LETTER FROM THE CHAIRMAN & CEO Albert G. Lowenthal

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.”

- Charles Dickens, A Tale of Two Cities

Dear Fellow Shareholders

The above quote aptly describes the year 2020. Coming off a successful 2019, with low national unemployment, a growing economy and a strong U.S. dollar, the economy expanded at a rapid rate through the month of February. The COVID-19 pandemic emerged in late February, and by the end of March effectively shut down the U.S. and the world’s economies, and the equity markets fell 34 percent in a matter of weeks.

Within that early period, we had over 90 percent of our people working from home — managing portfolios, serving clients and building technology. At the same time, our employees were caring for their families and loved ones, while also adjusting to remote work and the challenges of isolation. Making this transition successful depended on planning and technology. But above all, it has depended on Oppenheimer’s strong and flexible culture, our commitment to each other, to our clients, and to our business.

Our thoughts go out to all of the communities and individuals, including some of our own, as well as healthcare workers and first responders that have been most deeply hit by the COVID-19 crisis.

As a result of the pandemic, the Federal Reserve began a drive to loosen interest rates and provide liquidity to the economy to fend off the possibility of an economic depression. Congress quickly passed a relief bill (CARES) to provide an immediate buffer to the rapidly contracting economy through direct payments to low and moderate earners ($1200/family +$600/child) as well as expanded unemployment benefits, and aid to small businesses through forgivable loans, if spent on payroll (PPP loans). Finally, the CARES bill provided funding for WARPSPEED, a program to quickly provide a vaccine to defeat COVID-19. The $1.2 trillion was unprecedented in its size and scope.

By the end of April, the economy was in recession, unemployment reached a high of 15 percent and the service industries were all but locked down, including travel, retail, restaurants and bars, and entertainment. Bolstered by record liquidity, the equity markets bottomed in March and began to rally.

Despite the ongoing challenges associated with the pandemic, our associates rose to the challenge with creativity and dedication, enabling Oppenheimer to deliver a year of solid performance. We moved with speed and innovation to keep people safe, operations running, and customers served. Times like these reinforce our longstanding belief that our employees are our most important asset and that they are fundamental to the success of our firm. During the pandemic, we have taken extensive steps to protect and support our employees and their families. There are lessons to be learned from this experience, most importantly, that our associates are capable of both resiliency and creativity in times of crisis.

The virus has taken a severe toll. It has killed or sickened hundreds of thousands, it has dramatically altered daily life and threatened the financial security of many. It has upended how we operate, and surprisingly, increased the need and demand for our services. Regrettably, it also has divided our economy and our society between winners and losers. We operate in an industry where people and relationships are paramount. Our efforts to find the best people encompass hiring senior talent, ready and able to hit the ground running, as well as campus recruiting to nurture and grow new talent to build our future. We have been building, and continue to build, a strong foundation where tomorrow’s leaders can develop a successful career and a lasting legacy.

During 2020, the firm generated record revenue and net income, as well as setting numerous other records across our lines of business.

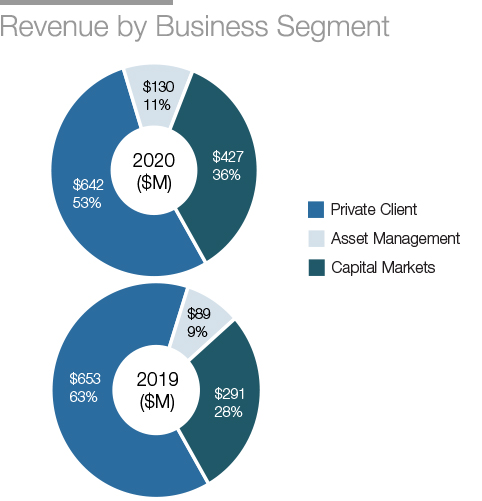

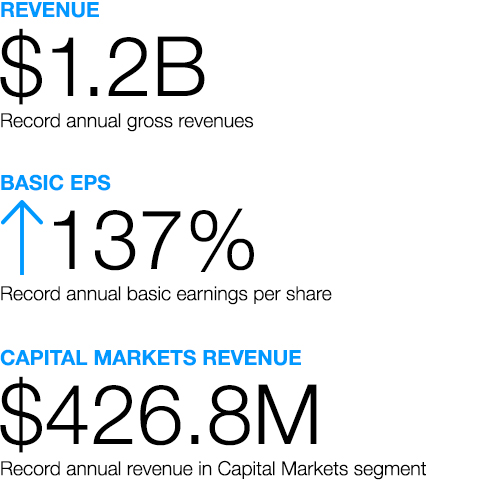

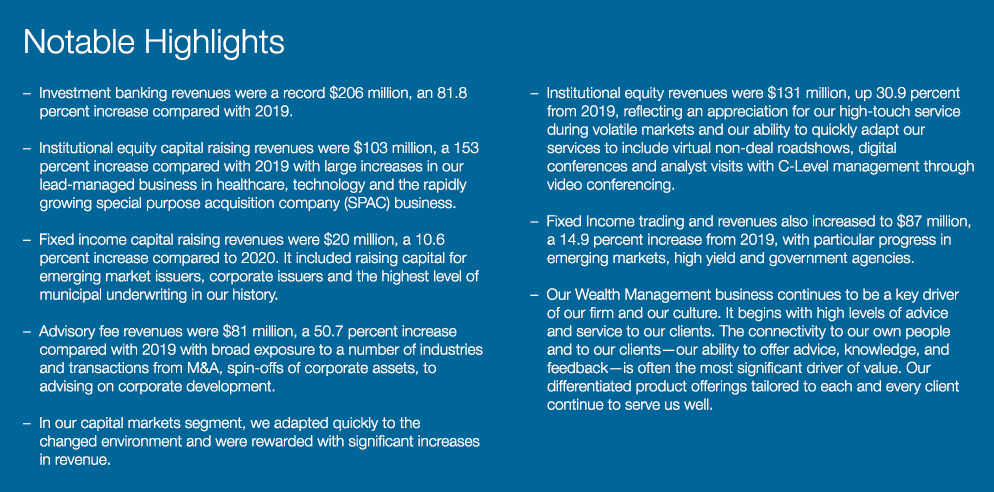

Throughout our history, Oppenheimer has built its reputation on our ability to react in periods of crisis, and to put our heads down, and to work diligently towards a successful outcome. Preparation has paid off—it is absolutely essential that we be up and functioning for all of our customers each and every day. We entered this crisis in a position of strength. Coming off of a strong performance in 2019, we were well prepared for the volatility and challenges of 2020. During this year, the firm generated record revenue and net income, as well as setting numerous other records across our lines of business. Net revenues were $1.198 billion, and net income was $123 million (or $9.73 per share), the best in Oppenheimer’s history, compared with $1.033 billion and $53 million (or $4.10 per share) in 2019, an increase of 132.3 percent. These remarkable results were driven by increased assets under management, a significant improvement in investment banking results and came despite record low interest rates, which reduced interest-related revenues by over $89 million. In addition, once again, we got a major boost from incentive fees from our alternative investments, which turned in superior returns for clients.

Institutional equity capital raising revenues were $103 million, a 153 percent increase compared with 2019 with large increases in our lead-managed business in healthcare, technology and the rapidly growing special purpose acquisition company (SPAC) business.

On December 31, 2020, the firm had a total of 12,481,443 shares outstanding with our book value rising to $54.93 per share as compared to $46.31 at the end of 2019. Under our repurchase authorization, we were opportunistic in repurchasing our common shares during the year, buying back 718,522 shares for $15.05 million, at an average price of $20.94 per share. In total, the firm repurchased approximately 6 percent of shares outstanding at the beginning of the fiscal year and returned total capital of nearly $34 million to shareholders through the combination of dividends and share repurchases. In addition, we further reduced and refinanced our bonded debt, reducing the amount outstanding from $149 million to $125 million, reducing the coupon from 6.75 percent to 5.5 percent and reducing our annualized interest cost by $3.25 million.

At year-end, client assets under administration totaled $104.8 billion while client assets under management in fee-based AUM programs totaled $38.8 billion, compared to $91 billion and $32.1 billion, respectively in 2019. We brought in more than $663 million in net new client managed assets into our fee-based programs during the year. Asset management and fee-based programs continue to be the preferred path for many clients. However, in 2020, for the first time in over five years, we saw a marked increase in our transaction business as clients, locked in at home, chose to spend more time and energy on individual investments and options trading, taking advantage of the volatile markets. Accordingly, we experienced an increase in commission revenue of $75 million or 23 percent. Interestingly, the availability of “free” trades offered to self-directed investors did not impede clients from paying commissions for the added security and convenience of having an experienced professional with whom to confer. The need for value-added advice and service has become ever more important in the COVID-19 era.

Here in 2021, despite the ongoing pandemic, we set new records in our client assets under administration, assets producing fee-based revenues, and the level of productivity of our financial advisors. We have the highest level of available capital in our history and strong liquidity. The ongoing high level of volatility, uncertainty around the economy’s future near-term growth, and today’s ultra-low interest rates will make for new challenges in the year ahead, including the possibility of higher levels of inflation, driven by higher demand, and extraordinary liquidity. We must continue to be responsive to rapid changes in our operating environment. We are well-positioned to compete in the years ahead to deliver higher, more sustainable returns for our shareholders.

At the same time, the coronavirus pandemic still poses a serious threat that could slow our recent progress. It serves as a sobering reminder that we must continue making the health, safety, and well-being of our employees and others a top priority. To all of our employees, to our friends, clients, and shareholders, we need for these to gain expanded access to the recently introduced vaccines so that we can recover our health, regain our ability to interact once again with one another, and restore our way of life. Once again, I would like to express my profound thanks to the dedicated employees of Oppenheimer. It is their tireless efforts, many sacrifices, and impressive achievements that made 2020 such a successful and outstanding year.

Sincerely,

Albert G. Lowenthal

Chairman & CEOBusiness Unit Year in Review

-

Private Client Division

Read about the Private Client DivisionWhile managing through this pandemic, the division reported revenue of $642.1 million.

-

Asset Management

Read about Asset ManagementDespite our dispersed work environment, Asset Management delivered record-setting financial results.

-

Equities Division

Read about the Equities DivisionGenerating $168 million in top-line revenue, an increase of 56 percent, the business turned in the best performance since the financial crisis.

-

Investment Banking

Read about Investment BankingGross revenues reached $136.2 million, an increase of more than 70 percent, also marking the fourth consecutive year of revenue growth.

-

Taxable Fixed Income

Read about Taxable Fixed IncomeInstitutional business saw significantly more robust results, with increases ranging from 20 percent to 155 percent, across our various desks.

-

Public Finance and Municipal Trading

Read about Public Finance and Municipal Trading2020 was a high-watermark year for Public Finance in terms of revenue growth, transaction volume, league table rankings and departmental growth.