Three Questions for Independent Physician Groups

- November 22, 2022

Each week, I have numerous conversations with Boards of Directors and C-level executives at independent physician groups. Sometimes the conversation is a first-time introduction; other times, our call or Zoom meeting is a follow-up from a conversation we already started. These conversations always seem to revert to a singular theme – independent groups want to remain independent. And there are three common questions that we always seem to field that convey this theme.

1. How do we remain independent?

The number one concern physician groups have is how to remain independent. The worry over losing independence is valid across all specialties in every region of the U.S. We hear about it almost daily in our conversations with CEOs and Boards of group practices. Retaining autonomy is the number one objective group leaders have ahead of every competing priority. Yet the harsh reality is that practice independence is threatened now more than ever.

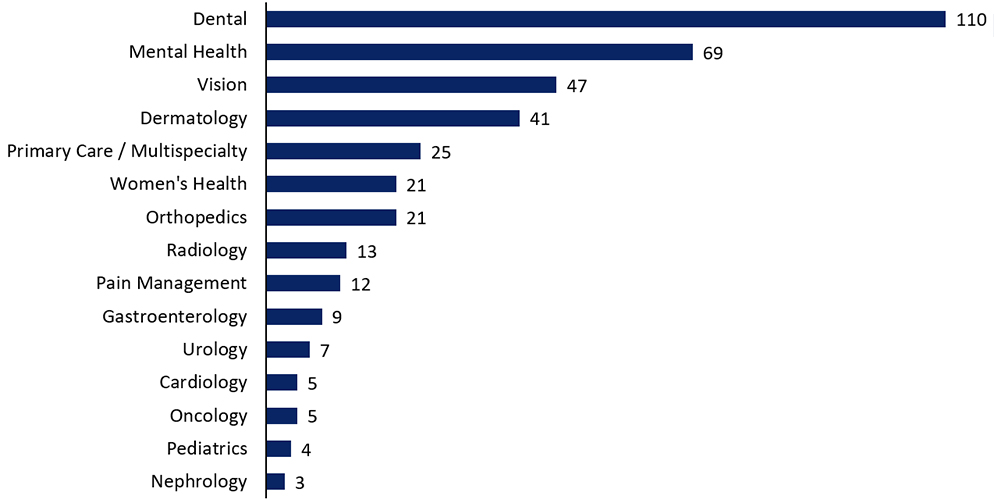

The massive threat to independence is the billions of dollars budgeted by health systems, publicly-traded corporations, and private equity funds to consolidate independent practices. Nearly every independent physician practice in the U.S. is on an acquisition target list today. By our count, there are more than 390 private equity-backed physician platforms seeking acquisitions (and this excludes a few specialties). The chart below tells the story.

Private-Equity Backed Physician Platforms (as of November 2022)

There are just over one million physicians professionally active in the U.S. According to the AMA's Physician Benchmark Survey, 2020 was the first year less than 50% of patient-facing physicians worked in private practice. The decline is dramatic compared to 54% of physicians who worked in physician-owned practices just two years ago.

At this pace, independent practice ownership would effectively disappear in the next two decades. From our vantage point, the challenge is that the speed of consolidation is increasing. In 2020, 40% of physicians worked in a group with partial or complete ownership by a hospital or health system. Perhaps most striking about the AMA survey is that 2020 was the first year private equity registered as material ownership with a 4.4% share.

Health systems, health plans, corporate provider groups, and private equity firms are aggressively pursuing physician practices. Optum, the national provider group wholly owned by UnitedHealth (the nation's largest health plan), has more than 53,000 physicians in its network – that's about 5% of the nation's physician workforce. In 2021, 407 physician groups announced a deal with a private equity or corporate investor, a 119% increase over the previous comparable period. These deals were valued at approximately $5.5 billion.

Here's the reality: the only viable plan for independence is a strategic plan focused on growth. If your group doesn't have a growth plan, you're already part of someone else's. Your group's strategy should focus on organic and inorganic growth, making investments in capabilities for value-based care programs, and proactively exploring your strategic alternatives.

2. How do we manage physician burnout?

Burnout is characterized by emotional exhaustion, depersonalization, and a sense of reduced accomplishment in day-to-day work. Without a doubt, it is a critical issue, especially among physicians. According to a recent study, more than 50% of physicians reported suffering from at least one burnout symptom. According to several scholarly articles, physician burnout usually arises from work-related stressors. Significant stressors include excessive workloads, significant administrative burdens, the use of electronic medical records (EMR), inefficient work processes, as well as complex organizational factors where physicians may feel that leadership operate with misaligned values. COVID only exacerbated the burnout challenges faced by independent physician groups, not just for physicians but for all healthcare workers, including providers in the behavioral health field.

While this is a grave issue throughout the healthcare system, one of the strategies that have been cited as addressing physician burnout has been in the form of organizational changes that focus on improving the work environment. While certainly not a panacea for burnout, we have noticed that physician groups that pursued structural alternatives such as forming an MSO and re-allocating administrative duties to the MSO have often seen a renewed sense of energy among the practice partners. One of the attributes that we often point out to our clients is that, as partners in an independent practice, the physicians are not only "employees" but also business owners. Business ownership often translates into value creation opportunities that were, best case, not fully understood or, worst case, completely ignored. By exploring a possible MSO structure and growth strategy using external capital, independent practice partners are often surprised by the magnitude of the value-creation opportunity. And the resulting uplift in energy and focus positively impacts the practice partners and often throughout the organization.

3. How do we migrate to value-based care?

If the number one concern for group practices is remaining independent, the number one answer to that question is "transition to value-based care." The payment side of the $4 trillion-plus U.S. healthcare economy - health plans, CMS, state Medicaid programs - is demanding it.

Way back in 2019 - before the pandemic - 91% of the 62 health plans and seven fee-for-service (FFS) state Medicaid programs surveyed about alternative payment models (APM) expected APM activity to increase (according to Health Care Payment Learning Action Network). CMS expects that by 2025, 100% of Medicare providers will be in a two-sided risk arrangement and half of Medicaid contracts in some form of VBC program. Humana, the second-largest Medicare insurer in the U.S., publishes an annual VBC report detailing progress in migrating members and providers to VBC arrangements; they spotlight better outcomes. The pandemic seems to have only accelerated APM activity.

From our vantage point, there are micro-regions in the U.S. where mature provider groups operate only under VBC arrangements such as percentage of premium capitation. These groups receive (as an example) 85% of the Medicare Advantage premium that the contracted health plan receives but are responsible for 100% of the member's medical costs. These groups have made extensive investments in their practices and boast better member outcomes and above-average operating margins.

Yet the vast majority of physician groups remain beholden to FFS models. A 2019 survey by Xtelligent Healthcare Media's Insights indicated that 70% of physician practices still earn 75% or more of their revenue from FFS.

If your practice hasn't developed a plan and allocated investment dollars to position it to transition to VBC arrangements, eventually, it will go by the wayside. Making investments in VBC - information systems, clinical workflows, C-suite talent - is critical today to position your practice to thrive. It's also key to remaining independent.

Oppenheimer Helps Independent Physician Groups Chart Their Futures

Oppenheimer's Healthcare Investment Banking Group is one of the nation’s leading advisors to primary care, multi-specialty, and single specialty physician practices. We have closed more than 40 transactions involving physician groups, including minority investments, private equity recapitalizations and strategic sales. We can add tremendous value by sharing:

- Advice on strategic alternatives

- Perspectives on valuation

- Perspectives on value-based care (VBC)

- Ideas on capital structure and financing

- Introductions to prospective partners and C-level talent

Marc Cabrera

Title:Co-Head of Healthcare, Head of Healthcare Services

DISCLOSURES

This notice is provided for informational purposes only, and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. Nothing contained herein shall constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited.

This notice may contain statistical data cited from third-party sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such third-party statistical information is accurate or complete, and it should not be relied upon as such. All market prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice.

2021 Oppenheimer & Co. Inc. Transacts Business on all Principal Exchanges and Member SIPC 4846244.2