Investing in High Quality

- May 16, 2023

High quality strategies are expected to be more resilient in a turbulent economic environment

After an unusually difficult year for investors in 2022, the investing landscape for 2023 once again looks to be challenging. The start of this year has seen both the equity markets and interest rates remain extremely volatile as the effects of central bank tightening work through the economy. Investors continue to weigh a resilient labor market and solid wage gains against the measurable risks of a credit contraction and a broader economic recession.

Against this difficult macro backdrop, investors are searching for the optimal way to protect their portfolios against both inflation headwinds and the threat of a global slowdown. We believe that owning high quality businesses is the right approach at this point in the economic cycle. High quality companies may provide a favorable risk/reward profile and play a key role in driving returns for long-term portfolios for a number of reasons including:

Consistent Profitability over Cycles

High quality companies typically generate consistent profits across all stages of business cycles. These companies deliver valuable goods and services and possess stable revenue streams that are minimally impacted by evolving macroeconomic conditions. Management teams of these companies are able to effectively manage costs to maintain superior profit margins relative to lower quality competitors

Economic Moats

Higher quality companies are often described as having “economic moats” or high barriers to entry for new competition within their sector or industry. These moats can result in a larger market share, less competition and the ability to grow even during periods of economic turbulence. Market leaders possess more pricing power than their competitors. Pricing power is very important, particularity during periods of elevated inflation, because it allows a business to pass along increasing costs directly to customers while maintaining higher profit margins

Conservative Balance Sheets

Quality companies tend to have more conservative balance sheets, which can be very advantageous during periods of economic uncertainty and inflation. These types of quality businesses are less reliant on the capital markets to fund future growth. Lower quality businesses, on the other hand, are highly dependent on external financing and will face significant headwinds as funding costs increase, inflation pushes interest rates higher and/or economic concerns drive credit spreads wider. As more highly indebted peers are forced to retrench and navigate higher costs and lower earnings, quality companies can implement growth initiatives and continue to take market share.

Seasoned Management Teams

The highest quality businesses tend to be led by experienced management teams who have proven track records of effective capital allocation in all types of business and economic settings. These strategic decisions generate high returns on invested capital and create shareholder value.

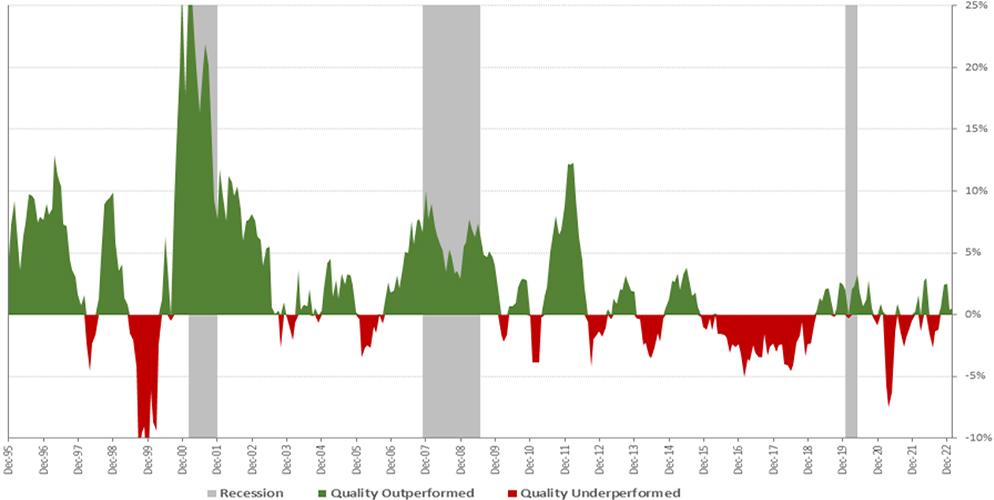

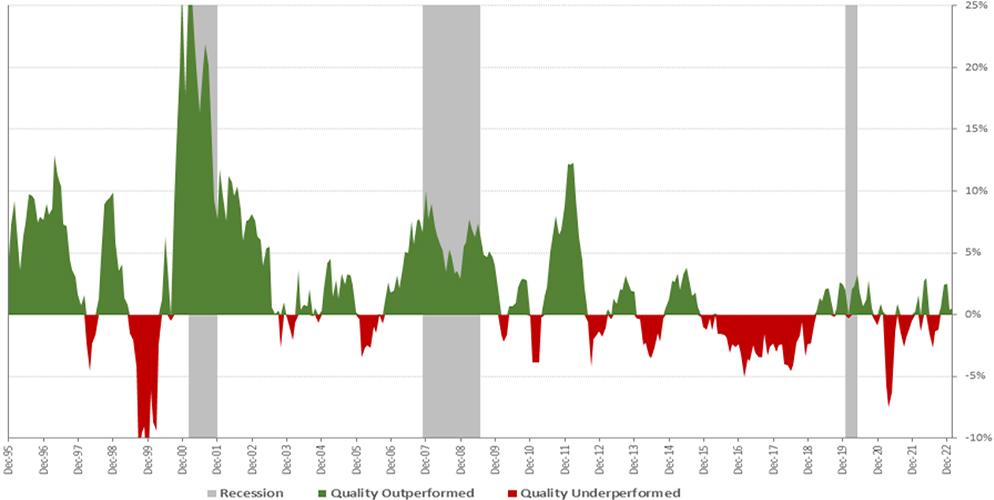

When Things Get Tough…Quality Wins the Day

Historically, high quality companies have outperformed during difficult economic periods. To demonstrate, we evaluated the performance of the S&P Quality Factor Index during the past several economic recessions. The S&P Quality Factor Index filters and ranks large cap companies by their return on equity, financial leverage, and accruals ratio, broadly accepted indicators of quality. Companies with strong scoring on these quality factors significantly outperformed the broader S&P 500 during the Covid-driven recession in early 2020, the Great Recession, and the 2001 recession following the Tech bubble bursting. In fact, over the last 20 years the S&P Quality factor outperformed the S&P 500 with slightly lower volatility.

S&P 500 Quality

12M Rolling Excess Returns over S&P 500

In conclusion, as investors contemplate the best way to position their long-term assets in this environment, we believe the equity of high quality companies with economic moats, pricing power, strong fundamentals and seasoned management teams deserve strong consideration. Regardless of the economic environment on the horizon, companies demonstrating these characteristics should be well positioned to generate attractive relative performance.

To learn more about high quality equity strategies available at Oppenheimer, please contact an Oppenheimer financial advisor.

Disclosure

This material is intended for informational purposes only. The information and statistical data contained herein have been obtained from sources we believe to be reliable. OAM Alternatives and OAM Consulting are divisions of Oppenheimer Asset Management. The opinions expressed are those of Oppenheimer Asset Management Inc. (“OAM”) and its affiliates and are subject to change without notice. No part of this material may be reproduced in any manner without the written permission of OAM or any of its affiliates. Any securities discussed should not be construed as a recommendation to buy or sell and there is no guarantee that these securities will be held for a client’s account nor should it be assumed that they were or will be profitable. Securities referenced herein are used as proxies or illustrations of broader market or sector principles. Past performance does not guarantee future comparable results. If you buy or sell a security at a premium, you buy or sell it at a higher price than usual. If you buy or sell a security at a discount, you buy or sell it at a lower price than usual.

All securities investing entails some risk of loss of principal. There is no guarantee the recommended strategy will be successful. Oppenheimer Asset Management is the name under which Oppenheimer Asset Management Inc. (OAM) does business. OAM is a registered investment adviser. This material may contain forward-looking statements or projections. These statements and projections relate to future events or future performance. A strategy's performance may be affected by general economic and market conditions, such as interest rates, inflation rates, economic uncertainty, changes in laws, and national and international political circumstances. The information provided herein should not be construed as a recommendation to buy, sell, or hold any particular security. Opinions expressed herein are current as of the date appearing in this material. OAM is a wholly owned subsidiary of Oppenheimer Holdings Inc. which also wholly owns Oppenheimer & Co. Inc. (“Oppenheimer”), a registered broker/dealer and investment adviser. 5654046.1