Past Events

Join us on Top of the Mountain For an Exclusive Day of Skiing

Wednesday, March 5, 2025

Plattekill Mountain, NY

Lift tickets, breakfast and lunch provided.

Lifts open from 8:45am to 4:15pm

Click here for directions.

Additional Services:

Guests can rent ski or snowboard equipment, as well as book private, semi-private and children lessons at an additional cost.

See details here. (a 20% discount off listed prices applies for our event –do not book online, let us know directly)

Feel free to invite relatives, friends and colleagues.

PLEASE notify us if you or anyone in your party will need to book a lesson or rent equipment, so we can coordinate with the resort and make sure they are properly staffed.

Our sponsors will be providing food, beverage and educational component:

Putnam Investments | Active Insights: Global Economy and Equity Markets

Equable Shares | Equable Shares: Hedging Specialists

Nuveen | Municipal Market Update

First Trust | Tums in the Road: Navigating Through Transitions

*No alcoholic beverages purchased by event organizers and/or sponsors before 4pm (guests can purchase on their own before that).

RSVP Here

2025 Market Outlook

Join us for a discussion with John Stoltzfus and Ari Wald.

January 30, 2025

5:30pm Reception

6:00 - 7:00pm Discussion

Oppenheimer & Co. Inc.

Chrysler East Building

666 Third Avenue, 13th Floor

Meet the Speakers and Moderator

John Stoltzfus | Chief Investment Strategist

Oppenheimer Asset Management Inc.

Ari Wald | Head of Technical Analysis

Oppenheimer & Co. Inc.

Nick Siconolfi | Moderator | Director of National Sales

Oppenheimer & Co. Inc.

Repair or Replace? The Deficient Trustee

November 12, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Unfortunately, some trusts, even where the administrative and dispositive provisions are well-designed, fail to operate as intended because the Trustee lacks the ability to be an effective fiduciary. The Trustee’s problems may result from his or her having insufficient trust administration expertise and/or a confrontational attitude towards one or more of the beneficiaries. Depending on the nature and extent of the Trustee’s shortcomings, resolving the situation may prove difficult. Considerations to be discussed in this teleconference include:

- Determining whether one or more breaches of fiduciary duty have been committed

- How to proceed if no actionable breach of duty has occurred

- Possible options for improving quality of administration or relationship with beneficiaries

- Removal and replacement of Trustee

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Durable Powers of Attorney - An Essential Estate Planning Component

October 22, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Powers of attorney are among the most important estate planning documents for many of our clients. With more people today anticipating or actually grappling with diminished capacity, the assets comprising our clients’ wealth may be under the control of an agent for an extended period of time. It is important, therefore, that estate planning professionals ensure that each power of attorney is carefully designed to meet the client’s individual purposes and that its acceptance by third parties is optimized. The following critical issues will be discussed during this teleconference:

- Determining appropriate powers to grant to an agent

- Designing powers of attorney to help prevent financial elder abuse

- Liability risks for the agent

- Third parties dealing with the agent

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Multi-Faceted Conflicts Among Trust Beneficiaries, Trustees, the IRS and the Courts

September 17, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

After the dust has settled, trust beneficiaries who may think they just won the lottery are sometimes surprised to discover that their position in the trust relationship may be less advantageous than they envisioned. Beneficiaries sometimes must take affirmative steps to enforce their rights and may find that their complaints regarding trust administration are determined not to be justified. Further, in some instances, a beneficiary may be required to account for and return distributions that should not have been made. We’ll address the following themes during this teleconference:

- The nature and timing of a beneficiary’s claims against a Trustee

- A beneficiary’s potential liability to the trust

- The IRS’ pursuit of a trust beneficiary for a tax liability

- A beneficiary’s standing to sue a third party who transacts business with the trust

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Addressing the Estate Planning Needs of Modern-Day Clients

August 20, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

We must be able to handle the estate planning needs of twenty-first century clients, whether they are children or grandchildren of our established clients or new clients who have already accumulated wealth or are on a trajectory to do so. Some of today’s clients adhere to values and live in ways not commonly recognized or understood in society just a few decades ago. Estate planning for these clients may involve considerations and require approaches that are unique relative to our experience with “traditional” or older clients. We’ll explore the following:

- Same-sex marriages, civil unions and cohabiting unmarried individuals

- Assisted conception children and children from other relationships

- Dealing with ancestors’ trusts whose terms restrict who may be a beneficiary

- ESG investing in a trust

Nuts and Bolts of Trust Terminations

July 23, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

The idea of bringing trust administration to a conclusion may seem to the Trustee like a relief – and, in many respects, it is. However, terminating a trust isn’t nearly as simple as merely distributing its assets (and even that may not be so simple) and walking away. Numerous details must be successfully navigated along the way, and, if they aren’t, unhappy benefi ciaries will ensure sleepless nights for the Trustee. In this presentation, we’ll delve into the following:

- Identifying and locating named or designated remainder benefi ciaries

- Properly allocating assets among and distributing them to the remainder benefi ciaries

- Income tax and generation-skipping transfer tax returns

- Statutes of limitation on actions by benefi ciaries and IRS against Trustee

- Propriety of seeking releases from benefi ciaries

Ethics Issues in a Contemporary Estate Planning Practice

June 18, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Estate planners and those who administer estates and trusts must frequently adapt to changes in our profession, including evolving ethics-based concerns. We cannot be focused only on our traditional ethics obligations owed to clients and former clients. Many other ethics issues, some of which were never or seldom thought about by estate planning and estate and trust administration practitioners in earlier generations, now arise with increasing frequency. These include:

- Ethics issues relating to managing office technology

- Maintaining confidentiality and the attorney-client privilege when working with a client’s other advisors

- Multijurisdictional practice hazards

- Maintaining competence

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Wine and Cheese Event

Please join us for an informal discussion on the latest financial markets and office/home furniture trends.

Wednesday, June 5, 2024

6:00 PM

Location:

ESTEL AMERICA Inc.

8 W 40th Street | 7th Floor

New York, NY 10018

Guest Speaker:

Executive Vice President at ESTEL AMERICA Inc

Space is limited. To confirm your attendance, please RSVP below:

Marital Agreements from A to Z

May 21, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Marriage dissolution, and the fi nancial obligations that often fl ow from it, has become so prevalent that a client’s planning for this possibility is sometimes nearly as important as his or her core estate planning instruments. Thus, marital agreements, especially among those who have been through divorce, are becoming a foundational component of some clients’ fi nancial security. These agreements must be closely coordinated with the client’s estate plan. Of frequent concern in this area are:

- What are essential requirements for all marital agreements

- Tax issues to address in marital agreements

- Spousal rights in retirement assets

- Anticipating and handling marital issues with closely-held business interests

China: Climbing the Great Wall of Worry

You are invited to join an in-person discussion on China.

Tuesday, May 7, 2024

5:30 PM: Drinks and Refreshments

6:00 PM: Discussion Starts

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Topics include:

- The Economic Slowdown: Real Estate & Export Drag Declining Birthrates: Approaching 1.0

- Decreased Foreign Investment

- Policy Response

Guest Speaker:

Cannon Estate Planning Teleconference Series

Shelter from the Storm – Anticipating and Avoiding Breach of Fiduciary Duty Claims

April 23, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

The roles of beneficiary and fiduciary by their inherent nature have the potential to engender conflict. Over recent decades, this con¬flict has been exacerbated by increasing demands of beneficiaries and expanded theories of fiduciary liability – flowing in part simply from the more litigious nature of society and in part from changes in trust law generally tilting toward enhancing the rights of benefi¬ciaries. This teleconference will address the following themes:

- Always the most common sources of friction: distributions and investments

- Design and use of governing instrument provisions to insulate the fiduciary

- Effect of reliance on counsel by fiduciary

- Effect of waiver and/or consent and/or receipt of accountings by beneficiaries

Cannon Estate Planning Teleconference Series

Deep Dive into Disclaimers

March 19, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

A disclaimer (otherwise known as a renunciation) is nothing more than an unqualified, irrevocable refusal to accept a transfer of property from another person. That simple definition, however, overlooks the complexities associated with the many different tax and nontax contexts in which the making of a disclaimer might be considered and what its results may be. In this session, we’ll closely examine many aspects of disclaimers, including:

- Differences in handling under state laws and federal tax law

- Estate planning uses – including formula disclaimers

- Special federal tax rules applicable to disclaimers by spouses

- Disclaimers of transfers at death versus disclaimers of lifetime gifts

- Effects of disclaimers on disclaimant’s creditors

Cannon Estate Planning Teleconference Series

State Income Tax Issues with Trusts

February 20, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

There’s a wide variety of fiduciary income tax laws among the states. In fact, many states have no fiduciary income tax at all or have a fiduciary income tax regime that is easily avoided. Given these facts, and considering our mobile society, estate planning professionals need to be conversant with how to structure estate planning vehicles and transactions to minimize state income taxes. Many factors, sometimes leading to conflicting results in, or tax being imposed by, multiple states, must be taken into account. During this teleconference, we’ll discuss the following:

- How a trust is or may become subject to a state’s income tax

- Constitutional challenges to a state’s taxation of a trust

- Changing a trust’s residency to avoid state income tax

- Determining the source of income for state income tax purposes

- Trusts that are subject to state income tax in more than one state

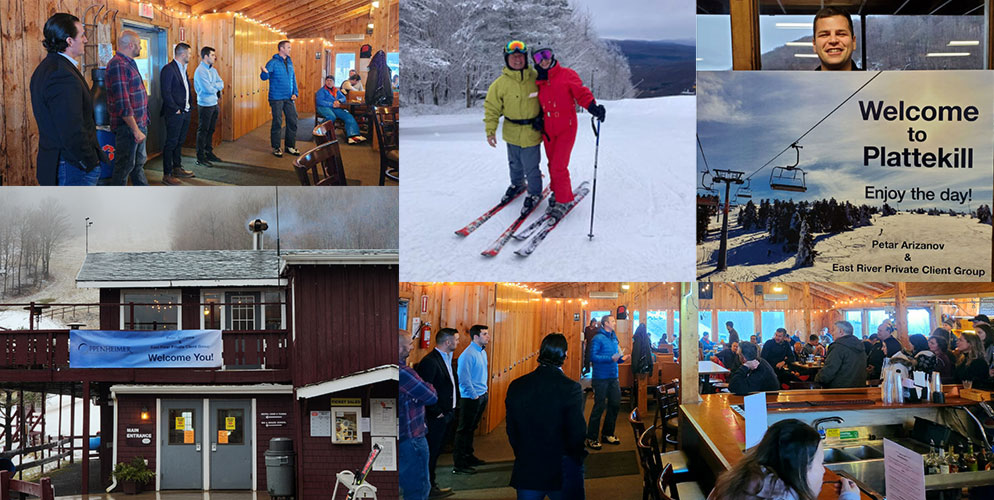

Join us on Top of the Mountain For an Exclusive Day of Skiing

Thursday, February 8, 2024

Plattekill Mountain, NY

Lift tickets, breakfast and lunch provided.

Lifts open from 8:45am to 4:15pm

Click here for directions.

Additional Services:

Guests can rent ski or snowboard equipment, as well as book private, semi-private and children lessons at an additional cost.

See details here.

(a 20% discount off listed prices applies for our event –do not book online, let us know directly)

Feel free to invite relatives, friends and colleagues.

PLEASE notify us if you or anyone in your party will need to book a lesson or rent equipment, so we can coordinate with the resort and make sure they are properly staffed.

Cannon Estate Planning Teleconference Series

Spousal Lifetime Access Trusts - A Fleeting Opportunity

January 23, 2024

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

The Tax Cuts and Jobs Act brought historically high estate and gift tax exemptions. With the seemingly inevitable “sunset” of the Act looming on the horizon, spousal lifetime access trusts (“SLATS”) have been widely promoted in recent years as the best “have-your-cake-and-eat-it-too” estate planning strategy out there. In this program, we’ll explore several aspects of the design, creation and administration of a SLAT, including:

- Purposes

- How best to fund to minimize tax risk

- Current and future beneficiaries

- Initial and successor Trustees

- Pitfalls to avoid

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Cannon Estate Planning Teleconference Series

Ethics: Malpractice in Estate Planning - Some Guidance on How to Avoid It

December 12, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

It goes without saying that an estate planning professional must provide competent services to the client. Confronted with an ever-changing legal and regulatory landscape, the estate planner must be vigilant not to allow the quality of his or her representation of clients to deteriorate. Given the plethora of currently available estate planning and post-mortem planning options, the potential for making mistakes may be greater than ever. In this teleconference, we’ll consider:

- What constitutes malpractice?

- The interrelationship of ethics rules violations and malpractice claims

- The potential for liability to non-clients

- Estate planning malpractice hazard zones

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Cannon Estate Planning Teleconference Series

Defusing Disaster

November 14, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Decedents sometimes leave an estate plan that creates more problems than it solves. Under the laws of most states, various judicial and nonjudicial options exist with which to repair estate planning defects after-the-fact. It is important to our practices that we have a comprehensive understanding of the following potential solutions:

- Trust modifications, decanting, premature terminations, settlement agreements

- Construing or reforming governing instrument language

- Beneficiary waivers, releases and consents

- Virtual representation

- Disclaimers or renunciations

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Cannon Estate Planning Teleconference Series

Directed Trusts - Slicing and Dicing Duties, Risks and Potential Liabilities

October 24, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Directed trusts, largely unknown in the United States just a few decades ago, are becoming quite common. Many states have adopted statutes to establish a framework for the operation of directed trusts, and courts are sometimes called upon to resolve messy disputes among trust protectors, Trustees and beneficiaries. We’ll discuss the unique drafting challenges, liability risks and other issues that arise in connection with directed trusts, including:

- State laws and desirable governing instrument provisions regarding directed trusts

- Ways to divide duties and responsibilities of trust administration between Trustee and trust protector

- Nature of a trust protector and whether a trust protector is or should be a fiduciary

- Potential liability of directed Trustees and trust protectors

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Cannon Estate Planning Teleconference Series

Gift and Estate Tax Black Holes

September 19, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Planning to avoid, or at least minimize, gift and estate taxes can be daunting. That statement has never been more true than it is in 2023. The IRS often challenges tax benefits claimed by taxpayers implementing new or revised estate planning techniques and strategies and sometimes even formulates new theories by which to undermine or eliminate more traditional tax planning approaches. This teleconference will focus on the following:

- Emerging problems with GRATs

- Step transaction and valuation nightmares

- Gift tax consequences of trust modifications, premature terminations and decanting

- Mismatch between gross estate inclusion and marital or charitable deduction amounts

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Cannon Estate Planning Teleconference Series

Estate Planning Solutions for the Disabled and Those Who May Be Approaching Disability

August 22, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Amazing advances in medical science have given people the prospect of ever-increasing longevity. The accompanying difficulty, however, is that folks living to an advanced age face a greater possibility of becoming disabled before death. Estate planners must contend with a unique, additional layer of complexity in representing clients who are getting older and whose acuity may be waning or who have an intended beneficiary who is disabled. We’ll review the following issues and challenges that are of particular interest and relevance in this context:

- Financial elder abuse

- Testamentary capacity and undue influence

- Design and efficacy of revocable trusts, durable powers of attorney and advance directives

- Designing and administering special needs trusts

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Cannon Estate Planning Teleconference Series

Opportunities and Obstacles Created by the Uniform Trust Code

July 25, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

As of August 2022, in the 20 years since Kansas became the first state to enact the Uniform Trust Code, 34 more states, plus the District of Columbia, have enacted it. Additionally, several states that have not enacted the UTC have adopted portions of it or have modeled some of their trust laws on it. Thus, it can fairly be said that the UTC has become highly influential in the development of trust law nationally. A statutory compilation of such stature periodically deserves a thorough review. We’ll examine some of the most important aspects of the UTC, including:

- Default and Mandatory Rules

- Virtual Representation

- Trust Modification

- Notice Requirements

- Duties Trustees Owe to Beneficiaries

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Cannon Estate Planning Teleconference Series

Ethics: When Doing What’s “Right” Might be Wrong

June 20, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Not all charges of breaches of professional ethics result from consciously attempting to cut corners, take advantage of a situation, extract excessive fees or treat someone unfairly. In fact, an ethics complaint may arise out of facts showing the respondent was striving to provide a laudatory level of service. During this program, we’ll address issues that may develop from:

- Concurrent representation of spouses and other family members

- Planning for a client’s possible eventual incapacity

- Safekeeping of a client’s estate planning documents

- Disclosure of a disabled client’s confidential information

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Cannon Estate Planning Teleconference Series

Beyond Boilerplate - Designing and Administering Special Purpose Trusts

May 23, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Some estate planning clients have needs or desires that transcend the ordinary. They could have intended beneficiaries with unusual characteristics or in difficult circumstances. They may require holding assets in trust that would not only not be typical trust investments but may be a real challenge for a fiduciary to hold and administer. For these folks, a standard, “off-the-shelf” Will, trust instrument and durable power of attorney will not suffice. In this teleconference, we’ll take a close look at the following:

- Incentive trusts

- Trusts to hold real estate for family enjoyment

- Unique challenges arising from holding closely-held business equity in trust

- Trust assets not in Trustee’s physical possession or direct control

Cannon Estate Planning Teleconference Series

It’s Not All About Saving Taxes - How Trusts Can Impact Beneficiaries’ Lives

Tuesday, April 25, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

A large segment of the estate planning industry has evolved from focusing primarily on estate tax deferral and minimization to non-tax planning. Today, many clients whose estates used to be in the category of taxable are now concentrating more on other matters, such as not making their children too rich too soon, protection of assets from claims of creditors and soon-to-be ex-spouses and selection of Trustees.

During this session, we’ll review:

- Outright bequests versus trusts with mandatory distributions versus lifetime trusts

- Various discretionary distribution standard options

- Effectiveness of spendthrift and wholly discretionary trusts

- Designating appropriate initial and successor Trustees

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Cannon Estate Planning Teleconference Series

Giving Income Tax Considerations in Estate Planning the Respect They Deserve

Tuesday, March 21, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

The current tax and estate planning environment requires particular attention to income tax issues that arise in formulating an efficient and effective estate plan as well as in trust and estate administration. Estate planning professionals need to have expertise not only in designing a plan that can minimize trust-level income taxes and achieve estate tax-free basis step-up at a trust beneficiary’s death but also in the following areas, which will be covered in this teleconference:

- Benefits and detriments of grantor versus non grantor trusts

- Miscellaneous income tax-related elections

- Costs subject to the two-percent floor under IRC § 67(e)

- State income tax considerations

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Strategies Designed to Strengthen Portfolios

Join us for an exclusive lunch session and access to industry leaders to learn about Strategies Designed to Strengthen Portfolios

Thursday, March 9, 2023

12:00 PM EST

Location:

Avra Madison Estiatorio

14 E 60th St

New York, NY 10022

Speakers & Topics:

John Stoltzfus

Chief Investment Strategist, Oppenheimer Asset Management Inc.

How to Manage Risk and Expectations Given the Current Economy and Financial Market Conditions?

Stephen May, CIMA®

Vice President, Capital Group

What are the Investment Themes to Focus on for 2030?

Hosted by:

Petar Arizanov, CFP®

Executive Director - Investments

Cannon Estate Planning Teleconference Series

The Intersection of Exceptional Estate Planning and Bad Trust Administration

Tuesday, February 21, 2023

1:00-2:30 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

It’s possible to have a superb estate plan in concept, including state-of-the-art estate planning documents, only to have defective fiduciary administration cause components of the plan to short circuit or, in some cases, cause the whole plan to explode in flames. The results may range from loss of expected tax status or benefits to diversion of trust assets. In this session, we’ll consider the importance of:

- Following governing instrument mandates to the letter

- Exercising dispositive and investment discretion with care and sensitivity

- Designating fiduciaries with expertise, experience and integrity

- A Trustee’s developing cooperative and informative relationships with beneficiaries

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Join us on Top of the Mountain For an Exclusive Day of Skiing

Thursday, January 19, 2023

Plattekill Mountain, NY

Lift tickets, breakfast and lunch provided.

Lifts open from 8:45am to 4:15pm

Click here for directions.

Additional Services:

Guests can rent ski or snowboard equipment, as well as book private, semi-private and children lessons at an additional cost.

See details here.

(a 20% discount off listed prices applies for our event –do not book online, let us know directly)

Feel free to invite relatives, friends and colleagues.

PLEASE notify us if you or anyone in your party will need to book a lesson or rent equipment, so we can coordinate with the resort and make sure they are properly staffed.

Cannon Estate Planning Teleconference Series

Powers of Appointment - The Swiss Army Knife of Estate Planning

Tuesday January 24, 2023

1:00-2:00 PM EST

Location:

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor

New York, NY 10017

Among the most useful tools at an estate planner's disposal is a power of appointment. There's an almost infinite variety of powers of appointment and they can be used to accomplish numerous important tax and non-tax estate planning objectives. In addition, powers of appointment may have significant and sometimes surprising tax consequences. In this presentation, we'll examine numerous aspects of powers of appointment, including:

- Types of powers of appointment

- How to design, draft and exercise powers of appointment

- Tax characteristics of powers of appointment

- Goals that may be achieved using powers of appointment

To ensure you enjoy lunch and a seat we recommend you arrive by 12:30 PM

Professionals Alliance Group (PAG) Forging relationships and revenue streams that are built to last.

Tuesday, November 8, 2022

6:00 PM Eastern Time (US & Canada)

You are invited to join our private event with select clients, partners, and advisors to hear more about this opportunity to expand your existing business lines and develop additional recurring revenue sources through access to a top-tier financial firm.

Oppenheimer & Co. Inc.

666 3rd Avenue, 13th Floor | New York, NY 10017

or Via Webex

Join Us on Top of the Mountain

Exclusive Day of Skiing

Thursday, January 20, 2022 | 8:45AM to 4:15PM:Plattekill Mountain, NY

Hosted by Petar Arizanov, Executive Director - Investments and

Daniel Stahlie, Senior Director - Investments

Lift tickets, breakfast, and lunch provided

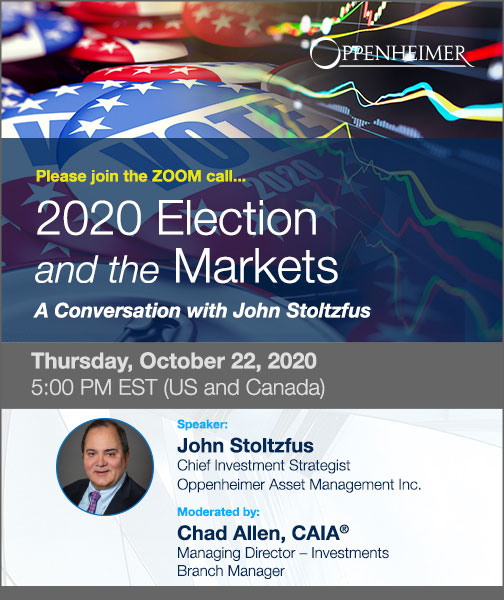

Pre-Election Outlook and Perspective on the Market

Date: Thursday, October 22, 2020 | 5:00PM ET

A Virtual Meeting with John Stoltzfus, Chief Investment Strategist, Oppenheimer Asset Management Inc. to discuss four possible election scenarios and their likely impact on equity markets.

Innovation and Disruption in an Era of Tesla and Alternative Energy

Please register in advance for this webinar:

https://zoom.us/webinar/register/WN_O711wkiFQz6SGRnf1eC3zg

For those who prefer telephone audio vs. the computer, you will get an email with your unique link, password and dial-in information to the Zoom meeting.

Third Annual TetherView Cyber Security Summit

Thu, May 28, 2020 | 1:00 PM - 3:30 PM EDT

Third Annual TetherView Cyber Security Summit

Cannon Estate Planning

Teleconference Series

March 24, 2020

Powers of Attorney: Not a Walk in the Park

May 26, 2020

The Relationship Among Trust Beneficiaries and Trustees, the IRS and the Courts

June 23, 2020

Ethics-Based Obligations in Specific Client Engagements

July 21, 2020

Maximizing Flexibility With Powers of Appointment

August 25, 2020

Picking Up the Pieces: Post-Divorce Planning

September 22, 2020

Moving the Needle With Your Clients’ Retirement Asset Planning

October 20, 2020

Contemporary Challenges in Trust Administration

November 17, 2020

Essential Asset Protection Planning

December 15, 2020

Conflicts of Interest Issues Facing Estate Planning Professionals

Covid-19: Collateral Impact & Opportunity

Covid-19

Teleconference Series

Tuesday April 28, 2020 | 11:30am - 12:30pm EDT

The Current State of Affairs and Thoughts on Re-Entry

Future of Everything

Innovation and Disruption in an Era of Tesla and Alternative Energy

Presentation by Noah Kaye, Managing Director and Colin Rusch, Equity Research Analyst

6:00 PM: Cocktails and hors d'oeuvres

6:45-7:30PM: Presentation with Q&A

Join Us on Top of the Mountain

Exclusive Day of Skiing

Plattekill Mountain, NYHosted by Petar Arizanov, Executive Director - Investments and

Daniel Stahlie, Senior Director - Investments

Thursday, March 5, 2020

8:45AM to 4:15PM: Lift open

Lift tickets, breakfast, and lunch provided

Understanding Medicare from A to D

Thursday, March 11, 2021 | 5:30 pm ET

Leonardo Vittini - Sales Director - First Eagle Investment Management, LLC

Medicare is key to affordable health care access for most Americans, and the benefits it provides should be factored into any comprehensive investment planning strategy. First Eagle’s seminar can help guide you through the essentials of Medicare, including:

- An introduction to the program, its coverage and its costs

- The enrollment process, and where and how to start

- Coordinating Medicare benefits with other forms of insurance

- The resources available to help individual

Energy, Environment and Equities

Thursday February 25 | 5:30 pm ET

Justin Campeau - Kayne Anderson - Portfolio Manager

Jos Shaver - Electron - Portfolio Manager

Covid, Congress and the Capital Markets

Thursday January 21 | 5:30 pm

A conversation with John Stoltzfus on

Covid, Congress and the Capital Markets

You are now leaving Oppenheimer.com

Oppenheimer & Co. Inc.’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Oppenheimer & Co. Inc. isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Oppenheimer & Co. Inc. name.