The latest edition of Oppenheimer & Co. Inc.’s Quarterly Biopharma Private Placement Insights Report is now available upon request.

Key Takeaways:

Private markets continue to weather the storm and remain remarkably resilient.

- Total amount invested remains significantly elevated compared with pre‐pandemic levels (2022: $18.4B vs. 2019: $12.8B vs. 2018: $13.7B)

- Q1 2023 aggregate deal volume ($4.1B) tracking above pre‐pandemic median ($3.2B), but below 2022 quarterly median ($4.5B)

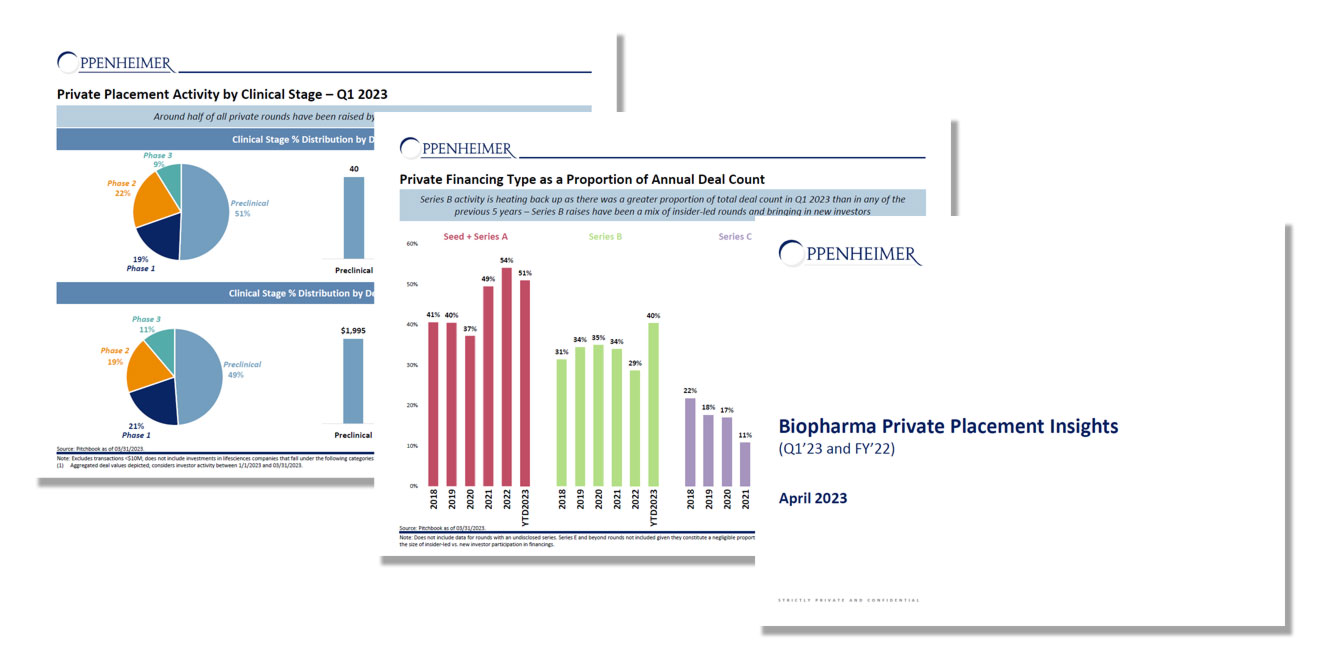

- Series B activity increased modestly in Q1 2023 despite anecdotal negative sentiments (29% of all deals in 2022 vs. 40% in Q1 2023)

- Pre‐ / post‐money valuations for Series A and B rounds have remained relatively stable over LTM, while Series C valuations have declined

- Oncology (mainly solid tumors) attracted the largest share of VC dollars in Q1 2023

- Small molecule and cell & gene therapies accounted for over 60% of the total number of deals completed in the quarter

- Nearly half of all private rounds were raised by preclinical‐stage companies

Investor selectivity and due diligence rigor has increased significantly

- Since 2022, many companies have raised extensions / insider rounds as investors are seeking more clinical progress in between rounds

- Companies and investors have become more open to new investors leading a slight down round rather than closing an insider round

- Many mid‐staged VCs and crossover investors have shifted their focus from private to public markets given the breadth of opportunities

- Due dilligence takes significantly more time and effort than in prior years

- Companies with differentiated science and management teams with proven track records continue to attract capital

Dry powder is abundant and must get deployed

- Private capital is available to fund innovation

- The VC dollars raised in 2020 ‐ 2023 must be injected into the biotech sector over the next few years

Early 2023 has already seen an array of large private deals, which bodes well as we look forward to the rest of the year

- Notable 2023 financings include: Cargo Therapeutics ($200M Series A), Aera Therapeutics ($193M Series B), and ArriVent ($150M Series B)

In the near term, macro headwinds will continue to pressure the private financing market

- Investor focus remains on inflation, interest rates, geopolitical tensions and potential ripple effects of the recent SVB collapse

Please reach out to Michael Margolis, R.Ph. ([email protected]), Daniel Parisotto, PhD ([email protected]), or Robert Lewis ([email protected]) directly to request a copy.

Michael A. Margolis, R.Ph.

Title:Senior Managing Director, Co-Head of Healthcare, Head of Healthcare Life Sciences

DISCLOSURES

This notice is provided for informational purposes only, and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. Nothing contained herein shall constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited.

This notice may contain statistical data cited from third-party sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such third-party statistical information is accurate or complete, and it should not be relied upon as such. All market prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice.

2023 Oppenheimer & Co. Inc. Transacts Business on all Principal Exchanges and Member SIPC 5646573.1