Letter from the

Chairman & CEO

Year in Review

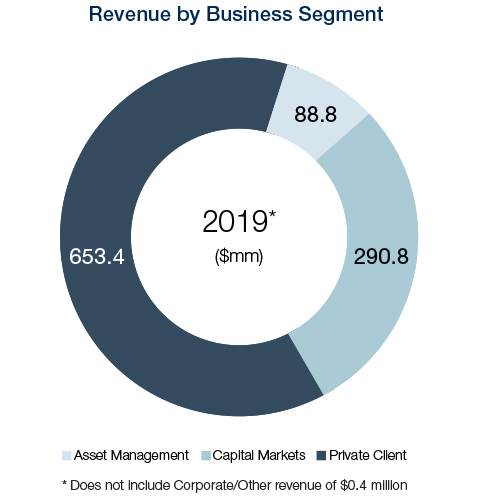

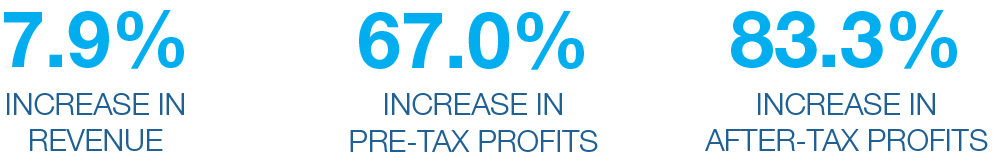

For Oppenheimer, 2019 was a very successful year and we were quite pleased with our results driven by higher short-term interest rates, increased assets under management, and a significant improvement in investment banking revenue. In addition, we got a major boost from incentive fees from our alternative investments which turned in superior returns. The firm reported revenues of $1.033 billion, an increase of 7.9 percent from $958.2 million in the prior year, and reported a pre-tax profit of $75 million, compared to a pre-tax profit of $45 million in 2018, an increase of 67 percent. As a result, after-tax profits increased 83 percent to $53 million (or $4.10 basic earnings per share) in 2019 from $29 million (or $2.18 basic earnings per share) in 2018.

On December 31, 2019, the firm had a total of 12,798,368 shares outstanding and book value per share was $46.31 as compared to $41.81 at the end of 2018. Under our repurchase authorization, we were opportunistic in repurchasing our common shares during the year, buying back 323,249 shares for $8.4 million, at an average price of $25.99 per share. In total, the firm repurchased approximately 2.5 percent of shares outstanding at the beginning of the fiscal year and returned total capital of nearly $14.3 million to shareholders through the combination of dividends and share repurchases. In addition, we retired $50 million in our outstanding bond debt at mid-year out of excess funds available, which will reduce our annual interest expense by $3.375 million.

Client assets under administration totaled $91 billion while client assets under management (AUM) in fee-based programs totaled $32.1 billion, compared to $80.1 billion and $26.7 billion, respectively in 2018. We brought in more than $6.7 billion in new client AUM into our fee-based programs during the year. Asset management and fee-based programs continue to be the preferred path for clients and we experienced another year in which clients chose managed solutions over transaction-based pricing. Accordingly, we experienced a decline in commission revenues of 2.9 percent as clients increasingly chose passive investments over actively-managed assets and again reduced turnover in their accounts. The pattern of ever lower commission rates that began in 1975 reached its nadir in the closing days of 2019 as we observed “free” trades offered to self-directed investors trading online. The need for value added advice and service has become ever more important in this new era.

We open 2020 with records for many revenue drivers including client assets under administration, assets producing fee-based revenues, and the level of productivity of our financial advisors. We are well positioned with the highest level of available capital in our history and strong liquidity. With this backdrop of success, we also know that the likelihood of increased market volatility, overall uncertainty, and today’s lower interest rates will make for new challenges in the year ahead. Our business has become increasingly impacted by the overall level of equity prices. Additionally, a downdraft in markets, however brief, will have an immediate impact on short-term revenue creation. Hence, we are focused on continuing to manage costs across the business.

Looking to a New Year and New Decade

As we turn our calendars to a new decade and the 2020s become our focus, we can celebrate the enormous strides made by our nation’s economy out of the depth of a major recession when the decade began. Our economy grew over 30 percent and unemployment dropped from over 10 percent to the 3.5 percent level of today. All of this occurred as we saw a major increase in our working population and the rise of the Millennial generation. The internet took on new importance as did the many services empowered by it: social media (Facebook, Twitter, Instagram); search (Google); online shopping (Amazon); cutting the cord (both landlines and cable). We adopted streaming as the preferred method of receiving our entertainment and sports (Netflix, Hulu) and the Internet of Things. The world around us has changed and so has the investment world. Over the past 10 years, we have watched investors move their preferred asset allocation from active to passive, preferring broad-based indexes to individual stocks, from transaction-based accounts to fee-based, and to a desire for account access 24/7 on every smart device.

We are well positioned with the highest level of available capital in our history and strong liquidity.

We are an investment firm, identifying trends, finding emerging industries and companies, and providing well-balanced portfolios to investors (both individuals and institutions) that can lead to long-term success. It remains a challenge, but we have shown decades of success in meeting this test. While we are making good progress, we still have significant work to do to deliver sustained, enduring results to our clients in meeting their goals and assisting them to see their investments as a single enterprise and in trusting Oppenheimer to guide them to a successful future. That work includes investing for our future in financial advisor training and recruiting, building out our investment platform with strategies that limit risk for investors and that meet investor long-term goals and provide for a secure future.

As we look forward, we will adapt to new and important regulatory initiatives. We have always put the financial well-being and interests of our clients first. Now an important new regulation, Regulation Best Interest (Reg BI), which becomes effective at mid-year, will not only mandate that we continue to do so, but will create significant new processes to evaluate our disclosures, our product platforms, our conversations with clients and prospects, and may continue to drive individual investors to advisory programs. We are dedicating substantial resources to “taming this beast” including training our associates and adopting new procedures to ensure compliance.

The opportunities in the near term are significant and we at Oppenheimer are adjusting our business model and adapting our outlook to ensure our success in the future. We believe winning means delivering consistent and sustainable growth and value creation.

- We are making meaningful progress throughout our firm to achieve this goal, but we still have much work to do. In the next year, we will continue our positive momentum with organic growth yielding increased revenues, increased advisor headcount, additions to client assets, and building our already well-respected brand.

- We are improving results in investment banking through the addition of experienced bankers to our ranks, as well as maintaining a high level of mandates across our footprint.

- We will continue to add both new and existing clients to our fee-based and managed programs. We will continue to spend on technology both to remain competitive as well as to deliver new and enhanced services.

- We will continue to improve platforms for our associates so they will deliver a higher level of insight and service by providing access to important data anywhere, at any time, to better meet client expectations. Our work ahead is to build on the progress already delivered and bring these and new capabilities to life.

- We will continue to recruit, motivate, and retain top talent in the interests of our clients so that they will be more successful working with us than with our competitors. We recognize the significant responsibility we have to our clients to protect their data and their privacy in an increasingly difficult and complex digital environment.

We recognize that our clients expect more than groundbreaking innovation. They want to work with companies they can trust to protect their data and handle it responsibly. We are committing significant attention and resources to protect our clients from fraud, cybersecurity risk, and invasion of privacy. Importantly, we will continue to do our utmost to ensure the safety and security of their assets entrusted to us. We are well positioned to take advantage of the trend toward industry consolidation. We are exploring strategic alternatives for utilizing our significant investments in systems, talent, and expertise, and we recognize the benefit we derive by utilizing excess capacity to increase shareholder returns and support future growth. It is clear that our strategy must be based on a careful review of the potential of any such expansion to contribute to long-term value.

While we are focused on driving change, we do this with a keen eye toward preserving much of the great culture of our company.

We are well positioned to take advantage of the trend toward industry consolidation. We are exploring strategic alternatives for utilizing our significant investments in systems, talent, and expertise, and we recognize the benefit we derive by utilizing excess capacity to increase shareholder returns and support future growth. It is clear that our strategy must be based on a careful review of the potential of any such expansion to contribute to long-term value.

Challenges lie ahead. We need to accelerate change within our walls and continue to find new avenues for growth. We continue to see smaller, more nimble competitors target margins and innovate more rapidly. Our rich history of success over more than one-and-a-half centuries is a distinct advantage. While we are focused on driving change, we do this with a keen eye toward preserving much of the great culture of our company. Though we are proud of who we are and how we serve our clients, we also believe we can deliver more for our clients, shareholders, and employees by setting higher standards of performance and pushing ourselves to create new and differentiated solutions. Our evolution will take time, but we have confidence that we will build on our success.

But just as important as growth, Oppenheimer’s culture stresses integrity, our insistence on achieving results the right way, and ensuring the firm operates in a manner consistent with our values. As we position the firm for long-term success, and welcome the next generation of talent, it is a business imperative to ensure our firm is a diverse and inclusive workplace. Culture starts at the top, with strong engagement from the Board of Directors, and their focus on sound corporate governance, and their commitment to corporate responsibility.

Our results would not have been possible without the strong commitment and performance of our dedicated associates across our firm. I want to thank each and every one of them for all they did and continue to do to help with the firm’s success. We are looking forward to another successful year, taking this firm in new directions and finding new success in our existing businesses by transforming tomorrow on behalf of our shareholders and our clients.

I am deeply appreciative of the privilege to lead this great firm and to serve our clients, our employees, and our shareholders.