Assessing the Economic Revival

Corporate earnings and GDP growth are surging but will the Delta variant and rising inflation dampen the recovery?

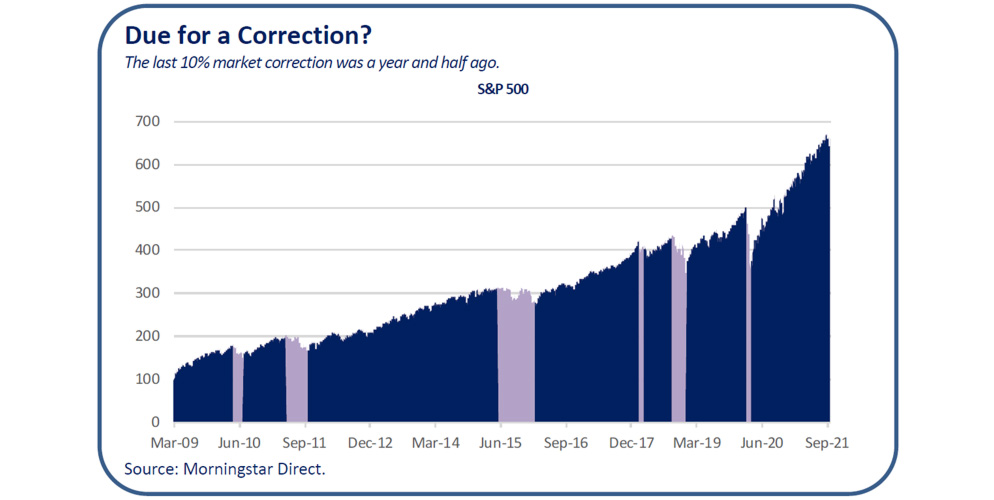

U.S. equity markets remained strong for most of 2021, logging seven consecutive months of gains from February through August. However, growing concerns surrounding the Delta variant, slowing economic growth, persistent inflation and eventual central bank tapering and rate hikes led to a more volatile September and the S&P 500’s first down month since January. With stocks already having pulled back about 5% from previous highs set in early September, investors continue to ponder whether or not we will see the first 10% correction of 2021.

Economic Growth to Remain Robust

Although notoriously difficult to predict, short-term market pullbacks or corrections are a normal part of the market cycle. We expect that risk assets will perform well or protect capital over the intermediate-term even as moderate near-term pullbacks could occur within U.S. equities.

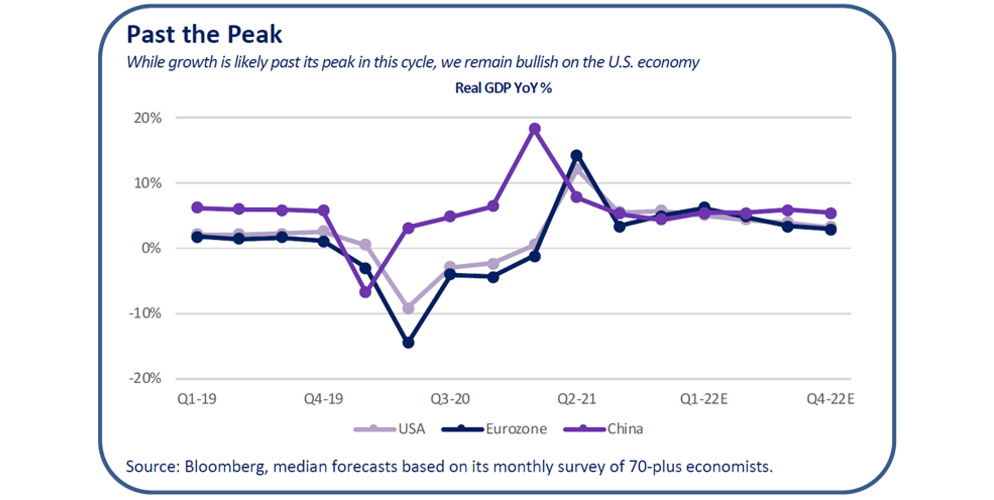

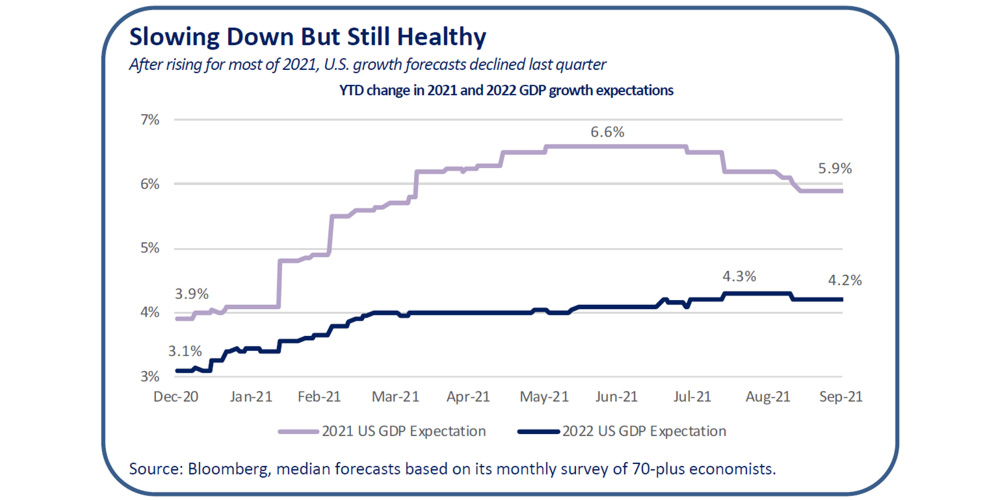

Bull Case: On the heels of the pandemic-fueled stock-market trough in March 2020, faster-than-expected vaccine production and distribution propelled a flurry of economic activity in 2021. By the second quarter, U.S. GDP had more than fully recovered the losses suffered in 2020. Economic activity is expected to remain robust over the intermediate-term, with consensus forecasts predicting 5.9% GDP growth for 2021 and 4.2% for 2022. Strong growth is expected in many overseas markets as well.

Coinciding with the rebound in economic activity, corporate earnings growth has also been revitalized. We’ve seen a dramatic improvement in earnings over the last several quarters as economic activity has resumed, and S&P 500 earnings are now expected to grow 46% year-over-year for the 2021 calendar year. Outside of the United States, earnings growth for European and Japanese companies have also turned around, expecting to be 54% and 22%, respectively, this year.

Bear Case: There has been a discussion regarding a potential slowdown in economic momentum in recent months, due in part to the rise of the Delta variant and the expiration of stimulus benefits. Despite strong GDP growth in the second quarter, there have been some higher frequency macro indicators that have missed expectations. That suggests a slight pause that is typical of mid-cycle transitions.

Outlook: While OAM Research recognizes that we are likely past the point of “peak growth” in this cycle, we remain bullish on the U.S. economy. While we’ve seen some downward revisions to growth forecasts for 2021, there have been modest increases in the forecasts for 2022. A strong macro backdrop over this upcoming period should be supportive for risk assets.

Vaccines and Variants

Bear Case: There has been a discussion regarding a potential slowdown in economic momentum in recent months, due in part to the rise of the Delta variant and the expiration of stimulus benefits. Despite strong GDP growth in the second quarter, there have been some higher frequency macro indicators that have missed expectations. That suggests a slight pause that is typical of mid-cycle transitions.

Outlook: While OAM Research recognizes that we are likely past the point of “peak growth” in this cycle, we remain bullish on the U.S. economy. While we’ve seen some downward revisions to growth forecasts for 2021, there have been modest increases in the forecasts for 2022. A strong macro backdrop over this upcoming period should be supportive for risk assets.

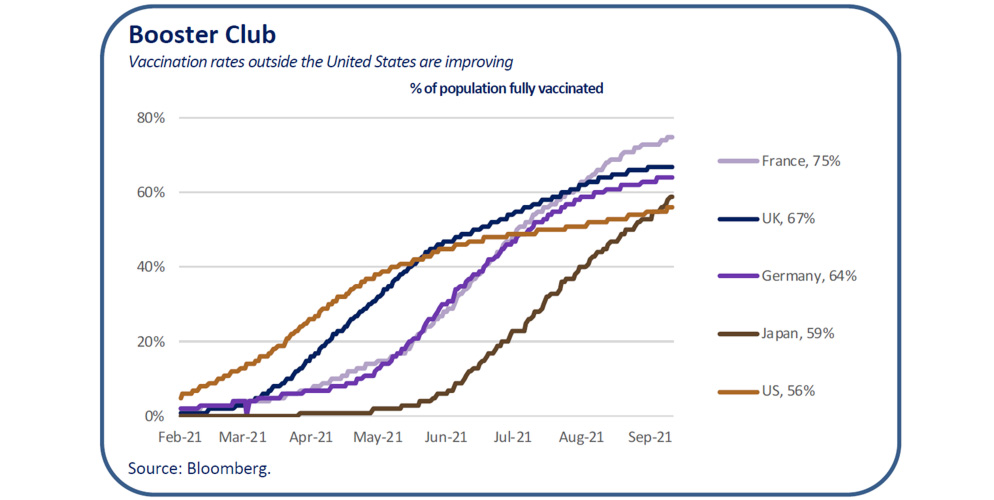

Outlook: While the trend of rising cases and slowing pace of inoculation is concerning from a health perspective, there has been little evidence of further economic disruption. In addition, the FDA’s recent full approval of the Pfizer vaccine and workplace vaccination requirements from the Biden administration are likely to aid in increased vaccination rates. Lastly, cases and hospitalizations have leveled off and begun to decline in recent weeks, suggesting that we are moving past the peak for this variant.

Keeping Inflation in Check

Bull Case: There are compelling reasons to believe that inflation will be cooling off from its current level. Year-over-year comparisons from the depths of the pandemic are starting to roll off, which will help to normalize some of the statistics. In addition, a number of the components of CPI that have driven higher inflation have shown signs of slowing. Energy prices are unlikely to make the same contributions to price increases relative to earlier in the year. Used car and truck prices also surged in the spring due to the semiconductor chip shortage, but prices declined in August as compared to July. While inflation is likely to remain higher than the Fed’s 2% target for some time, we are unlikely to see it remain as elevated as it has been over the last few months.

Bear Case: There are other measures of inflation that have, at least thus far, been less transitory than many expected. Housing costs and wage growth have been more persistent and may not subside as quickly as initially forecasted. Supply chain issues may also persist longer than currently expected. Producer prices as measured by PPI have remained consistently high and the 8.3% increase year-over-year observed in August marks the largest increase in over a decade. Supply chain issues were cited as a key factor related to the surge in raw material costs. These headwinds are unlikely to be quickly resolved and may lead to sustained higher production costs which would likely, at least partially, be passed onto consumers. Persistent inflation could also force the Fed to taper and start raising rates faster than previously anticipated.

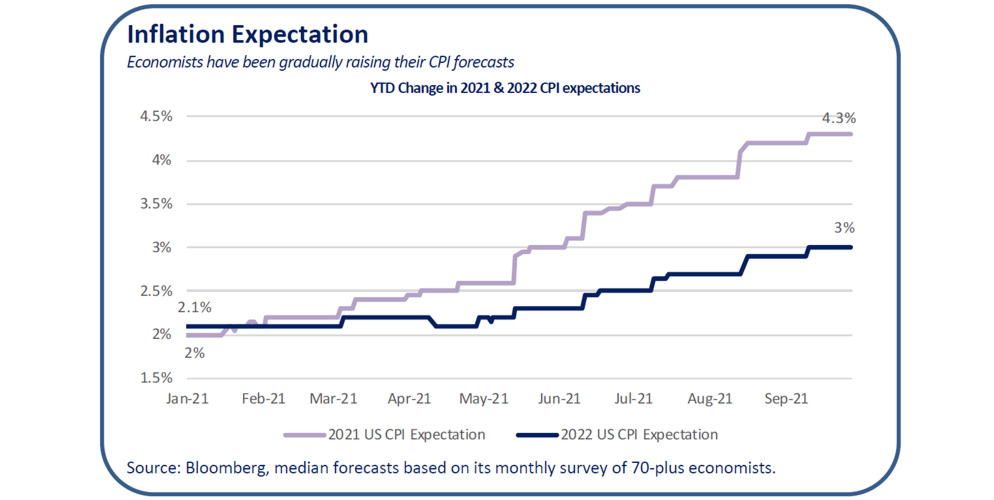

Outlook: Although the monthly growth in consumer prices has moderated over the summer compared to the increases in April through June, on a year-over-year basis, changes in both headline and Core CPI remain extremely elevated relative to historical averages. In addition, economists have been gradually raising their CPI forecasts for 2021 and 2022 over the course of this year. Market-implied expected inflation rates, as measured by the five- and 10-year breakeven inflation rates, have also remained higher than their long-term averages. Persistently high inflation for an extended period of time could have significant portfolio implications. Given the uncertainty, it is prudent for investors to consider inflation hedges for their portfolios. A tilt to value stocks within an equity allocation may be beneficial due to its more cyclical sensitivity. Core fixed income could continue to struggle in the face of higher inflation and higher interest rates. Investors should consider diversifying strategies as a complement to traditional equity and fixed income exposure.

Stay the Course

With such strong and sustained recovery off of the lows of March 2020, it is unsurprising to see equity markets begin to waver and volatility begin to rise. OAM Research believes that although the macro and fundamental backdrop remains positive, investors should still be prepared for more volatility and their portfolios should remain diversified across global equity, fixed income and diversifying strategies.

The following Asset Class Detail section summarizes our asset class views.

Asset Class Detail

OAM Research’s sector-specific opinions are derived from ongoing analysis of valuations, momentum, economics, business cycle and fund flows.

Global Equity

-

U.S. Large Cap

U.S. Large Cap U.S.

large caps are still overvalued but given current interest rates, they remain reasonable. A diversified portfolio of growth and value stocks is prudent given continued market uncertainty, but investors may tilt toward value with economic growth and rising rates expected to continue.Long/Short Equity

Long/short strategies have faced challenges in 2021 given the dominating movements of factors, particularly growth which has been negative. Managers have been holding their exposure levels and adding to high conviction positions through this choppy environment but are looking for fundamentals to drive stock performance.Current View: Slightly Positive

-

U.S. Small Cap

Valuations remain extended but off their highs after strong earnings growth and a pause in cyclical outperformance. Small caps should perform well if economic momentum is sustained but may be prone to bouts of volatility if the Delta variant causes any economic disruption.

Current View: Slightly Positive

-

Non-U.S. Developed

International equities posted positive returns but continued to lag U.S. stocks. However, superior vaccination rates, strong economic momentum and more attractive valuations relative to domestic stocks makes for an attractive backdrop. Be wary of downside risks: Covid-19 variants and stalled vaccination efforts. Europe may be better positioned for outperformance than Japan, where growth is more modest.

Current View: Slightly Positive

-

Emerging Markets

Valuations remain reasonable relative to developed markets and their own history. Concerns around slowing growth and increased regulation in China have weighed on the index this year, but growth prospects for many of the other emerging economies remain bright, especially as vaccine distribution continues to improve. The cyclical nature of many emerging markets should be beneficial as global growth recovers.

Current View: Slightly Positive

Global Debt

-

Core Bond

Treasury yields remained lower for most of the quarter before rising sharply in September on inflation and Fed tapering concerns. We expect rates to continue to move higher over the intermediate-term as the Fed gradually turns more hawkish and strong economic growth pushes the long end of the curve higher. Conservative investors should maintain an allocation to core bonds to lower portfolio volatility but investors requiring current income above inflation could supplement with investment-grade bonds, high-yield bonds or dividend-paying stocks.

Current View: Slightly Negative

-

Investment Grade

Investment-grade spreads remain very tight and yields remain low relative to history. Although corporate fundamentals have improved significantly, tight credit spreads leave little room for appreciation and rising interest rates will make for a challenging environment.

Current View: Slightly Negative

-

High Yield

Spreads remain tight relative to historical averages. However, fundamentals continue to improve and default rates are low. High yield provides much more attractive yields and carries less duration risk than investment-grade bonds, though effective active management continues to be important.

Current View: Neutral

-

Non-U.S. Developed

Interest rates overseas are modestly higher year-to-date, but non-U.S. sovereign debt continues to provide unattractive yields relative to U.S. Treasuries. Most central banks overseas are expected to remain extremely accommodative. Corporate bonds in Europe and Japan provide lower yields than their U.S. counterpart, though fundamentals are improving with a strengthening economy.

Current View: Slightly Negative

-

Emerging Markets

Emerging-market debt—government and corporate—offers much higher absolute yields relative to the rest of the world. Improved vaccine distribution and less cases could also be a strong catalyst for emerging markets. Investors may prefer local currency denominated debt to hedge U.S. dollar exposure.

Current View: Slightly Positive

Diversifying Strategies

-

Real Assets

Real assets offer attractive yields relative to broader equity markets. REITs have performed strongly in the face of rising inflation and valuations remain reasonable relative to the broader market. MLPs offer attractive yields at modest valuations and possess more upside potential as continued economic strength should put a floor under oil prices. Infrastructure has performed well in inflationary periods and could rally with the passage of further spending.

Current View: Positive

-

Macro

Fundamentally driven strategies performed relatively well in 2020 but have seen rising outflows in 2021. Timing global central bank policy decisions will be challenging as the outlook is uncertain and economic data is mixed. Macro strategies may be a source of return in 2022 as central banks’ view toward more hawkish policy is clearer and opportunities to take advantage of disparities between regional market recoveries increase.

Current View: Neutral

-

Other Strategies

Event-driven strategies continue to generate uncorrelated returns as M&A activity and deal flow remains robust, while multi-manager strategies also look attractive in their ability to diversify or rotate capital based on opportunity set. These strategies continue to act as fixed-income replacements for investors as a low interest rate environment persists in the near-term.

Current View: Positive

Reach out to your Oppenheimer Financial Professional if you have any questions.

The opinions expressed herein are subject to change without notice. The information and statistical data contained herein has been obtained from sources we believe to be reliable. Past performance is not a guarantee of future results. The above discussion is for illustrative purposes only and mention of any security should not be construed as a recommendation to buy or sell and may not represent all investment managers or mutual funds bought, sold, or recommended for client’s accounts. There is no guarantee that the above-mentioned investments will be held for a client’s account, nor should it be assumed that they were or will be profitable. OAM Consulting is a division of Oppenheimer Asset Management Inc. (OAM). OAM is an indirect, wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc. (Oppenheimer), a registered broker dealer and investment adviser. Securities are offered through Oppenheimer.

For information about the advisory programs available through OAM and Oppenheimer, please contact your Oppenheimer financial advisor for a copy of each firm’s ADV Part 2A.

Adopting a fee-based account program may not be suitable for all investors; anticipated annual commission costs should be compared to anticipated annual fees.

S&P 500 Index (“SPX”) is a well-known, broad-based stock market unmanaged index which contains only seasoned equity securities. The Fund does not restrict its selection of securities to those comprising the SPX. Performance of the SPX is provided for comparison purposes only. While the Fund’s portfolio may contain some or all of the stocks which comprise the SPX, the Fund does not invest solely in these stocks.

Russell 1000 Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. The Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics.

Russell 1000 Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

NASDAQ Composite Index tracks the performance of about 3,000 stocks traded on the Nasdaq exchange. The index is calculated based on market cap weighting.

VIX Index Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market's expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors' sentiments.

MSCI AC World ex-USA Index captures large- and mid- cap representation across 22 of 23 developed-market countries (excluding the U.S.) and 24 emerging-market countries.

LTM PE Ratio is the last 12-month price-to-earnings ratio.

Indices are unmanaged, do not reflect the costs associated with buying and selling securities and are not available for direct investment.

Risk Factors

The success of an investment program may be affected by general economic and market conditions, such as interest rates, the availability of credit, inflation rates, economic uncertainty, changes in laws and national and international political circumstances. These factors may affect the level and volatility of securities prices and the liquidity of a portfolio’s investments. Unexpected volatility or illiquidity could result in losses. Investing in securities is speculative and entails risk. There can be no assurance that the investment objectives will be achieved or that an investment strategy will be successful.

Special Risks of Foreign Securities

Investments in foreign securities are affected by risk factors generally not thought to be present in the United States. The factors include, but are not limited to, the following: less public information about issuers of foreign securities and less governmental regulation and supervision over the issuance and trading of securities. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Special Risks of Small- and Mid-Capitalization Companies

Investments in companies with smaller market capitalization are generally riskier than investments in larger, well established companies. Smaller companies often are more recently formed than larger companies and may have limited product lines, distribution channels and financial and managerial resources. These companies may not be well known to the investing public, may not have significant institutional ownership and may have cyclical, static or moderate growth prospects. There is often less publicly available information about these companies than there is for larger, more established issuers, making it more difficult for the Investment Manager to analyze that value of the company. The equity securities of small- and mid-capitalization companies are often traded over-the-counter or on regional exchanges and may not be traded in the volume typical for securities that are traded on a national securities exchange. Consequently, the investment manager may be required to sell these securities over a longer period of time (and potentially at less favorable prices) than would be the case for securities of larger companies. In addition, the prices of the securities of small- and mid- capitalization companies may be more volatile than those of larger companies.

Special Risks of Fixed Income Securities

For fixed income securities, there is a risk that the price of these securities will go down as interest rates rise. Another risk of fixed income securities is credit risk, which is the risk that an issuer of a bond will not be able to make principal and interest payments on time. Liquidity risk is the risk that you might not be able to buy or sell investments quickly for a price that is close to the true underlying value of the asset. When a bond is said to be liquid, there's generally an active market of investors buying and selling that type of bond.

Fixed income securities markets are subject to many factors, including economic conditions, government regulations, market sentiment, and local and international political events. Further, the market value of fixed-income securities will fluctuate depending on changes in interest rates, currency values and the creditworthiness of the issuer.

High Yield Fixed Income Risk

High yield fixed income securities are considered to be speculative and involve a substantial risk of default. Adverse changes in economic conditions or developments regarding the issuer are more likely to cause price volatility for issuers of high yield debt than would be the case for issuers of higher grade debt securities. In addition, the market for high yield debt may be less attractive than that of higher-grade debt securities.

Special Risks of Master Limited Partnerships

Master limited partnerships are publicly listed securities that trade much like a stock, but they are taxed as partnerships. MLPs are typically concentrated investments in assets such as oil, timber, gold and real estate. The risks of MLPs include concentration risk, illiquidity, and exposure to potential volatility, tax reporting complexity, fiscal policy and market risk. MLPs are not suitable for all investors.

Forward Looking Statements

This presentation may contain forward looking statements or projections. These statements and projections relate to future events or future performance. Forward-looking statements and projections are based on the opinions and estimates of Oppenheimer as of the date of this presentation, and are subject to a variety of risks and uncertainties and other factors, such as economic, political, and public health, that could cause actual events or results to differ materially from those anticipated in the forward-looking statements and projections. 3872148.1