ANNUAL REPORT 2020 Private Client Division

Year in Review

2020 was a year like no other. As with many years, the beginning of the year kicked off with a focus on engaging with clients to help them achieve their financial aspirations, finding new clients who would benefit by our platform, and assuring that we were communicating new ideas, themes, and market-moving events to our financial advisors and to clients. By mid-March, we pivoted to achieving these goals with a very different playbook. As the pandemic took hold in mid-March, the Private Client Division activated a comprehensive contingency plan with three key pillars as our guiding principles:

We are extraordinarily proud of the resiliency demonstrated by our associates in the Private Client Division, our Operations & Technology Divisions, as well as infrastructure teams that support our branch network each and every day. We engaged regularly to understand, interpret, and communicate the guidelines for assuring the safety of our associates and our clients, and to be able to continue to operate our business. Our offices remained operational with minimal disruption and adherence to strict protocols and reduced on site personnel who adhered to our strict requirements for on-site presence.

The pandemic made ever more clear the important role that we play in the financial health and future of our clients. As individual health and the fragility of life in general became the topic of conversation everywhere, our advisors were needed more than ever, helping clients address their financial planning needs. Surprisingly, we also found client interest and engagement was significantly heightened by the lack of travel and staying at home, resulting in a significant increase in transaction business, the new issue calendar, and financial news in general.

With this shut-down reality as a backdrop, we pivoted to digital delivery in many forms to achieve consistent communications with our associates and our clients, as well as to deliver required training and coaching.

During this time, we successfully implemented the most sweeping regulatory reform in many years, Regulation Best Interest (Reg BI). Consistent with our longtime client service goals, this rule requires broker-dealers to only recommend financial products to their clients that are in the client’s best interests, and to clearly identify any potential conflicts of interest. Reg BI establishes a standard of conduct for broker-dealers when recommending a securities transaction or investment strategy. While this has always been our belief, and as we continue to act in letter and the spirit of this rule, the implementation required technology and communication changes as well as field training to demonstrate compliance.

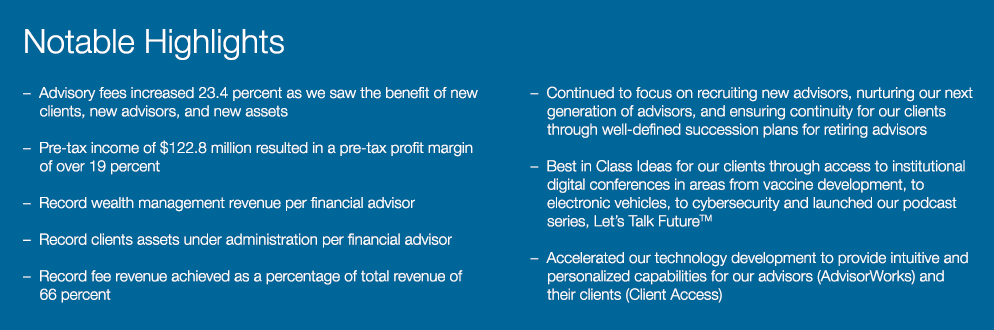

While managing through this pandemic, the division reported revenue of $642.1 million. As clients participated in the market rally, retail commissions increased 11 percent and advisory fees increased 23.4 percent. However, given the persistent low interest rate environment driven by actions taken by the Federal Reserve, bank deposit sweep income and interest revenue declined 70.3 percent and 29.8 percent, respectively.

With a multi-year focus on recruiting and driving productivity, our financial advisor are more accomplished than ever before with client assets under administration of $104.8 billion and assets under management of $38.8 billion at December 31, 2020, respectively. In our top advisor ranks, we continued to grow as a result of their capable management of their clients’ resources as well as their ability to attract new clients and additional assets from their existing clients. We continue to look opportunistically at advisor expansion opportunities and channel adjacencies to continue achieving our growth targets.

In our top advisor ranks, we continued to grow as a result of their capable management of their clients’ resources as well as their ability to attract new clients and additional assets from their existing clients. We continue to look opportunistically at advisor expansion opportunities and channel adjacencies to continue achieving our growth targets.

Advisors are the center of our Private Client Division and we are proud of the industry recognition that our advisors received, including awards from Forbes Shook in the categories of: Top Advisors, Best In State, 40 Under 40, Regional, and Working Mother. Collectively, we are relentlessly focused on providing advisors with the coaching and training, intuitive technology, marketing services, and delivering investment solutions with our Oppenheimer Asset Management (OAM) Division as well as Retirement, Insurance & Annuities, and Corporate and Executive Services partners. In addition, we collaborated with our Capital Markets partners to deliver value-added capabilities. Notable in this regard is the collaboration with Investment Banking in which meaningful business was executed during the year and a joint approach to developing a Family Office initiative was launched.

Areas of Focus

During the year, we delivered a variety of communications to continue to engage our clients and build our brand. As appropriate, we invited clients to institutional conferences in which our analysts and industry leaders presented insights from COVID-19, to Electronic Vehicles, to Cloud Technology. We launched our podcast series, Let’s Talk FutureTM, as a channel to showcase our thought leaders while informing and inspiring clients and a broader audience. Our digital delivery of content grew using our Oppenheimer.com, advisor websites, and social media channels.

In September, we announced the launch of a strategic alliance with a well-respected FinTech firm, InvestCloud to accelerate our digital experience platform for our advisors, associates, and clients. Central to this strategic alliance is the creation of a new digital advisor-client web-based portal expected to be launched in mid-2021. As part of our multi-year technology approach, the onboarding platform will provide connectivity to our advisor portal, Advisor Works, which continued to have solid improvements in functionality as enhanced features were introduced.

Looking Forward

Our utmost priority for 2021 and beyond is meeting the ever-changing needs of our advisors, our associates, and our clients. With consumers feeling cautiously optimistic about a post-pandemic life, our advisors are essential to help plan, invest, and transition their wealth in a manner that achieves their aspirations and legacy. Many lessons were learned in the past year. We learned to be more nimble, to communicate consistently, and to focus on what matters most.

Record wealth management revenue per financial advisor, clients assets under administration per financial advisor, and fee revenue achieved as a percentage of total revenue of 66 percent.

-

Private Client Division

Read about the Private Client DivisionWhile managing through this pandemic, the division reported revenue of $642.1 million.

-

Asset Management

Read about Asset ManagementDespite our dispersed work environment, Asset Management delivered record-setting financial results.

-

Equities Division

Read about the Equities DivisionGenerating $168 million in top-line revenue, an increase of 56 percent, the business turned in the best performance since the financial crisis.

-

Investment Banking

Read about Investment BankingGross revenues reached $136.2 million, an increase of more than 70 percent, also marking the fourth consecutive year of revenue growth.

-

Taxable Fixed Income

Read about Taxable Fixed IncomeInstitutional business saw significantly more robust results, with increases ranging from 20 percent to 155 percent, across our various desks.

-

Public Finance and Municipal Trading

Read about Public Finance and Municipal Trading2020 was a high-watermark year for Public Finance in terms of revenue growth, transaction volume, league table rankings and departmental growth.