Please complete the form below to download Oppenheimer's Q2 Preview and Q1 Review for Biotech VC, M&A, and BD Activity

// <![CDATA[ MktoForms2.loadForm("//info.oppenheimer.com", "627-CPK-162", 1294); // ]]>

Our 10 key takeaways:

- A staggering $5.8B was raised by private biotech companies, making 1Q24 one of the top post-pandemic quarters in terms of total capital raised

- Renaissance of $100M+ deals (most of which are clinical-stage companies)

- Higher number of Series Bs and Cs with a crossover flavor

- New investor participation as lead continued at similar levels as 2023 (including multiple co-led and even triple-led rounds)

- Oncology, Autoimmune / I&I, and CV&M attracted the majority of VC dollars; small molecules remained popular; ADCs and Cell Therapy continued to gain momentum in the private markets

- Cautious optimism towards an opening of the IPO window; clean clinical data is key for after-market performance

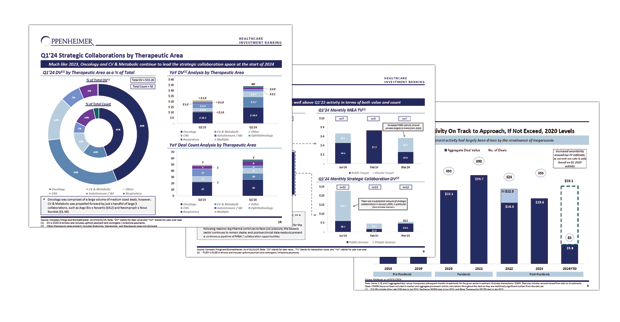

- 2023 M&A and BD frenzy continues in 2024 ($19.8B in acquisitions and $33.1B in collaborations during 1Q24 alone)

- Oncology, Autoimmune / I&I, and CV&M companies remained the primary targets for both M&A and strategic collaborations in 1Q24

- Small molecules remained the most sought after from a M&A standpoint (7 out of 19 deals), while cell & gene therapy (mostly siRNA, CAR-T, and gene editing) was heavily targeted for collaborations (28 out of 58 deals)

- 2Q24 already looks to be a very active quarter, but some volatility likely to creep in in 2H24

These reports are part of our leadership role in the biopharma sector. We hope to provide you with broader healthcare perspectives and actionable insights. Consider us a partner, trusted advisor, and extension of your team - with The Power of Oppenheimer Thinking.

Please reach out to Michael Margolis, R.Ph. ([email protected]), Daniel Parisotto, PhD ([email protected]), Zelyn Kwok ([email protected]), or Robert Lewis ([email protected]) directly to request a copy.

Michael A. Margolis, R.Ph.

Title:Senior Managing Director, Co-Head of Healthcare, Head of Healthcare Life Sciences

DISCLOSURES

This notice is provided for informational purposes only, and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. Nothing contained herein shall constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited.

This notice may contain statistical data cited from third-party sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such third-party statistical information is accurate or complete, and it should not be relied upon as such. All market prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice.

2023 Oppenheimer & Co. Inc. Transacts Business on all Principal Exchanges and Member SIPC 6530993.1