Is Inflation Here to Stay?

- July 27, 2021

Investors mull whether rising consumer prices are a long-term trend or a fleeting condition.

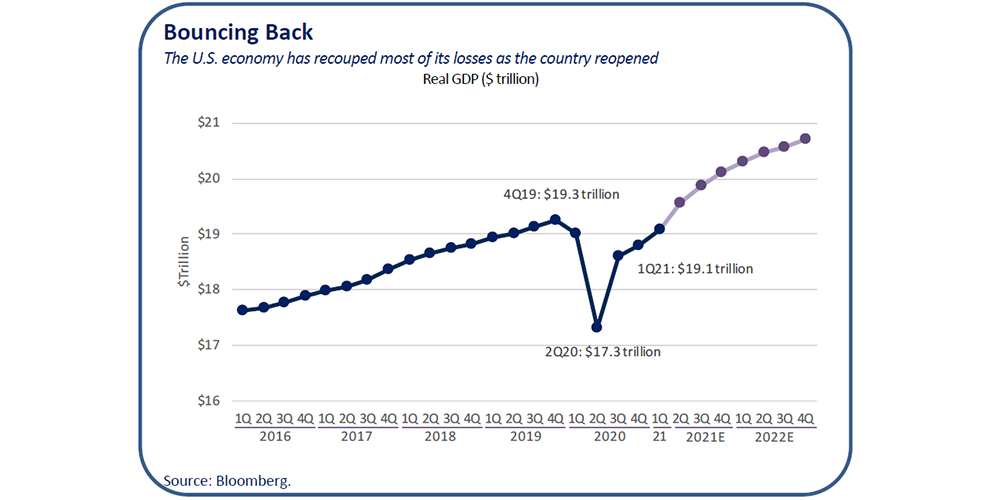

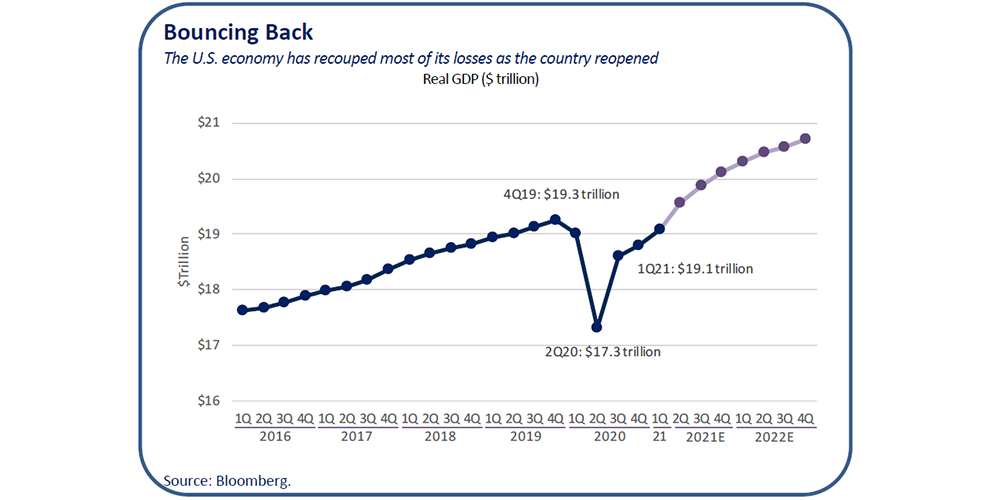

The U.S. economy has made a strong recovery from the Covid-19 pandemic, which had a devastating impact on commerce and consumers. Massive fiscal and monetary stimulus coupled with faster-than-expected development and distribution of Covid-19 vaccines have led to a swift rebound in economic growth. Through the end of the first quarter, U.S. GDP had recouped most of the losses related to last year’s recession, spurred by the reopening of the U.S. economy and a surge in consumer spending. The economy is expected to have fully recovered by the end of the second quarter and many economists are forecasting above-trend growth for the rest of 2021 and 2022.

Heating Up

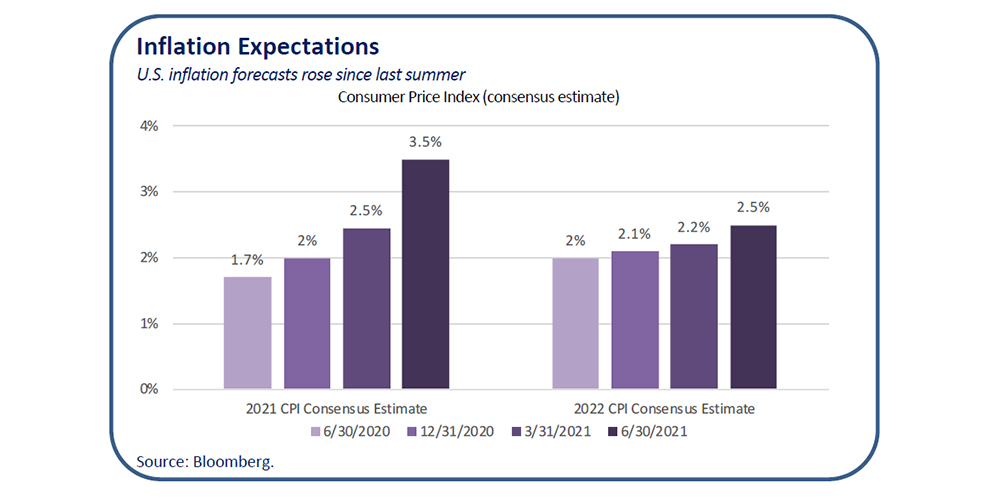

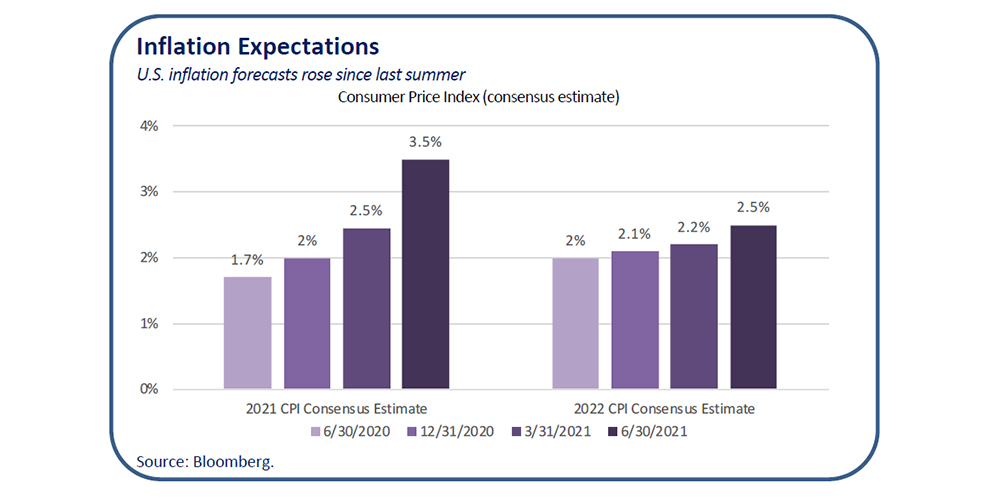

Not surprisingly, the expected resurgence in economic growth has been a strong tailwind for risk assets. Stocks, particularly those in cyclical sectors that stand to benefit the most from reopening of the economy, have outperformed other asset classes in 2021. Recently, however, the conversation has shifted to concerns around the potential for sustained inflation and its impact on different asset classes. Inflation expectations have been rising since last summer and gained momentum after news of vaccine approvals in late 2020. Today, long-term expectations are above the Fed’s 2% inflation target.

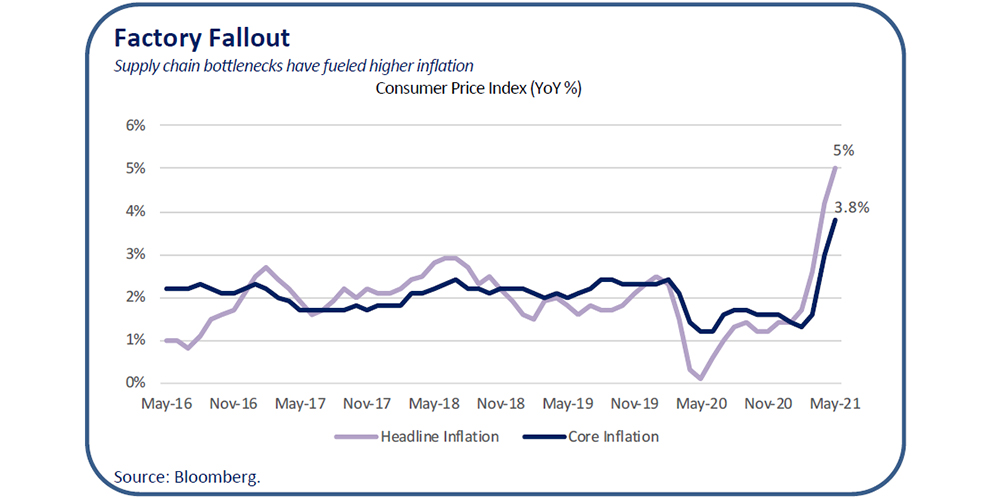

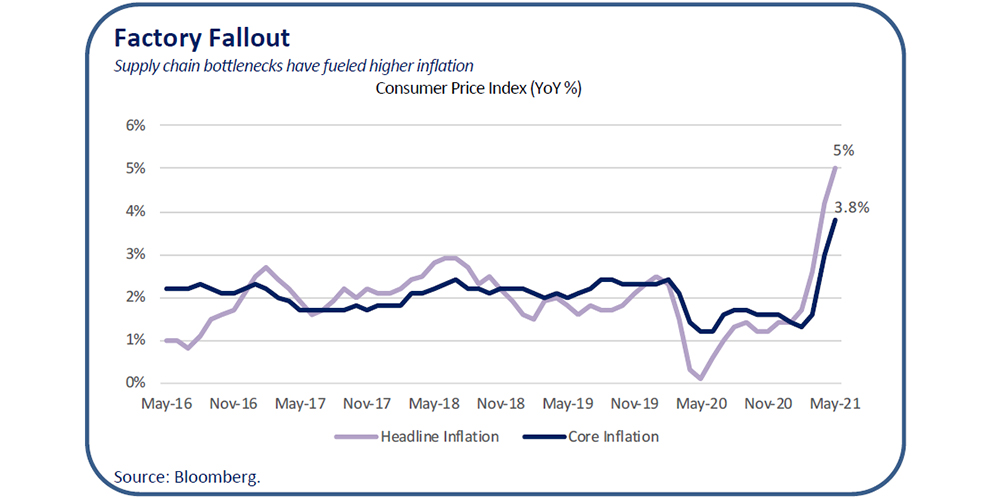

Over the past few months, inflation was expected to rise due to the base effects from the pandemic, as spending on goods and services has increased since the first half of last year when the U.S. was largely under lockdown. Inflation based on a number of metrics has mostly exceeded those expectations. The June Consumer Price Index was the latest data point to stir up market jitters. CPI grew 5.4% (above 5% estimate) in June compared to a year ago and core CPI (excluding food and energy) increased by 3.8%, which was also greater than expected.

Will Inflation Stay or Go?

Looking deeper, there are a number of signs that inflation may be transitory. For example, a meaningful portion of the inflation gain was driven by a sharp rise in used car and truck prices, which rose 7.3% from the prior month and 29.7% year over year. Part of the impact on the auto industry was related to the current semiconductor chip shortage. Energy and materials prices are up on a year-over-year basis as well. Consumer demand is steadily rising with the reopening, driven by excess cash from stimulus programs and record savings rates over the last year. Labor shortages have led to supply chain disruptions and price increases. All of these factors are potentially short term in nature and may be alleviated over the coming quarters.

Although several indicators point to recent inflation being temporary, inflation has been difficult to predict historically. And it is possible that inflation could remain elevated. Housing prices have soared over the last year on surging demand and low mortgage rates, but tight housing supply is also a major challenge that won’t be quickly remedied. Semiconductor production is in a race against an ever-evolving technology landscape driving continually increasing demand to reach equilibrium. If supply chain bottlenecks can be resolved, then the runway for economic growth appears clear.

Duration Matters

The Fed recently alluded to the possibility that they have underestimated inflation and indicated that it expects to raise rates sooner than initially forecast. If inflation persists longer than the market expects, then investors should consider the implications for their portfolios. For example, investors may want to reduce exposure to long-duration government bonds. Investors that are looking to allocate capital to hedge against higher inflation on the horizon should look at gold and other real assets, REITs and infrastructure. On the equity side, cyclical sectors tend to perform better than growth stocks in higher interest-rate environments. Finally, investors may want to consider alternatives strategies that have shared characteristics with fixed income without the interest-rate risk such as merger arbitrage or floating-rate private credit.

Closing the Gap

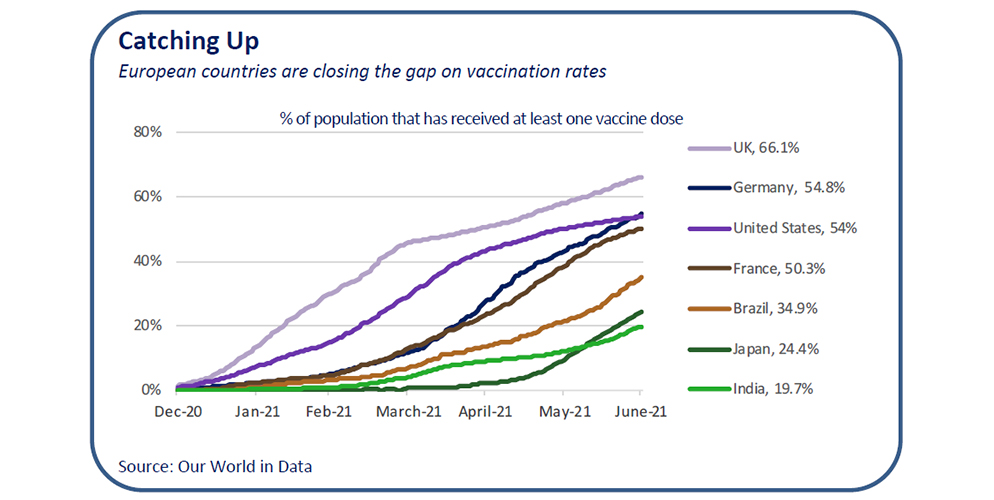

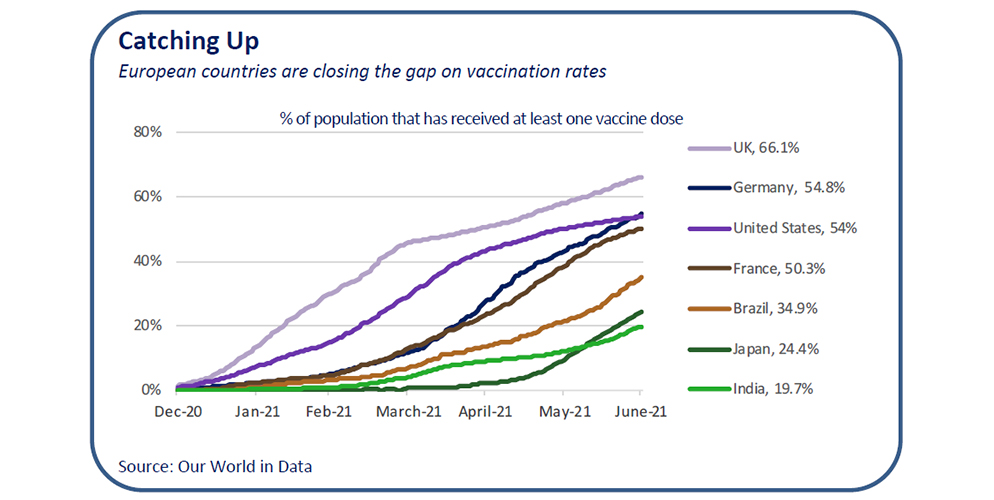

Inflation is less of a concern in developed economies outside of the United States, as many of these nations haven’t made as much progress combating Covid-19. A large contributor to the dispersion among the recoveries has been the vaccination efforts. However, that is changing rapidly with European countries closing the gap on vaccination rates at the end of June. This success has allowed many of these nations to partially or fully reopen, potentially unlocking significant pent-up demand and growth potential.

Intuitively, the pent-up demand could lead to a rebound in international economic growth and the outperformance of international stocks over their U.S. counterparts. While much of U.S. growth has been priced into the stock market, international stocks have largely lagged behind and may be poised to reverse that trend if growth potential is greater overseas.

In addition, non-U.S. equity indices tend to have much higher exposure to cyclical sectors relative to the United States. These cyclical sectors may stand to outperform relative to growth and defensive sectors during a period of potentially synchronized global growth, modestly higher inflation and higher interest rates. Earnings growth is also expected to be stronger in Europe relative to the United States, especially among cyclical sectors. Outside of the United States, equity valuations don’t appear as stretched compared to their long-term historical averages.

Risks Remain

Still, investors should be mindful of the fluid nature of the pandemic. Although significant progress has been made on vaccinations, a slowdown in that progress or the spread of Covid-19 variant strains could stall the economic recovery. We have already seen a recent pause in reopening plans in the U.K. and tighter restrictions in Israel.

Meanwhile, Japan has significantly lagged the rest of the developed world on vaccination progress and its lower growth outlooks could mean underperformance for the nation’s stock market. We believe investors should maintain diversification in their equity portfolios to mitigate any lingering pandemic risks while benefiting from a global recovery. Uncertainty has been a key theme for 2021, as evidenced by the back and forth between growth and value equities and the fluctuation in interest rates. In our view, portfolio diversification continues to be paramount in navigating market volatility.

The following Asset Class Detail section summarizes our asset class views.

Asset Class Detail

OAM Research’s sector-specific opinions are derived from ongoing analysis of valuations, momentum, economics, business cycle and fund flows.

Global Equity

U.S. large caps remain overvalued historically but look more reasonable when you consider interest rates. A diversified portfolio of growth and value stocks is prudent given continued market uncertainty but investors may tilt toward value given economic growth projections and rising rates.

Long/Short Equity Many hedged equity strategies have suffered from the swift rotations between growth and value stocks this year. In the second half of 2021, managers can rely on their ability to maintain exposure and stock-picking capabilities within this dynamic market environment.

Current View: Slightly Positive

Change: None

Valuations remain extended but off their highs after strong earnings growth and a pause in cyclical outperformance. Small caps may resume their rally on vaccine progress and the reopening of the U.S. economy.

Current View: Slightly Positive

Change: None

International equities have generated stronger returns recently helped by higher vaccination rates and a notable decline in cases. Non-U.S. markets are more cyclical and earlier in their economic recoveries, which could lead to outperformance. International stocks also trade at meaningful discounts relative to U.S. stocks. Still, be wary of downside risks such as Covid-19 variants and stalled vaccination efforts. Europe may be better positioned than Japan, which has low vaccination rates and modest growth.

Current View: Slightly Positive

Change: Increase

Valuations remain reasonable relative to developed markets and their own history. Vaccine distribution has lagged developed markets but gained traction in recent months. That should continue as supply concerns ease, driving outperformance. Emerging markets are cyclical and should benefit from a global recovery

Current View: Slightly Positive

Change: None

Emerging-market debt—government and corporate—offers much higher absolute yields relative to the rest of the world. Successful vaccine distribution could also be a strong catalyst for emerging markets. Investors may prefer local currency denominated debt to hedged U.S. dollar exposure.

Current View: Slightly Positive

Change: None

Global Debt

Treasury yields pulled back after increasing dramatically across the curve last quarter. Still, we expect rates to move higher over the medium term as the Fed gradually turns more hawkish and strong economic growth pushes the long end of the curve higher. Conservative investors should maintain an allocation to core bonds to lower portfolio volatility and to maintain purchasing power. But investors requiring current income above inflation could supplement with investment-grade bonds, high-yield bonds or dividend-paying stocks.

Current View: Slightly Negative

Change: None

Investment-grade spreads have continued to grind tighter. Although corporate fundamentals have improved, tight credit spreads leave little room for appreciation and rising interest rates will make for a challenging environment.

Current View: Slightly Negative

Change: None

Spreads continued to tighten in the second quarter and remain tighter than they were prior to the pandemic. Default rates have declined meaningfully in 2021, primarily due to positive developments in energy and retail. Still, current spreads will limit further appreciation and effective active management will be crucial in avoiding deteriorating credit situations.

Current View: Neutral

Change: None

Interest rates overseas have risen year-to-date, but non-U.S. sovereign debt continues to provide unattractive yields relative to U.S. Treasuries. Most central banks are expected to remain extremely accommodative. Corporate bonds in Europe and Japan provide lower yields than their U.S. counterparts and face more fundamental issues due to a slower economic recovery.

Current View: Slightly Negative

Change: None

Emerging-market debt—government and corporate—offers much higher absolute yields relative to the rest of the world. Improved vaccine distribution could also be a strong catalyst for emerging markets. Investors may prefer local currency denominated debt to hedge U.S. dollar exposure.

Current View: Slightly Positive

Change: None

Diversifying Strategies

Real assets offer attractive yields relative to broader equity market. REITs and utilities could protect in the face of rising inflation. Valuations remain reasonable relative to the broader market. MLPs offer attractive yields at modest valuations even after strong performance lately but expectations should be tempered given the sizeable gains in oil prices over the last year.

Current View: Positive

Change: None

Fundamentally driven strategies performed relatively well in 2020 but this was the first time in many years that these managers produced a meaningful return for investors. We remain cautious in 2021.

Current View: Neutral

Change: None

Event-driven strategies performed well in the first half of the year and the expectation is that these strategies will continue to generate attractive returns due to strong deal flow. The SPAC demand has slowed, which managers view as a positive development with fundamentally driven investors coming back to the marketplace. These strategies continue to act as fixed-income replacements for investors.

Current View: Positive

Change: None

Reach out to your Oppenheimer Financial Professional if you have any questions.

Disclosure

The opinions expressed herein are subject to change without notice. The information and statistical data contained herein has been obtained from sources we believe to be reliable. Past performance is not a guarantee of future results. The above discussion is for illustrative purposes only and mention of any security should not be construed as a recommendation to buy or sell and may not represent all investment managers or mutual funds bought, sold, or recommended for client’s accounts. There is no guarantee that the above-mentioned investments will be held for a client’s account, nor should it be assumed that they were or will be profitable. OAM Consulting is a division of Oppenheimer Asset Management Inc. (OAM). OAM is an indirect, wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc. (Oppenheimer), a registered broker dealer and investment adviser. Securities are offered through Oppenheimer.

For information about the advisory programs available through OAM and Oppenheimer, please contact your Oppenheimer financial advisor for a copy of each firm’s ADV Part 2A.

Adopting a fee-based account program may not be suitable for all investors; anticipated annual commission costs should be compared to anticipated annual fees.

S&P 500 Index (“SPX”) is a well-known, broad-based stock market unmanaged index which contains only seasoned equity securities. The Fund does not restrict its selection of securities to those comprising the SPX. Performance of the SPX is provided for comparison purposes only. While the Fund’s portfolio may contain some or all of the stocks which comprise the SPX, the Fund does not invest solely in these stocks.

Russell 1000 Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. The Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics.

Russell 1000 Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

NASDAQ Composite Index tracks the performance of about 3,000 stocks traded on the Nasdaq exchange. The index is calculated based on market cap weighting.

VIX Index Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market's expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors' sentiments.

MSCI AC World ex-USA Index captures large- and mid- cap representation across 22 of 23 developed-market countries (excluding the U.S.) and 24 emerging-market countries.

LTM PE Ratio is the last 12-month price-to-earnings ratio.

Indices are unmanaged, do not reflect the costs associated with buying and selling securities and are not available for direct investment.

Risk Factors

The success of an investment program may be affected by general economic and market conditions, such as interest rates, the availability of credit, inflation rates, economic uncertainty, changes in laws and national and international political circumstances. These factors may affect the level and volatility of securities prices and the liquidity of a portfolio’s investments. Unexpected volatility or illiquidity could result in losses. Investing in securities is speculative and entails risk. There can be no assurance that the investment objectives will be achieved or that an investment strategy will be successful.

Special Risks of Foreign Securities

Investments in foreign securities are affected by risk factors generally not thought to be present in the United States. The factors include, but are not limited to, the following: less public information about issuers of foreign securities and less governmental regulation and supervision over the issuance and trading of securities. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Special Risks of Small- and Mid-Capitalization Companies

Investments in companies with smaller market capitalization are generally riskier than investments in larger, well established companies. Smaller companies often are more recently formed than larger companies and may have limited product lines, distribution channels and financial and managerial resources. These companies may not be well known to the investing public, may not have significant institutional ownership and may have cyclical, static or moderate growth prospects. There is often less publicly available information about these companies than there is for larger, more established issuers, making it more difficult for the Investment Manager to analyze that value of the company. The equity securities of small- and mid-capitalization companies are often traded over-the-counter or on regional exchanges and may not be traded in the volume typical for securities that are traded on a national securities exchange. Consequently, the investment manager may be required to sell these securities over a longer period of time (and potentially at less favorable prices) than would be the case for securities of larger companies. In addition, the prices of the securities of small- and mid- capitalization companies may be more volatile than those of larger companies.

Special Risks of Fixed Income Securities

For fixed income securities, there is a risk that the price of these securities will go down as interest rates rise. Another risk of fixed income securities is credit risk, which is the risk that an issuer of a bond will not be able to make principal and interest payments on time. Liquidity risk is the risk that you might not be able to buy or sell investments quickly for a price that is close to the true underlying value of the asset. When a bond is said to be liquid, there's generally an active market of investors buying and selling that type of bond.

Fixed income securities markets are subject to many factors, including economic conditions, government regulations, market sentiment, and local and international political events. Further, the market value of fixed-income securities will fluctuate depending on changes in interest rates, currency values and the creditworthiness of the issuer.

High Yield Fixed Income Risk

High yield fixed income securities are considered to be speculative and involve a substantial risk of default. Adverse changes in economic conditions or developments regarding the issuer are more likely to cause price volatility for issuers of high yield debt than would be the case for issuers of higher grade debt securities. In addition, the market for high yield debt may be less attractive than that of higher-grade debt securities.

Special Risks of Master Limited Partnerships

Master limited partnerships are publicly listed securities that trade much like a stock, but they are taxed as partnerships. MLPs are typically concentrated investments in assets such as oil, timber, gold and real estate. The risks of MLPs include concentration risk, illiquidity, and exposure to potential volatility, tax reporting complexity, fiscal policy and market risk. MLPs are not suitable for all investors.

Forward Looking Statements

This presentation may contain forward looking statements or projections. These statements and projections relate to future events or future performance. Forward-looking statements and projections are based on the opinions and estimates of Oppenheimer as of the date of this presentation, and are subject to a variety of risks and uncertainties and other factors, such as economic, political, and public health, that could cause actual events or results to differ materially from those anticipated in the forward-looking statements and projections. 3675664.1