The financial landscape is undergoing a quiet revolution. Across the United States and Europe, women are gaining unprecedented control over investable assets, reshaping wealth dynamics and financial decision-making. This transformation is not the result of a single shift, but rather the convergence of long-term social, economic, demographic, and cultural trends.

For wealth managers, financial advisors, and institutions alike, understanding and adapting to these changes isn’t just good practice, it’s a strategic imperative.

Social Shifts: Financial Independence and Evolving Roles

Changing family structures are playing a central role in reshaping women’s financial trajectories. Declining marriage rates and high divorce rates have led to an increase in financially independent women. Many are marrying later—or not at all—while older women, including widows and divorcées, increasingly seek personalized financial advice.

- In the U.S., women over 50 are more likely to value in-person advisory services, often due to life transitions such as widowhood or divorce.

- However, women tend to engage with financial advisors later than men—35% of women report waiting until after age 45 to do so, compared to 28% of men.

- Despite growing demand, women remain underrepresented in the financial advisory workforce, comprising only 23% of U.S. advisors and 18–20% in Europe.

Economic Momentum: Rising Earnings and Asset Ownership

Women are outpacing men in educational achievement and are increasingly securing high-earning positions—empowering them with greater financial autonomy, regardless of marital status.

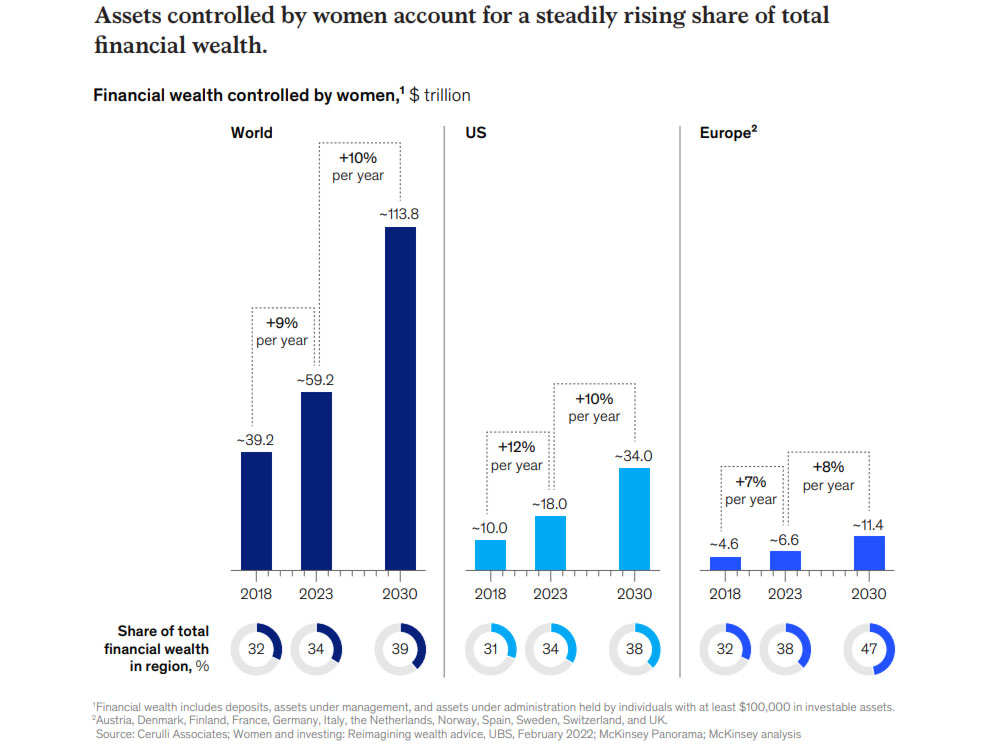

- Women now control about one-third of retail financial assets in both the U.S. and EU, projected to rise to 40–45% by 2030.

- Between 2018 and 2023, global wealth rose 43%, while wealth controlled by women grew 51%.

- As of 2023, women held approximately $60 trillion in global assets under management (AUM)—or 34% of global AUM.

- Notably, price awareness among female investors increased from 60% in 2018 to 75% in 2023, signaling more active and informed participation in financial markets.

Demographic Dynamics: Longevity and Wealth Transfer

Demographic forces are also accelerating this shift in wealth control. Baby boomers currently hold about 70% of U.S. retail assets, and with women’s longer life expectancy and generally younger age relative to spouses, they are poised to inherit and manage a significant portion of these assets.

- In the U.S., assets controlled by women increased from $10 trillion in 2018 to $18 trillion in 2023, projected to reach $34 trillion (38% of U.S. AUM) by 2030.

- In Europe, female-controlled assets grew from $4.6 trillion in 2018 to $6.6 trillion in 2023, and are expected to hit $11.4 trillion (47% of EU AUM) by 2030.

- Yet, many of these assets remain unmanaged: 53% of female-controlled assets in the U.S. are not professionally managed, compared to 45% for men.

- Closing this gap could unlock a $10 trillion opportunity by 2030 for firms that cater effectively to female investors.

Cultural Confidence: Redefining Financial Identity

As societal attitudes evolve, women are embracing greater confidence in managing their finances—individually or in partnership.

- In the U.S., financial confidence among women under 50 rose from 48% in 2018 to 61% in 2023.

- The percentage of all U.S. women who believe they will achieve their financial goals also increased, from 51% to 54% over the same period.

- With confidence comes discernment: 43% of women under 50 with in-person advisors believe in shopping around for better rates, highlighting a growing demand for transparency and value.

- Women’s willingness to switch advisors if their needs aren’t met further underscores the importance of tailored service.

The $20 Trillion Opportunity

By 2030, women are expected to assume control of an additional $16 trillion in assets in the United States and $4.7 trillion in Europe. This historic wealth shift—fueled by social, economic, demographic, and cultural changes—is redefining not only who holds wealth, but how that wealth is managed, invested, and grown.

For firms that invest in understanding the evolving needs of female clients and build inclusive, responsive advisory experiences, the next five years represent a generational opportunity to lead the future of wealth management.

Reach out to an Oppenheimer Financial Professional today to learn how you can optimize your financial strategy.

DISCLOSURE

Source: the-new-face-of-wealth-the-rise-of-the-female-investor.pdf

The information set forth herein has been derived from sources believed to be reliable but is not guaranteed as to accuracy and does not purport to be a complete analysis of any security, company, or industry involved. Opinions expressed herein are subject to change without notice. Oppenheimer & Co. Inc. does not provide legal or tax advice.

This material is not a recommendation as defined in Regulation Best Interest adopted by the Securities and Exchange Commission. It is provided to you after you have received Form CRS, Regulation Best Interest disclosure and other materials.

Oppenheimer & Co. Inc. Transacts Business on all Principal Exchanges and Member SIPC 8007559.1