Public Finance and Municipal Trading

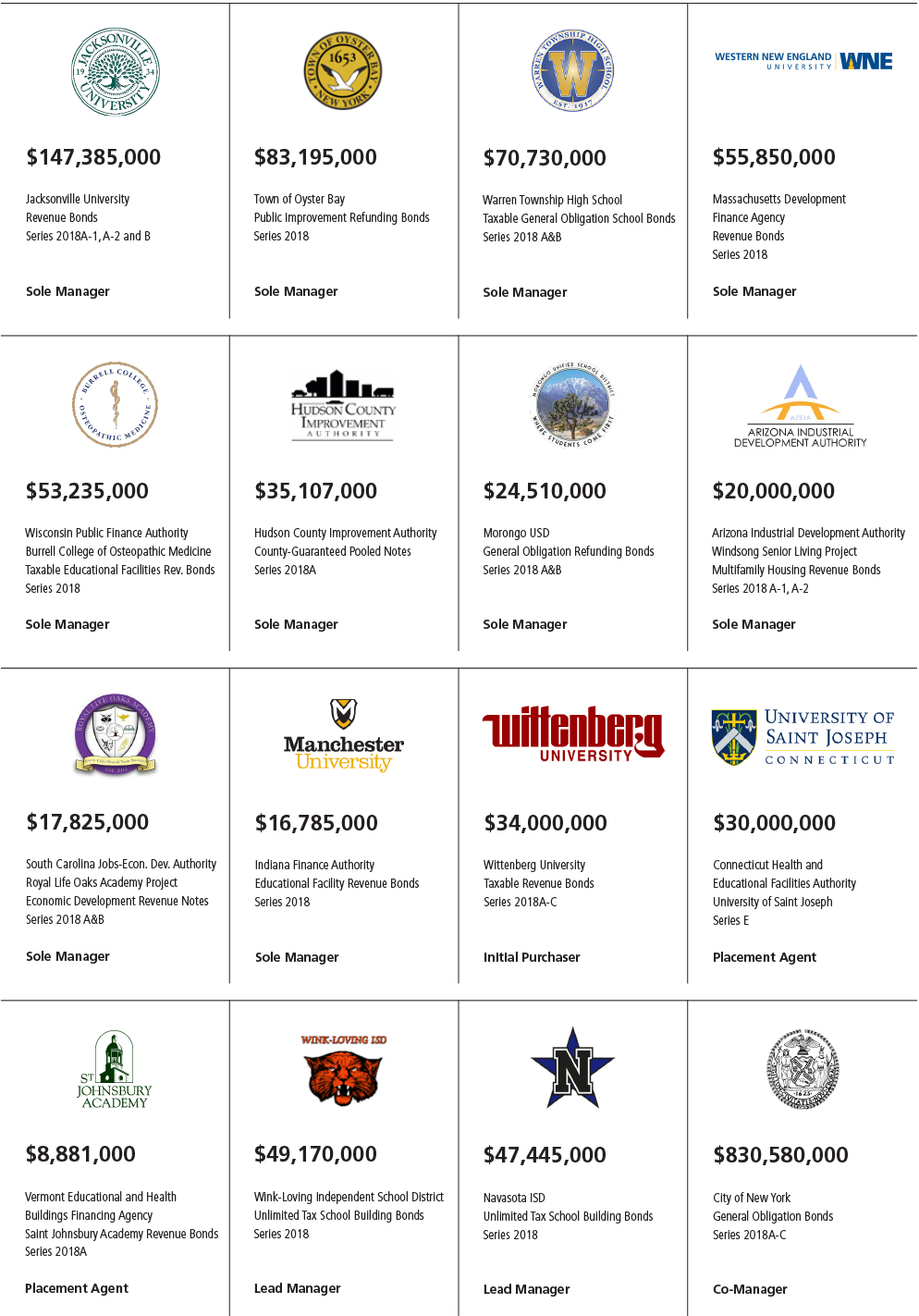

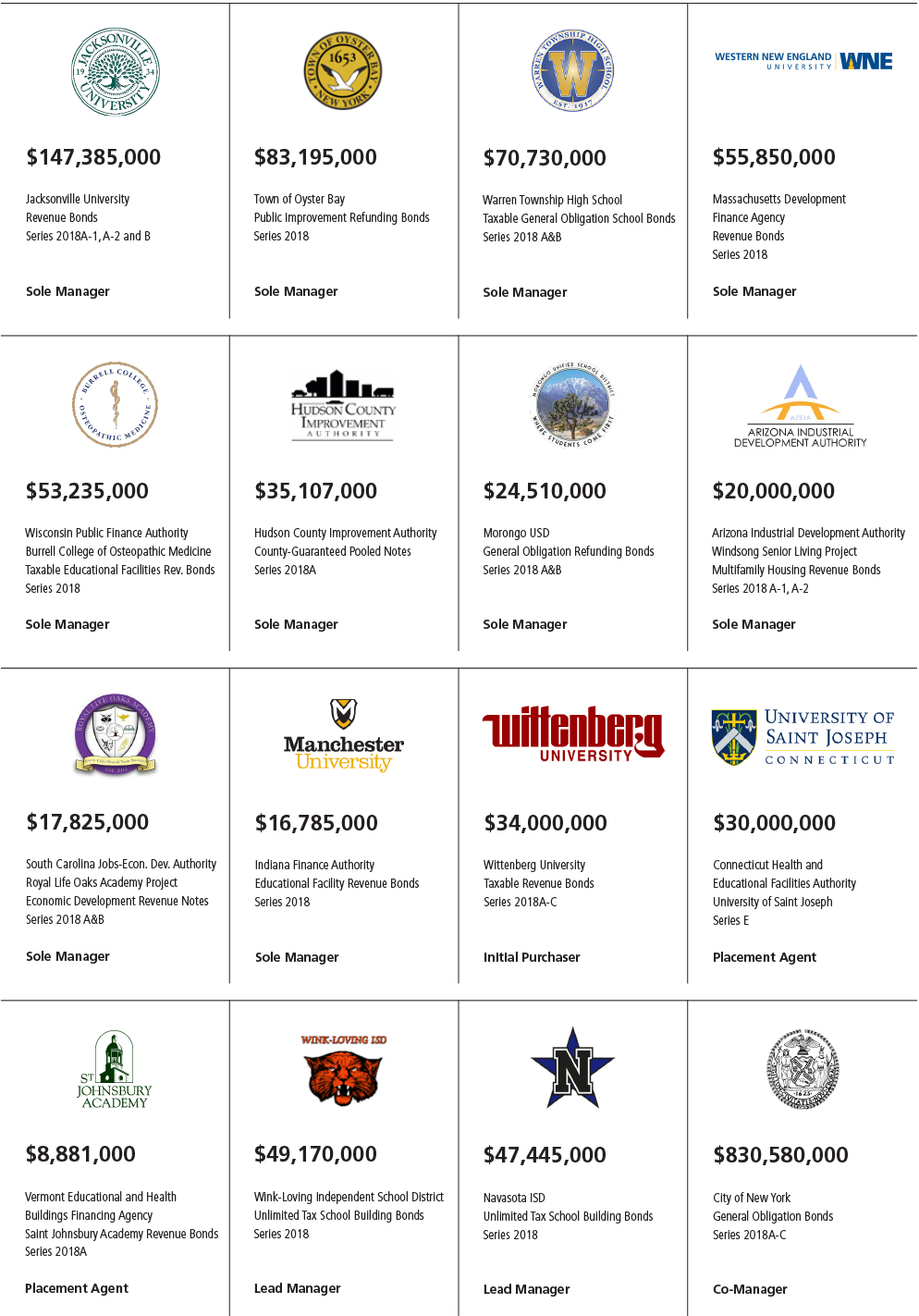

Public Finance and Municipal Trading sustained its mission of providing seamless execution of innovative and client-centric debt solutions, establishing long-standing and trusting relationships and operating with integrity and transparency. Public Finance and Municipal Trading worked diligently in 2018 on several notable transactions, including its role as lead manager on the first K-12 tax-exempt advance refunding issuance of a Build America Bond, as senior manager for the largest non-rated issuance for a private higher education institution since 2015, and sole manager for a rated college of osteopathic medicine.

The Municipal Bond market was significantly impacted by the Tax Cuts and Jobs Act. After peaking in 2017, issuance of new Municipal securities declined approximately 24 percent in 2018, largely due to an absence of tax-exempt advance refunding capacity. Institutional and individual investors spent much of the year re-evaluating portfolio strategy, given lower individual and corporate tax rates, as well as new limitations on state and local tax deductibility. Notwithstanding these challenging headwinds, the Muni market outperformed other asset classes, benefiting from the positive technical of reduced supply and heightened demand from net positive mutual fund flows.

During the year, we added seasoned professionals to the group and further strengthened our record of accomplishment in the higher education, K-12, senior housing, general municipal, public-private partnership, and project finance sectors. Due to our ability to educate buyers and place debt, the group is relied upon by issuers and their municipal advisors to facilitate market access both for stable and financially distressed issuers alike. The firm continues to establish itself as one of the leading underwriters of short-term issues; from 2015 to 2018, our ranking leaped from sixth to second place in terms of number of issues underwritten. The firm also provides liquidity in the primary market by actively bidding on competitive bond issues as a syndicate member–over this same period, our ranking leaped from ninth to fifth. This activity allows our underwriting and sales desks to stay apprised of new issue trends.

The Firm continues to establish itself as one of the leading underwriters of short-term issues.

Public Finance and Municipal Trading continued to educate our financial advisors throughout the country of our policy of utilizing relationships in the community to assist municipal issuers to raise needed capital. Financial advisors may be in a position to refer municipal underwriting transactions, and are encouraged to do so, are rewarded for a completed transaction. In one instance, a single referral to Public Finance and Municipal Trading resulted in multiple deals, aggregating to $169 million of notes and bonds issued over a 15-month period.