Looking ahead to 2021, we expect volatility to stay somewhat elevated and the major themes such as stay-at home/back–to–work, low interest rates, and contrary views on the pace, scale, and velocity of economic recovery will continue to drive volumes as market participants navigate through necessary portfolio re-positioning. As we did with great success in 2020, Oppenheimer’s Equity teams will continue to ensure daily content, product, and service remain topical, relevant, and impactful to serve the needs of a diverse client base.

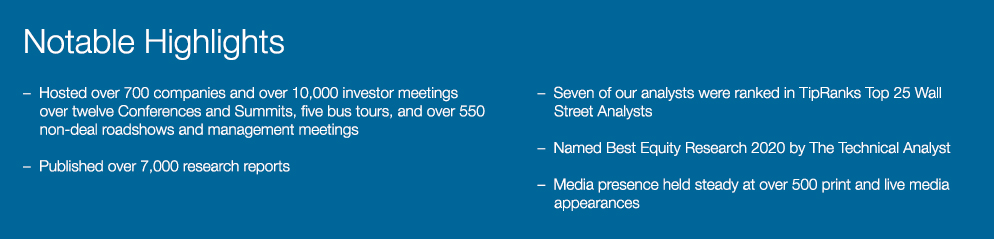

In perhaps the most significant development in 2020, building on the success of the last three to five years, Oppenheimer has achieved a superior level of recognition and visibility with important clients (both Long Only and Hedge Funds) in the core Agency business line. Compelling leadership and a disciplined and focused effort to identify and target key clients where the ability to interact and engage in highly sensitive and significant liquidity events has elevated Oppenheimer’s profile with some of the largest Institutional asset managers in the world. With a truly remarkable effort from research analysts and our Corporate Access team to generate a constant flow of Agency content to compliment the Banking effort and our block trading, the firm’s profile has never been stronger. The convergence of Agency with Banking as deal flow product has evolved upstream towards larger deals, bigger market capitalizations and (especially) more managed transactions is a trend we believe will continue.

Lastly, for the first time in a decade we have seen all of the above come together in such a way that all of the major Equity business lines were able to participate together in the success that was 2020, and because we are now accessing major clients mind and wallet share with multiple product categories: Cash Equity Liquidity/Research/Corporate Access; Convertible Bonds; Derivatives and Event-driven strategies, we have achieved a critical mass of penetration with major clients that has lifted us into the ‘strategic partner’ realm.