To the moon...

The Markets have rebounded swiftly from their “Liberation Day” lows from the previous quarter. With investors buying the dip, the most speculative sectors didn’t just “climb a wall of worry” – they catapulted over it. While this upside momentum is welcome, it comes with market indexes already at near-euphoric valuation levels – this would not a problem if the macroeconomic and political environments were operating perfectly. Unfortunately, they are not (and seldom are).

Many “investors” have moved dramatically away from what would be considered the traditional ways to evaluate a company fundamentally. Not all stocks are trading at these nose-bleed levels; but, many are (at least the ones getting the most headlines in the financial news outlets).

Our large cap value strategy maintains a true value-focused, fundamental research process. We don't adjust the definition of value as market multiples expand. "Value" is not just a word to me. It's my philosophy, to the core…

I have always believed that it’s just as important to view the risks associated with an investment as the potential rewards they may bring.

Today’s valuations on many stocks are troubling to me. I believe they offer greater risk than potential reward.

Identifying solid, dividend growing companies remains our focus. Why? Mostly because it’s one of the most tried-and-true strategies I know of.

Meantime, if you have any questions or concerns do not hesitate to contact us.

All the best,

Scott

P.S. Since this is my passion, I am always ready to do more if it. If there’s someone you know who could use a second opinion on their investments please think of us.

Scott Shulman

Managing Director-Investments

Senior Portfolio Manager

Omega Portfolio Management

The Shulman Group

Oppenheimer & Co. Inc.

1801 K Street, NW, Suite 750

Washington, D.C. 20006

202-261-0701 Phone

202-261-0739 Fax

877-999-9280 Toll Free

For up to date information or access to your account, please visit our website Shulman Group Website

This communication should not be construed as an offer to sell or the solicitation of an offer to buy any security.

The information enclosed herewith is sole opinion of the Advisor and is not the product of Oppenheimer & Co. Inc. or its affiliates. Oppenheimer & Co. Inc. has not verified the information and does not guarantee its accuracy or completeness.

The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Index is one of the most widely used benchmarks of US Equity Large Cap performance.

Oppenheimer & Co. Inc. Transacts Business on all Principal Exchanges and Member SIPC 8283502.1

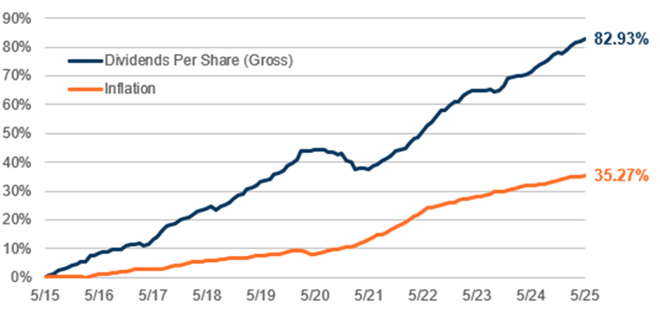

Dividend distributions continue to be one of the most efficient ways for companies to return capital to shareholders. They also contribute meaningfully to overall returns. In addition, dividends can be a significant potential inflation hedge. Inflation, as measured by the consumer price index, increased by 35.27% over the 10-year period ended May 2025. Total dividends paid by the S&P 500 Index’s constituents increased by a staggering 82.93% over the same period.

Growth of S&P 500 Index Dividend Payout vs. Inflation

Source: Bloomberg. Monthly data from 5/31/2015 – 5/31/2025. Data is indexed to 100. Past performance is no guarantee of future results. Data is for illustrative purposes only and not indicative of any actual investment.

The S&P 500 Dividend Aristocrats Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by First Trust Portfolios L.P. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by First Trust Portfolios L.P. The S&P Dividend Aristocrats Target 25 Portfolio is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such products nor do they have any liability for any errors, omissions, or interruptions of the index..

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.