Timely market analysis and portfolio positioning in the face of volatilityPractical Perspectives

Episode 2 | Finding Income

Peter Cadaret:

Thank you for joining us for Oppenheimer's Practical Perspectives investment series. To help put the current market volatility in proper context for our clients, we've launched this audio series to highlight how our key investment partners and some of Wall Street's most experienced investment managers are responding to the recent market events. I'm your host, Peter Cadaret, Head of Sales and Marketing for Oppenheimer Asset Management. Today, I'm pleased to be joined by one of our long-standing investment partners, Rahul Sharma of Schafer Cullen Capital Management.

Peter Cadaret:

Rahul's the portfolio manager of Schafer Cullen's Global High Dividend ADR portfolio, and the International High Dividend and Emerging Markets High Dividend portfolios. Rahul's been in the investment industry for over 20 years and sits on the executive committee of Schafer Cullen. Rahul, thank you very much for joining us. First quarter of 2022 has really been dominated by the news in Europe of a war in Ukraine, obviously, and the economic impacts of sanctions. But the market seems to have been holding up relatively well despite this difficult news. So let's start from a high level and get your general perspective on where we are in the market cycle, and where we are in the face of this current volatility.

Rahul Sharma:

I think the war in Ukraine, I would kind of summarize as having really three impacts, or you could summarize it with three points. The first thing we had to do is to figure out what exposure do our companies have, and that's pretty straightforward. You could see what the revenue and earnings exposure is. You could see if they have any assets in Russia. And if you write that down as zero, you could understand what the impact is. We didn't have a lot of exposure. We had less than 1% of our revenues, were exposed, and less than 1% of our assets. And in light of the fact that's stocks dropped, at first, between 10 and 15%, I would say that that already discounted whatever lost revenues there were in Russia.

Rahul Sharma:

But then the second harder to grasp impact is the cost inflation that... And of course, inflation was already out of control entering this period. And it's a highly inflationary event, we think. I don't think I could think of another country that if you started not buying their exports or started sanctioning, that would have more of an inflationary impact than Russia. I don't know, maybe Saudi Arabia or maybe if the US was somehow sanctioned, that could have a similar impact. But Russia really does supply a large amount of commodities and they also tend to have very high quality commodities. So you're taking out some of the lowest cost, highest quality commodities supply out of the supply chains, or at least reducing that.

Rahul Sharma:

And we're obviously speaking to all of our companies and no one really knows what the impact of this is going to be yet. There a lot of uncertainty about it. So that has prompted us to make a modest shift in our exposures, by reducing exposure to companies that we thought were more vulnerable to those first two points. One, if they tended to have a bit more exposure to Russia, or because we didn't have much of that. If they tend to be more vulnerable to cost inflation. And that does mean of European companies and more cyclical areas like consumer discretionary, industrials. So you've seen us take that exposure down a little bit. And because we do think we're in an environment for stagflation at this point, we wanted to position the portfolio for that sort of environment by taking up positions in companies that tend to have really good pricing power in an inflationary environment, that could still do well in this environment.

Rahul Sharma:

And so that meant taking up exposures in certain types of consumer staple companies, healthcare companies, pharmaceutical companies, which were quite cheap to begin with. We've it to our energy exposure, and we've added to our materials exposure as well. And I think that positions a portfolio quite well for the environment, and even that more cyclical stuff that we still have positions in, in Europe that we took down a little bit. At some point, that's going to be very interesting too. Because, the valuations are attractive as they are. The big uncertainty is just, are things going to get worse for the war?

Rahul Sharma:

By worse, I mean, is there going to be some sort of nuclear event? Is Russia going to decide to enter other countries, or might additional sanctions come on? The big one being gas or oil that could cause even more cost inflation. But I think these things, if you look through that history, these things do tend to resolve themselves in some way. And from that point, these sorts of impacted investments tend to do very well going forward. So we're so optimistic over the long term about that exposure as well.

Peter Cadaret:

So let's talk a little bit about the potential spillover effect of that inflationary catalyst of what you talked about in terms of Russia and their contribution to the commodities markets. Many have described the environment as transitory for inflation. Others believe it's a longer haul for inflation. What are your thoughts in terms of the duration of the inflationary environment and when we can start seeing light at the end of that tunnel?

Rahul Sharma:

I don't think it's going to go away soon. I think, maybe if we're lucky, we're looking a year out, you might start seeing things subside, meaningfully. Maybe in the second half, it could get a little bit better as well. But for the meantime, in light of the fact that there's so many aspects to this, that about are being further exacerbated... So, we already had a lot of supply chain issues going on globally. And we were all already seeing companies setting up dual supply chains, as China wants to have their own supply chains, and the US wants to have their own, that in itself is very inflationary. And now you add a third thing with all the supply chain disruptions that are coming because of the sanctions or because ports are being blocked or people are not flying over Russia and that sort of thing.

Rahul Sharma:

So that just makes it, I think, last longer. And I think that we will be in a structurally... And even if it does get better, I think we're going to be in a structurally higher environment for inflation that we've seen, certainly, compared to the last 10 years for many years to come. And so that makes the value of what we do that much better, we think. Because then, if you're trying to figure out how you can preserve your income in an inflationary environment, well, we would suggest that investing in high yielding stocks that have good [inaudible 00:06:08] growth potential, has got to be one of the best ways to do that.

Peter Cadaret:

So, let's narrow our focus down to that subset of those high quality, strong, free cash flow, high dividend businesses. So talk for just a minute about how those businesses are faring, what the stability of the dividends look like, and how they're weathering this difficult environment.

Rahul Sharma:

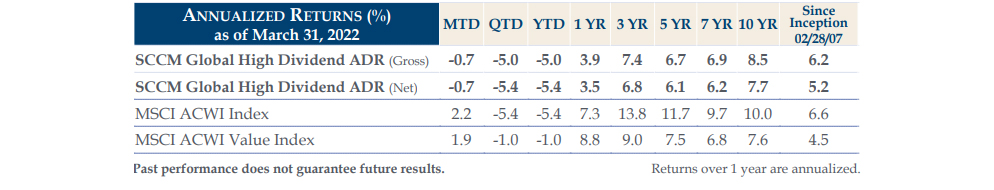

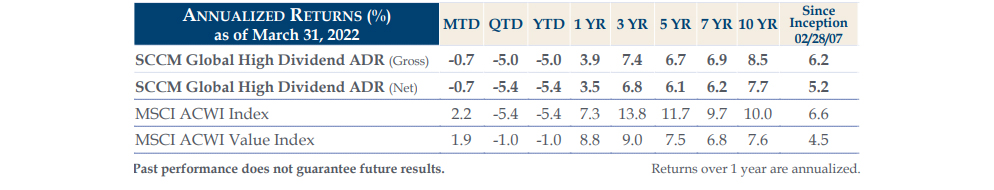

With these... The good news is even the companies that were more vulnerable to cost inflation, many of those companies have already paid their dividends or announced their dividends. And we were seeing good growth in the dividends this year. And that was after our best year for dividend growth in history, where last year we had close to 20% per annum dividend growth, and the portfolio income level succeeded pre-COVID levels by the end of the year. And then this year to start again, as I mentioned, because a lot of companies had already announced their dividends and had good years last year, we're also seeing dividend growth. We're coming in at around 10% this year, so that's quite robust.

Rahul Sharma:

Still off of a high yield of around 4.8%. And I think now to an extent, some companies might be a little bit more vulnerable. Like I said, we've kind of managed that, we've kind of taken that exposure a little bit down. And then we've taken our exposure up in places where we don't think there's really any risk to the growth, where these companies have had a lot of experience managing environments of high inflation and tend to have non-cyclical businesses, that have products that people just need and have all this historically commanded pricing pressure. And then in certain areas, you might even get upside to dividends, from what we saw in the beginning year, certainly in prices like energy or-

Peter Cadaret:

So let's make a comparison. So the dividend side is one component, but then there's also the valuation discussion of the international markets compared to the US and others. So let's take a look, and maybe walk us through. Where are we in the valuation comparison, in the international versus the US market, and where are we in the dividend yield comparison between those two markets?

Rahul Sharma:

We're still at historical extremes. Our portfolio is trading at close to a 40% discount to the S&P 500, and that's probably a conservative estimate. We're at about a 15% discount to EAFE, which is also near a historical extreme. So the valuations are very attractive. We're probably bottom quartile, relative to history in terms of where our PE is. And the same with the yield. Our dividend yield is close to triple that of the S&P 500. And we're about 70% higher than MSCI EAFE. And as I said, the growth is very strong in terms of the dividend growth. That might slow a little bit going forward, but still, I think it'll be pretty good. And even though rates have gone up, I still think that the gap you get in yield, and just not having the risk of losing as much in bonds like we're seeing happen this year, makes the income attribute to the strategy really important at a time when people are really going to need it, in light of the environment for inflation that we're in.

Peter Cadaret:

And I think that's a conversation we're having on a regular basis about where you can achieve that consistent income in this low yield environment. So I think that's very interesting. Let's talk a little bit about the opportunity set created on the back of this volatility, right? So clearly there is... The world is paying attention to what's going on in Ukraine. There are concerns about the supply chain and energy disruptions, but that's creating quite an opportunity from a number of different perspectives. We touched on valuation, but what do you see as the key themes and key opportunities as we look out to 2022 and 2023?

Rahul Sharma: I think just like COVID of accelerated, some of the mega trends that we're seeing; things like climate change and that sort of thing, trying to address these issues. I think you're going to see the same thing come out of the war. In the short term, it looks like climate change related problems are getting worse, because people are having to use more fossil fuels and God knows there's some destruction going on. And carbon being admitted everywhere, due to the war. And I think that what you see happens is two things.

Rahul Sharma:

I think as economies try to bail themselves out of what could be close to a recessionary environment, if that were to occur, I think that you're going to see that spending going towards these climate change initiatives. And then I think there's going to be even a greater need to do it, in light of the fact that we're probably taking a step back over the short term in terms of the goals of countries to reduce carbon emissions. And that tends to be a good thing for, we think, particularly for European countries and companies, and companies in the Nordic region as well, who tend to be way ahead in addressing these issues. So they're the leaders in providing the products and services to address climate change needs. So I think that is going to be... We already have very good exposure to that within our portfolio, but I think that you're going to see that even become a bigger opportunity because of the war.

Peter Cadaret:

So broadly speaking, you mentioned the climate side of it. But if we dig in a little bit further, just the broad ESG theme seems to obviously be much more developed in Europe and in the international markets, perhaps, than the US. So how relevant are those kind of ESG conversations when you're sitting in the board room with one of the companies that you invest in? And is it a key part of the conversation you're having with companies in Europe?

Rahul Sharma:

It is. We don't have a ESG mandate per se, but ESGs have been something we've always cared about. Maybe initially, 10 years ago, was more on the G side, but then it's become more on the E and S side. We've done a lot of work as a firm to get our hands around this whole issue. We even are now running ESG mandates at Schafer Cullen. We think we have really good experience in doing this. We use MSCIs, ESG research product, to help us get a framework on some of the issues. And when we are talking to companies, yeah, we are bringing up these issues and asking them, what are they going to do to improve themselves in a certain way. Because we do think that companies with better ESG will command better multiples.

Rahul Sharma:

And so that's important. And then that's one aspect then... The more exciting side, frankly, from my perspective is thinking about the companies that are, like I said, selling the products and services to address climate change concerns. So that, I just think, is a huge mega decade theme. And those companies, I think, are going to grow a lot faster. And so this correction's provided a great opportunity to have exposure with some of these companies that are kind going down, even though they still have this long opportunity in front of

Peter Cadaret:

So, Rahul, to wrap up our conversation, obviously we talked about the valuation gap between the international markets and the US. And obviously the very strong cashflow and dividend yield characteristics. I think one of the key questions on the mind of our investors is what's the catalyst to close that gap in valuation? What's the catalyst for the next few years to spark the international markets to really get back to the top of the performance chart. So what do you see as that catalyst and what do you see as the timeframe an investor should have in mind for that type of investment?

Rahul Sharma:

Well, I think, just as the war is turbocharging the climate change trend, I think the same is to true for the other big thing that was going on; which was higher inflation and higher interest rates. That because this event is so inflationary that even causes more of a need for countries to start raising rates. And many are obviously starting to do that and people keep expecting them to do more. And so that just tends to be a very good thing for value and for international.

Rahul Sharma:

International value has always performed very well in inflation and high interest rate environments. And it's just, because if you look at the indices or our exposure, we just have a lot more exposure to sectors that benefit from higher rates and inflation; whether it be commodities, financials, energy, things like healthcare that are of more resilient in that sort of environment, compared to say the S&P 500 that is loaded up in with tech stocks that tend to really get hit hard. Like today when [inaudible 00:14:04] start going up and they have much less exposures to those areas that benefit from inflation.

Rahul Sharma:

So right now, the worst kind of the focus, hopefully it'll resolve or end, and that certainly could be a short term catalyst. But that longer term catalyst, and again, is just a structurally higher environment for rates and inflation, which tends to benefit international value a lot. And it was very promising before the war started. That's exactly what was happening; we were saying international value really at massively outperform, international started to outperform the US. Then because the war is closest to a large exposure in the internationally [inaudible 00:14:42], namely Europe, you saw that give back. But I just think that's kind of a temporary blip, and again, as you get a resolution to the war at some point, and then that structurally different environment, that should be a real big [inaudible 00:14:55] for international value.

Peter Cadaret:

Excellent. Well, Rahul, I appreciate you jumping on with us today. I appreciate you walking through your views on the international landscape, where we are in valuation and what you see as the opportunity set going forward. So thanks very much for sharing your insight and we appreciate you being on with us today.

Rahul Sharma:

Sure, anytime Pete. Have a great day.

Peter Cadaret:

You too. Thank you.

Schafer Cullen Global High Dividend ADR

DISCLOSURE

Past performance does not guarantee future results. Investing in securities involves risks and may result in loss of principal. A history of paying dividends is not a guarantee of such payments in the future. Companies may suspend their dividends for a variety of reasons, including adverse financial results. Some of the information in this document may contain projections or other forward looking statements regarding future geopolitical events or future financial performance of funds, countries, markets or companies. Actual events or results may differ materially.