Letter from the Chairman & CEO

Corporate earnings ultimately drive equity prices and investor expectations over the short term may change, setting the stage for better outcomes on investment decisions. While one can view the market environment as a half-empty glass due to an increasing national debt and annual budget deficit, a polarized electorate, and trade issues like Brexit and the China trade war, we, at Oppenheimer, are driven by our desire to assist investors to make intelligent and appropriate investment decisions. We do not believe that “trees grow to the sky,” but we are inclined to be optimistic and to be influenced by the measurable realities of the economy, by a belief in the pursuit of global solutions, and above all, by finding new and sound investment opportunities... and there are always opportunities. Our job is to take a careful and measured view and to provide the services and capabilities that enable us to be a trusted advisor to our clients. In short, we are, first and foremost, an investment firm.

For Oppenheimer, 2018 was a successful year and we were quite pleased with our improved results driven by higher short term interest rates, increased assets under management, and a significant improvement in investment banking results.

This past year tested our resolve with the S&P down 6.2 percent, the Dow down 5.6 percent, and the NASDAQ down 3.9 percent. This was accompanied by the U.S. Government 10-year benchmark bond rallying to 2.69 percent yield by year-end representing a flight to safety by investors. Market leadership rotated out of new economy names and sought refuge in utilities, government bonds, and cash equivalents. As is often the case with such volatility, staying the course proved the favored strategy, as early 2019 has seen a better market environment and a marked recovery in equity prices.

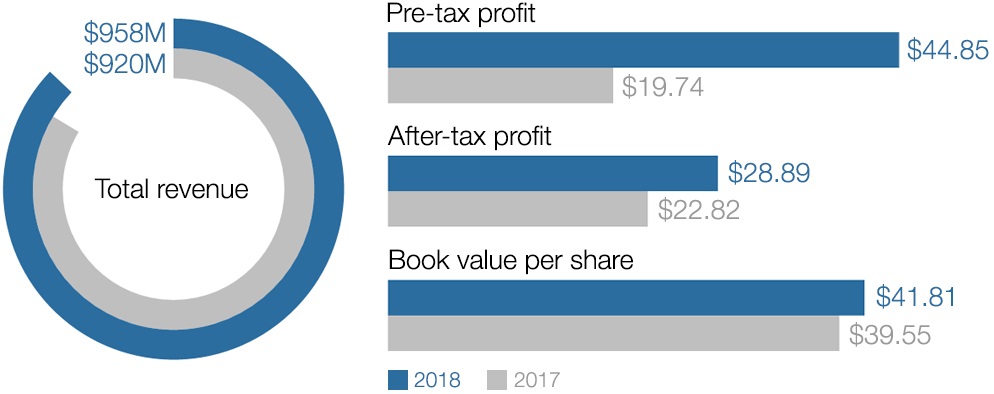

For Oppenheimer, 2018 was a successful year and we were quite pleased with our improved results driven by higher short-term interest rates, increased assets under management, and a significant improvement in investment banking results. Nevertheless, to some extent these excellent operating results were offset by the impact of reduced performance in certain alternative investments. For the year, the Company reported revenues of $958 million, an increase of 4.1 percent from $920 million in the prior year, and reported a pre-tax profit of $44.85 million, compared to a pre-tax profit of $19.74 million in 2017, an increase of 127 percent. However, after-tax results did not increase at the same rate, primarily due to a one-time tax benefit recorded in the fourth quarter of 2017 as a result of the enactment of the Tax Cuts and Jobs Act. As a result, after-tax profits increased 27 percent to $28.89 million (or $2.05 diluted earnings per share) in 2018 from $22.82 million (or $1.67 diluted earnings per share) in 2017. On December 31, 2018, the Company had a total of 13,041,474 shares outstanding and the book value per share was $41.81 as compared to $39.55 at the end of 2017.

Client assets under administration totaled $80.1 billion while client assets under management in fee-based programs (“AUM”) totaled $26.7 billion, compared to $86.9 billion and $28.3 billion, respectively in 2017. Despite bringing in more than $600 million in net new client AUM into our fee-based programs during the year, AUM declined $2.2 billion in 2018 due to market depreciation, most of which took place in the fourth quarter. Asset management and fee-based programs continue to be the preferred path for clients and we experienced another year in which clients chose managed solutions over transaction-based pricing. Accordingly, we experienced a decline in commission revenues of 2.1 percent as clients increasingly chose passive investments over actively managed assets and again reduced turnover in their accounts.

In 2018, as market volatility increased, we maintained a strong focus on the needs and priorities of our clients. For the past several years, we have been dedicated to modernizing our business. We have been relentless in our pursuit of hiring and retaining talented colleagues, attracting productive advisors, building up our technology and digital capabilities, delivering a full-range of investment solutions, and continuing to stress the importance of compliant behavior throughout our enterprise.

Where we are headed:

- Organically growing our all-important wealth management business with an increased advisor headcount derived from recruiting experienced advisors with strong client allegiances as well as adding new advisors through our successful training programs.

- Investing in our Capital Markets businesses by continuing to identify niche businesses where we see demand for services that are being unmet in the marketplace and where our firm is uniquely qualified to build the infrastructure or services necessary to meet these demands.

- Attracting, motivating, and retaining top talent has always been the primary key to success in the investment business. It has long been a key tenet of this company that we must invest in our employees, we must motivate and empower them to expand and enhance their personal and professional skills, and we must help them to realize their full potential within the framework of our enterprise. Now, and in the future, we understand the need to provide opportunity for all employees that is personally fulfilling, intellectually rewarding, and above all, that builds the kind of deep, lasting relationships that position Oppenheimer as the employer of choice.

- We believe that technology is not an end in itself, but a means to an end. The digital revolution impacting our economy provides us with enormous opportunities to better understand our business and to synthesize the vast amount of data available to us both to provide growth opportunities and to empower us to do a better job of meeting the needs and goals of our clients. We are investing in technology so as to provide a higher level of efficiency and effectiveness in everything we do and to provide our employees with a robust, state-of-the-art platform with which to manage our business and deliver our services. We will continue to utilize new technology and high impact delivery methods to gain operational efficiencies and improve our clients' experience.

- We recognize the significant responsibility we have to our clients to protect their data and their privacy in an increasingly difficult and complex digital environment. We commit an enormous amount of resources to protect all of our clients from fraud, cybersecurity risk, and invasion of privacy. We will continue to invest in building higher walls and stronger borders around our clients’ data and information, and importantly, we will do our utmost to ensure the safety and security of their assets entrusted to us for safekeeping.

We will continue to develop new and innovative services and expand our already robust platform so as to better meet our clients’ evolving needs and to help reach and assist new clients.

In 2018, importantly for our industry, the courts ruled for a reversal of the Department of Labor’s fiduciary rule. While a great deal of time and effort was invested in preparing for it, that effort will now be directed toward the expected finalization of a uniform best interest standard by the SEC. We anticipate that these new standards will enhance investor protections and likely will require additional changes to our business model. We will make any and all necessary changes with the primary goal of keeping our customers at the center of everything we do and maintaining flexibility and choice for the benefit of clients and their advisors.

Over a decade has passed since we suffered the worst financial crisis since the Great Depression. Time brings many changes. We have, as of this writing, experienced the longest sustained economic expansion and bull market in our nation’s history. At Oppenheimer, we have learned a great deal and we have built a business model for sustained success. This approach led to outstanding results in fiscal 2018 and we expect to continue this positive momentum in 2019. We are well positioned to take advantage of the trend toward industry consolidation. We are exploring strategic alternatives for utilizing our significant investments in systems, talent, and expertise, and we recognize the benefit we would derive by utilizing excess capacity to increase shareholder returns and support future growth. It is clear that our strategy must be based on a careful review of the potential of any such expansion to contribute to long-term value. While we prefer to use capital to reinvest in our business, we will not pass on opportunities to enhance shareholder value through share buy-backs.

We will also continue to invest in our culture, which is rooted in a foundation of commitment to the firm’s Code of Conduct. Our guiding values—integrity, excellence, and teamwork—define who we are and how we work together with stakeholders. We will continue to set the highest standards of personal and professional responsibility throughout our firm so as to achieve compliance in an increasingly rules-based industry.

We will continue to develop new and innovative services and expand our already robust platform so as to better meet our clients’ evolving needs and to help reach and assist new clients. We will continue to recruit, motivate, and retain top talent in the interests of our clients so that they will be more successful working with us than with our competitors.

I am deeply appreciative of the privilege to lead this great firm and to serve its clients, its employees, and its shareholders.