Muni Bonds and ESG Investments Harness the Capital Markets to Foster Socially Beneficial Goals

- November 28, 2022

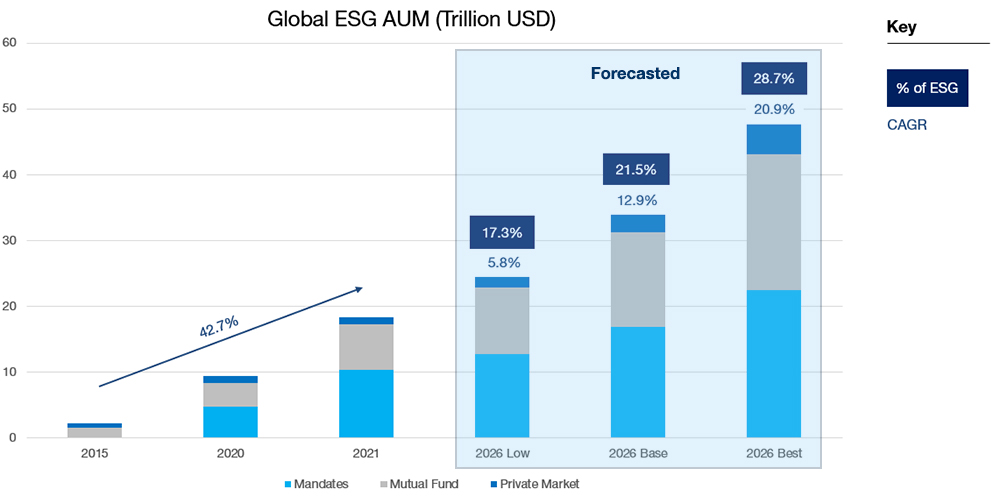

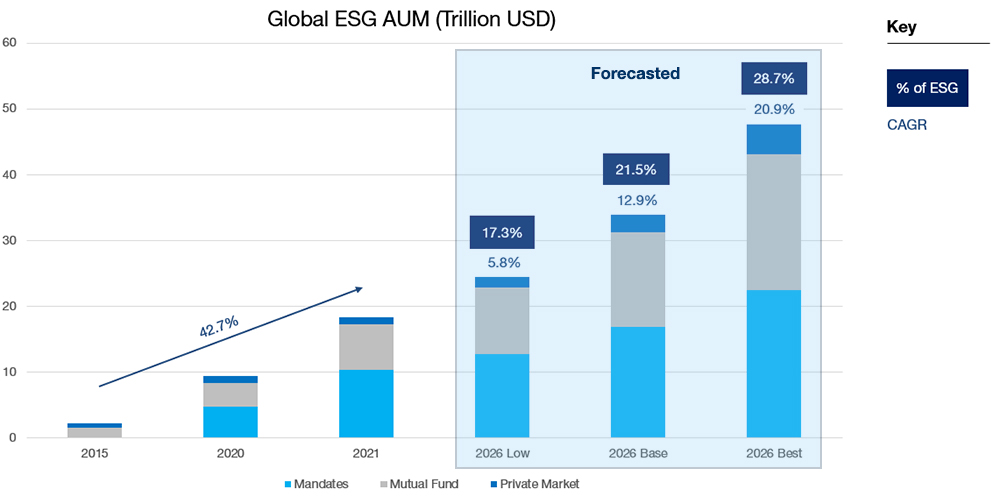

Money is flowing into mandated portfolios at an unprecedented clip.

Environmental, Social and Governance (ESG) investment frameworks were developed to harness the capital markets to efficiently achieve broader socially beneficial goals by providing investors (capital providers) and corporate and government managers (capital users), with the incentives, signals, and information needed to drive capital into projects that aim to achieve specific goals. ESG investing has taken on a much higher profile as we are confronting climate and societal issues that threaten to reach a boiling point. As a result, money is flowing into ESG mandated portfolios at an unprecedented clip, Bloomberg Intelligence1 projects that Global ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total assets under management. A similar projection is made by a recent EY report2 that concluded ESG assets are set to grow much faster than the rest of the market, we duplicate a chart from that study to the right.

ESG assets are set to grow much faster than the rest of the market.

ESG however, has not been without controversy. Most of the controversy centers around “greenwashing” where capital users make exaggerated claims about the degree by which projects will achieve ESG goals. ESG attention aside, municipal bonds have long been analyzed by investors and credit rating agencies from an ESG risk perspective; rating agencies have always sought to understand how environmental, social and governance risks impact the credit quality of a municipal bond issuer. What is relatively new is the recognition by ESG mandated capital providers that municipal bonds serve as a vehicle to invest directly into projects and programs that achieve ESG goals.

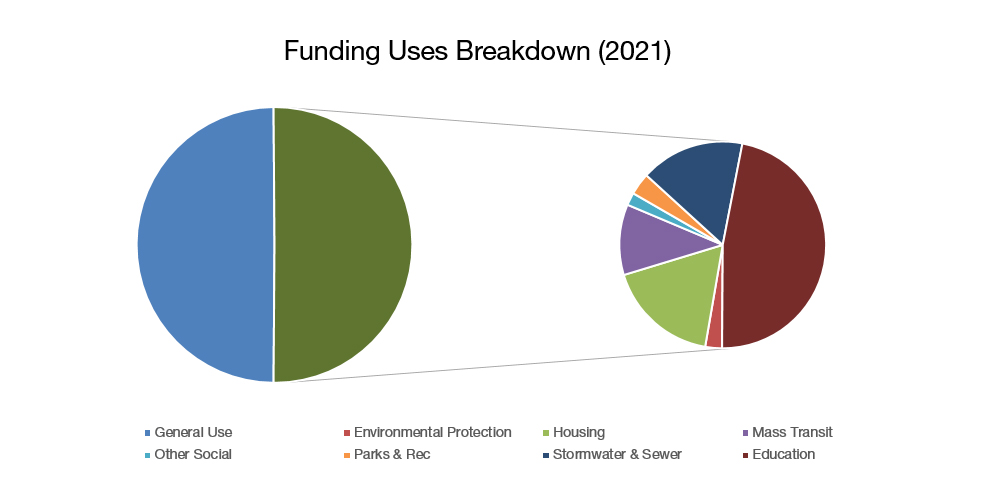

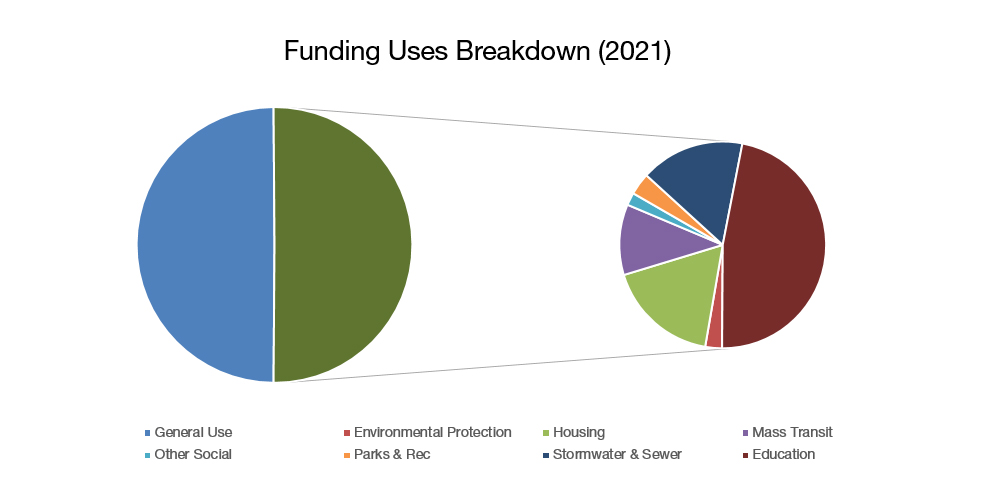

Though greenwashing is and will remain a concern in the municipal sector, municipal bonds raise capital for very narrow purposes and fall solidly within ESG frameworks. In 2021 municipal bonds raised a total of $453 billion, approximately half of which are for sectors straight down the ESG fairway, as seen in the chart to the right3.

About half of municipal bond fund capital is allocated for ESG.

Municipal bonds permit capital providers to invest in shovel ready projects that move the ball forward in helping to address our country’s most difficult issues. As such, we expect that ESG will continue to build momentum into 2023 and beyond.

DISCLOSURE

1Bloomberg Intelligence, ESG assets may hit $53 trillion by 2025, a third of global AUM

2EY Asset and Wealth Management Revolution 2022, Exponential Expectations for ESG, page 4

3SDC General Use of Proceeds 2021, based on amount raised per use of proceeds, as of 11/1/22

This notice is provided for informational purposes only, and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. Nothing contained herein shall constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited.

This notice may contain statistical data cited from third-party sources believed to be reliable, but Oppenheimer & Co. Inc. does not represent that any such third-party statistical information is accurate or complete, and it should not be relied upon as such. All market prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice.

2022 Oppenheimer & Co. Inc. Transacts Business on all Principal Exchanges and Member SIPC 5188369.1