What Happened?

What Happened?

The third quarter of 2025 was a strong one for all assets, with 93 of the 96 indices tracked by OAM finishing in positive territory. From an economic standpoint, though, momentum slowed as the quarter went on, particularly in the labor market. By September 17, the Fed responded with a 25 basis point cut, bringing the policy rate to 4.00–4.25 percent. The move was broadly expected and nearly unanimous, with only new Governor Stephen Miran favoring a larger 50 bp cut.

The main concern was weaker job creation. At the same time, jobless claims stayed contained and consumer spending held steady.

- Job Creation: The three-month average of nonfarm payrolls slowed to 29k versus 55k in Q2 and 111k in Q1.

- Claims: Initial jobless claims (four-week moving average) were 237k, essentially flat versus 241k in Q2 and 223k in Q1.

- Unemployment rate: Stable at 4.3%, versus 4.1% in Q2 and 3.9% in Q1. The stability likely reflects a lower labor force participation rate tied to aging demographics.

- Spending and income: Personal spending rose 0.6% in the latest release after 0.5% in Q2 and 0.8% in Q1, supported by steady total payrolls.

- Inflation: Core PCE rose 0.2% month-over-month, down from 0.3%, not showing large tariff pass-through so far.

Reference yields moved lower during the month, on softer employment & contained inflation:

- 5-year Treasury: 3.70% → 3.74%

- 5-year AAA muni: 2.37% → 2.32% (Taxable Equivalent Yield ~3.92%)

- 10-year Treasury: 4.23% → 4.15%

- 10-year AAA muni: 3.22% → 2.92% (Taxable Equivalent Yield ~4.93%)

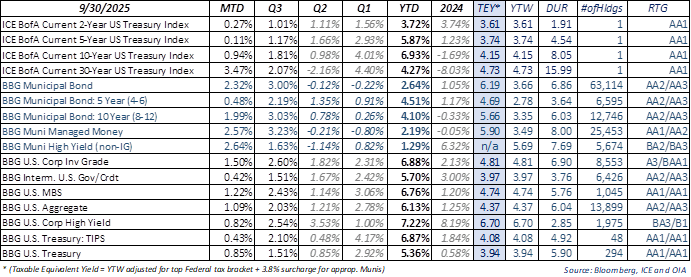

Reference Risk/Return snapshot for the month:

All yield figures represent gross market yields and do not reflect the impact of fees or expenses. Index performance is not indicative of the performance of any particular investment. Indexes are unmanaged and their returns do not take into account any of the costs associated with buying and selling individual securities. Individuals cannot invest directly in an index. Past performance is not indicative of future results.

What Are We Thinking?

With rate cuts now underway, the Fed’s focus has shifted toward “risk management.” Inflation is still sticky (CPI 3.1 percent YoY, PCE 2.7 percent YoY), but the slowdown in job creation has become the priority. Tariff effects are being treated as a one-time price shock, leaving the employment mandate at the center of policy.

Their policy trade off seems to be clear. Higher rates cannot stop tariff inflation, but they can deepen labor market weakness if left inadvertently restrictive. Powell’s repeated references to uncertainty—echoing his 2018 language—in our view, highlight that when the outlook is cloudy, the Fed manages risks first. Unless payrolls deliver a major upside surprise (median September forecast +52k, with a wide range of +109k to –20k, and possible delay from the government shutdown), the slow path lower in rates looks set to continue. Our base case is for two more cuts before year-end, broadly in line with market expectations.

To its credit, the Fed has raised rates 11 times since March 2022, paused 14 times, and now cut four times without tipping the economy into recession. We believe this track record suggests the committee is navigating the current cycle with notable skill and caution.

In Taxable Fixed Income: Solid macro and corporate fundamentals, coupled with persistent institutional demand and limited net new supply, have anchored credit spreads and performance. We expect fundamentals and technical factors to remain supportive through year-end. Corporate bond demand remains strong on the back of attractive all-in yields.

In Tax-exempt fixed income: Municipals finally joined the broader fixed income rally, with long maturities benefiting from weaker employment data and muted tariff pass-through. Performance is now more in line with taxable markets, while concerns about elevated supply earlier this year are fading as we move closer to year-end.

Bottom line: We expect fixed income to stay well supported against the Fed’s lower rate path as we head into the fourth quarter. The key risks to monitor are the Supreme Court’s ruling on tariffs, widening fiscal deficit pressures, and renewed debate over Fed independence. We believe any of these could push term premia higher and represent the next challenge for markets.

Ozan Volkan

Title:Senior Portfolio Manager OIA Tax-Exempt Fixed Income

Leo Dierckman

Title:Senior Portfolio Manager OIA Taxable Fixed Income

Michael Richman, CFA

Title:Senior Portfolio Manager OIA Taxable Fixed Income

Disclosures

This piece is intended for informational purposes only. All information provided is subject to change. Investing in securities is speculative and entails risk. There can be no assurance that the investment objectives will be achieved or that an investment strategy will be successful Securities are offered through Oppenheimer & Co. Inc., a registered broker-dealer and affiliate of OAM. This material is not a recommendation as defined in Regulation Best Interest adopted by the Securities and Exchange Commission. It is provided to you after you have received Form CRS, Regulation Best Interest disclosure and other materials. Past performance does not guarantee future results. The risks associated with investing in fixed income include risks related to interest rate movements as the price of these securities will decrease as interests rates rise (interest rate risk and reinvestment risk), the risk of credit quality deterioration which is an issuer that will not be able to make principal and interest payments on time (credit or default risk), and liquidity risk (the risk of not being able to buy or sell investments quickly for a price that is close to the true underlying value of the asset). Average credit quality is calculated by considering the proportion of the value of each individual credit rating) lower of Moodys or S&P) and noting it as a percentage of the entire portfolio, thus producing the average credit quality. Adverse changes in economic conditions or developments regarding the issuer are more likely to cause price volatility for issuers of high yield debt than would be the case for issuers of higher grade debt securities. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) such as Standard & Poor or Moody's of the creditworthiness of the issuer with respect to debt obligations. Ratings are measured on a scale that generally ranges from AAA/AAA (highest, depending on the rating organization) to C or D (lowest, again, depending upon the rating organization). Quality Distribution is based on a weighted average of strategy accounts. Bond ratings are categorized by the lower of Moody's or S&P. For more information regarding bond ratings on municipal bonds, please visit www.moodys.com/ratings or www.spglobal.com/ratings.

* (Taxable Equivalent Yield = YTW adjusted for top Federal tax bracket + 3.8% surcharge for appropriate Munis). The views expressed herein are those of the authors as of the date indicated and may change without notice. They do not necessarily reflect the opinions of Oppenheimer & Co. Inc. or its affiliates and should not be construed as a firm recommendation or investment advice.

Any forward-looking statements are based on current assumptions, expectations, and market conditions, which are subject to change.

There is no guarantee that any projections or views will be realized.

OAM and Oppenheimer & Co. Inc. are both indirect wholly owned subsidiaries of Oppenheimer Holdings Inc. Securities are offered by Oppenheimer & Co. Inc. 8140363.5