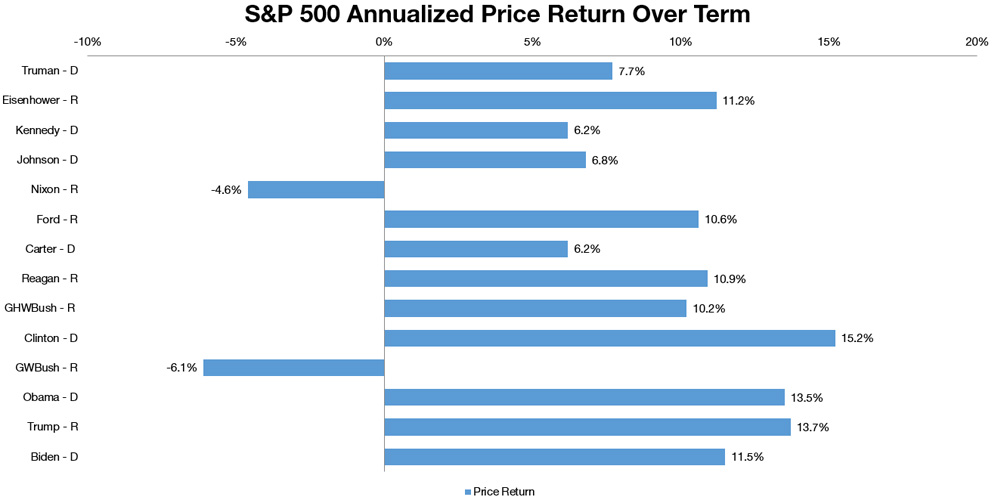

Understanding the correlation between U.S. presidential administrations and S&P 500 price returns is a topic that frequently piques the interest of investors. With each new administration comes prognostication about how the market will fare under their leadership. However, as we delve deeper into the data, it becomes evident that the relationship between political parties and market performance is more nuanced than a simple Democrat versus Republican comparison.

Analyzing the Data

The assertion that the market performs better under either Democrats or Republicans is a common inquiry. However, a closer examination of historical data reveals a mixed picture. While it’s true that the broad U.S. market has experienced declines during only two presidencies – Richard M. Nixon and George W. Bush – the average annualized return under Democratic administrations stands at 9.6%, compared to 6.6% under Republican administrations.

Source: Bloomberg, OAM Research.

Index performance is not indicative of the performance of any particular investment. Indexes are unmanaged and their returns do not take into account any of the costs associated with buying and selling individual securities. Individuals cannot invest directly in an index. Past performance is not indicative of future results.

It is important to recognize that market performance during a presidency is influenced by a myriad of factors beyond just political affiliation. Headwinds and tailwinds experienced during an administration's tenure are shaped by various elements such as monetary policy, demographics, and innovation within any given period.

Monetary Policy and Economic Conditions

The Federal Reserve’s monetary policy decisions play a significant role in shaping market dynamics. Interest rate adjustments, quantitative easing programs, and other monetary tools can impact investor sentiment and market performance. Economic conditions, including unemployment rates, GDP growth, and consumer confidence, also influence market behavior during different administrations.

Additionally, demographic trends, such as population growth, aging populations, and shifts in consumer preferences, can have profound effects on industries and sectors within the economy. Technological advancements and innovations drive productivity gains, disrupt traditional business models, and also create new investment opportunities, all of which contribute to market fluctuations.

Political Policy vs. Market Realities

While political policies certainly have implications for the economy and financial markets, their direct impact on market performance may be less pronounced than commonly assumed. Market participants often adapt to regulatory changes, tax reforms, and other policy shifts, mitigating their immediate effects on investment outcomes.

For investors, understanding the interplay between political landscapes and market dynamics is crucial for making informed decisions. Rather than relying solely on political affiliations as predictors of market performance, investors should consider a broader range of factors, including economic indicators, global trends, and company-specific fundamentals.

An Oppenheimer Financial Professional can be Your Guide

Navigating the complexities of market performance under different presidential administrations requires expertise and careful analysis. Working with a trusted financial advisor who understands the intricacies of the market can help investors develop a robust investment strategy aligned with their goals and risk tolerance.

While it’s tempting to draw simplistic conclusions about the relationship between U.S. presidencies and S&P 500 price returns, the reality is far more complex. Market performance is shaped by a multitude of factors, many of which extend beyond the realm of politics. By taking a comprehensive approach to analyzing market dynamics and seeking professional guidance, investors can position themselves to navigate the ever-changing landscape of the financial markets with confidence and resilience.

This article represents the views and opinions of Oppenheimer Asset Management. It does not constitute investment advice or an offer or solicitation to purchase or sell any security and is subject to change at any time due to changes in market or economic conditions. The comments should not be construed as a recommendation of individual holdings or market sectors, but as an illustration of broader themes. Investing involves risk, including possible loss of principal. Asset allocation and diversification may not protect against market risk, loss of principal or volatility of returns.

The Standard & Poor’s (S&P) 500 Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks.

Oppenheimer Asset Management is the name under which Oppenheimer Asset Management Inc. (OAM) does business. OAM is a registered investment adviser and is an indirect wholly owned subsidiary of Oppenheimer Holdings Inc., which also indirectly wholly owns Oppenheimer & Co. Inc. ("Oppenheimer"), a registered investment adviser and broker dealer.

6604199.1