Uncovering Alpha in a Retrieved Recovery

- February 17, 2021

Anusha Rodriguez discusses her outlook for alternative investments in the coming year as central bank stimulus and improving fundamentals continue to steer markets and the global economy back on the path to recovery.

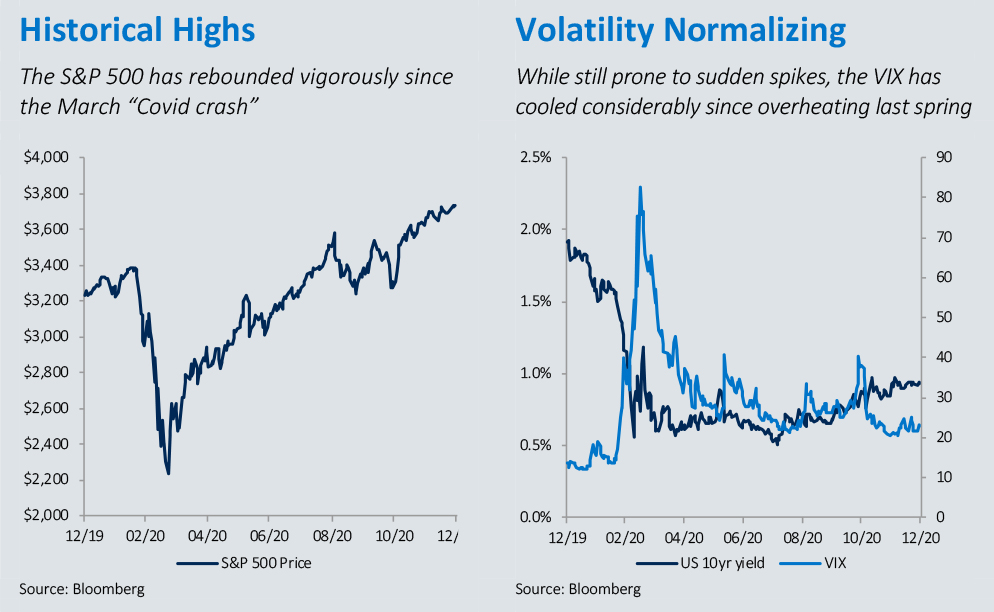

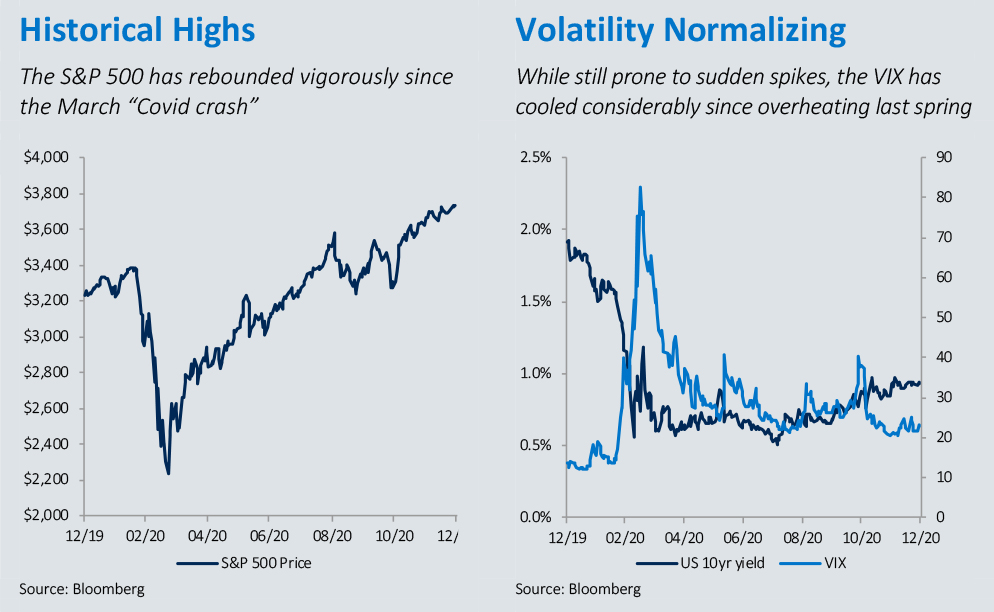

Covid-19 and the economic wreckage and volatility it created defined 2020. But so did the stock market’s resilience in the face of the unthinkable. It was one of the steepest—and the quickest—market corrections in history, as liquidity across the global financial system sharply contracted. Dedicated to a full recovery, central banks worldwide stepped in to inject a massive amount of monetary and fiscal stimulus to keep markets afloat. So far, the strategy has worked with major market indices eclipsing all-time highs. The global economy will take longer to recuperate, but macro fundamentals are already showing signs of improvement.

As we set our sights on 2021, Oppenheimer Asset Management eyes a number of catalysts paving the way for a broad-based, global economic recovery. Current vaccine development and distribution is promising, with initial vaccine contenders from Pfizer and Moderna in the early stages of distribution around the world. With the U.S. election season behind us, we believe the resulting clarity will continue to bode well for markets and investor sentiment. Any changes to the current global monetary policy will be pivotal, with markets looking to price in low interest rates for the next several years. Overall, given lackluster bond yields and sector-specific underperformance within equities, investors may wish to reconsider the traditional 60/40 portfolio.

Anusha Rodriguez, head of the $6.5 billion OAM Alternatives platform, recently sat down to discuss her 2021 outlook. Given the uncertainty surrounding the pandemic and its resulting economic fallout, Rodriguez stresses the value of active management, fundamental research and a selective manager platform. In the following interview, she explains why she believes long/short equity, event-driven, private equity and credit and ESG-tilted strategies will drive attractive absolute returns and suitably position portfolios for the upcoming year.

1. Which alternative strategies will do best in 2021? Why?

We believe global long/short equity, event-driven, private equity and credit strategies are poised to generate outsized returns in 2021. Global long/short equity strategies have been able to successfully navigate market volatility in 2020, generating alpha and protecting capital through downturns with active portfolio management. We believe that prudent managers that can generate both long and short alpha across markets will perform well again in 2021. Additionally, we anticipate that event-driven managers will benefit from an enhanced opportunity set, increased M&A activity and sector-based consolidation due to Covid-19 disruptions. With depressed valuations, companies across market caps and geographies may now become prime targets for hostile and friendly acquisitions.

Private equity and credit strategies have historically been uncorrelated to broader public markets. We see this trend continuing, with successful managers tactically deploying capital as the economy recovers. Within private equity, more companies are choosing to stay private for longer, enabling managers to identify fast-growing companies that may be trading at discounts to their public counterparts. Co-investment opportunities are also growing in popularity, providing investors increased exposure to proven companies that may benefit from sector tailwinds. We believe co-investments can be a great addition for portfolio enhancement, particularly within the consumer, technology and health-care sectors.

Private credit can be a diversified fixed-income component of a portfolio at a time when traditional fixed-income returns have been below average. With interest rates at historical lows or even negative, private credit strategies may be able to generate outsized returns through more complex strategies while retaining seniority in the capital structure. That includes non-bank lending, convertible bonds and other opportunistic distressed investments.

2. What types of alternative strategies are you actively scouting for now? Why?

By offering complementary strategies to our current offerings, OAM Alternatives aims to provide our clients a diversified and curated platform of highly pedigreed managers across asset classes. We anticipate that several themes will continue to accelerate in 2021 and beyond, including environmental, social and governance (ESG) investing, technology innovators and disruptors and core real estate. These areas are benefiting from growing secular tailwinds, increased consumer adoption and the current macro environment.

ESG investing continued to gain mainstream acceptance in 2020, as the cost of producing renewable energy (wind and solar) became cheaper relative to natural gas and coal. For the year, we saw record inflows of more than $45 billion into ESG mutual funds, with increased investor appetite for these products aided by positive and diversified underlying performance. We remain bullish on ESG and believe that an allocation to renewable energy and its underlying infrastructure will be particularly attractive for years to come.

With companies choosing to stay private longer, we’re seeing increased market competition across sectors driven by disruptive innovation. The market dislocation caused by Covid-19 provided an opportunity for nimble, capital-efficient companies to gain market share while scaling their user base in a remote environment. We’re seeing increasingly attractive opportunities across sectors, with a focus on machine learning, artificial intelligence, enterprise software, e-commerce, consumer and health-care companies. With global health top of mind, notable advancements in the medical industry have increased awareness and funding for the sector. These developments are translating into high-quality investment opportunities that are worth monitoring.

Prompted by the pandemic, there continues to be an exodus from densely populated urban centers to parts of the country with perceived lower costs of living. We believe that selective real-estate strategies may provide capital appreciation and yield to investors as various pockets of the asset class recover. Specifically, we see multi-family and industrial real estate outperforming traditional office and retail properties.

3. Which strategies are you reducing exposure to or avoiding in 2021?

We’re cautious of managers across strategies that may be chasing performance after the initial selloff in March. Substantial changes to the portfolio or investment process, including outsized positions, style drift and increased use of leverage may signal a change in the underlying investment thesis and philosophy. Frequent evaluation of managers and sectors will be critical as we navigate the post-Covid landscape.

Structural change is often a necessity for growth. As we dissect the post-Covid world, it’s clear that historical methodologies and passive management may not perform as they once did and the traditional 60/40 allocation model may not provide investors with the same return profile of the past. With interest rates around the world at record lows, rising sovereign debt and continued debasement of fiat currencies, reducing exposure to traditional fixed-income strategies may protect against permanent capital impairments. Overall, we continue to monitor changing market dynamics and investor appetite to provide access to strategies that diversify, enhance and protect capital throughout market cycles.

4. What manager selection challenges do you face amid Covid-19? How has your team adapted?

A newly remote world has given us a chance to refine our due diligence process and rethink how we interact with our pipeline managers and monitor current strategies on the platform. Manager selection is vital in curating a selective, high-quality lineup of alternative strategies. And despite this year’s difficult conditions, the OAM Alternatives team conducted more than 500 manager meetings during 2020. In the face of economic shutdowns and restrictions on in-person meetings, we were able to launch a series of new managers during the year. We remained productive by holding conference calls and Zoom meetings, while also attending 25 virtual conferences globally.

Anusha Rodriguez

Title:Managing Director, Head of Alternative Investments, Head of Research and Due Diligence

Anusha Rodriguez is a managing director, head of alternative investments and head of research and due diligence at Oppenheimer Asset Management. Prior to joining Oppenheimer, she was a vice president at Citi Private Bank focused on relative value and multi‐strategy managers, as well as external fund of funds. Previously, Anusha was a director at Morgan Stanley focused on various alternative strategies.

DISCLOSURE

This information is provided for informational purposes only and should not be construed as an endorsement of or a solicitation to invest in any specific program. The opinions expressed herein are subject to change without notice. There is a substantial risk of loss when investing in alternative investments and, for each specific fund, the risk of underperforming the general markets or other funds. The investor should carefully review the PPM of any fund before investing. Alternative investments are not appropriate for all investors and only may be offered to certain qualified investors. Past performance does not guarantee future results.

Investors must be able to bear the economic risk of such an investment for an indefinite period and can afford to suffer the complete loss of investment. An Investor’s ability to redeem from such investments is limited to specific time periods (eg. monthly, quarterly, semi-annually, annually) with certain notice requirements.

Some of the alternative fund managers that OAM is recommending are recently formed and have limited operating history. Some newly formed managers and funds may have limited assets under management. With newly formed managers, there may be greater operational and financial risk factors. Oppenheimer & Co. Inc. has selling agreements with the hedge funds on the alternative fund platform. Oppenheimer & Co. Inc. receives part of the management fee and incentive fee and does not receive the same compensation from each hedge fund. This may be a potential conflict of interest for Oppenheimer & Co. Inc. and its financial advisors to recommend funds that pay higher compensation.

The value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements. Both past performance and yields are not reliable indicators of current and future results. There is no guarantee that any forecast will come to pass or that any investment strategy will be successful. Investors should consider the fund as a supplement to an overall investment program and should invest only if they are willing to undertake the risks involved.

The risks associated with investing in fixed income include risks related to interest rate movements as the price of these securities will decrease as interest rates rise (interest rate risk and reinvestment risk), the risk of credit quality deterioration which is an issuer will not be able to make principal and interest payments on time (credit or default risk), and liquidity risk (the risk of not being able to buy or sell investments quickly for a price that is close to the true underlying value of the asset).

This commentary may contain forward looking statements or projections. These statements and projections relate to future events or future performance. Forward-looking statements and projections are based on the opinions and estimates of Oppenheimer as of the date of this presentation, and are subject to a variety of risks and uncertainties and other factors, such as economic, political, and public health, that could cause actual events or results to differ materially from those anticipated in the forward-looking statements and projections.

Indices are unmanaged, hypothetical portfolios of securities that are often used as a benchmark in evaluating the relative performance of a particular investment. An index should only be compared with a mandate that has a similar investment objective. An index is not available for direct investment, and does not reflect any of the costs associated with buying and selling individual securities or management fees.

Oppenheimer Asset Management is the name under which Oppenheimer Asset Management Inc. (OAM) does business. OAM Alternatives is a division of OAM. OAM is a registered investment adviser and is an indirect wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc., a registered investment adviser and broker dealer. 3404344.1