Simplifying Long-Term Care Planning

- July 29, 2020

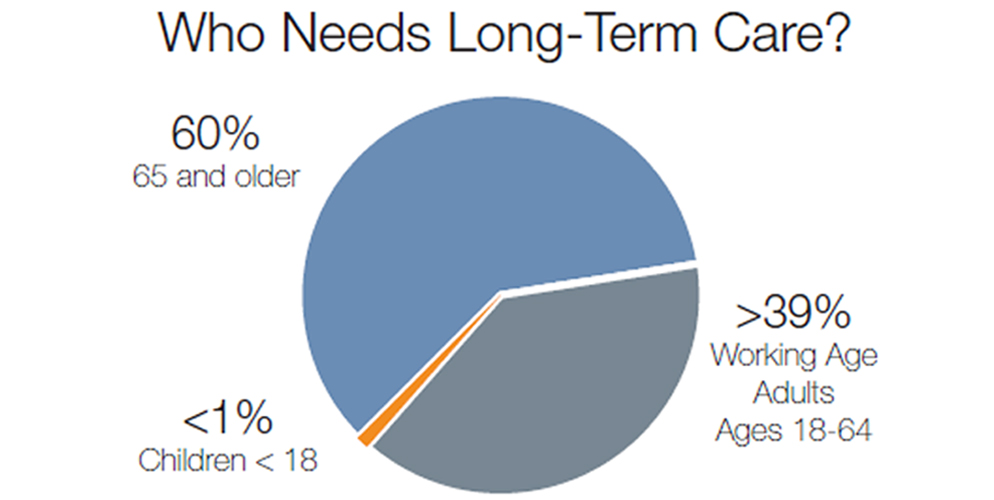

One of the biggest risks to your retirement can be a long-term care event. If you or a loved one ends up needing long-term care (LTC), the expense can be shocking. The average cost of a semi private nursing home room in 2018 was $89,425 per year. Someone turning age 65 has almost a 70% chance of needing some type of long-term care services in their lifetime.*

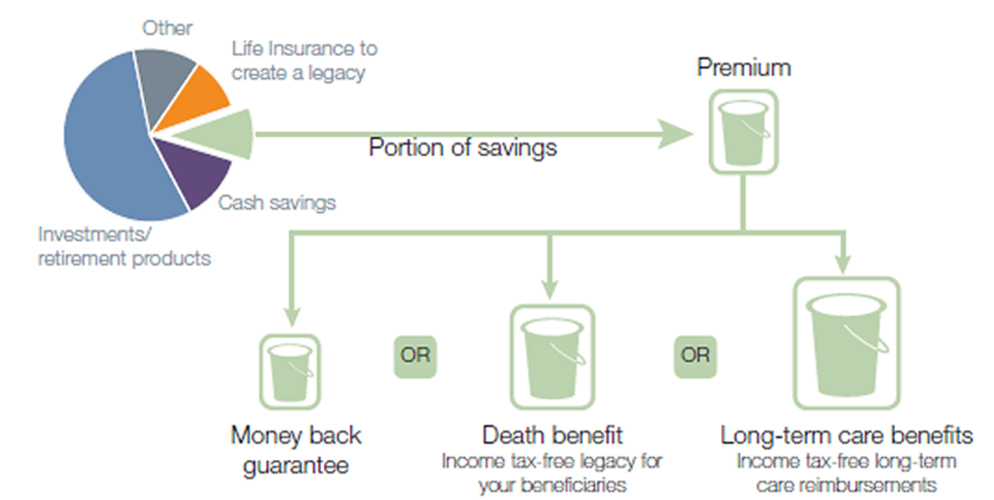

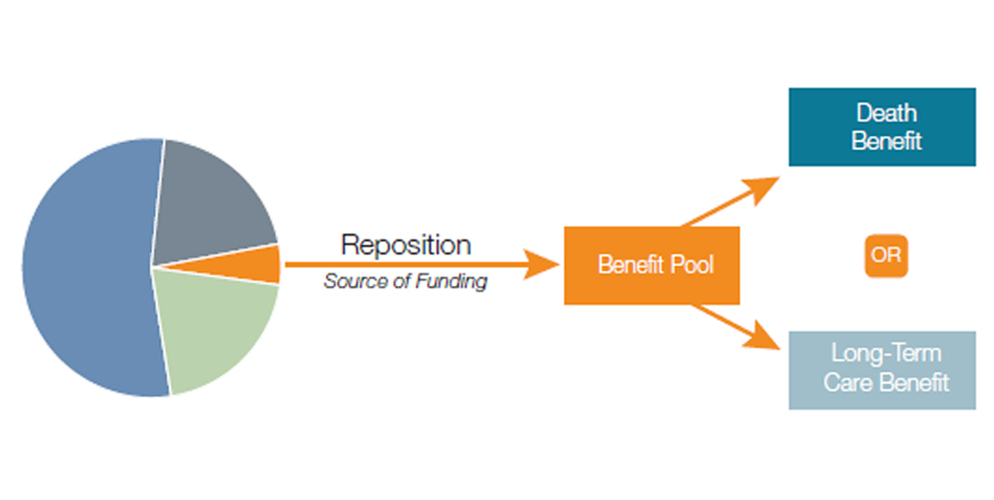

There are many strategies available to help fund for these costs, a long-term care insurance policy being one of them. It can cover a range of services to meet your personal care needs either in a nursing home, assisted living facility or in home care.

The Three Paths to LTC Insurance Coverage

Traditional, Stand-alone LTC

|

Highlights |

Decision Points |

|---|---|

|

|

Linked Life/LTC Insurance

|

Highlights |

Decision Points |

|---|---|

|

|

Life Insurance with LTC Rider

|

Highlights |

Decision Points |

|---|---|

|

|

Contact your Oppenheimer Financial Professional today to explore the different long-term care options available to you.

Disclosure

* Source: https://longtermcare.acl.gov

© 2020 Oppenheimer & Co. Inc. Transacts Business on All Principal Exchanges and Member SIPC. All rights reserved.

This brochure is intended for informational purposes only. The material herein has been obtained from various sources believed to be reliable but is not guaranteed by us as to accuracy or authenticity. All information provided and opinions expressed are subject to change without notice. No part of this brochure may be reproduced in any manner without written permission of Oppenheimer & Co. Inc. (“Oppenheimer”). Neither Oppenheimer nor any of its affiliates or employees provide legal or tax advice. However, your Oppenheimer Financial Professional will work with clients, their attorneys and their tax professionals to help ensure all of their needs are met and properly executed. Investors should consult with their legal and/or tax Advisors before implementing any wealth transfer strategies. Securities are offered through Oppenheimer. Variable annuities are sold by prospectus only, which describes the risks, fees and surrender charges that may apply. Investors should consider the investment objectives, risk and charges of the investment company carefully before investing. The prospectus contains this and other information. You may obtain a prospectus from your Oppenheimer Financial Professional. Please read carefully before investing. Oppenheimer may receive compensation in the form of fees or commissions for services referred to and performed by our strategic alliance firms. However, Oppenheimer and the firms mentioned herein are completely independent of each other. Oppenheimer Life Agency Ltd. is a wholly owned subsidiary of Oppenheimer & Co. Inc.