PUBLIC FINANCE Public-Private Partnership (P3)

An innovative approach to delivering public infrastructure

The Public-Private Partnership – or P3 – model is an innovative approach to delivering public infrastructure that involves the investment of private capital and the deployment of private-sector operational expertise to design, build, finance, operate and maintain public assets via long-term agreements.

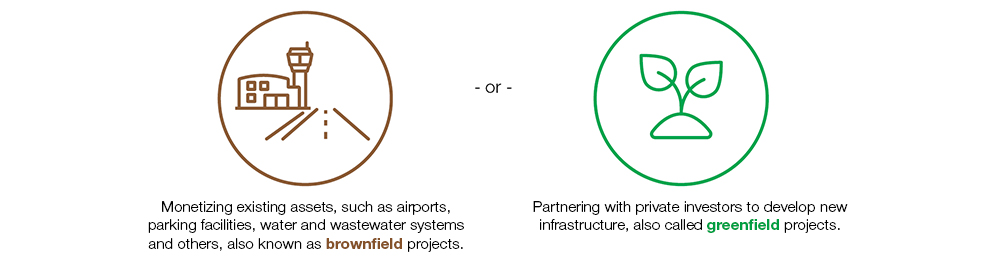

The P3 structure has proven successful for decades in Europe and Canada and is gaining momentum in the United States. It allows public entities to address financial shortfalls by either:

Proceeds from monetizing infrastructure assets can be used to fund other infrastructure projects (a practice known as asset recycling), as well as pension obligations or other municipal funding needs.

Many municipalities today are operating with limited debt capacity in the wake of the COVID-19 pandemic and years of budget shortfalls. While these public entities may access the municipal debt market to refinance various existing issues over the next several years, issuing new debt may remain challenging for them.

With all these factors in mind, the P3 approach has assumed an increasingly vital role as a means of obtaining financing for municipalities and other public entities who have seen their access to traditional funding avenues become gradually more constrained.

Defining P3

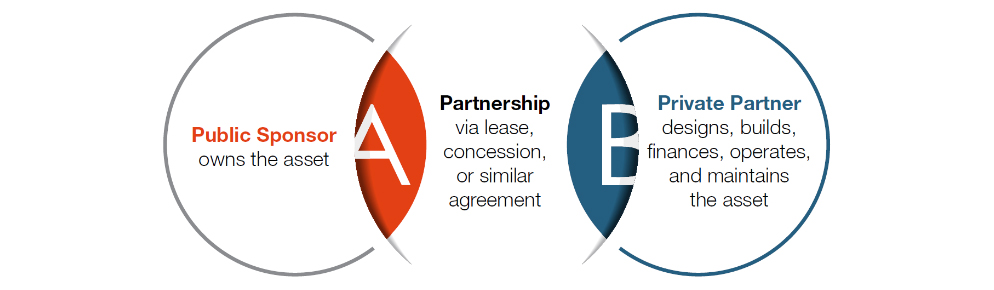

In general, P3 is a contractual agreement (via lease, concession, project or project-development agreement or similar) between (A) a public-sector entity (public sponsor) and (B) a private consortium of investors and operators (private partner) to design, build, finance, operate and maintain a public infrastructure asset (or perform some subset of those functions).

The public sponsor owns the asset throughout the term of the agreement and takes control of it again at the end of the contract, under conditions defined in the agreement. The private partner receives either:

agreed-upon payments from the public sponsor during the periods when the asset is available for use under terms of the agreement (availability payments), or

user fees and other revenues generated by the asset (revenue risk)

which fund its operations and drive returns.

What P3 Is Not

It is important to understand from the outset what P3 is not:

-

It is not free money

Private investors in P3 projects need to meet their debt service and equity return requirements, either through user fees or availability payments. These return hurdles often involve a higher cost of capital than what is typically seen in the municipal finance market. -

P3 is also not an opportunity to transfer all risks to the private sector

In fact, determining which risks are better suited to the public or private partner is an important part of the P3 evaluation process. It is not a universal solution – careful analysis is needed to ensure that a P3 delivers the best value proposition for the public entity. -

Finally, P3 is not a contract that can be signed and put on the shelf

Ongoing participation and oversight by the public sponsor helps to ensure delivery of value to the public over the entire life of the deal.

5 Key Benefits of the P3 Model

P3 project delivery may offer numerous advantages to public entities which can offset the additional cost of capital associated with private-sector involvement. These advantages include:

Private funds that seek to deploy capital toward infrastructure investments have raised multiple billions of dollars for equity investment, and have access to billions more via the debt capital markets and infrastructure-specific government lending programs.

These dollars are chasing a limited number of viable infrastructure projects, leading to highly competitive bidding processes. This investor demand may result in opportunities to deliver projects that have been on a municipality’s “wish list” for years. Since the equity and debt invested by private sector partners in P3 projects have no recourse to the public sponsor, they are not commitments of the municipality or public entity and do not increase the public sponsor’s debt burden.

(Note: Ratings agencies may look at availability payments for a P3 project as future liabilities of the public sponsor. “Revenue risk” projects, however, in which the private sector partner is compensated through user fees and other revenues generated by the asset, do not create such liabilities, and have no impact on the public sponsor’s debt levels.)

Private operators are able to deliver best practices from their own global experience to every phase of a P3 project. Design and construction, for example, are typically completed more quickly and at lower cost when compared with public sector delivery models.

Since the private operator will typically be responsible for ongoing maintenance of the asset and its cost, every design choice they make will incorporate life-cycle considerations – for example, the developer may choose an HVAC system for a building that is more expensive upfront, but more reliable and less expensive to maintain over the building’s life. Operational expertise may deliver a better user experience over the life of the project, and – for revenue-generating assets – helps to optimize revenue and profitability.

A P3 offers the chance to optimize risk management for a given project and assign that risk to the party best able to manage it. Risks typically transferred to the private sector include construction cost and schedule, traffic and revenue, operational cost, and maintenance cost.

Some risks can and should remain with the public sponsor. Under availability payment P3s, traffic and revenue risk remains with the public sponsor. The public sponsor also tends to keep some or all of the permitting and environmental and other regulatory risks.

Each of these risks has a value associated with it, and transferring that risk to the private partner increases the project value to the public sponsor.

The private partner in a P3 project will have incentives to operate and maintain the public asset in a professional manner throughout the typical 30-50 year concession period. The concession agreement will include operating standards for the asset that the private partner must adhere to over the life of the deal, as well as hand-back requirements that define the status of the asset that the public sponsor partner takes back at the end of the concession.

Private operators’ economic returns are contingent on maintaining these standards; public sponsors should monitor the standards and enforce compliance throughout the project term. It is important to note that, under a P3 structure, the concept of deferred maintenance that is prevalent in public assets is non-existent.

Private operators want to maximize the return on their investment through efficient design, construction, operations and maintenance of a project. Public sponsors can share in the upside of these results by negotiating revenue or profit sharing structures in the concession agreement. Upside sharing helps to align the interests of all parties and avoid potential criticism of unfair value being delivered to the private partner.

Overarching Best Practices

All successful P3s share certain key attributes – and in a failed P3 structure, it’s a near-certainty that one or more of these will be missing. Ensuring that these attributes are in place is critical to attracting investors to a P3 procurement process, since they signal a greater certainty of reaching financial close.

-

Political support

A successful project needs a political champion who vocally and publicly demonstrates the importance of the project and the need to deliver it as a P3. Ideally, this champion will be at the highest level of the executive branch such as governor, mayor, or county executive. For best results, this public champion should be at a comfortable place in the election cycle, to avoid the project getting tangled in election politics or terming out. Further support from other stakeholders such as labor unions, regional planning agencies and the general public is also helpful. The results of the scoping study discussed on page 6 can help to provide or solidify further support for the P3 approach. -

Visibility on crossing regulatory hurdles

Every project faces regulatory hurdles – environmental approvals, other permitting, rights of way, federal agency approvals – and it is a best practice to have these issues resolved or at least on track for resolution within a reasonable time frame before launching a P3 process. If permitting risk is to be transferred to the private partner, there will likely be cost and schedule implications.

-

The right advisors

P3 advisory is a highly specialized field, and investors recognize firms that are known for running efficient, transparent, and successful projects. Selecting and engaging the right financial, legal and technical advisors is a critical early step in any P3 process. -

Compelling investment story

With all of the other pieces in place, a municipality needs to be able to demonstrate to investors that there is a business case for the project. Showing a base case that meets typical investor return hurdles with opportunities for upside via innovation is ideal.

Overview of the P3 Process

In order to help public entities game plan for a potential P3 and anticipate possible challenges, we provide the following schematic overview of the key checkpoints involved in conducting a ‘typical’ P3 process:

a. Determine that P3 could be an appropriate solution for a project or existing asset

- There is no commitment to proceed with the project or P3 at this point

b. Select advisors, including:

- Financial advisors to manage the investor-facing process (including negotiations) and assist with economic evaluation of the project and proposals

- Legal advisors to draft deal documents and assist with negotiations

- Technical advisors to perform analysis in support of the investment story

c. Assemble diligence information

- Greenfield project scope or financial and technical information on existing assets

d. Work with financial advisor to perform a scoping study to confirm and justify P3 delivery as the preferred approach

- Decide on deal structuring parameters to maximize value (concession term, availability payment vs. revenue risk, alternative technical concepts, stipend for proponents, criteria for winning bidder)

- Financial modeling and assurance of value proposition for investors

- Risk assessment and value-for-money analysis

e. Outreach to potential private partners across the P3 market (pre-marketing)

- May include a request for interest (“RFI”) process or conversations between advisors and prospective bidders

f. Reach a go / no-go decision

- Based on results of the scoping study and investor outreach

- Best Practice: make the results of the scoping study public once you’ve made the decision to proceed, in order to demonstrate transparency and build political support for the project and P3 approach

g. Prepare deal documentation

- Legal concession / lease / contract, operating standards, etc.

- RFQ and RFP documents defining the process and criteria for selection

- Marketing materials for distribution to investors

h. Issue request for qualifications (RFQ), evaluate responses and short-list the best candidates

- Best Practice: Limit short-listed teams to 3 or 4 participants and announce publicly (or at least among short list). A smaller group is easier to manage in the process and increases the chances of each to win, which raises competitive tension.

i. Initiate request for proposals (RFP) process with short-listed investors

- Investor due diligence

- Management presentations and site visits

- Preparation and delivery of binding bids

j. Evaluate RFP responses and select winning bidder

- Best Practice: Include a best-and-final offer (BAFO) provision in the RFP that allows for a second round of bids if two or more initial proposals are close to one another.

k. Finalize any outstanding issues and prepare for financial close

- Investor financing, outstanding legal issues, etc.

m. Public-private Partnership

- Best Practice: Assign someone in the organization to monitor the concession and private partner's performance over the term.