12-08-2025

Goggin Group Commentary

Oppenheimer’s 2026 S&P500 Target:

John Stoltzfus introduces his 2026 S&P 500 target at 8,100, implying an ~18% return from current levels becoming the most optimistic forecaster among those tracked by Bloomberg for a third year running…

John cites accommodative monetary and fiscal policy in addition to strong corporate earnings as the core of what lies ahead for his 2026 SPX target, which assumes an earnings projection of $305 per share for the S&P 500, with a projected forward P/E multiple of 26.5x.

If you would like to read more, please visit our home page where you can see John’s latest reports in the Recent Insights section and log into Client Access there too.

For any issues with creating a Client Access Log Profile, Logging In, or Accessing the Research Tab in your client access portal please give Buck a call at 1-203-328-1173.

John Stoltzfus - Oppenheimer’s Chief Investment Strategist

Market Strategy Radar Screen

- Our price target of $8,100 for 2026 assumes an earnings projection of $305 per share for the S&P 500, with a projected forward P/E multiple of 26.5x.

- We expect the Federal Reserve to cut rates by 25 basis points this week at its meeting on Wednesday, Dec. 10.

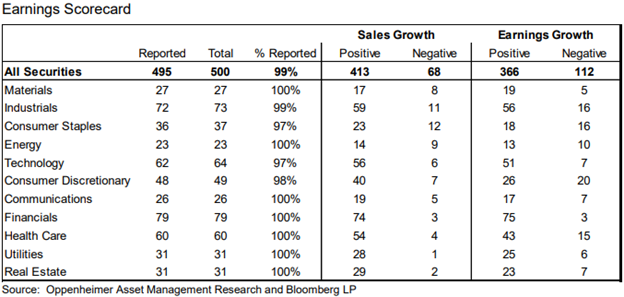

- Q3 earnings season continues to show better than expected results. With 4 9 5 (9 9%) companies of the S&P 500 having reported, earnings are up 12.9% on the back of revenue growth of 8. 2%. Prior to the start of the season, FactSet put expected earnings growth at 8% from a year earlier.

- Of the 11 sectors, ten have reported positive earnings growth in Q3. Just one sector show s negative earnings growth and that’s in the single digits.

- This week the final five companies of the S&P 500 are scheduled to report Q3 results.

Ari Wald - Oppenheimer’s Head of Technical Analysis

Inflection Points

- We’ve argued that it’s neither high nor low rates, but stable rates that have historically supported equity prices.

- Similarly, while reactionary Fed cuts late in the equity cycle have historically been a market warning, equities have welcomed the preemptive round of looser policy that started last year.

- The 10-year UST yield has, in turn, slowly descended rather than sharply collapsed.

- Looking ahead, we expect range-bound rates with a downward bias to remain a net-positive for equities.

3Q25 Earnings Scorecard – John Stoltzfus

With 495 or 99% of the firms in the S&P 500 index having reported, the quarter persists stronger than expected with earnings growing 12.9% from a year ago, on revenue gains of 8.2%. Prior to the start of the quarter, bottom -up estimates from FactSet put analysts’ expected earnings growth at 8% from a year earlier.

Disclaimers:

The information provided is general in nature and should not be construed as a recommendation or an offer or solicitation to buy or sell any securities and is for informational purposes only, does not represent legal or tax advice, and is subject to change. Oppenheimer & Co. Inc. does not provide legal or tax advice.

The Standard & Poor’s (S&P) 500 Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Individuals cannot invest directly in an index.

There can be no guarantee that the companies selected for a portfolio will declare dividends in the future or that if declared, they will remain at current levels or increase over time.