Welcoming a new baby is one of life’s most joyful milestones, but it also comes with a host of financial responsibilities that can feel overwhelming. From medical bills and childcare to long-term savings goals like college tuition, preparing for the cost of raising a child requires thoughtful planning. Whether you're expecting your first child or expanding your growing family, understanding these financial realities early can help you build a more secure and confident future.

Childcare Cost Breakdown:

Raising a child comes with a significant price tag - medical costs, childcare, and diapers are just a few additional expenses for the household. Now is the time to take a close look at your income and expenses and adjust your budget accordingly. Below are some statistics to keep in mind when creating your family financial strategy:

- The average cost of childbirth and health costs such as delivery and postpartum care is $18,865, with an average out-of-pocket payment costing $2,854 for those on large group plans, according to the Peterson-Kaiser Family Foundation.

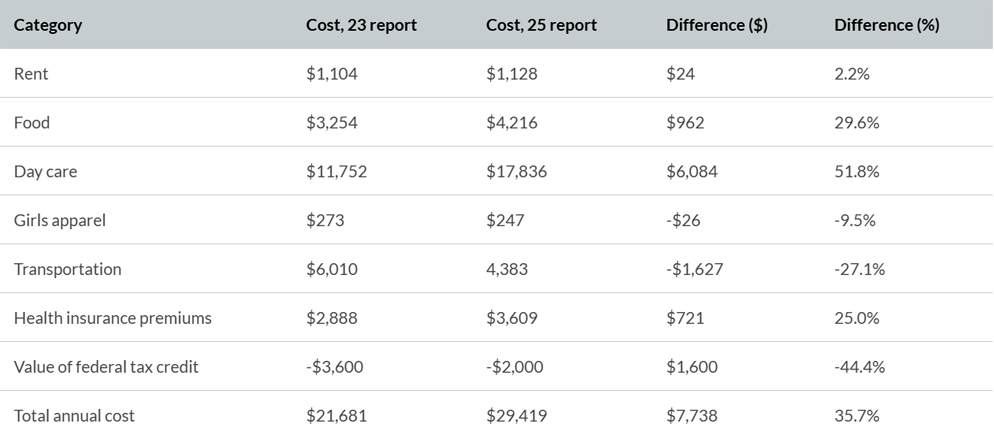

- Studies collated by Brookings show that the average cost of raising a child to age 17 who was born in 2015 will be ~$26000 more than in other comparative periods of similar inflation.

- Worldwide, annual childcare costs range from $8,310 - $17,171 depending on national population and birth year, per US Department of Labor data and Pew Research.

- For many high-income families, housing and food take up a bulk of the costs, making up 26% and 15% of expenses, respectively, not factoring for inflation, according to a 2015 US Department of Agriculture study.

- LendingTree reports that families spend an average of 22.6% of their income on the basic annual expenses to raise a child, up from 19.0% in their 2023 study.

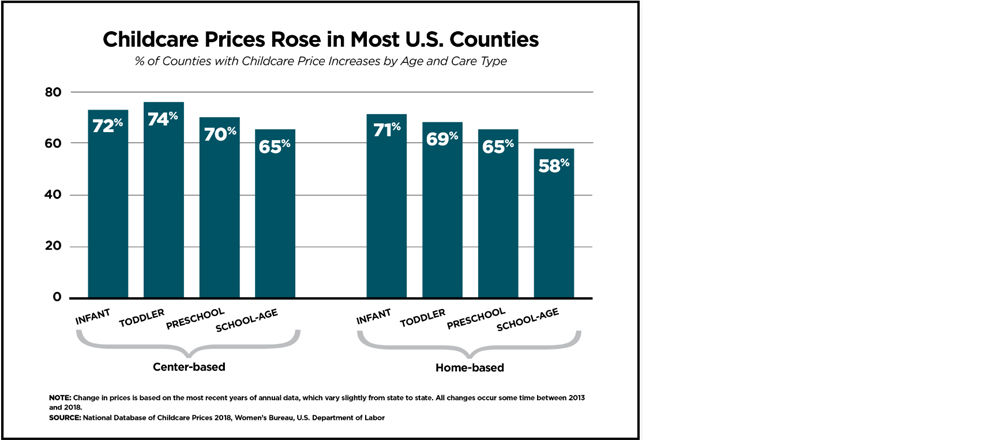

- A study by the Bureau of Labor Statistics shows that between January 2015 and April 2025, the cost of daycare and preschool has grown over 28%.

Establish Your Financial Safety Net:

A strong emergency fund becomes even more critical when you're responsible for another life. Most financial professionals recommend maintaining three to six months' worth of living expenses in liquid savings. Life insurance, disability coverage, and updating your will or trust should also be top priorities now that you welcomed a new member into the family.

Make a Plan for College Costs:

College tuition continues to climb, and many parents are discovering that the best time to start saving is well before their child can recite the alphabet. The earlier you set money aside, the more time it will benefit from compound growth. Education-focused accounts can amplify that growth through tax advantages.

One popular option is a 529 college savings plan, which is a tax-advantaged account allows you to invest specifically for future education expenses. Earnings grow tax-deferred, and withdrawals remain free of federal income tax when used for qualified expenses such as tuition, fees, and room and board. Earnings withdrawn for non-qualified purposes are subject to ordinary income tax and, in most cases, a 10% penalty. You can even roll any unused funds into your child’s Roth IRA.

Revisit Your Employee Benefits at Work:

Many new parents are surprised to learn that their employer-sponsored benefits may already include valuable tools for growing families. Take a fresh look at your company’s parental leave, dependent care FSAs, and healthcare options. Some plans now offer fertility benefits, adoption assistance, and newborn wellness programs. Every family’s situation is unique, and there’s no one-size-fits-all plan. A financial advisor can help align your long-term goals with the realities of new parenthood from building wealth to protecting what you’ve already built. It is never too early or late to start.

Parenthood is a life-changing journey filled with both priceless moments and practical considerations. By understanding the true costs of raising a child and taking proactive steps like creating a budget, building an emergency fund, exploring savings plans, and leveraging workplace benefits, you can ease financial stress and focus more on what matters most: your growing family. Planning today lays the groundwork for a stable and fulfilling tomorrow, from the first day of preschool to college graduation.

Reach out to an Oppenheimer Financial Professional today to explore personalized strategies for your family’s evolving priorities.

DISCLOSURE

Sources:

- We analyzed 5 years’ worth of childcare prices. Here’s what we found. | U.S. Department of Labor Blog

- Health costs associated with pregnancy, childbirth, and postpartum care - Peterson-KFF Health System Tracker

- It’s getting more expensive to raise children. And government isn’t doing much to help. | Brookings

- It Costs $297,674 to Raise a Child Over 18 Years | LendingTree

- https://blog.dol.gov/2024/09/30/we-analyzed-5-years-worth-of-childcare-prices-heres-what-we-found

The information set forth herein has been derived from sources believed to be reliable but is not guaranteed as to accuracy and may change without notice.

Oppenheimer Transacts Business on all Principal US Exchanges and Member SIPC 8218924.1