Our Services

Tailored Solutions

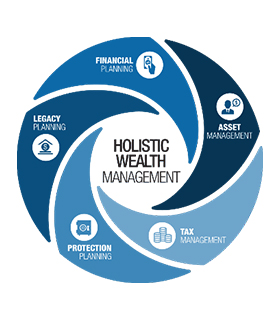

Holistic wealth management requires more than just investment management- that is why I deliver a customized, comprehensive experience to assist you in areas that go beyond investments. The investment insights of Oppenheimer, trust and fiduciary services from Oppenheimer Trust Company, and insurance solutions through Oppenheimer Life Agency offer ways to help you manage all the unique pieces of your financial life. Acting as your single point of contact, I can help you meet virtually any of your financial needs.

.jpg?language=en)

Investment Management

Delivering Exceptional Investment Management

I like to use an analogy of an airline pilot when describing my investment philosophy. It is the pilot's job to make sure the passengers get to their destination, get there on time, and get there safely. Think of your goals as the destination, the markets as the weather, and me as the pilot. I cannot predict what the market is going to do in the future, but it is my job to make the necessary adjustments to our flight path as weather patterns change. We may get there a different way than we expected, but we are going to get you to the destination, safely and on time. Throughout our relationship, we will talk about your aspirations and ask questions about what matters most to you. Answers to these questions will help me manage, grow, and preserve your wealth.

Financial Planning

A consistent approach for long-term success:

- Where are you now? Defining your attitude toward investing and reviewing your current financial position.

- What matters to you? Identifying what's important to you now and in the future.

- Your path, your plan. Creating a personalized financial plan and investment strategy to help you reach your goals.

- Making it happen! Setting plans in motion, tracking your milestones, and modifying your plan as your needs and goals change.

Trust & Estate Services

Transitioning Wealth

Estate planning is never easy, but with the right strategy in place, you can help ensure that your financial goals are addressed and your legacy is preserved. Whether you're considering how to pass on your wealth to your children and grandchildren, sell or transfer your business, or contribute to your favorite charity, I can help you build and execute that plan. I can assist you with a wide variety of estate planning strategies, such as:

- Taking advantage of estate planning and legacy gifting

- Creating a reliable income stream for retirement

- Maximizing gifting

- Passing on your assets to the next generation

- Creating a family tradition of gifting

- Crafting customized retirement account beneficiary designations

Comprehensive Fiduciary Products Offered

- For Individuals:

- Trustee Services

- Custody Services

- Insurance Trusts

- For Not-For-Profits:

- Endowments

- Foundations

- Charitable Trusts

- Perpetuity Services

- Cash Management

- For Businesses:

- Balance Sheet Cash Management

- Custody Services

- Escrow Agent Services

Liquidity Events

Navigating Life’s Changes

Liquidity events encompass a range of circumstances, including sale of a business, significant stock option exercises, divorce, inheritance, and other wealth transitions. These events typically require sophisticated planning, comprehensive asset management services, and coordination among all involved advisors, from accountants and attorneys to insurance agents and bankers.

I excel in understanding the intricate financial complexities that arise from significant liquidity events. This is done by providing comprehensive support for pre- and post-liquidity planning, offering valuable guidance on mapping my clients' desired paths, and assembling the right team to help them achieve their goals.

My pre- and post-liquidity planning approach involves conducting a thorough analysis of existing and future cash flow needs, assessing estate consequences, devising strategies to help minimize the effective tax rate of transactions, and developing generational planning and education initiatives, along with considerations for charitable aspirations.

Corporate Executive Services

What We Offer:

- Employee Stock Option Financing

- Assist you with financing the exercise of your stock options, usually without any outlay of cash. The program includes exercise and sell, exercise and hold, and exercise and sell-to-cover.

- Restricted and Control Stock Strategies

- Assist you in the sale of restricted or control stock in compliance with applicable laws and with minimal effort on your part. If an outright sale is not appropriate, we can provide you with alternative strategies for accessing liquidity.

- Rule 10b5-1 Trading Plans

- Diversify a portfolio that contains large company stock positions and/or options, and helps protect you against insider trading liability.

- Stock Repurchases

- Design and implement a stock buyback plan tailored to help address financial goals. You are provided with strategies addressing financial benefit while complying with regulatory policies and rules.

- Exchange Fund

- Assists you in diversifying large concentrated stock positions without triggering immediate capital gains taxes.

You are now leaving Oppenheimer.com

Oppenheimer & Co. Inc.’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Oppenheimer & Co. Inc. isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Oppenheimer & Co. Inc. name.