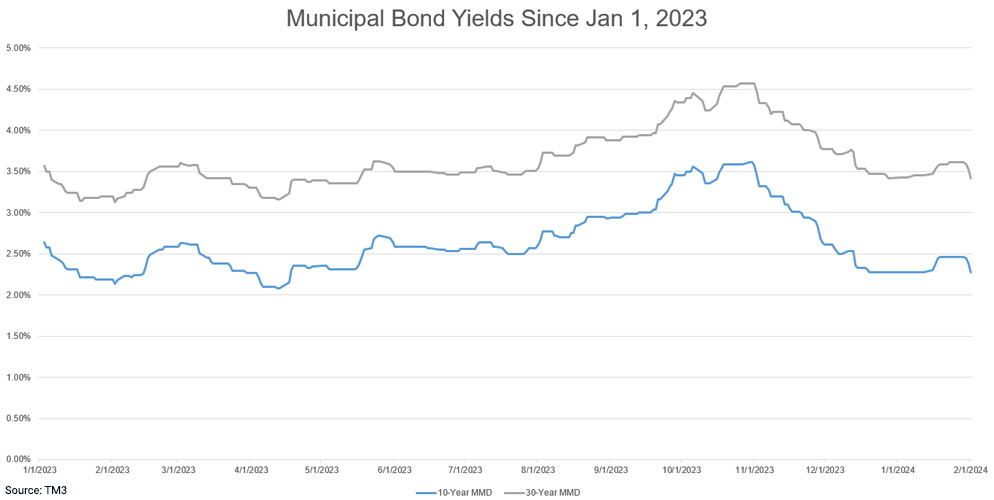

In week centered around January’s Federal Open Market Committee meeting, municipal bond yields rallied by as many as 19 basis points. This rally occurred despite the Fed’s decision to hold the federal funds target rate between 5.25% and 5.50%, and despite Fed Chairman Powell’s hawkish tone regarding future rate cuts. Powell stated that while cuts are expected in 2024, they are not guaranteed. He lowered expectations of a rate cut at the March FOMC meeting by saying that the Fed would ‘move carefully’ and continue to look for signs that inflation is moderating. Prior to this week’s FOMC meeting, the market-applied odds of a March cut had risen to as high as 80%. After Powell’s remarks, that figured dropped down below 40%.

Although rate cuts may still be several months off, investors believe that rates have peaked and have been active in trying to lock in today’s yield levels. Investors deposited $1.47 billion into municipal bond mutual funds this week, the first weekly inflow above $1 billion since January 2023. The surge in demand helped fuel this week’s rally.

Tax-exempt yields over the past week

| 10-Year MMD | 30-Year MMD | |

|---|---|---|

| January 26, 2024 | 2.46% | 3.61% |

| February 1, 2024 | 2.28% | 3.42% |

| Change (bps) | -18 | -19 |

Treasury yields also ignored Powell’s hawkish tone, with the 10-year Treasury dropping by 30 basis points since last Friday. The 10-year Muni-to-Treasury Ratio currently sits at 59%, and the 30-year Muni-to-Treasury Ratio currently sits at 83%.

Treasury yields over the past week

| 10-Year Treasury | 30-Year Treasury | |

|---|---|---|

| January 26, 2024 | 4.16% | 4.39% |

| February 1, 2024 | 3.86% | 4.10% |

| Change (bps) | -30 | -29 |

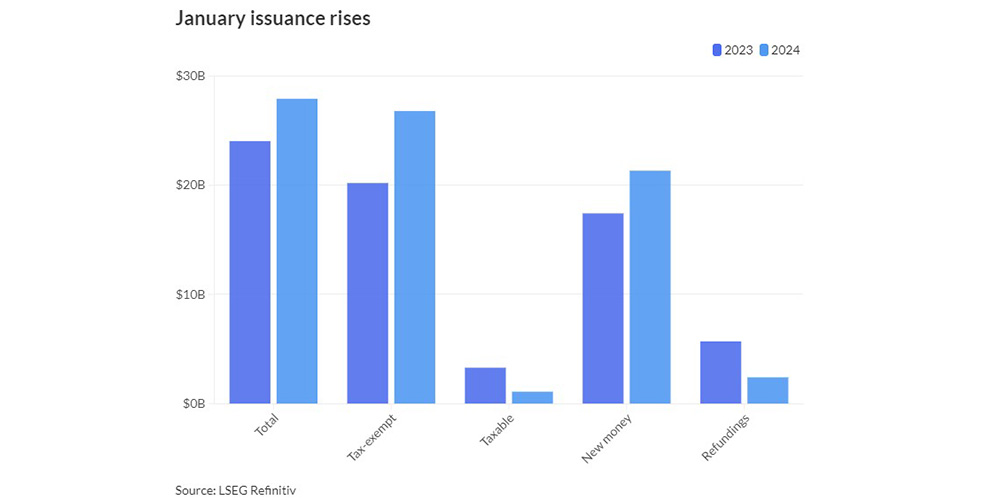

On a positive note, January bond issuance was up year-over-year. January’s volume rose 16%, with a total $27.9 billion brought to market, compared to $24 billion issued in January 2023. The increase in volume is a result of tighter spreads, growing capital needs, and lower federal stimulus dollars.

Written by Dan Shaw, Director, Oppenheimer & Co. Inc., Public Finance.

Disclaimer

All materials, including proposed terms and conditions, are indicative and for discussion purposes only. Finalized terms and conditions are subject to further discussion and negotiation and will be evidenced by a formal agreement. Opinions expressed are our present opinions only and are subject to change without further notice. The information contained herein is confidential. By accepting this information, the recipient agrees that it will, and it will cause its directors, partners, officers, employees and representatives to use the information only to evaluate its potential interest in the strategies described herein and for no other purpose and will not divulge any such information to any other party. Any reproduction of this information, in whole or in part, is prohibited. Except in so far as required to do so to comply with applicable law or regulation, express or implied, no warranty whatsoever, including but not limited to, warranties as to quality, accuracy, performance, timeliness, continued availability or completeness of any information contained herein is made. Opinions expressed herein are current opinions only as of the date indicated. Any historical price(s) or value(s) are also only as of the date indicated. We are under no obligation to update opinions or other information.

The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or instrument or to participate in any trading strategy. Oppenheimer does not provide accounting, tax or legal advice; however, you should be aware that any proposed indicative transaction could have accounting, tax, legal or other implications that should be discussed with your advisors and or counsel. The materials should not be relied upon for the maintenance of your books and records or for any tax, accounting, legal or other purposes. In addition, we mutually agree that, subject to applicable law, you may disclose any and all aspects of any potential transaction or structure described herein that are necessary to support any U.S. federal income tax benefits, without Oppenheimer imposing any limitation of any kind.

Oppenheimer shall have no liability, contingent or otherwise, to the user or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the data or formulae provided herein or for any other aspect of the performance of this material. In no event will Oppenheimer be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using the data provided herein or this material, even if Oppenheimer has been advised of the possibility of such damages. Oppenheimer will have no responsibility to inform the user of any difficulties experienced by Oppenheimer or third parties with respect to the use of the material or to take any action in connection therewith. The fact that Oppenheimer has made the materials or any other materials available to you constitutes neither a recommendation that you enter into or maintain a particular transaction or position nor a representation that any transaction is suitable or appropriate for you.

© 2024 Oppenheimer & Co. Inc. Transacts Business on All Principal Exchanges and Member SIPC. All rights reserved. No part of this presentation may be reproduced in any manner without the written permission of Oppenheimer. Oppenheimer & Co. Inc., including any of its affiliates, officers or employees, does not provide legal or tax advice. Investors should consult with their tax advisor regarding the suitability of Municipal Securities in their portfolio.

6329371.1