Tailwinds for Investing in Renewables

- March 18, 2021

Renewable energy, such as wind and solar power, can offer unique diversification benefits as well as alternative sources of growth, income and risk management.

When seeking to build better portfolios, diversification is key. To that end, investing in asset classes that have a low correlation to stocks and bonds can be an important step. Right now, investors are witnessing higher stock-market volatility, historically low bond yields and an increasing number of dividend cuts in the wake of the Covid-19 outbreak. As a result, the savviest investors are seeking alternative sources of return, income and risk control to strengthen their portfolios.

One way to achieve these objectives is by investing in natural resources as they tend not to move in lockstep with equity and fixed-income markets. In addition, they can be reliable sources of income and growth. Renewable energy, such as wind and solar power, are particularly attractive segments of the asset class. In contrast to traditional asset classes, these power sources derive their returns from the ability to harness wind and solar energy, capital raised for new infrastructure projects and the price of electricity. That makes them a portfolio diverifier and potentially an effective cushion against volatility.

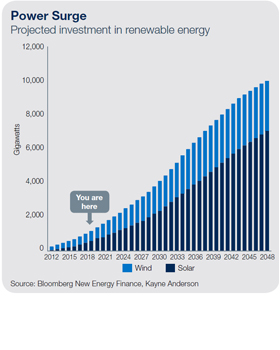

In our view, the renewable energy industry is fast approaching an inflection point, driven by advancements in technology that have lowered costs and increased conversion efficiency. This growing asset class has attracted significant capital from the public and private sectors, with approximately $300 billion projected to flow into new renewable energy assets annually over the next 30 years, according to Bloomberg New Energy Finance.

Institutional investors, such as pension funds and endowments, have long used renewable energy as a diversifier and risk management tool inside their portfolios. In fact, David Swensen, the famed head of Yale’s endowment, broke from convention in the late 1980s by including 20% of his portfolio in alternative investments, including natural resources. More recently, some college endowments, such as Georgetown University and the University of California, have completely divested from companies that focus on fossil fuels to reallocate to renewables. Allocations to renewable energy among institutional investors are expected to nearly double over the next five years.

The investment case is built on strong demand for clean energy, lower costs than traditional sources of power and the need for new and improved infrastructure. In terms of demand, technological innovation is fueling growth in nearly every sector of the marketplace. The tech sector is using a portion of its capital expenditures to power largescale data centers with clean energy. These data centers require an enormous amount of electricity—equal to what’s needed to light a million homes—so their renewable energy contracts make a significant impact.

At the same time, new legislation and stiffer regulatory requirements are pushing companies to curtail pollution and protect the environment. Governments around the world have instituted policies that encourage companies to reduce their carbon emissions.

The demand for renewable energy is also being driven by a growing appetite for socially responsible investments. In a 2019 survey of 800 individual U.S. investors, Morgan Stanley found that 85% of participants expressed interest in sustainable investing strategies. Among millennials, that number was even higher at 95%. That demand has translated into increased investment. Year-to-date, flows into ESG-focused mutual funds hit $20.9 billion, just shy of the annual record of $21.4 billion of flows set in 2019, according to Morningstar.

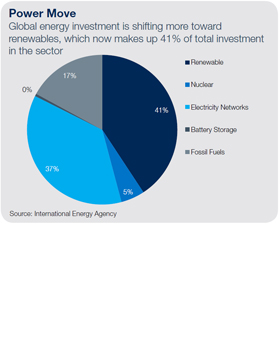

Further, the efficiencies and cost savings that come with these power sources add to their appeal. We believe renewable energy has hit an important inflection point as an asset class as it relates to cost, viability and global awareness. Together, these factors have led to more capital flowing into renewable energy investment in what we consider a secular shift in the global power matrix. Global investments in new renewable power capacity have outpaced traditional fossil fuels 2 to 1 in recent years. In 2019, renewables made up 41% of new global investment in the power sector.

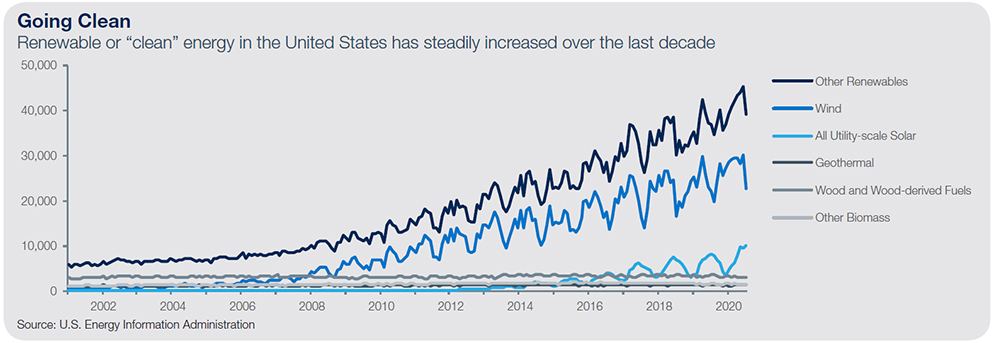

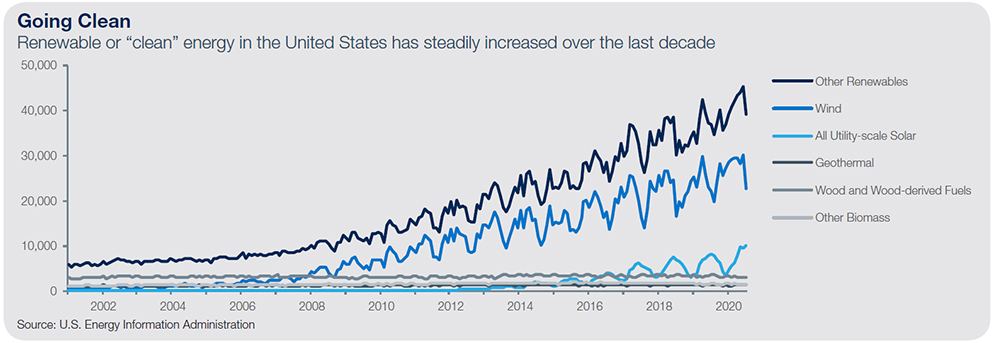

In the first five months of 2020, renewable energy sources (solar, wind, hydropower, biomass and geothermal) made up a larger portion of electrical production compared to coal or nuclear power in the United States, according to the U.S. Energy Information Administration. Indeed, domestic coal consumption has been on the decline since its peak in 2007, with electrical generation by coal experiencing a 27% yearover-year decrease from April 2019. Coal now accounts for just 17% of the nation’s total electrical output.

Moreover, the advancements in the private sector have been further bolstered by public policy actions. The U.S. and EU governments have implemented various initiatives in recent years with plans to increase spending on renewable energy infrastructure and establish clean energy mandates. Specifically, the EU is targeting net zero greenhouse gas emissions by 2050 and is funding research within the renewable energy space. The EU plan seeks to derive 20% of its energy consumption from renewable sources by 2020, 32% by 2030 and 80% by 2050.

Meanwhile, U.S. lawmakers have released the Congressional Action Plan, which outlines a strategy for reaching a 100% clean energy target by 2050. Under this strategy, clean energy initiatives would draw support from federal funding of infrastructure projects, research grants and potentially new legislation. If the plan is approved in Congress, then it will help create new jobs. This plan comes on the heels of previously established tax credits and incentive programs promoting renewable energy and reducing carbon emissions.

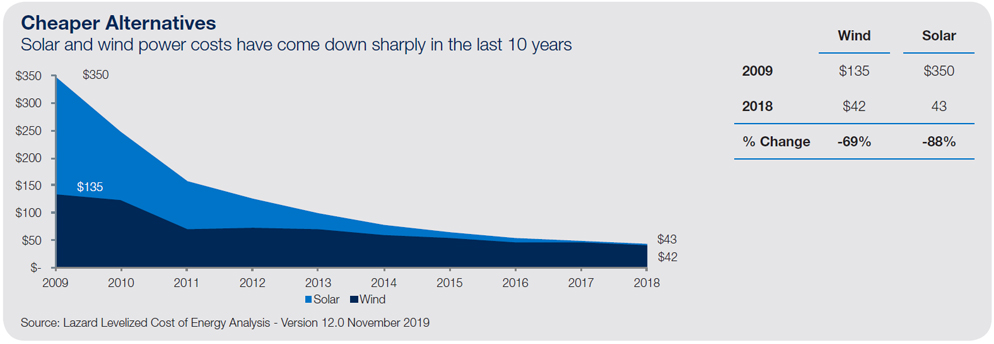

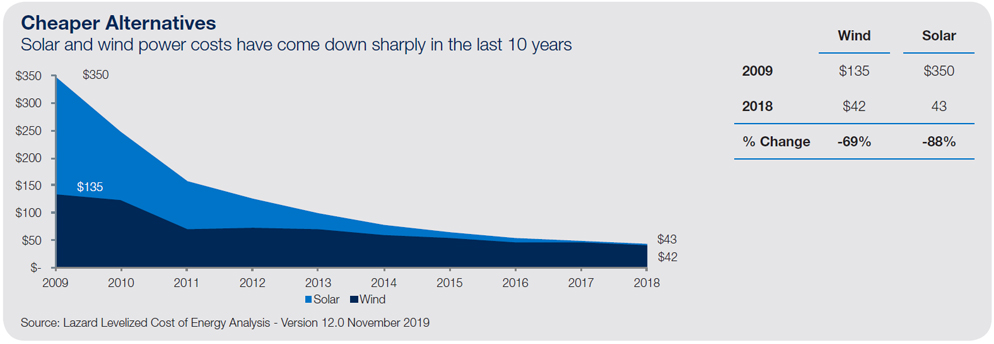

This widespread shift in the global power matrix is a direct result of the innovation and technological advances that are driving down the cost to produce renewable energy. Specifically, solar (-88%) and wind (-69%) power costs have decreased substantially over the last decade and non-subsidized power from these sources is now more cost competitive than traditional fossil fuels. The falling costs of building solar panels and wind turbines along with software enhancements used to covert raw power to grid-compatible energy have fueled this decline.

At the macro level, there is a favorable backdrop for long-term investors to participate in this global shift to clean energy. With these winds of change at their back, a portfolio with exposure to high-quality renewable energy companies can help generate consistent returns through a combination of price appreciation and income. In addition, an allocation to renewables can help reduce overall equity-market risk and hedge against inflation.

For more information on how to access renewable energy through investments at Oppenheimer, please contact your financial professional.

DISCLOSURE

© 2020 All rights reserved. This report is intended for informational purposes only. All information provided and opinions expressed are subject to change without notice. The information and statistical data contained herein have been obtained from sources we believe to be reliable. No part of this report may be reproduced in any manner without the written permission of Oppenheimer Asset Management or any of its affiliates. This material is not a recommendation as defined in Regulation Best Interest adopted by the Securities and Exchange Commission. It is provided to you after you have received Form CRS, Regulation Best Interest disclosure and other materials.

Past performance does not guarantee future results. Investing in securities involves risk and may result in loss of principal. There is no guarantee the recommended strategy will be successful. A strategy’s performance may be affected by general economic and market conditions, such as interest rates, inflation rates, economic uncertainty, changes in laws, and national and international political circumstances. The information provided herein should not be construed as a recommendation to buy, sell, or hold any particular security. Opinions expressed herein are current as of the date appearing in this material. Funds that invest exclusively in one sector or industry involve additional risks. The lack of industry diversification subjects the investor to increased industry-specific risks.

This material may contain forward looking statements or projections. These statements and projections relate to future events or future performance. Forward-looking statements and projections are based on the opinions and estimates of Oppenheimer as of the date of this presentation, and are subject to a variety of risks and uncertainties and other factors, such as economic, political, and public health, that could cause actual events or results to differ materially from those anticipated in the forward-looking statements and projections.

Oppenheimer Asset Management is the name under which Oppenheimer Asset Management Inc. (OAM) does business. OAM Alternatives is a division of OAM. OAM is a registered investment adviser and is an indirect wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc., a registered investment adviser and broker dealer. 3285729.1