OPPENHEIMER HOLDINGS INC. Annual Report 2023

Dear Fellow Shareholders

Better than expected…2023 was a year in which the economy and the equity markets performed much better than expected. We ended the year with an “Everything Rally,” all markets up, and key leading economic indicators positive. Not so for our financial performance, but more on that later. While the Federal Reserve continued raising short term rates this past year to a 22-year high of 5½%, inflation began to come under control, and by year-end was reduced from 9.1% in June of 2022 to 3.4% in December of 2023, seemingly well on the way to the Fed’s announced goal of 2%. At the same time, the unemployment rate ended the year at 3.7%, proving that the Fed can end the era of low rates and Quantitative Easing without causing a recession. We believe the Fed is within reach of its post-pandemic normalization process and will begin cutting rates by mid-year 2024, which should provide an acceptable cost of capital for both companies and individuals to successfully achieve their near-term financing goals.

.jpg?language=en)

Albert G. Lowenthal (left) Chairman and Chief Executive Officer

Robert S. Lowenthal (right) President and Head of Investment Banking

The impact of higher rates was felt throughout the economy, as consumers and home buyers made adjustments to their purchasing plans. We also witnessed the carnage created on bank balance sheets as the value of treasury bonds fell, causing multiple high profile regional banks to collapse, including Silicon Valley Bank, Signature Bank, and First Republic Bank. Separately, UBS bought Credit Suisse, further consolidating our industry. Equity markets, while volatile, ended the year with the S&P 500 up by 24.2%, led by the “Magnificent Seven” which were up by an astonishing 111% in 2023 and comprised a significant portion of the upward valuation in the index. AI (artificial intelligence) took on a life of its own, not only in the introduction of Chat GPT, but in its revaluation of leading companies in the market and its immediate impact on the economy as businesses rushed to adapt, legislators fought to adopt controls and everyone began using it to write poetry, songs and to research virtually everything.

While the economy and markets in general proved to be stable throughout the year, events throughout the world and at home were anything but. We saw a continued war in the Ukraine, and a new and horrific level of violence in Gaza, after an unprovoked attack by Hamas on Israel. For even the most disinterested observer, it was a distressing period in our nation’s life with uncontrolled migration at our southern border, turmoil in our cities and major issues on our college campuses.

In the United States, we continued to see a wave of change to our social norms, affecting the way we live, work and communicate. These changes are affecting governance of all forms, which ultimately affect business growth, regulation, and the investing environment. Predicted demographic trends are becoming a reality: in 2024, the United States will have approximately 11,200 people per day reaching the age of 65, which totals about 4.1 million individuals per year through 2027. At the same time, the pace of technological change is accelerating rapidly, impacting the way we operate and invest both today, and in the future.

Closer to home, the capital markets remained closed for most of the year and for most issuers, providing little opportunity for an improvement in investment banking. On the other hand, this period has provided ample opportunity for us to meet and add a number of highly experienced bankers both on the corporate as well as the public finance business, as both domestic and foreign institutions reduced their footprint or left the business. The closing of several large regional banks in March, due to their misjudging the impact of a rising interest rate environment on their bond portfolios, as well as the ongoing issues in the commercial real estate market, provides reassurance that we are an investment firm and investment bank and should continue our focus on the business we know.

I'm gratified that our strong fundamentals and spirit prevailed through a year of adversity. We worked through tremendous challenges, including continued costs associated with settlements of arbitrations arising from the activities of a long-departed financial advisor and the settlement with the SEC of charges related to Off-Channel Communications (texting). Despite these challenges, this past year confirmed that our diversified revenue streams, our control over our operating costs and our talented workforce provide the underpinnings of a strong and resilient business.

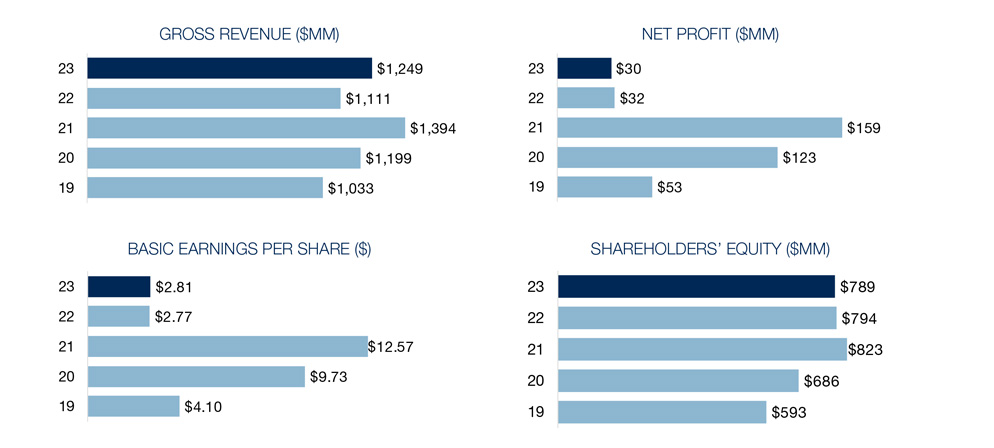

During the past year, revenues totaled $1.2 billion, and net income was $30.2 million (or $2.81 basic earnings per share), compared with $1.1 billion and $32.4 million (or $2.77 basic earnings per share) in 2022. This represents an increase of 12.4% in our total revenue. The costs of the two issues discussed above were approximately $70 million pre-tax, and not to be considered normal operating costs of our business. Notably, our results were positively impacted due to record bank sweep deposit income and higher total interest income (of approximately $277.4 million in 2023 versus $165.3 million in 2022). In 2023, more than ever, our results depended on our business model and the endurance of our highly dedicated associates.

Financial Highlights

On December 31, 2023, the Company had a total of 10,186,783 Class A shares outstanding with our book value rising to a record valuation of $76.72 per share as compared to $72.41 at the end of 2022. Under our repurchase authorization and Dutch Auction tender offer, we took advantage of the lower level of our share price and bought back 900,518 shares for $35 million, at an average price of $39.00 per share. In total, the Company returned total capital of nearly $42 million to shareholders through the combination of dividends and share repurchases. Our share repurchases over the period increased shareholder value as we purchased stock at a compelling value.

We take pride in our mission, and as near-term headwinds recede and we continue to invest in our business, we are well positioned for future success. We understand the importance of delivering what clients need today, while investing our time and talents innovating for the future. We will make advancements in our technology platform to aid critical decision-making in controlling risks both those that arise from the markets and those that are embedded in the world around us. We will also continue to develop advanced analytic tools that increase our efficiency and productivity, while investing in cyber security to ensure system and client safety.

I believe Oppenheimer has the talent and vision to meet the many challenges ahead and the ability to provide our clients with the advice and solutions they will need to reach their goals in the future. Like others in our industry and in our country, we’ve been tested—by the pandemic, by inflation and by challenged capital markets. We’ve strived successfully to maintain our commitments to our clients and our communities.

In 2023, we invested in and redefined our brand, leveraging research and insights from our employees, advisors, clients, and prospects. Recognizing that our brand isn't just a name but a representation of our identity and mission, we aimed to clarify who we are and why it matters to our stakeholders. Our strategic focus moving forward revolves around harmonizing our values, talent, and solutions to stand out in the market. Our research uncovered that while Oppenheimer is well-known, there's room for clearer understanding of what we do. We are gratified by the strong scores received by our clients, but recognize our brand needs to modernize in order to reach the next generation. We developed our positioning line: "The Power of Oppenheimer Thinking." This phrase that encapsulates our commitment to empowering clients through exceptional investment insight and collaborative effort. We then launched our advertising campaign in early April in major media outlets and deployed new brand assets across all channels.

The post-pandemic work world has undergone significant change. We're investing in our people adapting to hybrid work expectations driven by digital technology and remote capabilities, yet realizing the many benefits that come from working together in the same space and time. Fueled by a new generation's mindset and demand for talent, we're embracing new methods of apprenticeship, collaboration, and idea generation. Our practices evolve to meet the shifting demands of our business, including reducing our real estate footprint at every opportunity as we adjust to the business realities of reduced attendance in a post-pandemic world.

Our three principal business units – Private Client, Asset Management, and Capital Markets continue to operate synergistically for the benefit of our clients, our firm, and ultimately, our shareholders.

Our Wealth Management clients, particularly baby boomers, where there is the greatest accumulation of wealth, are focused on preserving and increasing wealth and maintaining their standard of living. Clients were rewarded both with high interest on their fixed income investments and with increasing values in their equity portfolios this past year. In large measure, clients are positioned well to participate in the next wave of economic growth for the U.S. Our advisors provide advice to plan, invest, and transition wealth to achieve clients' goals and aspirations. Our Wealth Management results were solid with significant increases in our interest sensitive revenues. While our advisory and commission revenues decreased slightly, the effects of favorable short-term rates enabled our bank sweep deposit income to set a record and our interest revenue was materially higher.

Our Company is focused on helping advisors succeed at every stage of their careers and is carrying forward the traditions of today's advisors who, time and again, steadfastly support their clients'; goals and harness the Company's resources to see that their clients' investment portfolios can stand the rigors of a challenging market. At the same time, we work tirelessly to attract new talent: both experienced advisors, as well as to train new advisors to build our ranks. Today's investors place a premium on financial advice from a trusted advisor. Our advisors work closely with clients to clearly define their financial goals and then deliver what matters most, sharing our thought leadership and insights.

Our Capital Markets businesses continued to be negatively impacted by the lack of activity and opportunity in the closed markets, as companies, particularly high growth companies, waited on the sidelines in anticipation of more favorable market conditions. Investment Banking revenues continue to be adversely affected by reduced corporate transactions and a stagnant IPO environment. Despite these conditions, we invested opportunistically in businesses and human capital as we believe an inflection point is close, as companies will raise needed capital to support their ongoing growth and operations.

Oppenheimer relaunched our brand with digital billboards in Times Square and rang the Opening Bell at the New York Stock Exchange on October 16, 2023.

The Company remains committed to and actively engaged in the high-priority work of succession planning. As I write this letter, we have implemented a path to succession for key positions so as to be able to continue to operate at high levels of productivity across the Company. We stand on over 140 years of experience in investing in and financing America, and yet we still have the energy and opportunity of a newly formed company. One thing you can count on: We will continue to do what is needed in the ongoing pursuit of better ways to provide value to our clients.

Delivering on Oppenheimer’s significant growth potential will require leadership that has a deep understanding of the Company’s current strengths, assets and industry expertise. We have that in Robert Lowenthal, my son and the team he has surrounded himself with to guide the Company into the future. The Oppenheimer management team is comprised of engaged and capable leaders, whose skillsets are aligned with the needs of our business including managing client portfolios, servicing institutions, and in providing investment banking services to issuers to meet their financing needs in a changing, yet growing economy.

We remain steadfastly invested in Oppenheimer’s long-term success and are committed to strong oversight for the Company and its shareholders, as well as Board refreshment and aligning Board skills and experiences with our strategic priorities.

As a concluding reflection, I have been your Company’s CEO for 39 years now. In that period, the price of Oppenheimer’s stock has increased from $1.10 to over $41 as of the end of 2023, a 37x increase, outperforming the S&P indices by a considerable margin and yet our shares still sell at a considerable discount to their underlying book value. At the beginning of 2022 our total outstanding shares were 12.5 million. As we begin 2024, that has been reduced to 10.3 million, an over 17% decrease. Dividends have been paid regularly, and when our results have supported it, we have paid a special dividend to reward shareholders at a compelling tax advantage. We have taken these actions while continuing to invest in the growth and strength of our business. Not surprisingly, annual revenues over these many years have risen from $5 million to $1.2 billion. Our shareholders equity has risen from $5 million to almost $800 million as of December 31, 2023 and book value from $1/share to over $76/share as of December 31, 2023. We are dedicated in our commitment to drive value for our shareholders.

We remain steadfastly invested in Oppenheimer’s long-term success and are committed to strong oversight for the Company and its shareholders, as well as Board refreshment and aligning Board skills and experiences with our strategic priorities. To that end, the Board recently named two new directors – Stacy Kanter and Suzanne Spaulding, who will bring diversity, fresh perspectives and expertise that complements the talents and experience of the Oppenheimer Board as we continue to focus on delivering for shareholders and our clients.

My thanks to our dedicated team and thanks to you, our shareholders, for your ongoing support of Oppenheimer as we continue to build our brand and our Company for the future. Thank you for your belief in our ability to deliver value to you, and thank you for your trust.

Sincerely,

Bud Lowenthal

Notable Highlights

- $801.8 million in revenue, a 18.7% increase

- $194.4 million in pre-tax revenue, a 36.7% increase

- $118.2 billion of assets under administration (AUA), a 13% increase

- $172.8 million in bank deposit sweep income, a full-year record

- Relocated multiple branch offices to new updated locations

- Advisory fee revenue represented 69% of total commission and advisory fee revenue for the Private Client Division

- $43.9 billion in assets under management

- $415 million in advisory fee revenue generated for the firm

- 89,000 client accounts

- Year-over-year, managed account programs displayed double digit growth

- Successfully introduced multiple Managed Account Programs

- A strategic client engagement initiative positively impacted the Agency business line and with a strong 4Q23 finish, total Equities revenue of $128 million

- External headwinds continued to prevail throughout 2023, most notably a significant decline in over-all market volume (-7%) and sharply lower volatility (-34%)

- Options business off from record of prior year due to reduced market volatility in 2023

- Reduced capital raising by corporations led to fewer new issues in the market in 2023 and coincided with reduced secondary trading of convertible securities year-over-year

- Agency business line showed a strengthened High Touch (HT) Trading competitive position among the top tier of U.S. institutional payers and strong growth with dedicated Health Care Investors confirming our emphasis on direct client engagement

- Fixed Income Division showed positive revenue growth

- Careful oversight of trading exposure was rewarded with limited losses in a yearlong downward trending market

- Absence of primary issuance in Emerging Markets and Public Finance forced greater focus on secondary sales and trading, with positive effect

- Strategic personnel management and recruiting positions us extremely well; including the addition of a full-scale Distressed Debt Team with twelve members, complementing our existing High Yield effort

- Inverted yield curve continues to constrain business with depositories

- Global Investment Banking street fees and volumes dropped to a decade low, impacting capital markets and advisory results

- Overall revenues represent a balanced mix of advisory and capital markets activity

- Strong convertible issuance momentum for the firm, with issuances up nearly 25% year-over-year driven by significant book-run activity

- Expanded banker headcount by more than 30% over the last three years with significant additions in our chosen verticals

- Anticipate a strong pipeline heading into 2024 encouraged by the level of client dialogue

- $28 billion in total capital raised over more than 700 municipal transactions

- New leadership as well as strategic hires to expand footprint nationally

- #3 Municipal Note Underwriter (No. of issues)

- #5 Municipal Bond and Note Underwriter (No. of issues)

- #9 Texas School District Senior Managing Underwriter (No. of issues)

- Leading Placement Agent in California