ANNUAL REPORT 2020 Asset Management

Year in Review

In 2020, Oppenheimer Asset Management (OAM) stood tall in the face of adversity. Making an early decision to pivot to a largely remote work environment, our employees stayed focused on providing our financial advisors and their clients with timely advice, unique investing ideas and consistent, high-quality service. Despite restrictions on travel and face-to-face meetings, we remained fully engaged in a virtual world, further cementing our culture of effective communication. Each time we were tested, we rose to meet the challenges. And that resilience has paid off in our record-setting results. The world has changed but our mission remains the same—to be a reliable business partner to our advisors, offering them access, choice, insight, and education. We are well-equipped to face future challenges, launch new technology, and continually strive for excellence.

While volatility and economic uncertainty colored 2020, so did the stock market’s resilience. We experienced one of the steepest—but the quickest—market corrections in history, as global liquidity sharply contracted. Fortunately, central banks stepped in to inject a massive amount of stimulus to keep markets afloat and provide much needed support to the newly unemployed. So far, that strategy has worked, with major market indices eclipsing all-time highs at the end of 2020. While the global economy may take longer to recuperate, fundamentals have already showed signs of significant improvement. The critical hurdle for the markets—and society at large—is the need to curtail COVID-19 through widespread vaccination. We expect the stock market to remain sensitive to developments tied to the pandemic, but we’re optimistic that we can continue progress throughout 2021.

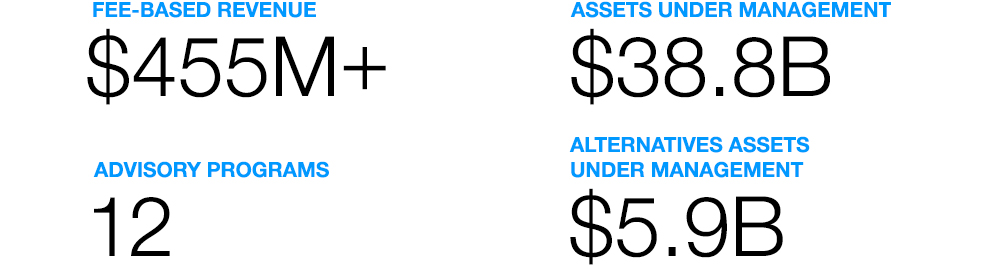

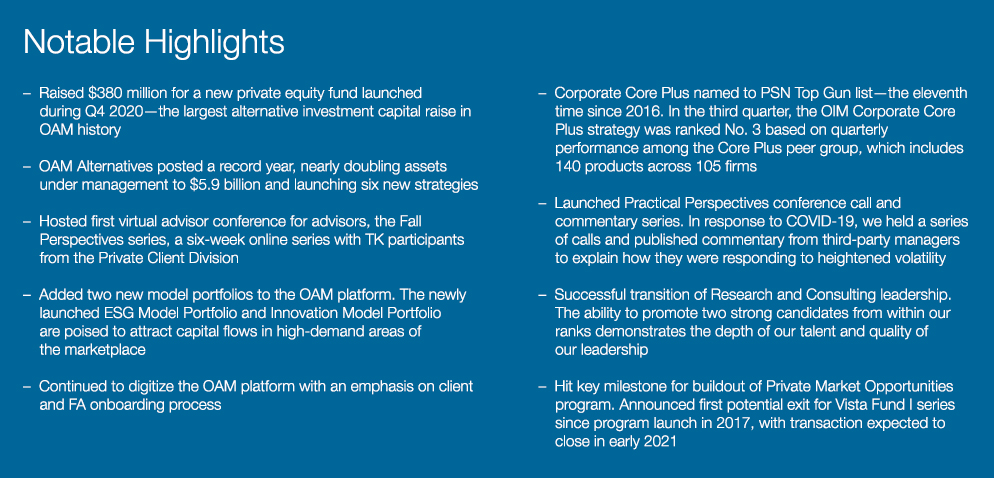

Despite our dispersed work environment, OAM delivered record-setting financial results: assets under management grew to $38.8 billion, total advisory fee revenue surpassed $455 million and total client accounts hit 77,500 across 12 advisory programs. Through partnerships between our global business units and our due diligence team, we were able to raise $350 million in private assets throughout the year. We successfully launched six new strategies on our alternative investments platform, AUM in alternatives now stands at an all-time high of $5.9 billion, nearly doubling its asset base from a year ago. That is particularly impressive amid the pandemic. We saw this period as an opportunity to take advantage of timely investment themes. Amid economic shutdowns and restrictions on in-person meetings, OAM Alternatives conducted more than 500 manager meetings in 2020. We also had success in our proprietary fund lineup.

Through partnerships between our global business units and our due diligence team, we were able to raise $350 million in private assets throughout the year.

The Consulting team remained diligent in a virtual environment in tracking and meeting with our Focus List investment partners throughout the year. Throughout 2020, our traditional actively managed strategies saw positive growth. Our Unified Managed Account (UMA) platform grew to $9.5 billion, increasing more than 17 percent. Additionally, we added five separate account managers to our Focus List. Our flagship Market Strategy Portfolio (MSP), a conservative asset allocation strategy run by our chief investment strategist, celebrated its five-year anniversary in October. At the end of 2020, assets held in the MSP and Market Strategy Dividend portfolio were approximately $390 million. We launched two model portfolios, one focused on environmental, social and governance (ESG) investing and the other focused on growth and innovation.

In addition to the weekly digital information series we started in March, we held our first virtual conference for financial advisors this past year, the 2020 Fall Perspectives series, which ran from late October to early December. The online series featured an esteemed lineup of speakers that included some of the brightest minds of Wall Street. Over the span of six weeks, we tackled the economic landscape, U.S. elections, public and private markets, ESG investing, tax code implications, and many other timely topics. Through this compelling content, we sought to inform, inspire, and provide context for our advisors in the midst of an unprecedented period.

Areas of Focus

In 2020, we demonstrated our ability to adapt to exceptional challenges and still deliver strong financial results. This result is tightly aligned with our legacy of perseverance and persistence. While the market environment shifted dramatically in the wake of COVID-19, our strengths became more evident. As one of the nation’s premier boutique investment managers, we offer a robust lineup of global investment strategies across a broad range of asset classes. Our equity, fixed income, and alternative investments—including private equity and hedge funds—are available through a number of different programs and products.

With an emphasis on access, choice, insight, and education, we continue to provide comprehensive and objective investment advice to help clients tackle today’s challenges—and prepare for tomorrow’s unforeseen risks. We hold an unwavering commitment to helping our clients meet their investment goals, whether it’s acquiring wealth, preserving wealth, drawing down wealth, or building better portfolios. We’re deeply committed to steering them toward a secure financial future.

Our broadly diversified platform and our client service allow us to stay closely connected with our network of financial advisors. The pandemic proved that we are flexible and nimble enough to pivot in difficult times and still deliver superior results. It is a testament to the talented, hard-working people who make up the Oppenheimer family.

With an emphasis on access, choice, insight and education, we continue to provide comprehensive and objective investment advice to help clients tackle today’s challenges—and prepare for tomorrow’s unforeseen risks.

Each day, we continue to equip and empower our advisors with the timely information so they can help their clients achieve better outcomes, grow their practices and better utilize our investment platform. Whenever possible, we will leverage technology to build investment tools to improve their experience and create operational efficiencies.

At OAM, we rely upon an open-architecture platform with strong research and due diligence. Giving advisors the flexibility to choose the appropriate program of investments that best suit their clients is ingrained in our philosophy. We will continue to provide them with the tools and support needed to be successful, particularly as the industry faces challenging new regulatory requirements and a shift toward a fee-based advisory model.

Looking Forward

In 2020, our flexibility and dedication to client service was outstanding. We were able to shift seamlessly to a virtual workplace while expanding the depth and breadth of our product lineup. In 2021, we will continue to adapt to a changing business climate and seek to broaden the scope of digital tools as a way to enhance the advisor and client experience. Connectivity in a virtual world is critical as relationships remain the bedrock of our business. Training and education for advisors will remain at the forefront as we launch new tools, hold more frequent online forums and create timely marketing materials to bolster the knowledge base of our advisors. In terms of staffing, recruiting top talent to help drive scale and profitability will be a high priority.

Business Unit Year in Review

-

Private Client Division

Read about the Private Client DivisionWhile managing through this pandemic, the division reported revenue of $642.1 million.

-

Asset Management

Read about Asset ManagementDespite our dispersed work environment, Asset Management delivered record-setting financial results.

-

Equities Division

Read about the Equities DivisionGenerating $168 million in top-line revenue, an increase of 56 percent, the business turned in the best performance since the financial crisis.

-

Investment Banking

Read about Investment BankingGross revenues reached $136.2 million, an increase of more than 70 percent, also marking the fourth consecutive year of revenue growth.

-

Taxable Fixed Income

Read about Taxable Fixed IncomeInstitutional business saw significantly more robust results, with increases ranging from 20 percent to 155 percent, across our various desks.

-

Public Finance and Municipal Trading

Read about Public Finance and Municipal Trading2020 was a high-watermark year for Public Finance in terms of revenue growth, transaction volume, league table rankings and departmental growth.