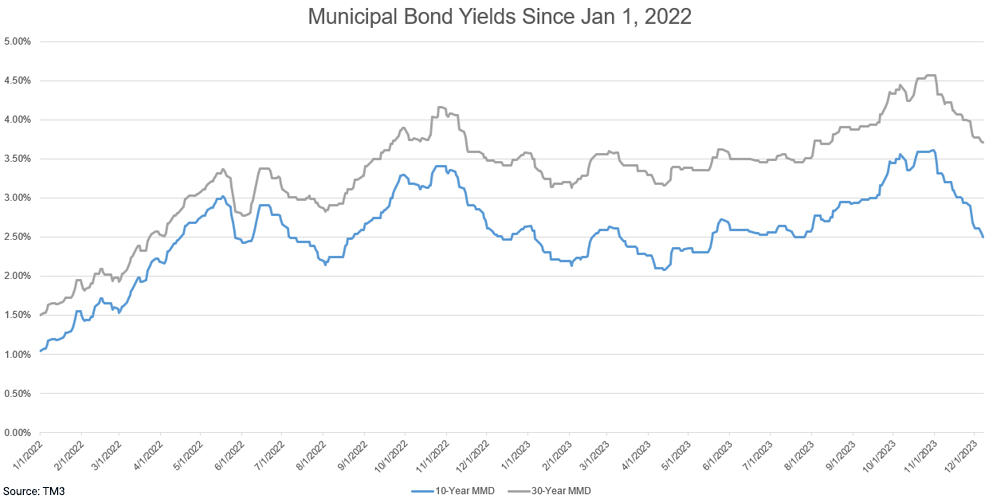

Municipal bond yields plummeted this week after the Federal Reserve Bank announced it would hold rates steady this month, and forecasted three rate cuts in 2024. The Fed’s announcement came Wednesday after the December Federal Open Markets Committee meeting. Municipal yields reacted favorably to the news, with the entire MMD curve dropping by 17 basis points on Thursday. The 10-year MMD is now 28 basis points lower than where it started the year, and the 30-year MMD is right back where it started in 2023.

Despite the rally, investors continued to pull money out of municipal bond mutual funds, with outflows this week coming in at $524 million. With many investors now believing rates have peaked, analysts believe inflows in muni funds will soon return.

Tax-exempt yields over the past week

| 10-Year MMD | 30-Year MMD | |

|---|---|---|

| December 8, 2023 | 2.50% | 3.71% |

| December 14, 2023 | 2.36% | 3.57% |

| Change (bps) | -14 | -14 |

Treasury yields also fell this week after the Fed’s announcement. Fed Chairman Jerome Powell stated in his presser that they now expect the Federal Funds Rate target to be 4.625%, which is 75 basis points lower than the current rate. The Fed expects to achieve this over 3 rate cuts in 2024. While the timing is unknown and any cuts will be data-driven, many investors are hoping to see the first cuts occur by April or May of next year. Powell emphasized that these predictions are very preliminary, and that inflation remains higher than they would like, with no guarantee it will continue to decline.

Treasury yields over the past week

| 10-Year Treasury | 30-Year Treasury | |

|---|---|---|

| December 8, 2023 | 4.24% | 4.32% |

| December 14, 2023 | 3.94% | 4.06% |

| Change (bps) | -30 | -26 |

Written by Dan Shaw, Director, Oppenheimer & Co. Inc., Public Finance.

Disclaimer

All materials, including proposed terms and conditions, are indicative and for discussion purposes only. Finalized terms and conditions are subject to further discussion and negotiation and will be evidenced by a formal agreement. Opinions expressed are our present opinions only and are subject to change without further notice. The information contained herein is confidential. By accepting this information, the recipient agrees that it will, and it will cause its directors, partners, officers, employees and representatives to use the information only to evaluate its potential interest in the strategies described herein and for no other purpose and will not divulge any such information to any other party. Any reproduction of this information, in whole or in part, is prohibited. Except in so far as required to do so to comply with applicable law or regulation, express or implied, no warranty whatsoever, including but not limited to, warranties as to quality, accuracy, performance, timeliness, continued availability or completeness of any information contained herein is made. Opinions expressed herein are current opinions only as of the date indicated. Any historical price(s) or value(s) are also only as of the date indicated. We are under no obligation to update opinions or other information.

The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or instrument or to participate in any trading strategy. Oppenheimer does not provide accounting, tax or legal advice; however, you should be aware that any proposed indicative transaction could have accounting, tax, legal or other implications that should be discussed with your advisors and or counsel. The materials should not be relied upon for the maintenance of your books and records or for any tax, accounting, legal or other purposes. In addition, we mutually agree that, subject to applicable law, you may disclose any and all aspects of any potential transaction or structure described herein that are necessary to support any U.S. federal income tax benefits, without Oppenheimer imposing any limitation of any kind.

Oppenheimer shall have no liability, contingent or otherwise, to the user or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the data or formulae provided herein or for any other aspect of the performance of this material. In no event will Oppenheimer be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using the data provided herein or this material, even if Oppenheimer has been advised of the possibility of such damages. Oppenheimer will have no responsibility to inform the user of any difficulties experienced by Oppenheimer or third parties with respect to the use of the material or to take any action in connection therewith. The fact that Oppenheimer has made the materials or any other materials available to you constitutes neither a recommendation that you enter into or maintain a particular transaction or position nor a representation that any transaction is suitable or appropriate for you.

© 2023 Oppenheimer & Co. Inc. Transacts Business on All Principal Exchanges and Member SIPC. All rights reserved. No part of this presentation may be reproduced in any manner without the written permission of Oppenheimer. Oppenheimer & Co. Inc., including any of its affiliates, officers or employees, does not provide legal or tax advice. Investors should consult with their tax advisor regarding the suitability of Municipal Securities in their portfolio.

6164639.1