Why are dividends so important?

Simply put – dividends tend to be a window into the soul of a company financially. Since dividends are paid from cash that a company earns, it’s reasonable to conclude that a company that pays increasingly higher dividends needs to be earning more money over time in order to pay those cash dividends.

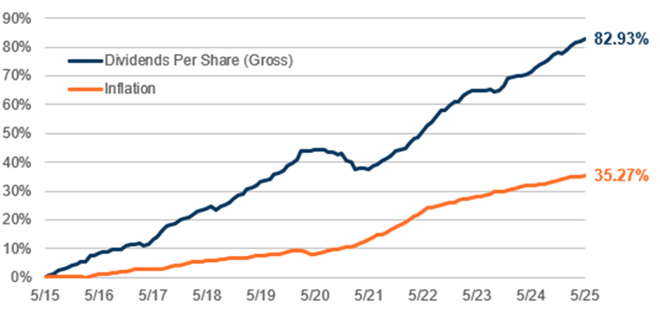

And as you can read from the illustration below, dividends are a good way to hedge an investment portfolio from inflation.

Ultimately, as earnings grow, share prices tend to rise too.

So, owning shares of companies that grow their dividends over time tend to be companies that are experiencing earnings growth. In addition, it is reasonable to conclude that owning a diversified portfolio of “dividend growers” should prove beneficial to increasing the value of said portfolio over the long haul.

“Dividend paying stocks with sustainable and increasing payouts represent an attractive opportunity in today’s market, in our view.”

-Dave McGarel, First Trust CIO

June 2025

Dividend distributions continue to be one of the most efficient ways for companies to return capital to shareholders. They also contribute meaningfully to overall returns. In addition, dividends can be a significant potential inflation hedge. Inflation, as measured by the consumer price index, increased by 35.27% over the 10-year period ended May 2025. Total dividends paid by the S&P 500 Index’s constituents increased by a staggering 82.93% over the same period.

Growth of S&P 500 Index Dividend Payout vs. Inflation

Source: Bloomberg. Monthly data from 5/31/2015 – 5/31/2025. Data is indexed to 100. Past performance is no guarantee of future results. Data is for illustrative purposes only and not indicative of any actual investment.

The S&P 500 Dividend Aristocrats Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by First Trust Portfolios L.P. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by First Trust Portfolios L.P. The S&P Dividend Aristocrats Target 25 Portfolio is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such products nor do they have any liability for any errors, omissions, or interruptions of the index..

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.