have become more prevalent. The Fed was quick to combat Covid-19 by cutting short-term rates to zero and adding more than $3 trillion to its balance sheet through new quantitative easing. Fiscal support has also been robust through the passage of the $2 trillion Cares Act and another $900 billion in stimulus at the end of 2020. More stimulus may be in the offing under a Democrat-controlled administration and Congress.

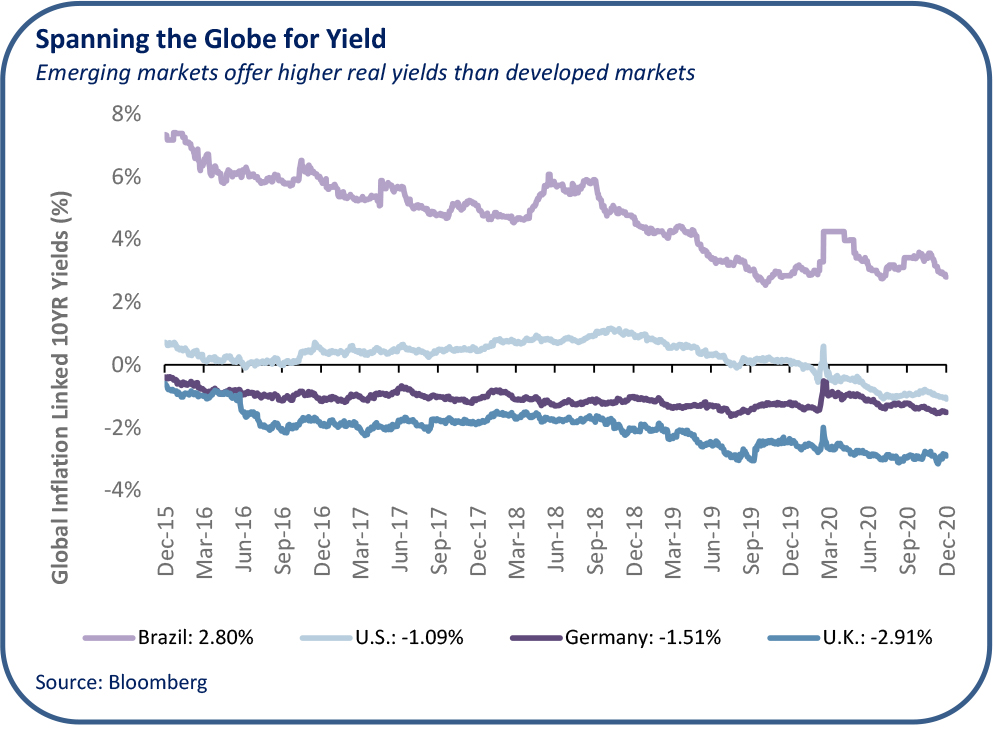

Expectations of a strong rebound in economic growth combined with continued accommodative fiscal and monetary policies has many investors anticipating reflation over the intermediate-term. Reflation with ultra-low interest rates will likely mean a difficult environment for conservative investors searching for current income. U.S. Treasuries have been producing negative real yields for the majority of 2020. Barring a drastic pivot from the Fed, sub-zero yields are likely to continue in 2021 and beyond.

Meanwhile, the outlook for non-U.S. government debt is even worse, as many developed countries have debt with negative nominal yields and central banks with similarly accommodative policies. Yield-starved investors may be forced to look at adding riskier assets to their portfolios. Allocations to dividend-paying stocks, real assets, high-yield bonds and emerging-market debt can provide investors with additional current income. However, these allocations will also add more volatility to the portfolio relative to investment-grade fixed income. Investors stretching for yield in these asset classes should consider pairing the allocation with a diversifying, low-volatility strategy that is less correlated to other asset classes.

Diversification Key in 2021

We believe that it is critical for investors to maintain a diversified portfolio given the wide range of potential outcomes. Amid such uncertainty, it’s difficult to accurately predict how the pandemic situation will unfold over the next several months. We think it makes sense to hold a mix of cyclicals, growth stocks and defensive companies within an equity portfolio. The cyclical exposure will allow investors to participate in the upside if the early bull market dynamic continues, while the growth and defensive allocations should provide protection in the bear case. It’s important to maintain diversification from a geographical perspective as well, as emerging markets could outperform in the bull case and broad non-U.S. equities could outpace U.S. stocks if dollar weakness continues in 2021.

Although we’re cautiously optimistic on global equities, an equity portfolio should still be balanced with fixed income and diversifying strategies to dampen volatility and downside risk in the overall portfolio. Fixed income and diversifying strategies with uncorrelated return streams should provide ballast in the face of stock market volatility and if the bull case doesn’t play out. Holding a diversified portfolio across a number of asset classes allows investors to protect more capital in down markets while still participating in growth during up markets. Given the uncertainty investors face in 2021, a diversified portfolio will likely be the key to navigating market volatility.

Asset Class Detail

OAM Research’s sector-specific opinions are derived from ongoing analysis of valuations, momentum, economics, business cycle and fund flows.

Global Equity

-

U.S. Large Cap

U.S. large-cap equities remain overvalued historically, but valuations look more reasonable when you consider the interest-rate environment. A diversified portfolio of growth and value stocks is prudent given the nascent recovery and pandemic-fueled volatility. Long/short equity strategies performed well in 2020 and should continue to add alpha through stock picking, exposure management and risk management while reducing portfolio beta and volatility. More dispersion in 2021 should result in both long and short alpha.

Current View: Slightly Positive

Change: None

-

U.S. Small Cap

U.S. small-cap valuations remain extended. Small caps have outperformed in recent months and could continue to excel if vaccine distribution is successful and leads to a strong economic recovery. Small caps tend to perform well in the early stages of a new bull market. Still, they have higher betas and may be prone to a steeper selloff if the recovery stalls.

Current View: Slightly Positive

Change: Increase

-

Non-U.S. Developed

International equities lag U.S. peers but are trading above their longer-term averages. Non-U.S. stocks have benefited from positive momentum spurred by vaccine news, a slowly improving macro picture, a weakening dollar and massive fiscal and monetary support. The cyclical nature of markets like Europe and Japan may lead to non-U.S. equity outperformance if vaccine distribution is successful.

Current View: Neutral

Change: Increase

-

Emerging Markets

Valuations remain reasonable relative to developed markets and their own history. Successful vaccine distribution may lead to outperformance. China, a large portion of the index, has rebounded well from the pandemic, but other EM countries aren’t well-equipped to contain the virus.

Current View: Slightly Positive

Change: Increase

Global Debt

-

Core Bond

The Treasury yield curve steepened since the summer, but yields remain near historical lows due to Fed stimulus. Short-term rates should stay near zero through 2023, leaving little room for additional capital appreciation for income-focused investors. Conservative investors should maintain an allocation to core bonds to lower portfolio volatility and as a source of buying power amid volatility. But investors requiring current income above inflation can supplement with higher-risk exposure to investment-grade bonds, high-yield bonds or dividend-paying stocks.

Current View: Slightly Negative

Change: None

-

Investment Grade

Investment-grade spreads have continued to grind tighter, and they’re only slightly higher today than when the year began. Spread tightening has been driven by Fed stimulus and corporate bond purchasing rather than fundamentals, but continued Fed flows should provide support. The risk of ratings downgrades has been declining as the pace of downgrades has slowed since April.

Current View: Slightly Negative

Change: Decrease

-

High Yield

High-yield spreads continued to tighten in the fourth quarter and are only slightly elevated relative to early 2020. Default rates have remained elevated since April and could continue in 2021 if lockdowns are extended. Effective active management will be crucial in avoiding deteriorating credit situations, especially in hard-hit areas such as oil and gas and retail.

Current View: Neutral

Change: None

-

Non-U.S. Developed

Non-U.S. sovereign debt continues to provide unattractive yields relative to U.S. Treasuries. Similar to the Fed, central banks overseas are expected to continue to be extremely accommodative. Corporate bonds in Europe and Japan provide lower yields than their U.S. counterparts and face similar fundamental issues due to Covid-19, though total returns for U.S.-based investors may look more attractive if the dollar weakness continues.

Current View: Slightly Negative

Change: None

-

Emerging Markets

Emerging-market debt, government and corporate, offers much higher absolute yields relative to the rest of the world. Successful vaccine distribution could also be a strong positive catalyst for emerging markets. Investors may prefer local currency denominated debt to hedged U.S. dollar exposure.

Current View: Slightly Positive

Change: None

Diversifying Strategies

-

Real Assets

Real assets offer attractive yields relative to broader equity market. REITs and utilities could protect well in the face of rising inflation. Valuations remain reasonable. MLPs offer attractive yields and have upside potential after commodity prices stabilized and earnings beat expectations, and a divided U.S. government takes the worst-case regulatory scenarios off the table.

Current View: Positive

Change: None

-

Macro

Fundamentally driven strategies performed relatively well in 2020 due to key events that managers were able to exploit. This was the first time in many years that these managers produced a meaningful return for investors. We remain cautious in 2021.

Current View: Neutral

Change: None

-

Other Strategies

Event-driven strategies saw a rebound in M&A activity in the back half of 2020 with the market recovery along with the special purpose acquisition company (SPAC) market heating up. We expect attractive opportunities in 2021 for these strategies. Distressed strategies should do well if there is an extended period when certain sectors struggle that leads to increased restructurings.

Current View: Positive

Change: None

Reach out to your Oppenheimer Financial Professional if you have any questions.

The opinions expressed herein are subject to change without notice. The information and statistical data contained herein has been obtained from sources we believe to be reliable. Past performance is not a guarantee of future results. The above discussion is for illustrative purposes only and mention of any security should not be construed as a recommendation to buy or sell and may not represent all investment managers or mutual funds bought, sold, or recommended for client’s accounts. There is no guarantee that the above-mentioned investments will be held for a client’s account, nor should it be assumed that they were or will be profitable. OAM Consulting is a division of Oppenheimer Asset Management Inc. (OAM). OAM is an indirect, wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc. (Oppenheimer), a registered broker dealer and investment adviser. Securities are offered through Oppenheimer.

For information about the advisory programs available through OAM and Oppenheimer, please contact your Oppenheimer financial advisor for a copy of each firm’s ADV Part 2A.

Adopting a fee-based account program may not be suitable for all investors; anticipated annual commission costs should be compared to anticipated annual fees.

S&P 500 Index (“SPX”) is a well-known, broad-based stock market unmanaged index which contains only seasoned equity securities. The Fund does not restrict its selection of securities to those comprising the SPX. Performance of the SPX is provided for comparison purposes only. While the Fund’s portfolio may contain some or all of the stocks which comprise the SPX, the Fund does not invest solely in these stocks.

Russell 1000 Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. The Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics.

Russell 1000 Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

NASDAQ Composite Index tracks the performance of about 3,000 stocks traded on the Nasdaq exchange. The index is calculated based on market cap weighting.

VIX Index Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market's expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors' sentiments.

MSCI AC World ex-USA Index captures large- and mid- cap representation across 22 of 23 developed-market countries (excluding the U.S.) and 24 emerging-market countries.

LTM PE Ratio is the last 12-month price-to-earnings ratio.

Indices are unmanaged, do not reflect the costs associated with buying and selling securities and are not available for direct investment.

Risk Factors

The success of an investment program may be affected by general economic and market conditions, such as interest rates, the availability of credit, inflation rates, economic uncertainty, changes in laws and national and international political circumstances. These factors may affect the level and volatility of securities prices and the liquidity of a portfolio’s investments. Unexpected volatility or illiquidity could result in losses. Investing in securities is speculative and entails risk. There can be no assurance that the investment objectives will be achieved or that an investment strategy will be successful.

Special Risks of Foreign Securities

Investments in foreign securities are affected by risk factors generally not thought to be present in the United States. The factors include, but are not limited to, the following: less public information about issuers of foreign securities and less governmental regulation and supervision over the issuance and trading of securities. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Special Risks of Small- and Mid-Capitalization Companies

Investments in companies with smaller market capitalization are generally riskier than investments in larger, well established companies. Smaller companies often are more recently formed than larger companies and may have limited product lines, distribution channels and financial and managerial resources. These companies may not be well known to the investing public, may not have significant institutional ownership and may have cyclical, static or moderate growth prospects. There is often less publicly available information about these companies than there is for larger, more established issuers, making it more difficult for the Investment Manager to analyze that value of the company. The equity securities of small- and mid-capitalization companies are often traded over-the-counter or on regional exchanges and may not be traded in the volume typical for securities that are traded on a national securities exchange. Consequently, the investment manager may be required to sell these securities over a longer period of time (and potentially at less favorable prices) than would be the case for securities of larger companies. In addition, the prices of the securities of small- and mid- capitalization companies may be more volatile than those of larger companies.

Special Risks of Fixed Income Securities

For fixed income securities, there is a risk that the price of these securities will go down as interest rates rise. Another risk of fixed income securities is credit risk, which is the risk that an issuer of a bond will not be able to make principal and interest payments on time. Liquidity risk is the risk that you might not be able to buy or sell investments quickly for a price that is close to the true underlying value of the asset. When a bond is said to be liquid, there's generally an active market of investors buying and selling that type of bond.

Fixed income securities markets are subject to many factors, including economic conditions, government regulations, market sentiment, and local and international political events. Further, the market value of fixed-income securities will fluctuate depending on changes in interest rates, currency values and the creditworthiness of the issuer.

High Yield Fixed Income Risk

High yield fixed income securities are considered to be speculative and involve a substantial risk of default. Adverse changes in economic conditions or developments regarding the issuer are more likely to cause price volatility for issuers of high yield debt than would be the case for issuers of higher grade debt securities. In addition, the market for high yield debt may be less attractive than that of higher-grade debt securities.

Special Risks of Master Limited Partnerships

Master limited partnerships are publicly listed securities that trade much like a stock, but they are taxed as partnerships. MLPs are typically concentrated investments in assets such as oil, timber, gold and real estate. The risks of MLPs include concentration risk, illiquidity, and exposure to potential volatility, tax reporting complexity, fiscal policy and market risk. MLPs are not suitable for all investors.

Forward Looking Statements

This presentation may contain forward looking statements or projections. These statements and projections relate to future events or future performance. Forward-looking statements and projections are based on the opinions and estimates of Oppenheimer as of the date of this presentation, and are subject to a variety of risks and uncertainties and other factors, such as economic, political, and public health, that could cause actual events or results to differ materially from those anticipated in the forward-looking statements and projections. 3417809.1