The S&P 500, MSCI EAFE, and MSCI Emerging Markets indices returned 2.0%, 4.3%, and 1.3%, respectively. The U.S. 10-year Treasury yield ended the month at 4.23% after falling by 0.14% during the month. The closely followed 2-year/10-year spread finished the month at 0.64%, 0.21% wider than a month earlier. Investment grade and high yield corporate bonds appreciated. The U.S. dollar fell by 2.2%, reversing much of last month’s rally.

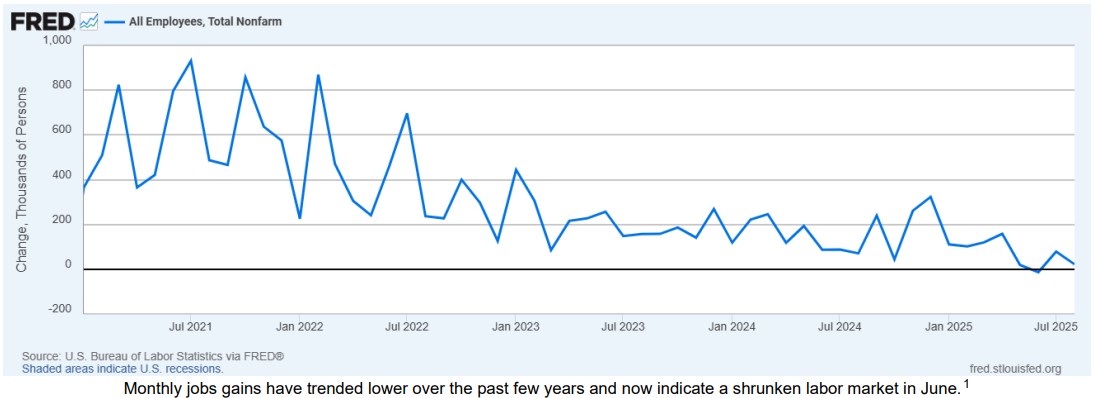

The current market consensus is that the Federal Reserve will lower the fed funds rate on September 17. The majority of committee members has communicated the belief that the risk of a softening labor market is a greater concern than the possibility of stoking inflation. While the unemployment rate remains low at 4.3%, recent nonfarm payroll reports and revisions have caught the attention of policy makers and investors. In the first payroll report since the head of the Bureau of Labor Statistics was fired, it was announced that only 22,000 jobs were added in August compared to the expected 75,000. Additionally, the June data was revised lower again and now reflects a reduction of 13,000 jobs, the first negative month since December 2020. The July jobs report was revised slightly higher. The Quarterly Census of Employment and Wages (QCEW) released on September 9 estimated that 911,000 fewer jobs were created during the year prior to March 2025 than previously announced, providing additional evidence of a softening labor market. The revision was on the high end of the expected range and represents the largest percentage negative revision since the global financial crisis. The revision is subject to an update in March 2026. Last year’s similarly large negative initial QCEW revision of 818,000 was subsequently adjusted to a still-sizable 598,000.

The following is a summary of key points that occurred in the markets globally during the month.

US Equity Summary:

- The S&P 500 returned 2.0% for the month and is up 10.8% YTD.

- Large cap underperformed small and mid-cap equity segments according to the Russell market cap indices.

- Growth underperformed value across all segments according to the Russell style indices.

- Ten S&P 500 sectors were positive for the month. Materials, Healthcare, and Energy were the top performers. Utilities, Industrials, and Information Technology were the weakest performing sectors.

- Quarterly S&P 500 earnings growth was 7.5% (blend of reported and estimates) with 99% of companies reported. Of the reporting companies, 81% reported positive earnings surprises.

- From a factor perspective, Enhanced Value, Pure Value, and High Dividend performed the best. Pure Growth, Momentum, and Growth fared the worst.

Developed and Emerging Market Equity Summary:

- The MSCI EAFE Index returned 4.3% for the month, outperforming the MSCI EM Index, which returned 1.3%.

- Communication Services, Consumer Discretionary, and Energy were the top performing international equity sectors. Information Technology, Utilities, and Industrials were the weakest performing sectors.

- Materials, Communication Services, and Consumer Discretionary were the top performing emerging market equity sectors. Energy, Healthcare, and Financials were the weakest performing sectors.

- Frontier markets outperformed emerging markets, as the MSCI Frontier Markets Index returned 6.3%.

Fixed Income Summary:

- Yields on Treasury bonds were lower during the month with the exception of a slight increase on the 30- year yield. Yields on maturities from 2-months to 10-years were lower by at least 0.14%.

- The 10-year Treasury bond rose during the month as the yield ended the month at 4.23%, 0.14% lower than where it started the month.

- The closely followed 2yr/10yr yield spread ended the month at 0.64% after widening by 0.21%.

- Investment grade credit generated positive returns, posting a 1.1% return as per the Bloomberg U.S. Credit Index.

- High yield spreads tightened slightly, and the Bloomberg U.S. Corporate High Yield Index returned 1.3%.

- The broad Bloomberg Global Aggregate Bond Index rose 1.5% for the month.

- Municipal bonds returned 0.9% as per the Bloomberg Municipal Bond Index, with the high yield segment up 0.5%.

- Non-U.S. hard currency sovereign bonds were up 1.6% as per the FTSE WGBI Non-USD.

- The U.S. Dollar Index was down 2.2% for the month

Disclosures

Indices are unmanaged and presented for comparison purposes only. Please note that the returns displayed for indices do not take into account any of the costs associated with buying and selling individual securities. Individuals cannot invest directly in an index.

Bloomberg Global Aggregate Bond Index: provides a broad-based measure of the global investment-grade fixed rate debt markets. It contains three major components that comprise over 94% of the value: the U.S. Aggregate Index, the Pan-European Aggregate Index and the Asian-Pacific Aggregate Index. In addition to securities from these three benchmarks, the index also includes Global Treasury, Eurodollar, Euro-Yen, Canadian and Investment-Grade 144A index-eligible securities not already in the three regional aggregate indices.

Bloomberg Municipal TR USD: The Bloomberg Barclays Municipal Bond Index is considered representative of the broad market for investment grade, tax-exempt bonds with a maturity of at least one year.

Bloomberg US Corporate High Yield TR USD: Bloomberg Barclays US Corporate High Yield TR USD

Bloomberg US Credit TR USD: The index measures the performance of investment grade corporate bonds.

Bloomberg US Treasury 1-3 Yr TR USD: The Bloomberg Barclays Capital US Treasury Bond 1-3yr term index measures the performance of short-term government bonds issued by the US Treasury.

Bloomberg US Treasury 10 Yr USD: The index measures the performance of government bonds issued by the US Treasury.

Bloomberg US Treasury 20+ Yr TR USD: The Index is market capitalization weighted and includes all of the securities that meet the Index criteria. The index includes all publicly issued, U.S. Treasury securities that have a remaining maturity greater than 20 years, are non-convertible, are denominated in U.S. dollars, are rated investment grade (Baa3 or better) by Moody’s Investors Service, are fixed rate, and have more than $150 million par outstanding. Excluded from the Index are certain special issues, such as flower bonds, targeted investor notes (TINs) and state and local government series bonds (SLGs), and coupon issues that have been stripped from assets already included.

Bloomberg US Aggregate Bond Index: The U.S. Aggregate Index covers the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The Index includes bonds from the Treasury, Government-Related, Corporate, MBS (agency fixed-rate and hybrid ARM pass throughs), ABS, and CMBS sectors. The U.S. Aggregate Index is a component of the U.S. Universal Index in its entirety.

FTSE WGBI Non-USD: The FTSE World Government Bond Index (WGBI) measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGBI is a widely used benchmark that currently includes sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 30 years of history available. The Non-USD index measures the performance of the markets outside of the US.

MSCI EM Index: The MSCI Emerging Markets Index captures large and mid cap representation across 23 Emerging Markets (EM) countries. With 822 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country

MSCI EAFE Index: The MSCI EAFE Index is recognized as the pre-eminent benchmark in the United States to measure international equity performance. It comprises the MSCI country indices that represent developed markets outside of North America: Europe, Australasia and the Far East.

MSCI Frontier Markets Index: Captures large and mid cap representation across 29 Frontier Markets (FM) countries.

Russell 1000 Growth Index (R1000 Growth): Measures the performance of the Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000 Index (Russell 1000): Measures the performance of the 1,000 largest companies in the Russell 3000 Index. Frank Russell Co. ranks the US common stocks from largest to smallest market capitalization at each annual reconstitution period. The Russell 1000 Index represents the vast majority of the total market capitalization of the Russell 3000 Index. It is considered to be generally representative of US Equity Large Cap performance.

Russell 1000 Value Index (R1000 Value): Measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

8392442.1