The Benefits of Working with The Credit Union Investment Strategy Group

Credit Union Team with over 125 years Combined Experience

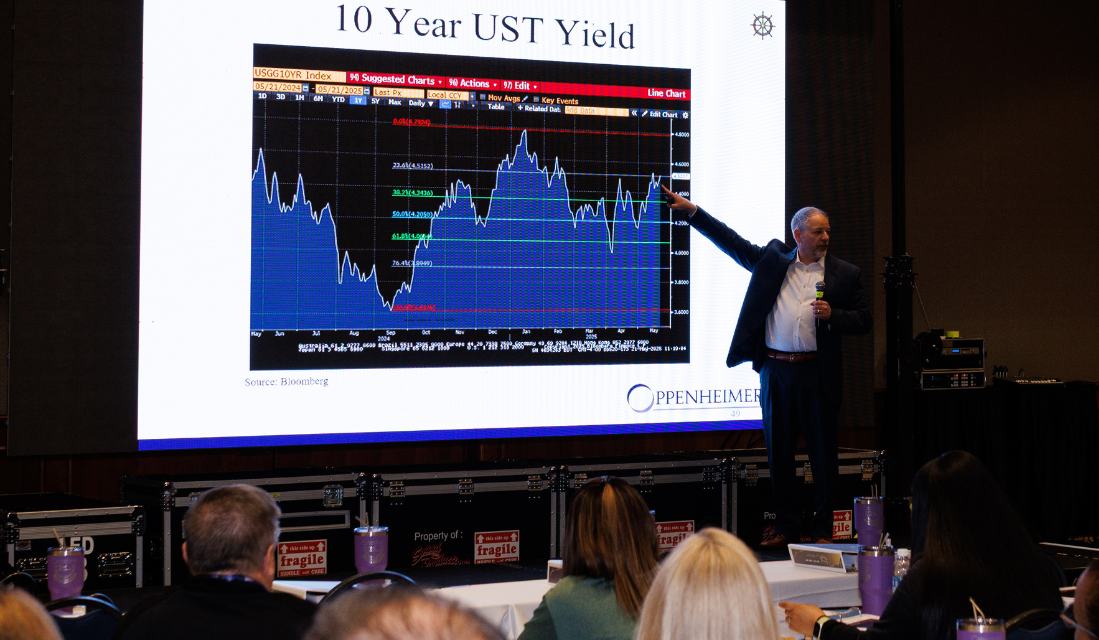

Discover how our proven strategies can help your credit union meet its investment goals through holistic assessment of the entire balance sheet, and strategic application of securities permissible by the NCUA.