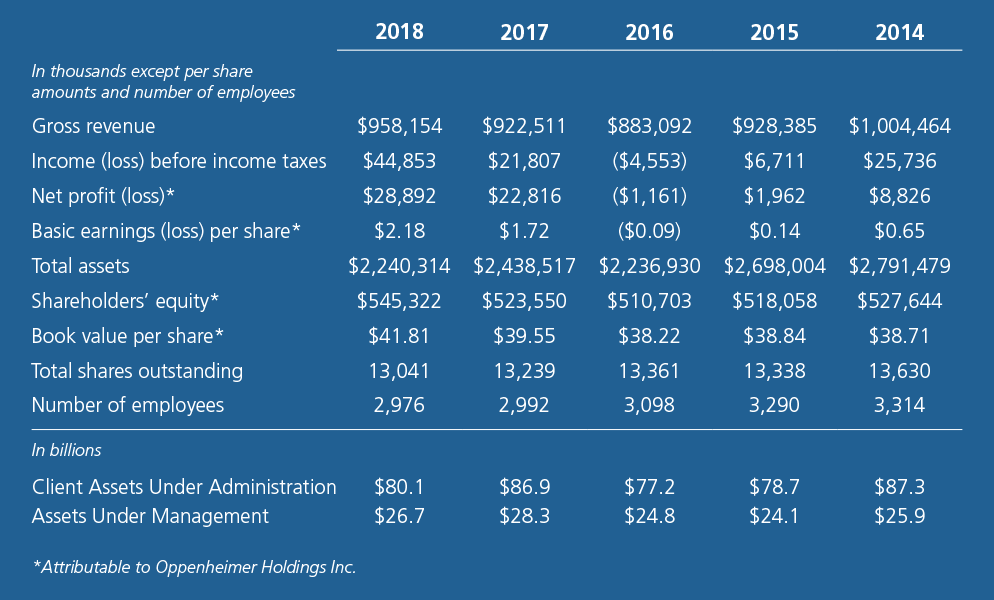

Last year we discussed the potential for change, and in 2018, we experienced it. We began the year with volatility and rode a wave of recovery into mid-year powered by increased earnings, a strong domestic economy, and supercharged by the impact of decidedly lower corporate tax rates. As we approached the end of the year, markets reflected growing trepidation driven by a slowing economy, continued increases in interest rates, global trade conflicts, and domestic political discord. We also witnessed the first glimpse of market liquidity issues, driven by a lack of risk capital due to the Volcker Rule, and structural issues driven by the impact of passive investment vehicles such as exchange traded funds, or ETFs.

As I write this letter, the market has responded positively to favorable comments by the Federal Reserve, to the government returning to work following a shutdown, to a more sanguine view of trade issues, and to stronger consumer spending. The combination of a strong domestic economy, low interest rates, and low unemployment tend to act as a bromide that can significantly improve expectations even as risks appear.